Finexer Open Banking Blogs

PayByBank: Get Paid Faster in 2026

Explore how PayByBank is revolutionising payments in 2025. Learn about…

Faster B2B Payments in 2026 with Open Banking APIs

Learn how Open Banking APIs enable real-time transactions, reduce fees,…

Sign in Using Bank: Fast and Secure Onboarding in 2026

Sign in using bank offers seamless onboarding through open banking—streamline…

A Guide to PSD2 and Open Banking

Explore the impact of the PSD2 Directive on the financial…

Guide to UK Bank Transfer Modes: CHAPS, BACS, SWIFT, and Faster Payments

Confused by different bank transfer modes? Uncover the differences between…

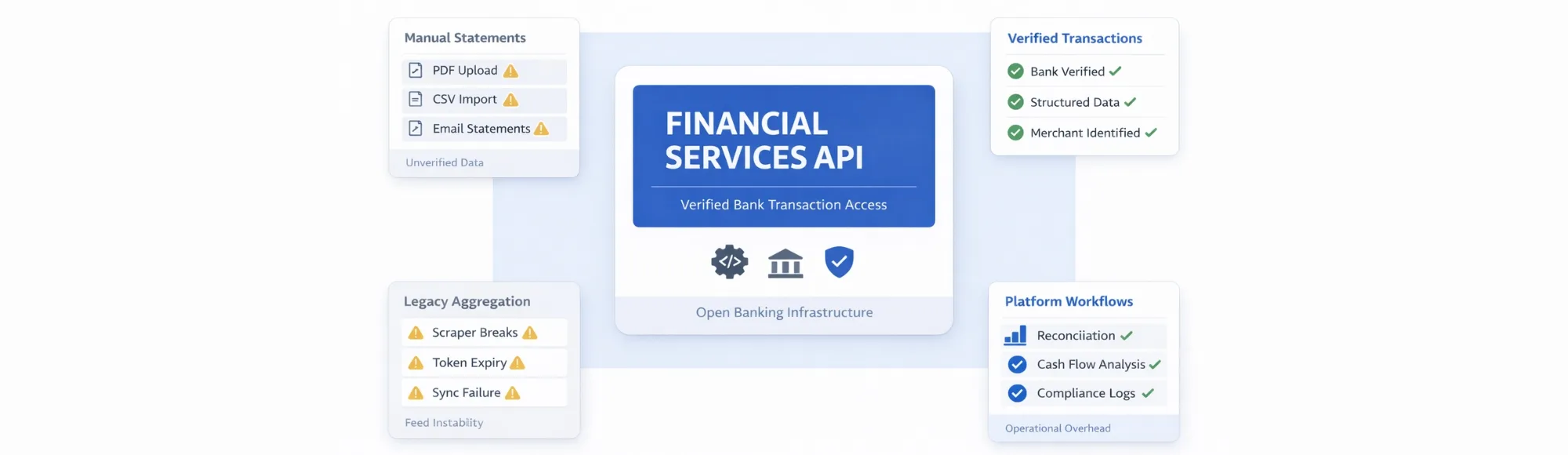

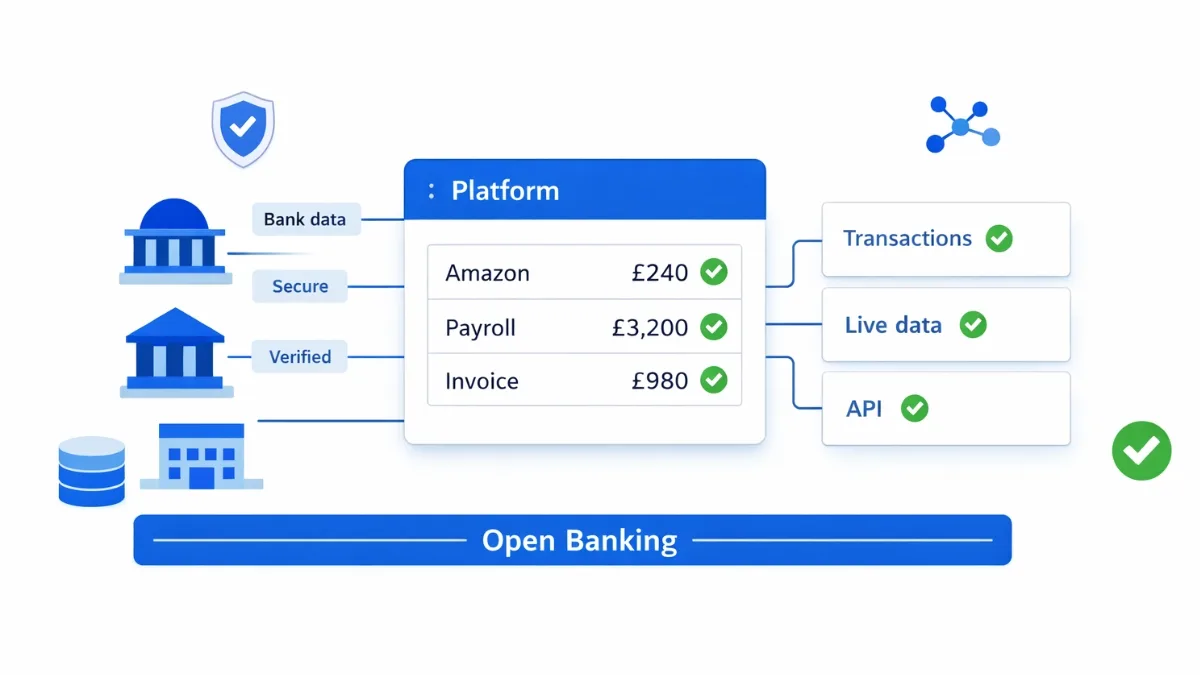

Verified Financial Services API for UK Regulated Platforms

Verified financial services API infrastructure for UK fintech platforms. Access…

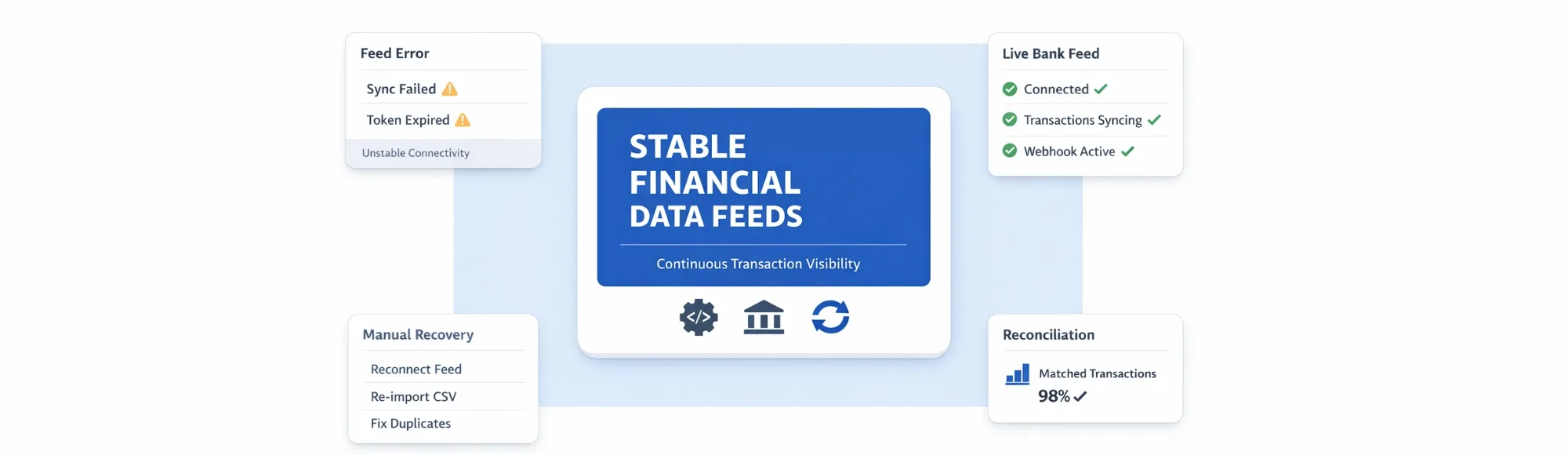

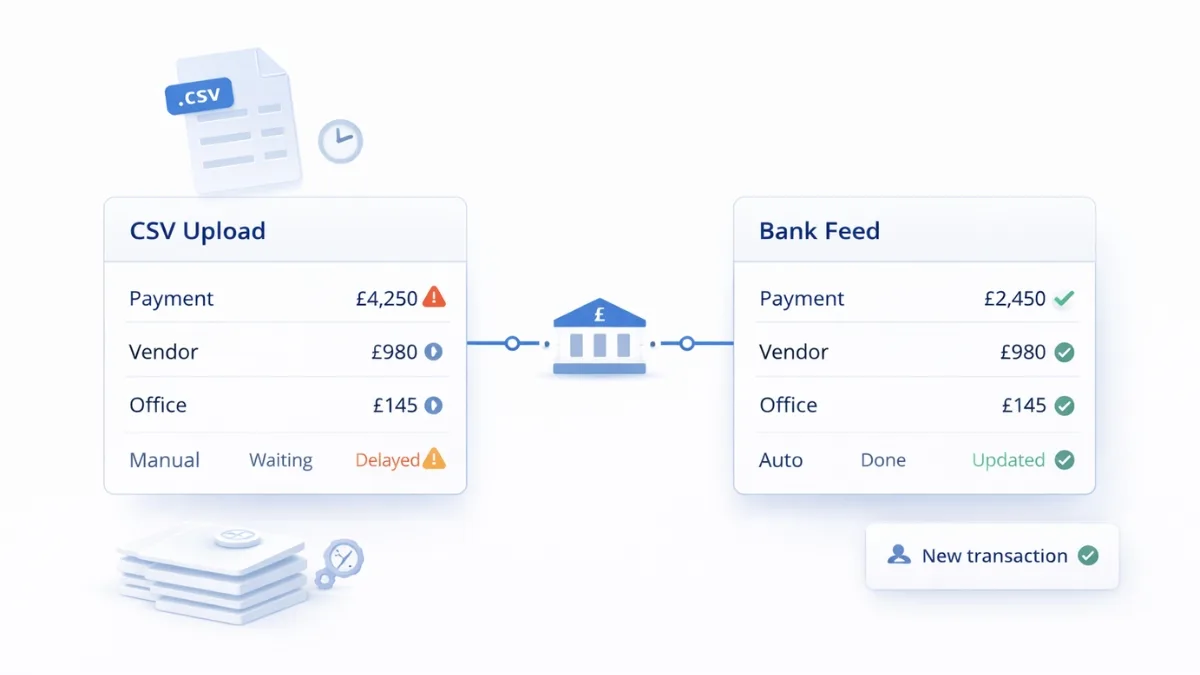

