Finexer Open Banking Blogs

-

PayByBank: Get Paid Faster in 2025

Explore how PayByBank is revolutionising payments in 2025. Learn about…

-

Faster B2B Payments in 2025 with Open Banking APIs

Learn how Open Banking APIs enable real-time transactions, reduce fees,…

-

Sign in Using Bank: Fast and Secure Onboarding in 2025

Sign in using bank offers seamless onboarding through open banking—streamline…

-

A Guide to PSD2 and Open Banking

Explore the impact of the PSD2 Directive on the financial…

-

Guide to UK Bank Transfer Modes: CHAPS, BACS, SWIFT, and Faster Payments

Confused by different bank transfer modes? Uncover the differences between…

-

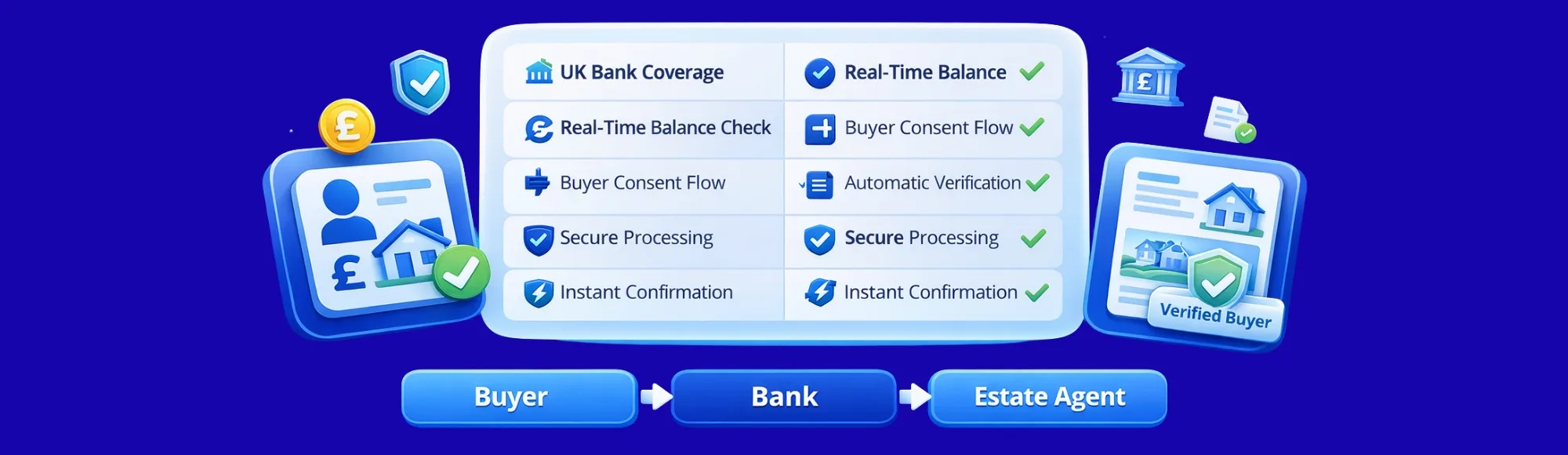

Real Estate Bank Verification: How Estate Agents Instantly Verify Proof of Funds & Bank Accounts Using Open Banking

Real estate bank verification for UK estate agents. Verify buyer…

-

Instant Payroll Payment Software: How Businesses Can Pay Employees in Real Time Without Bank Delay