Reliable Data Feed Management for UK Accounting Platforms

Essential data feed management for UK accounting platforms using Open…

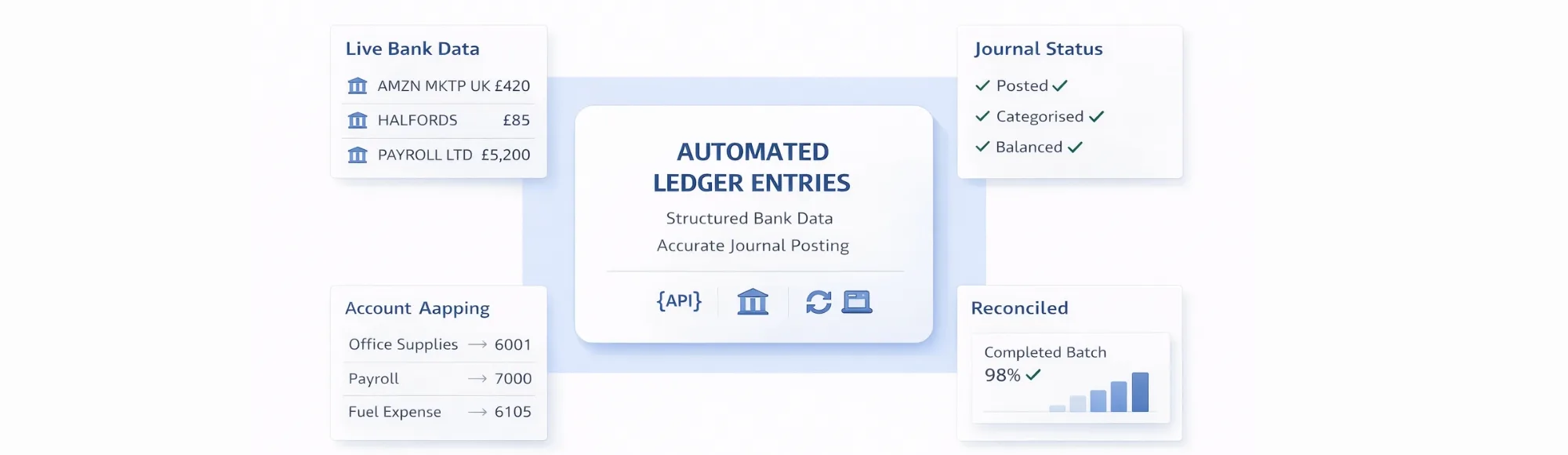

Automated Ledger Entries for UK Accounting Platforms

Automated ledger entries for UK accounting platforms using structured bank…

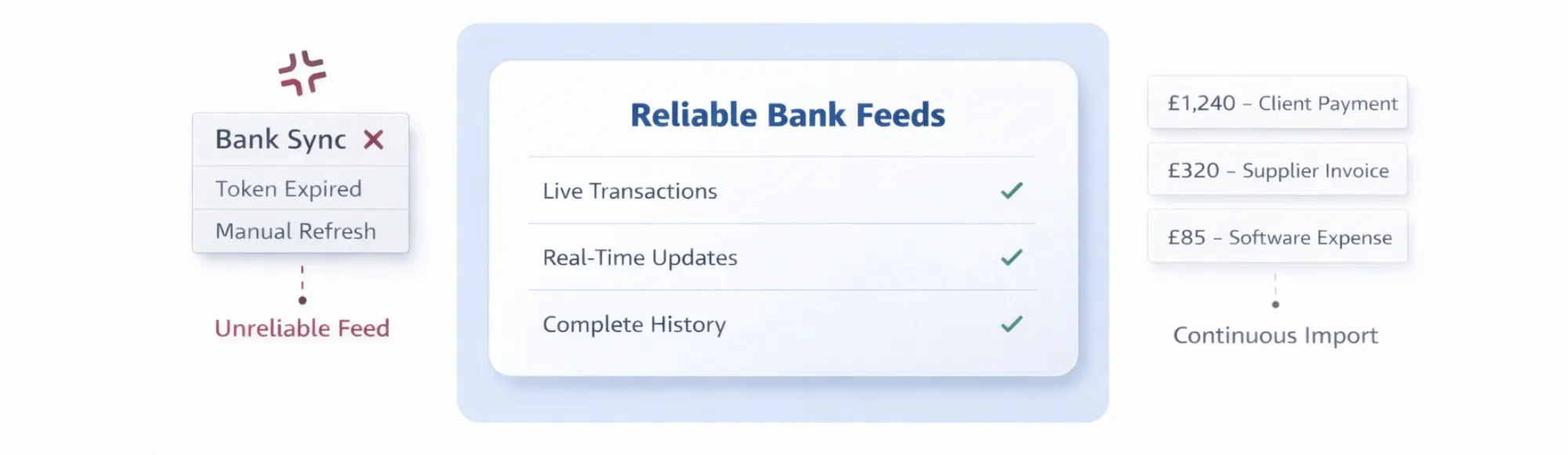

Reliable Bank Feeds for UK Accounting Platforms

Reliable bank feeds for UK accounting platforms using Open Banking…

Automated Accounting Process Automation for UK SaaS Platforms

Automated accounting process automation for UK SaaS platforms using verified…

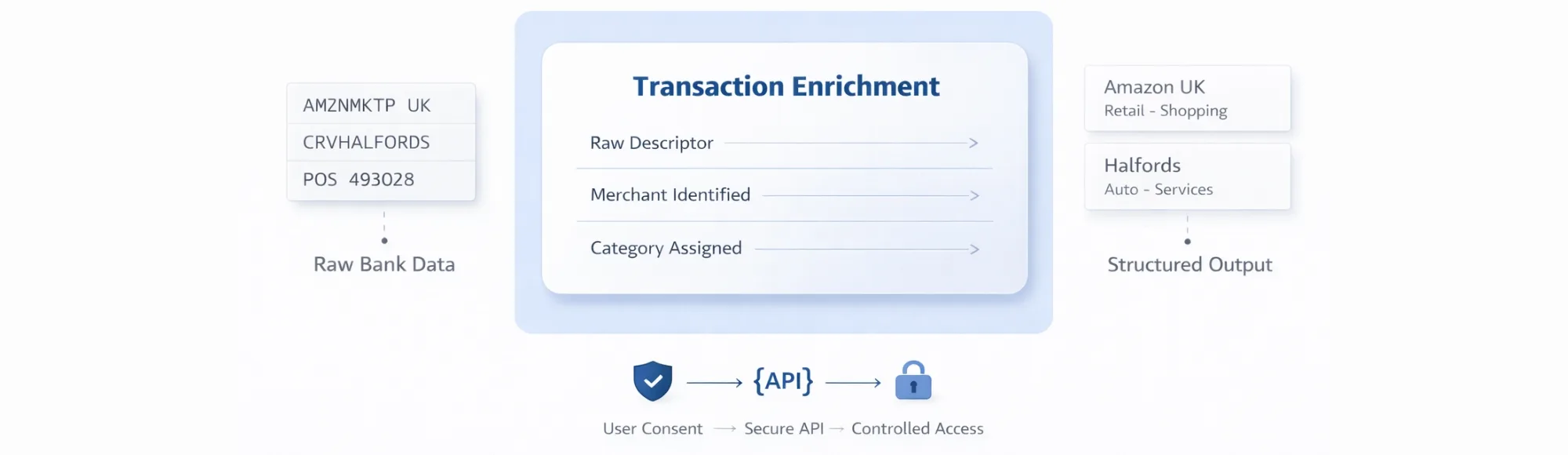

Verified Data Enrichment Tools for UK Financial Platforms

Essential data enrichment tools evaluation for UK financial platforms. Access…

Essential Data Privacy Compliance for UK Regulated Platforms

Essential data privacy compliance for UK regulated platforms using consent-based…

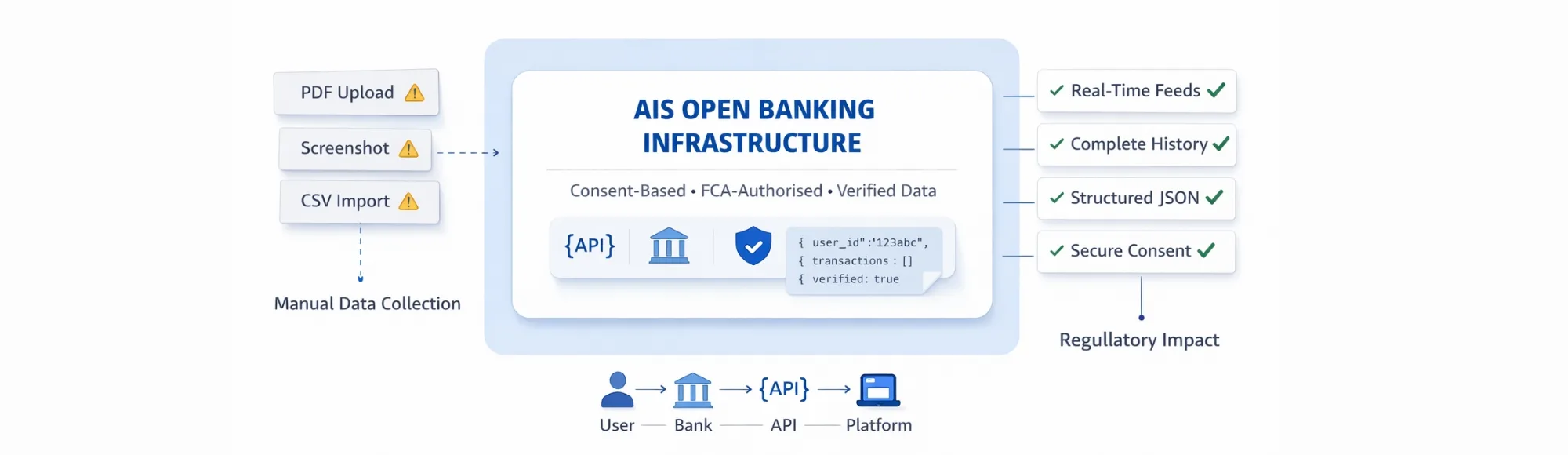

Secure AIS Open Banking Infrastructure for UK Regulated Platforms

AIS Open Banking infrastructure enables UK platforms to access verified…

Verified Audit Trail Compliance for UK Regulated Platforms

Automated audit trail compliance for UK regulated platforms using verified…

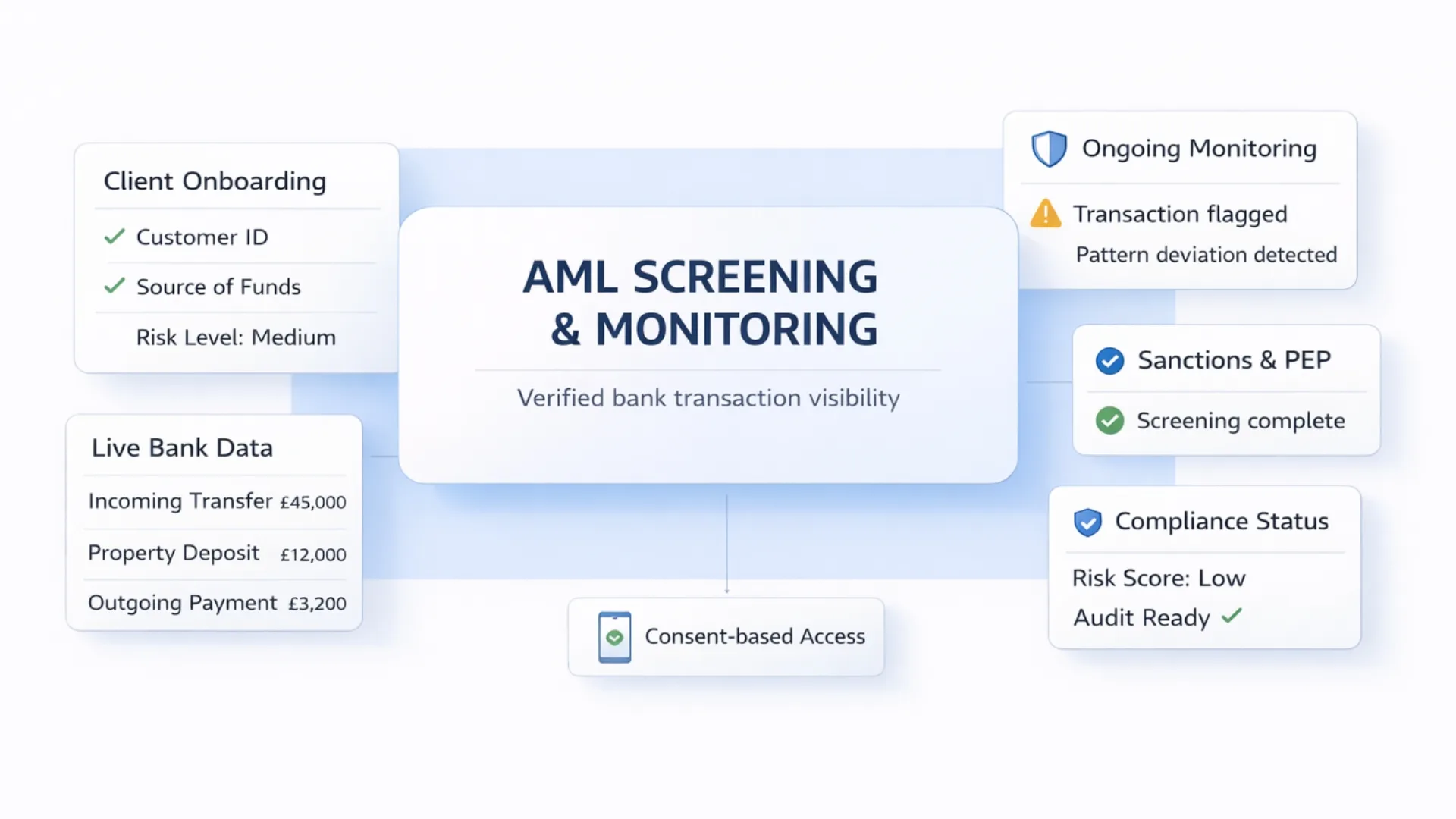

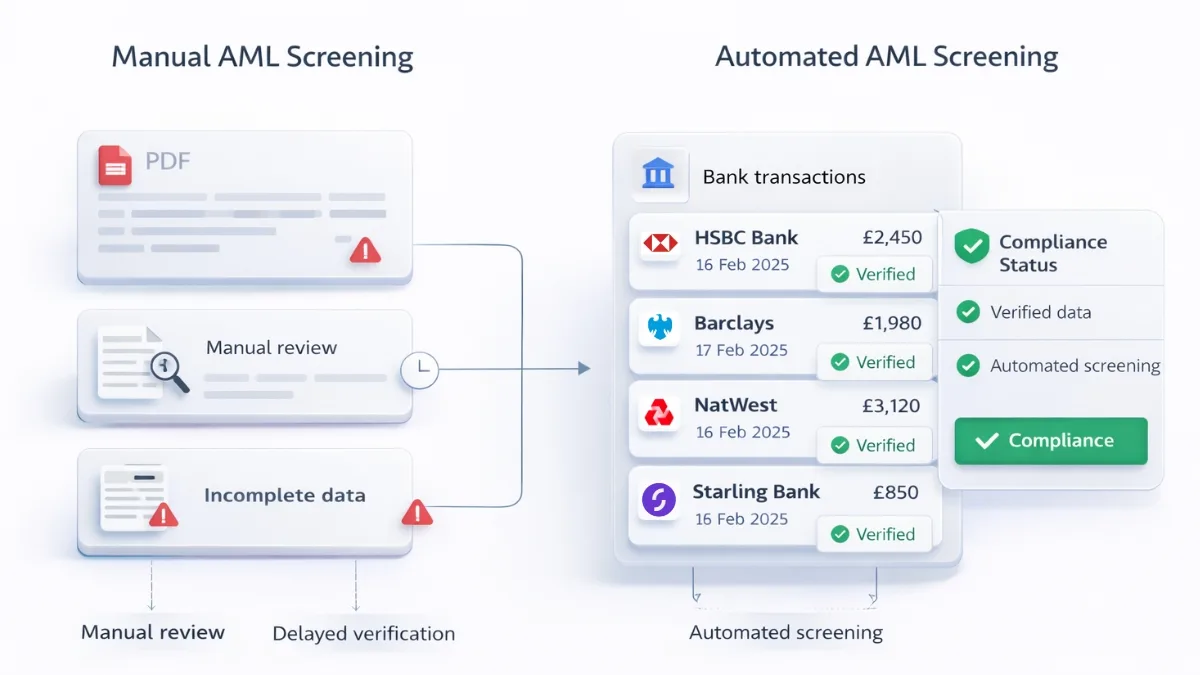