Instant payroll payment software for UK businesses. Pay employees in…

-

Law Firm Payment Automation for UK Firms: Automating Client Payments End-to-End

Law firm payment automation for UK firms. Automate client payments…

-

Automated AML Checks for Law Firms: How to Choose the Right Screening Solution

Automated AML checks for law firms reduce manual screening time…

-

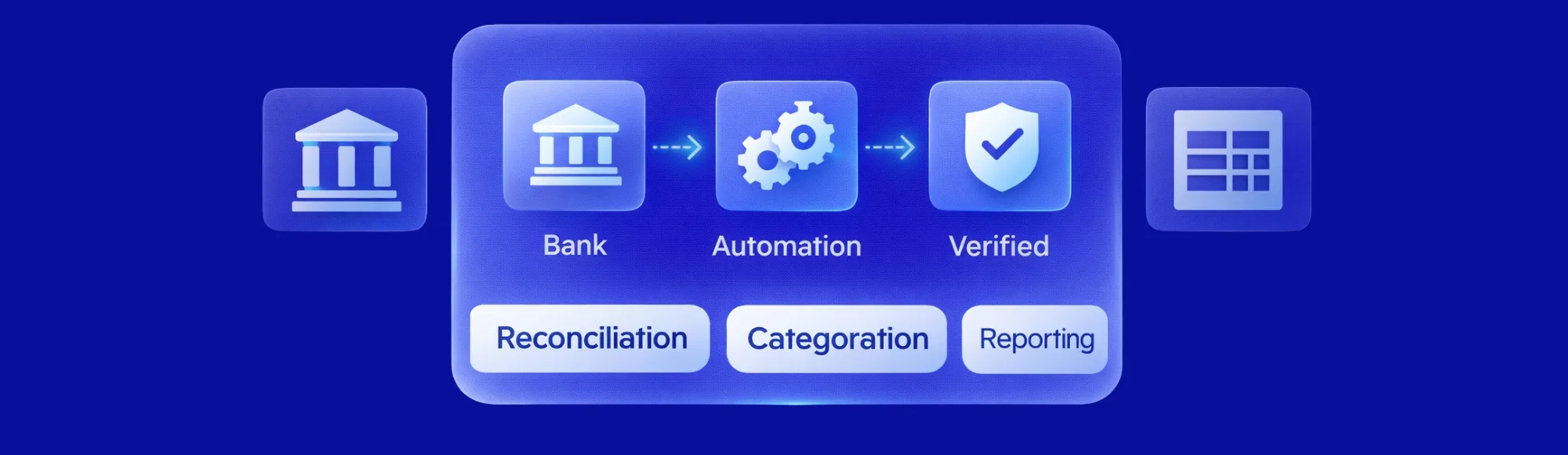

Accounting Workflow Automation: How Modern Finance Teams Automate Reconciliation, Categorisation, and Reporting