AML Screening and Monitoring for UK Regulated Platforms

AML screening and monitoring for UK platforms using verified bank…

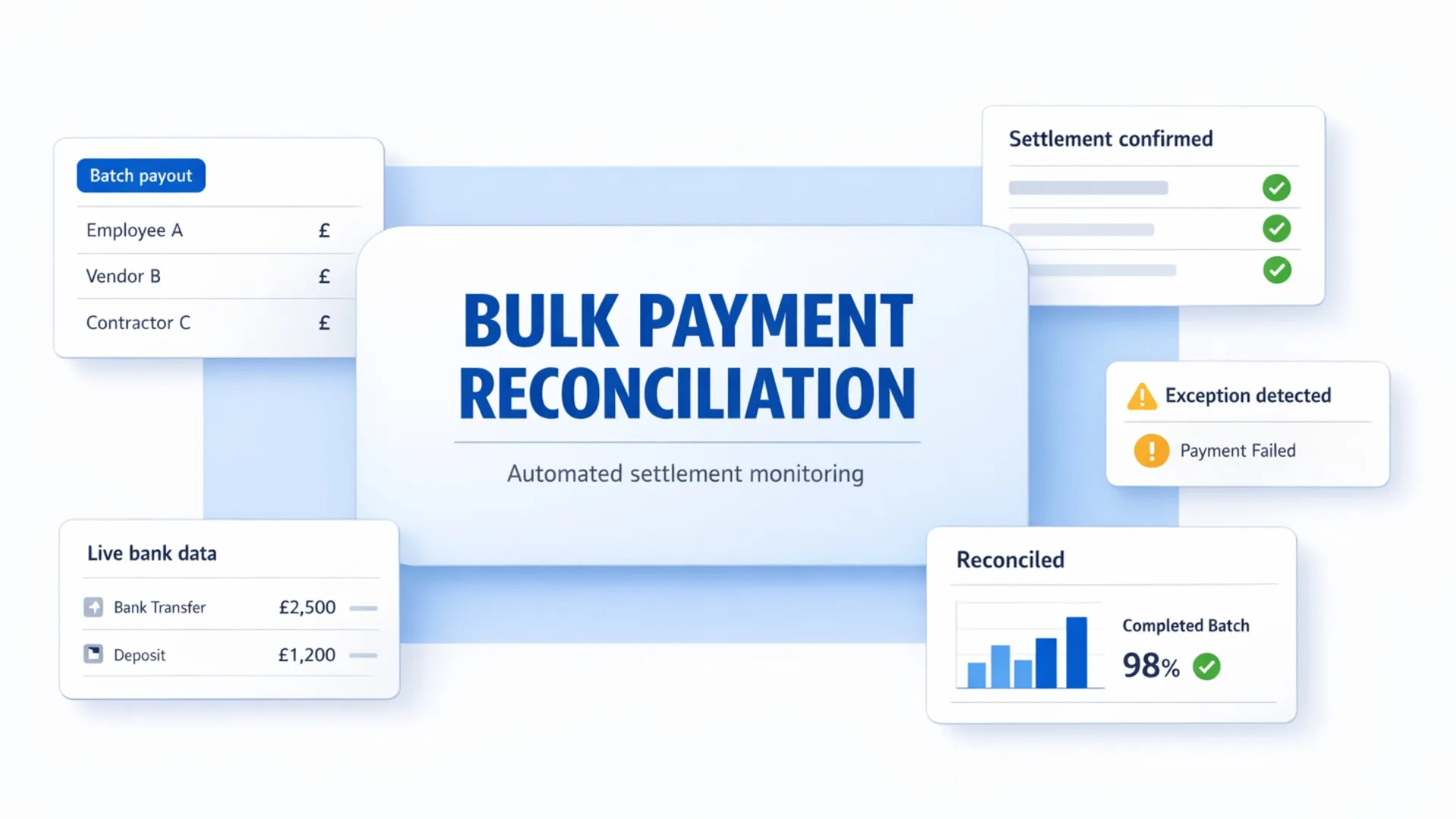

Automated Corporate Bulk Payment Reconciliation for UK Financial Platforms

Automated corporate bulk payment reconciliation enables UK platforms to monitor…

Best Data Enrichment Tools for UK Fintech & Accounting Scaleups (2026 Guide)

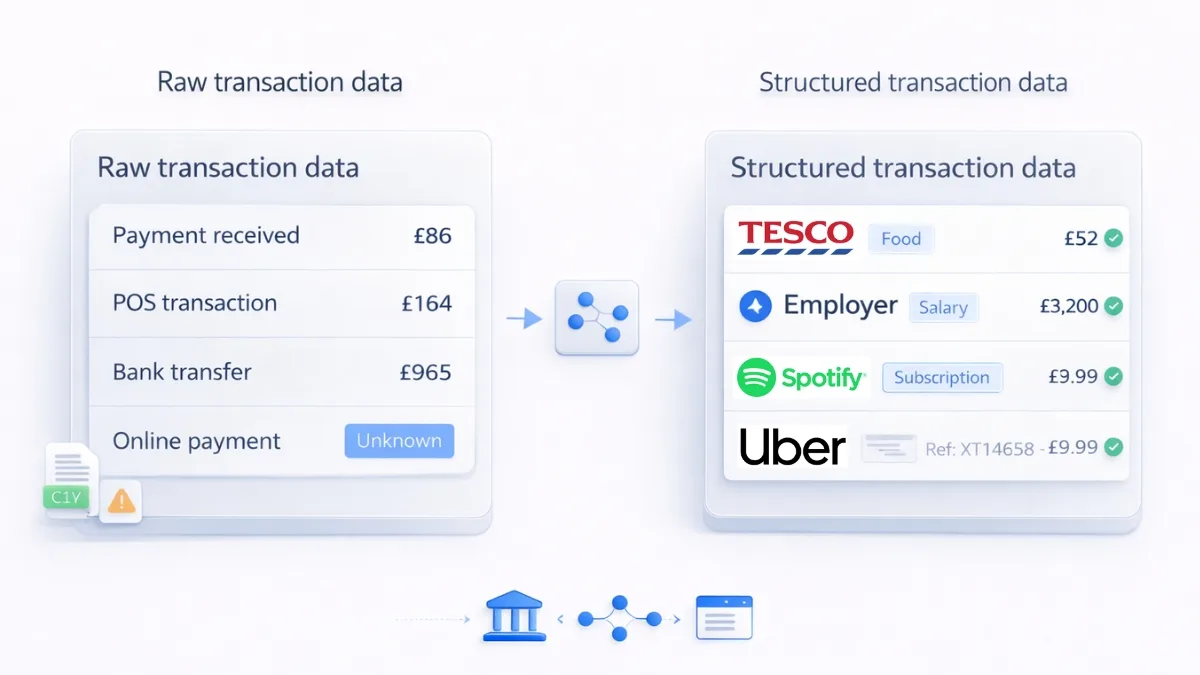

Compare the best data enrichment tools for UK fintech and…

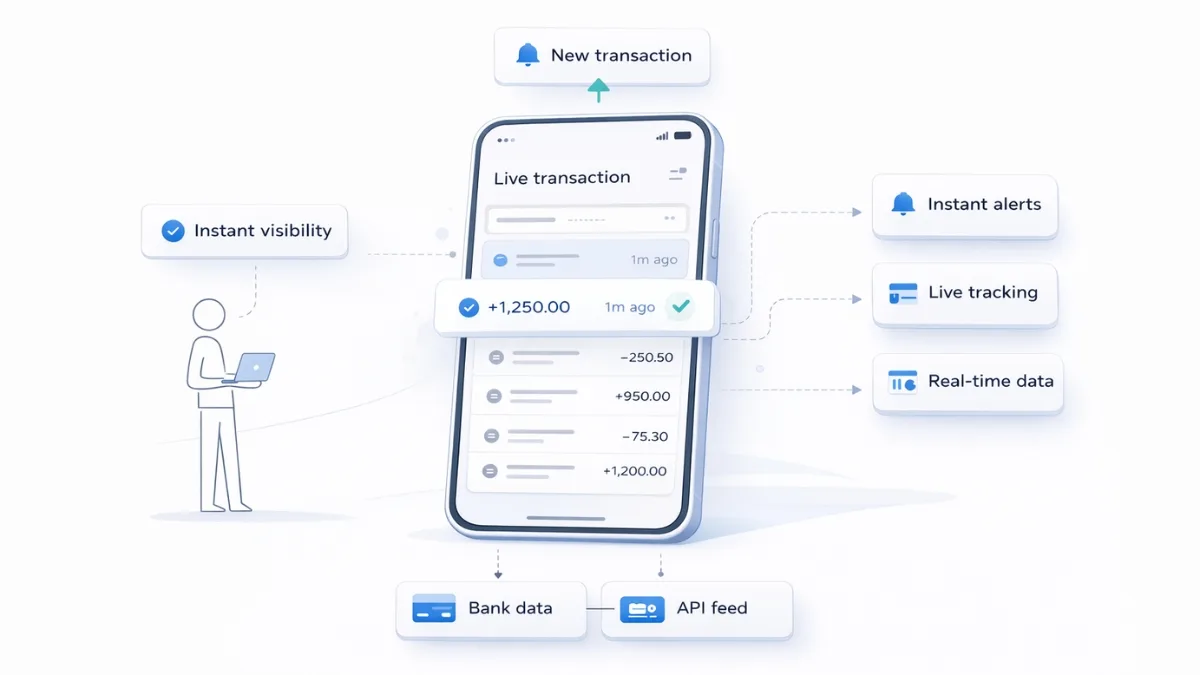

Automated Real-Time Transaction Monitoring for Fintech Platforms

Real time transaction monitoring enables UK fintech platforms to access…

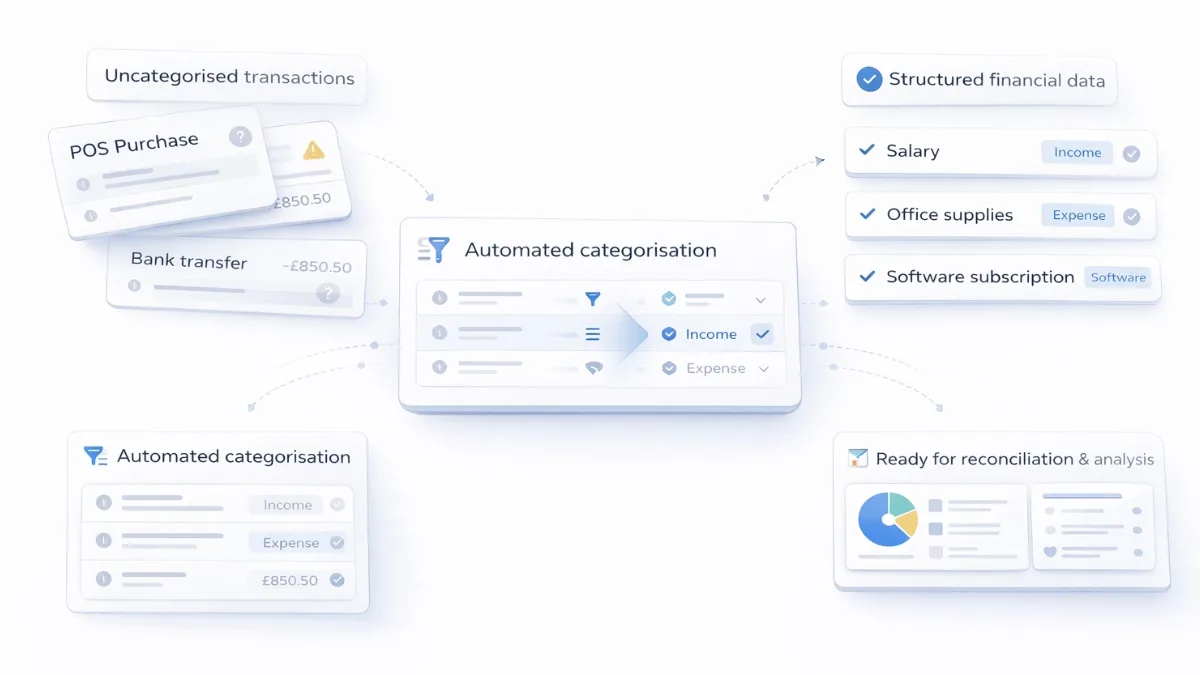

Automated Financial Data Categorisation for UK Platforms

Automated financial data categorisation enables UK platforms to access structured…