Get Accounting Workflow Automation with Finexer Cut manual processing time,…

-

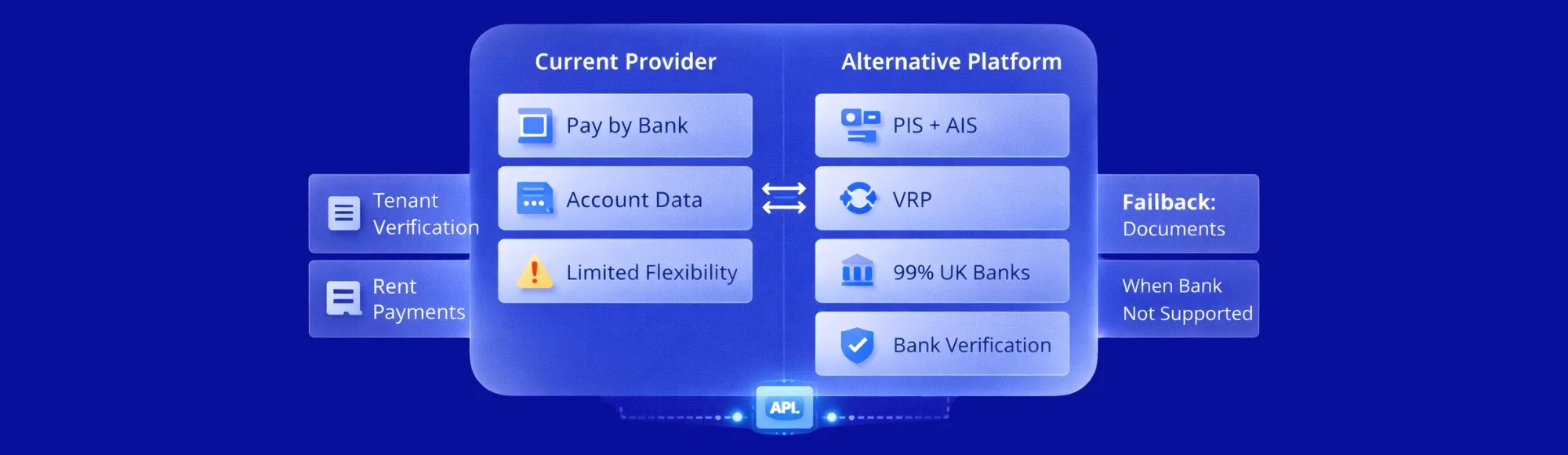

Switching from GoCardless Open Banking: UK Alternatives for Payments & Data APIs

Looking for GoCardless alternatives? Switch to Finexer for 99% UK…

-

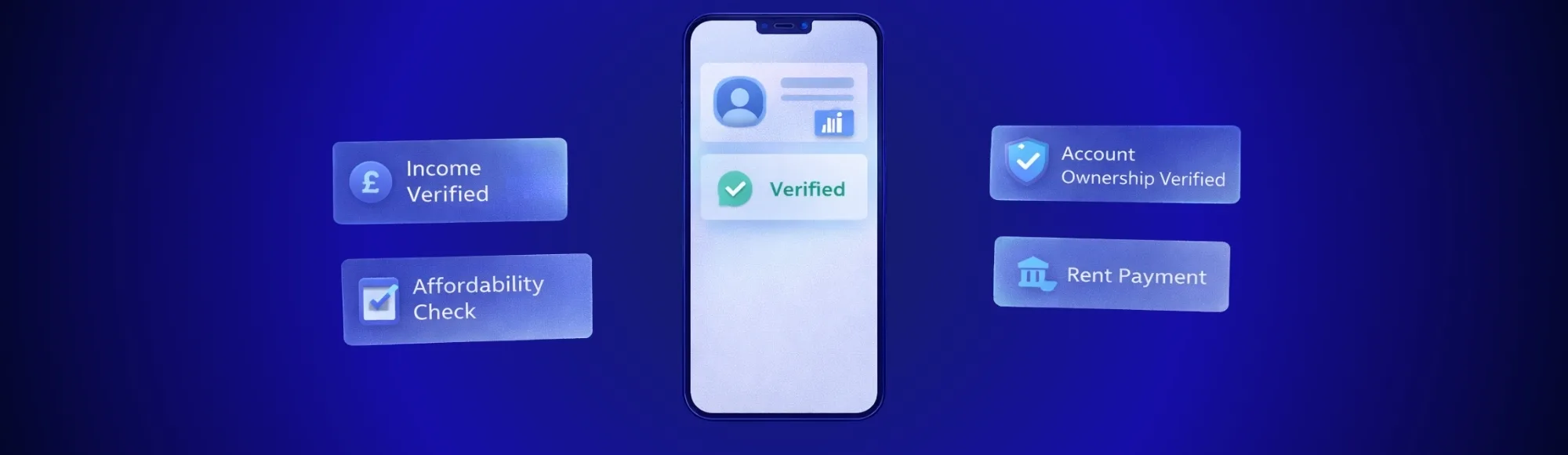

Open Banking for Renting: How Letting Agents Automate Tenant Affordability & Rent Payments

How letting agents use open banking for renting to automate…

-

Looking for a Noda Open Banking Alternative? Compare UK Providers for Payment Initiation & Account Information Services