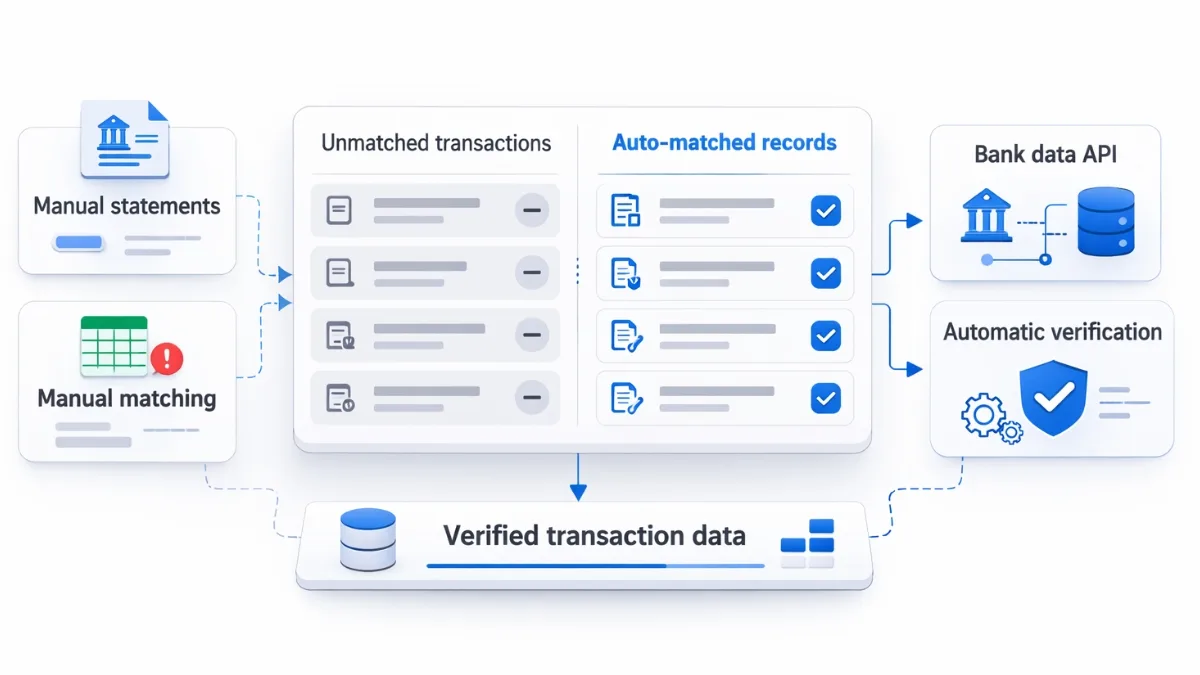

Automated Client Account Reconciliation for UK Platforms

Automated client account reconciliation enables UK platforms to match transactions…

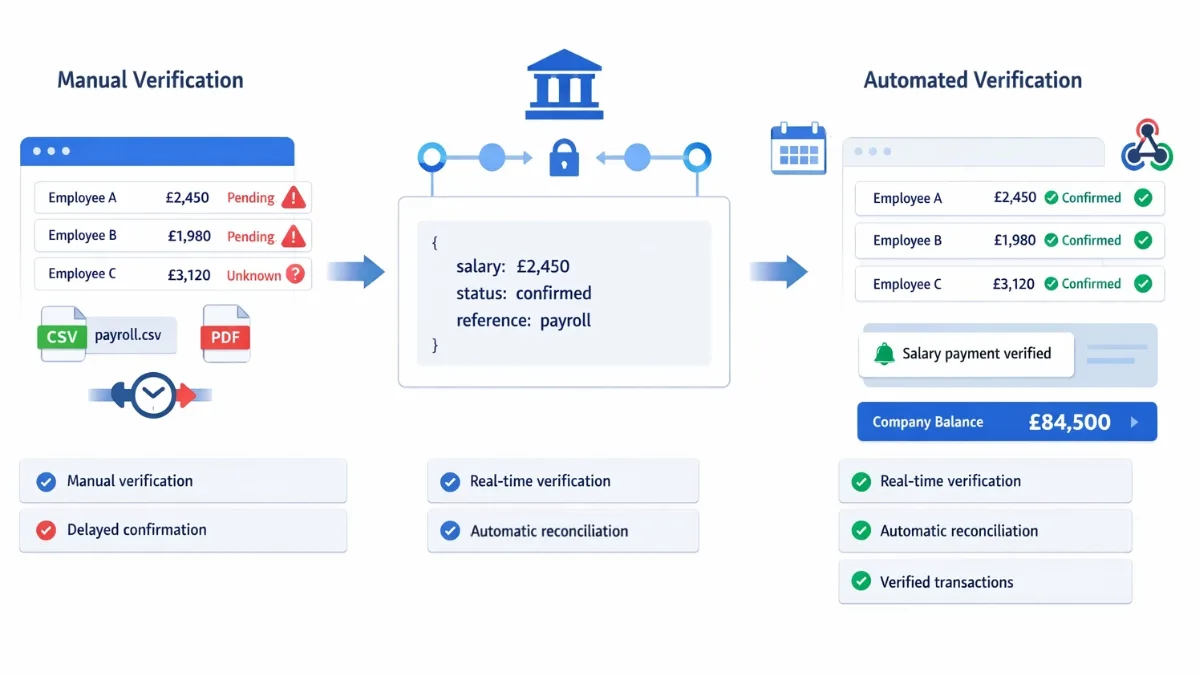

Payroll Processing Services for UK Platforms

Payroll processing services infrastructure enables UK platforms to verify salary…