Looking for a Noda open banking alternative? Switch to Finexer…

-

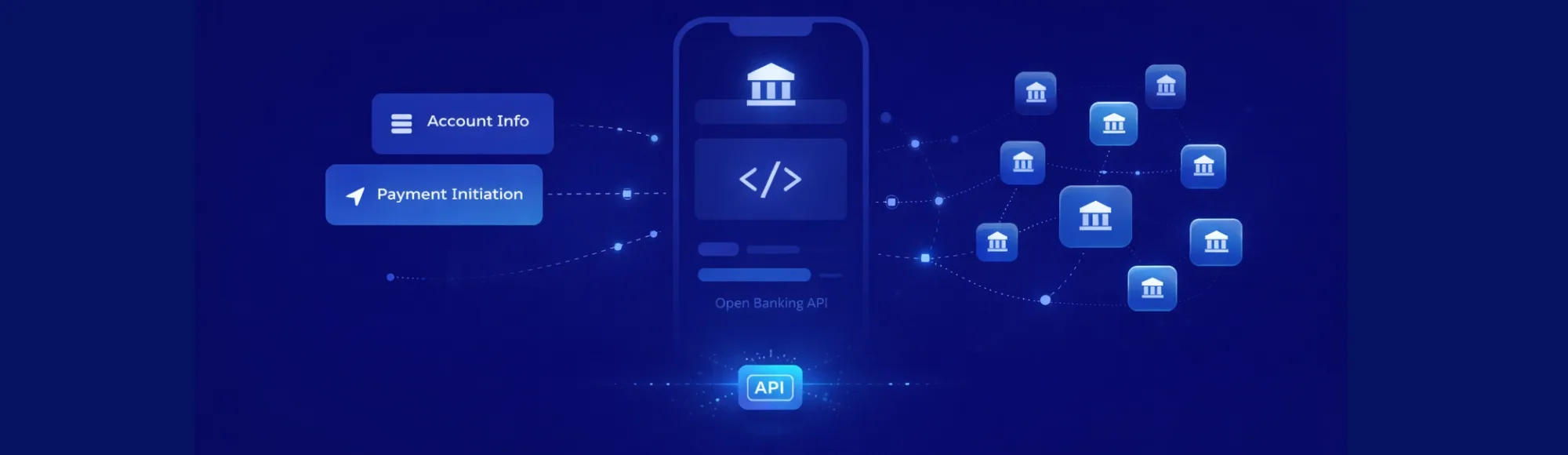

Top 10 Open Banking API Examples That Power Real AIS Products in the UK

Discover 10 open banking API examples powering real UK businesses.…

-

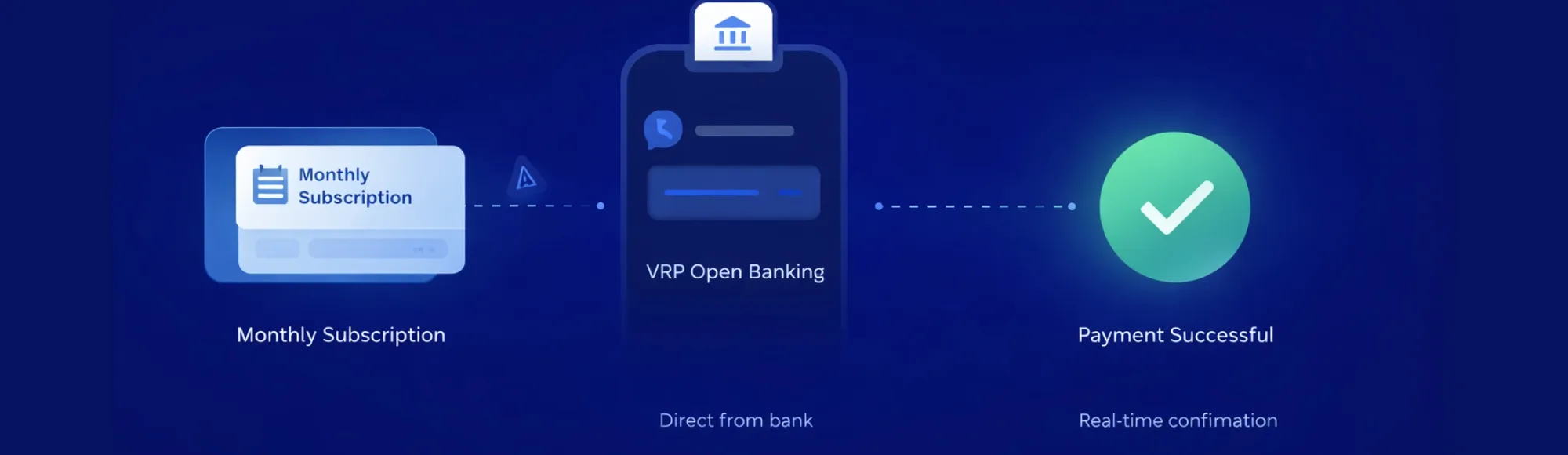

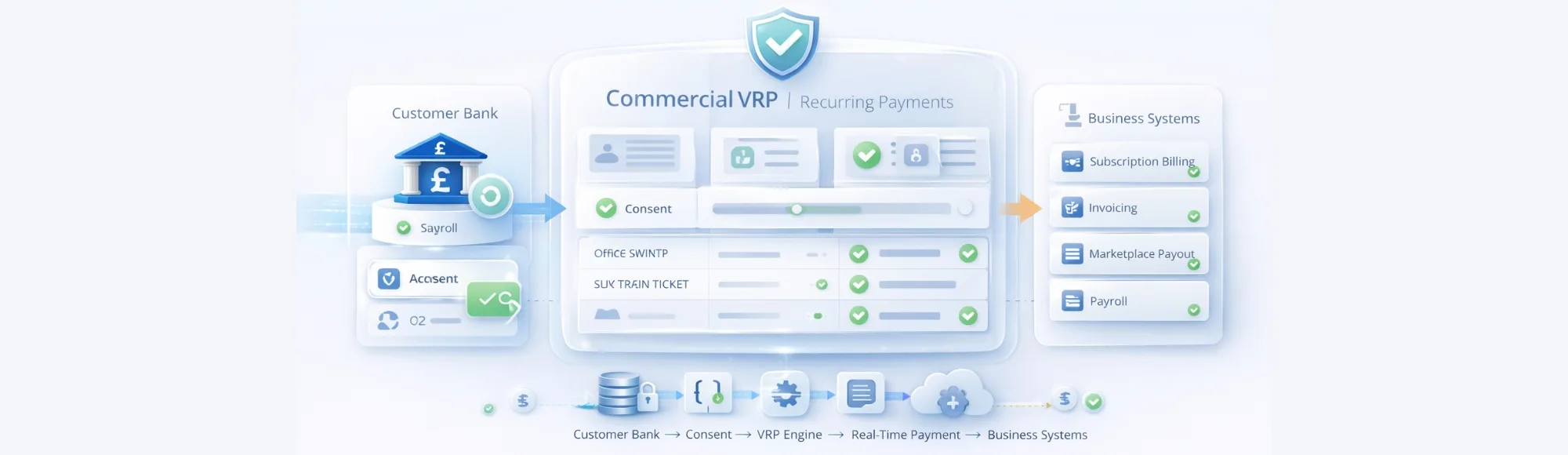

How VRP Payments Reduce Churn in UK Recurring Billing

Get VRP Payments with Finexer Cut churn, improve payment success…

-

Payment Links for UK Businesses: Accept Bank-to-Bank Payments Without Cards or Gateways