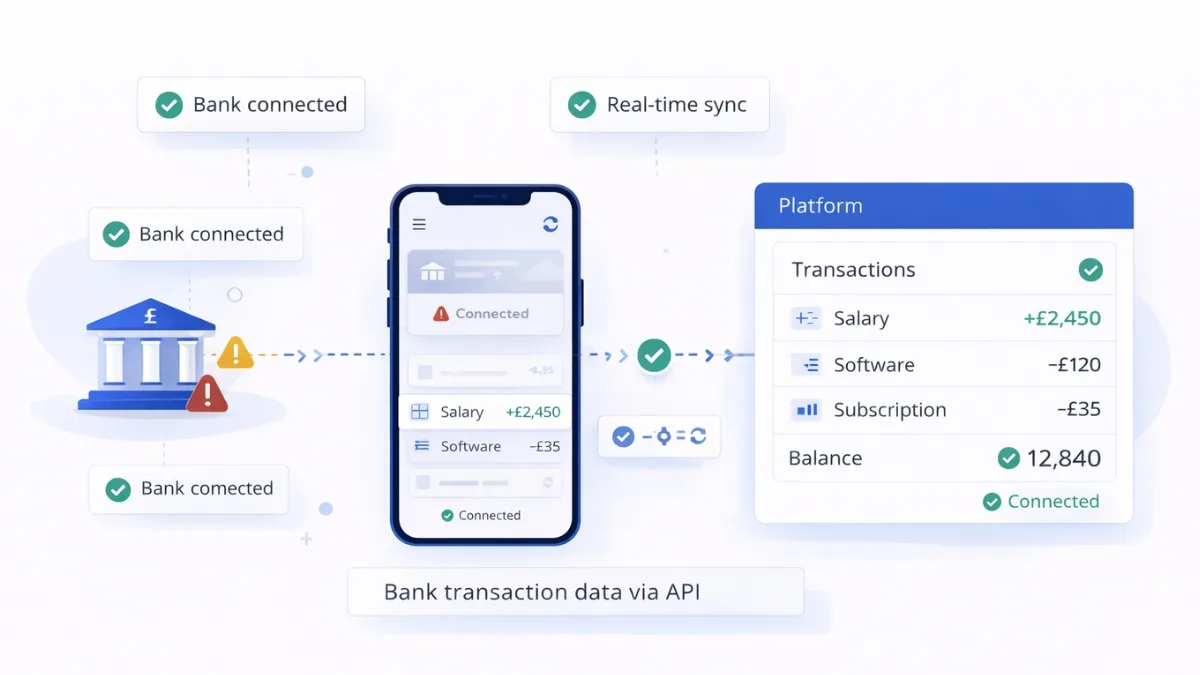

API to Get Bank Transactions for UK Platforms

API to get bank transactions enables UK platforms to access…

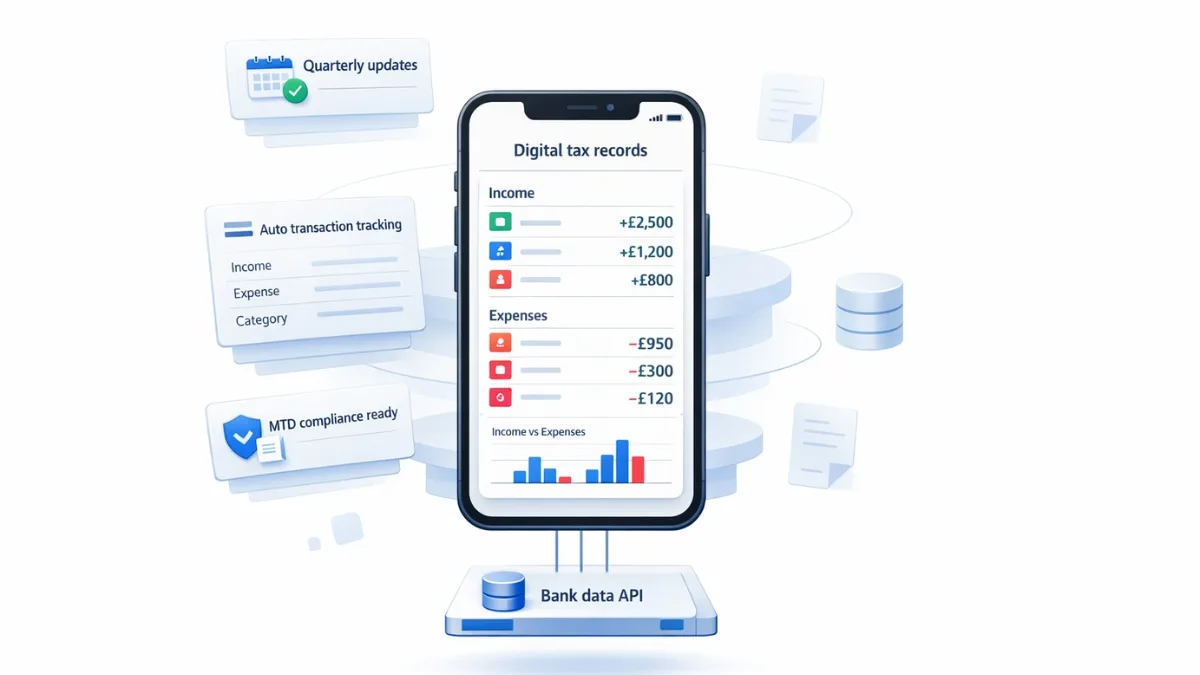

HMRC MTD ITSA Software for UK Accounting Platforms

Building HMRC MTD ITSA software features? Access verified bank transaction…

AML Screening for UK Financial Platforms

Building AML screening workflows? Access verified bank transaction data for…

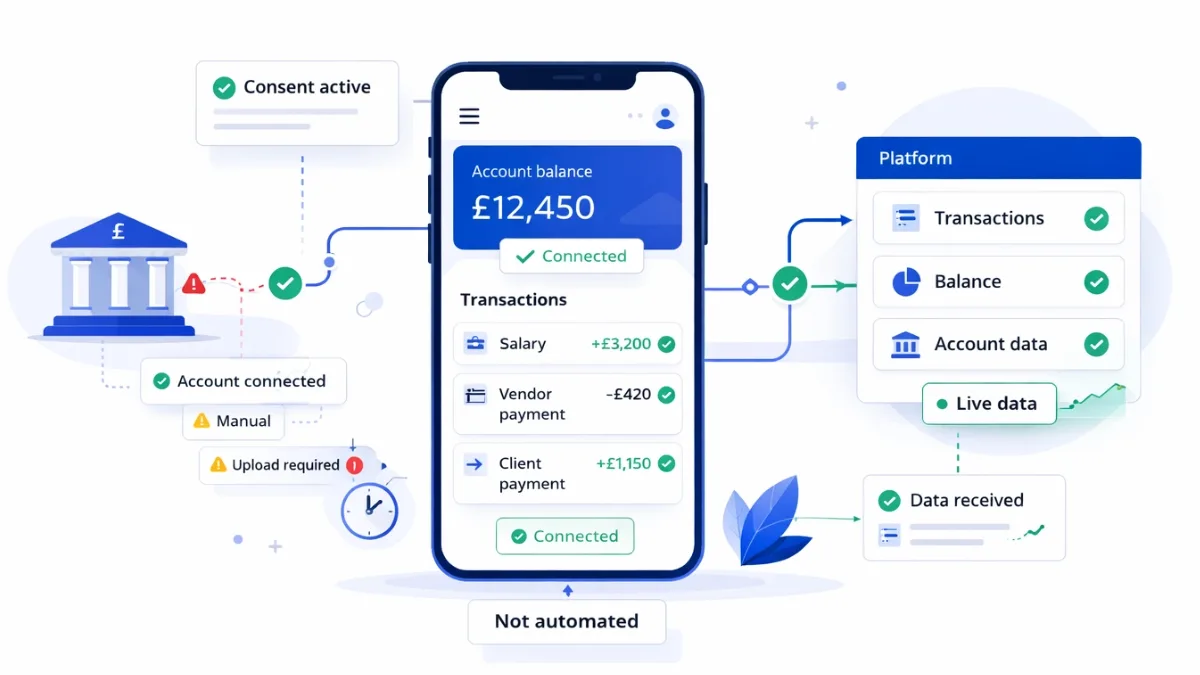

Open Banking AIS: How to Access Financial Data Reliably

Open banking AIS infrastructure enables UK platforms to access bank…

Data Enrichment API for UK Financial Platforms

Need structured transaction data for your platform? Access enriched bank…

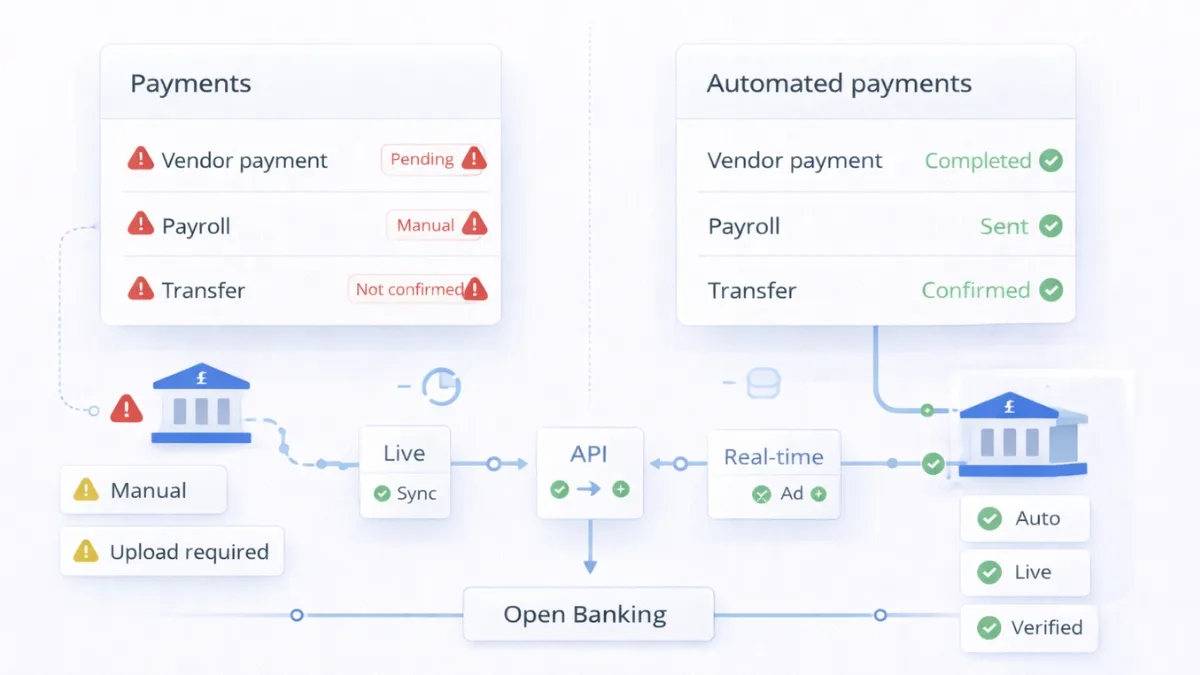