Accept pay-by-bank payment links via open banking. Cut card fees,…

-

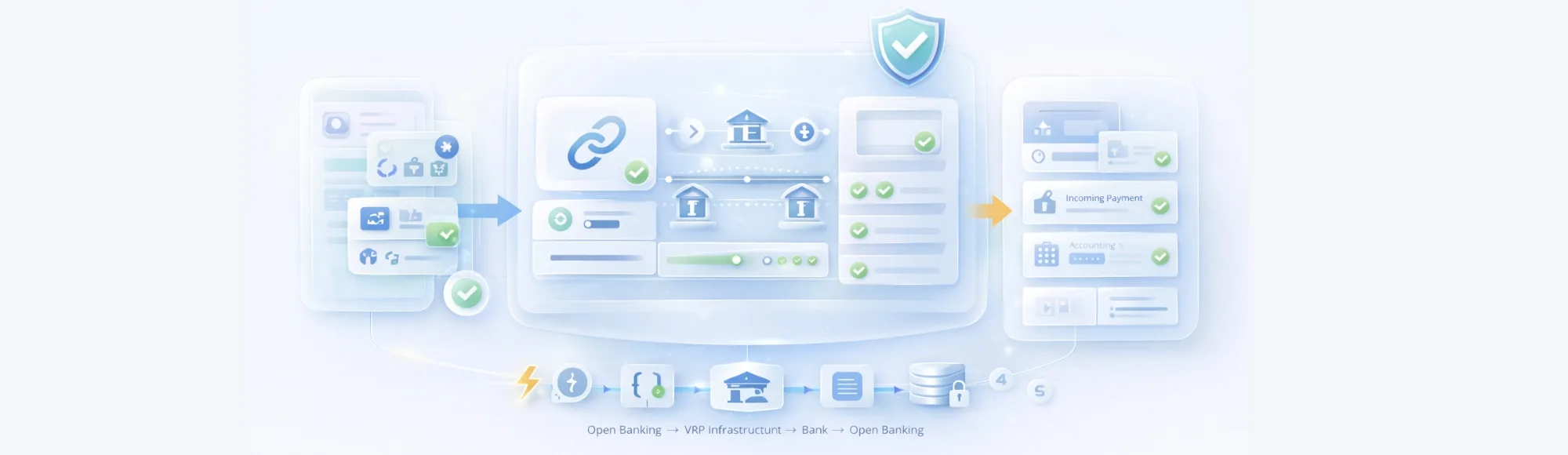

FCA Confirms Commercial VRP: What UK Businesses Must Prepare For

FCA confirms commercial variable recurring payments in the UK. Learn…

-

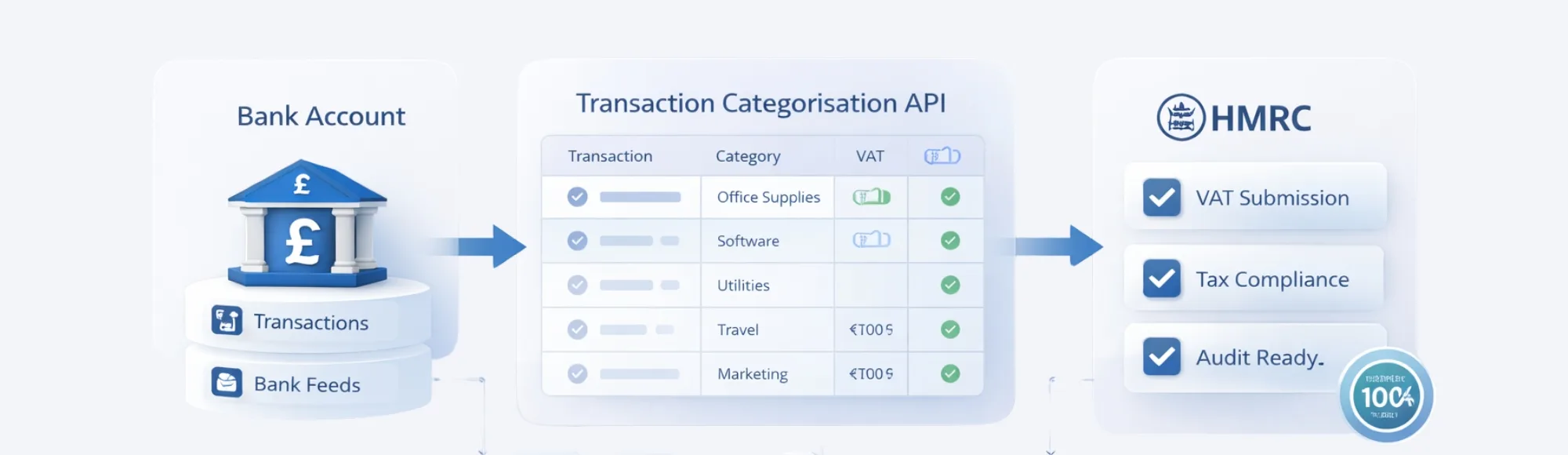

Transaction Categorisation API for Audit-Ready Bookkeeping: How UK Firms Reduce VAT Errors

See why transaction categorisation APIs outperform manual processing with faster…

-

A2A Payments in the UK: Buyer Checklist for Choosing an Open Banking Provider

Learn how to choose the right A2A payments provider in…

-

How Far Back Do Source of Funds Checks Go in the UK? Complete Guide

UK source of funds checks usually cover 3–6 months of…

-

Bank Account Verification in the UK: How to Confirm Customer Details Instantly (Without Manual Checks)

Confirm customer bank details in seconds, cut failed payments, and…

-

Top 5 Refund Management Platforms Built for High-Volume Retailers

Get Paid with Finexer Connect with 99% of UK Banks…

-

Free MTD Software for Landlords: What’s Actually Free and What Can Cost You Penalties

Free MTD software for landlords often misses key features. Discover…

-

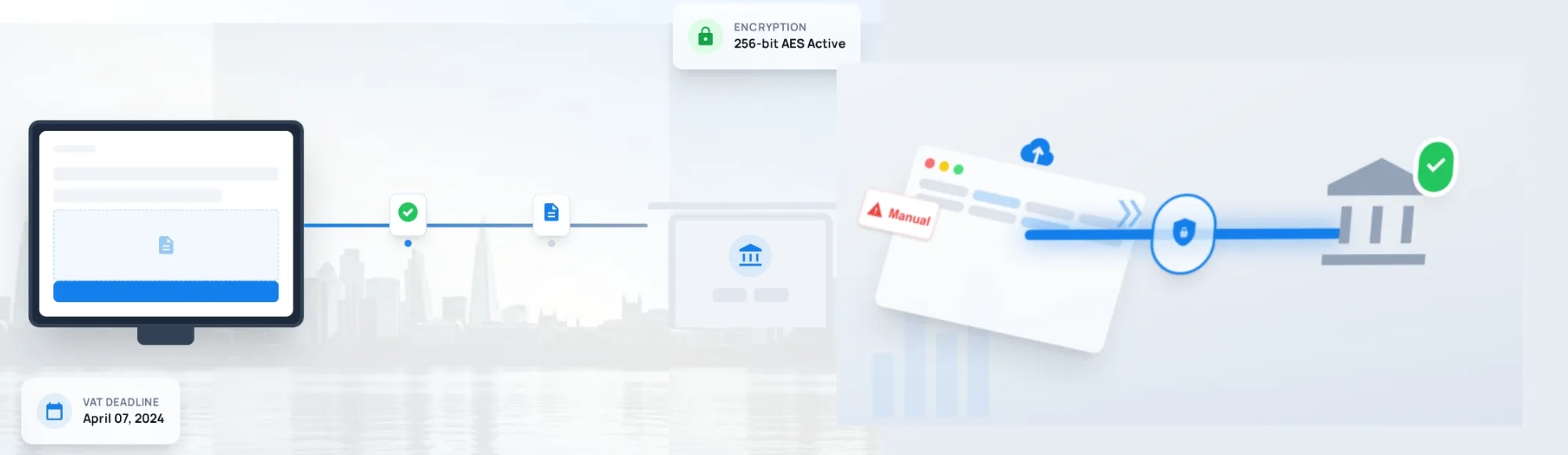

MTD Bridging Software: What UK Businesses Must Check Before Choosing One

Struggling with HMRC VAT submissions? Learn how to choose the…

-

Proof of Funds: Fast Verification Without Manual Bank Statements

Verify proof of funds in seconds without bank statements. Discover…

-

Bank Feed API for UK Accounting SaaS: What to Build First for Faster Growth

Build bank feed APIs for UK accounting SaaS that actually…

-

Bulk Payments: How Businesses Send High-Volume Bank Payments Efficiently in the UK

Learn how UK businesses handle bulk payments at scale, including…

-

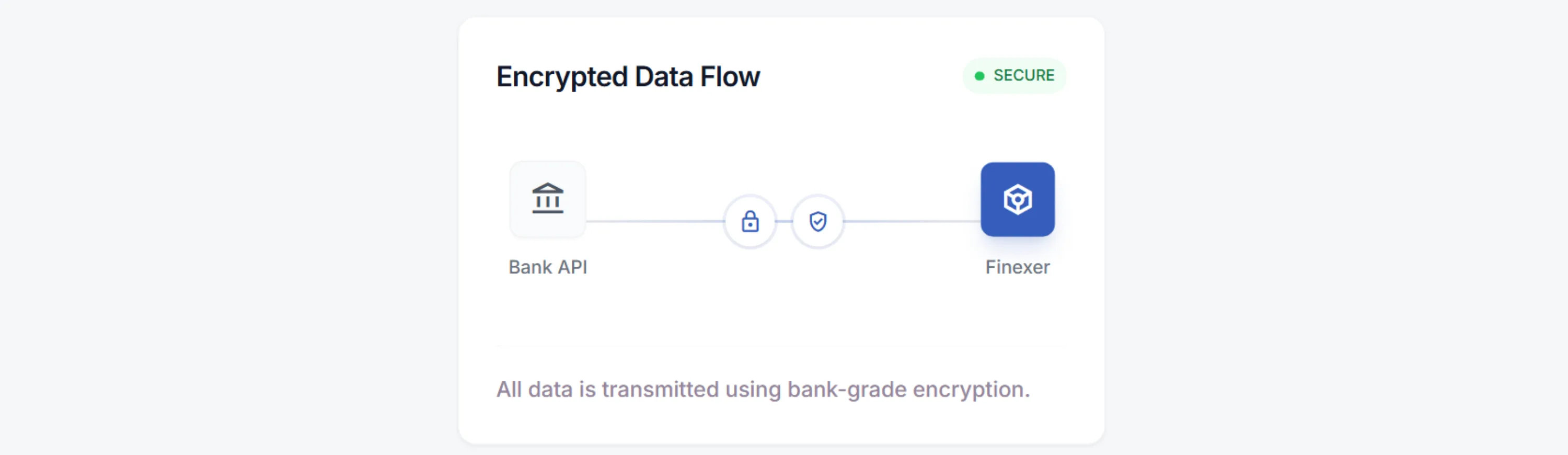

Why Open Banking API Security Is Under Regulatory Pressure in 2026

Get Secure Open banking API with Finexer Connect with 99%…

-

Why 2026 Is the Right Time to Invest in Open Banking

Explore Finexer for Open banking services Connect with 99% of…

-

Buy now pay later guide: How it works and Top UK providers

Our guide to Buy now pay later. Learn how it…

-

How to Choose an AIS Provider for Income Verification: A Step-by-Step Guide for 2025

Learn how to select the right AIS Provider for accurate…

-

How Enterprises Should Evaluate Bank Data Quality: A 12-Point Checklist

A practical, enterprise-friendly framework for evaluating Bank Data Quality, accuracy,…

-

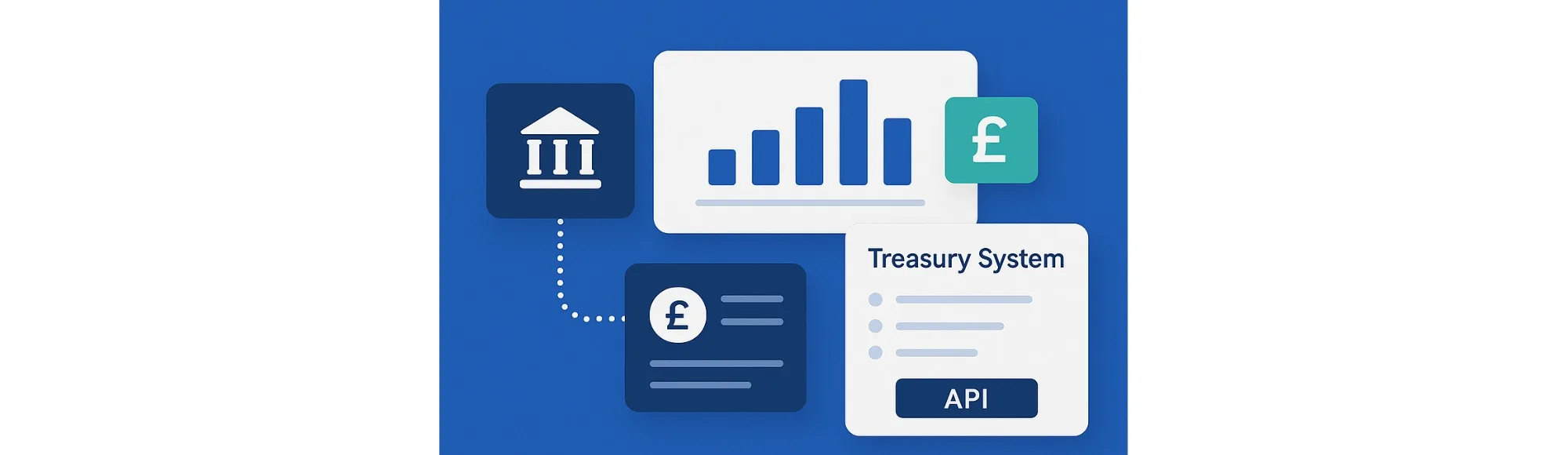

Open Banking API Integration for Enterprise Treasury Management Systems

See how UK enterprises enhance treasury management systems with real-time…

-

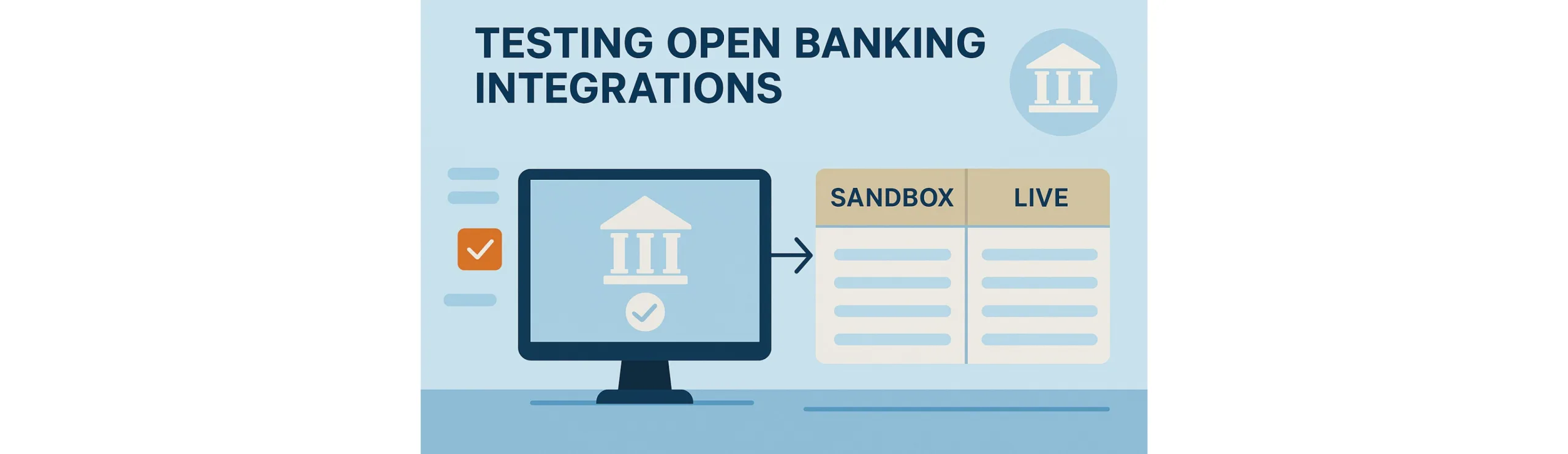

Testing Open Banking Integrations: Sandbox vs Live Data Scenarios

Learn about testing Open Banking integrations using sandbox and live…

-

Finexer Joins FinTech Wales to expand Open Banking Innovation

Finexer is proud to announce its membership with FinTech Wales,…