B2B Payment Automation: How UK Platforms Replace Manual Bank Transfers

B2B payment automation enables UK platforms to replace manual bank…

Open Banking Financial Data: UK Platform Integration Checklist

Open banking financial data integration requires reliable infrastructure. UK platforms…

Automation of Accounting Process Using Bank-Verified Data

Automation of accounting process requires reliable bank transaction data. UK…

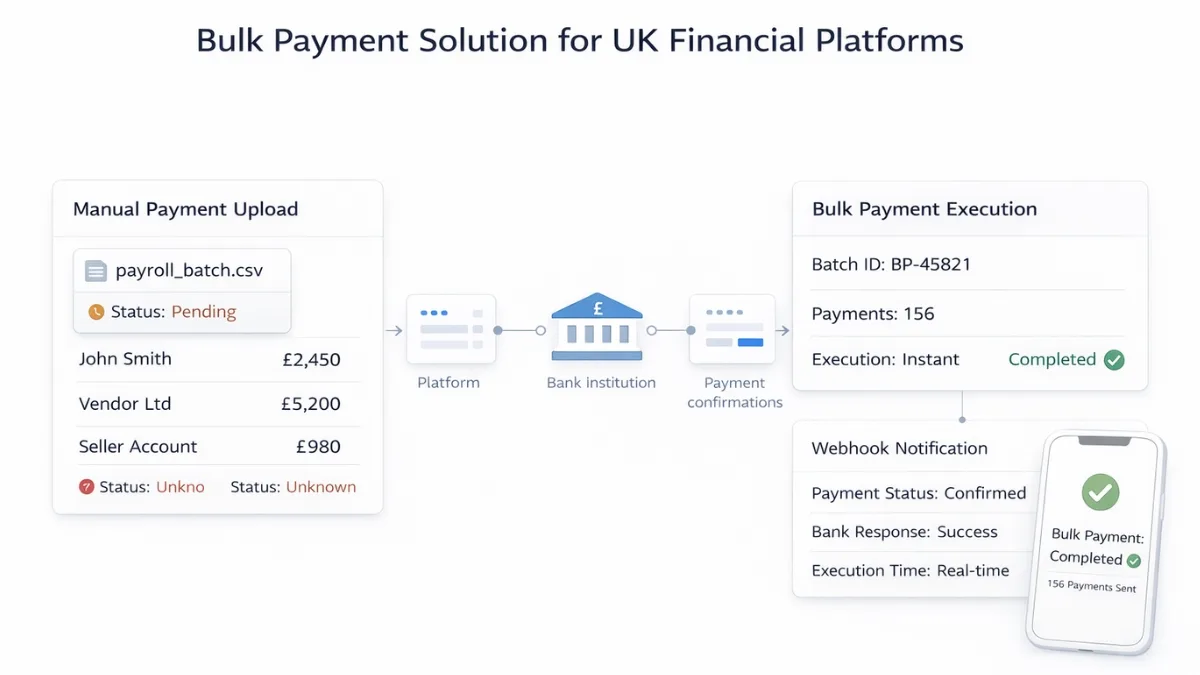

Bulk Payment Solution for UK Financial Platforms

UK platforms need reliable bulk payment solution infrastructure for payroll,…

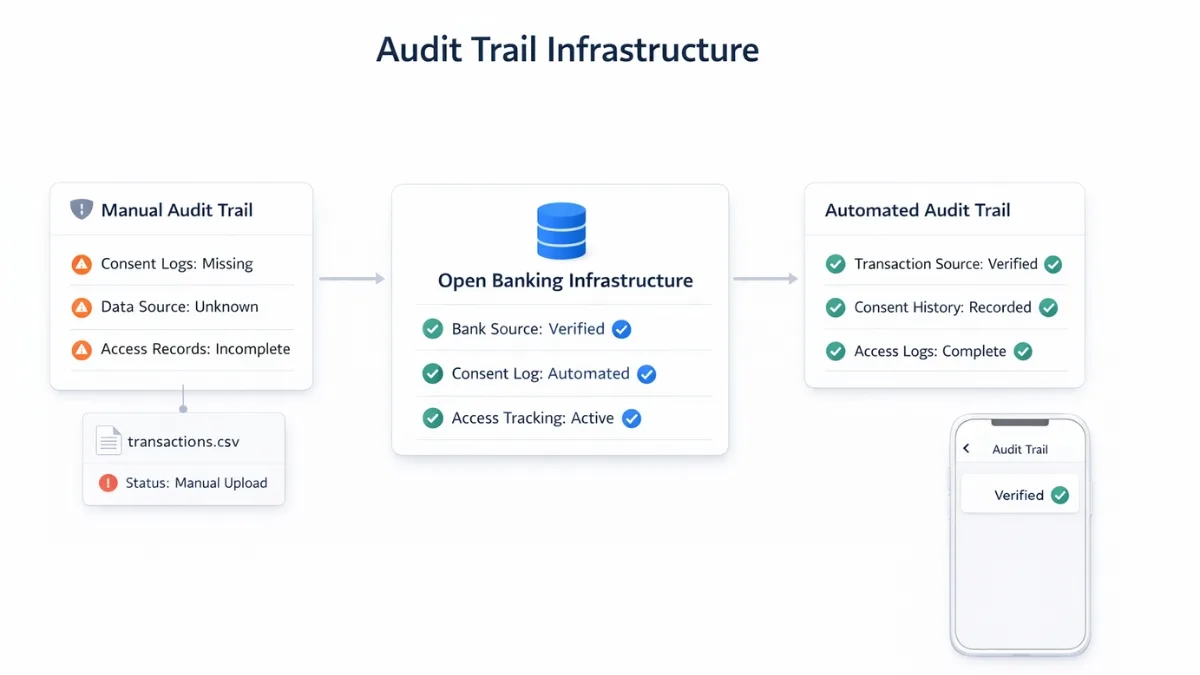

Audit Trail Infrastructure for UK Fintech Platforms

Audit trail in financial platforms tracks data origin and consent.…

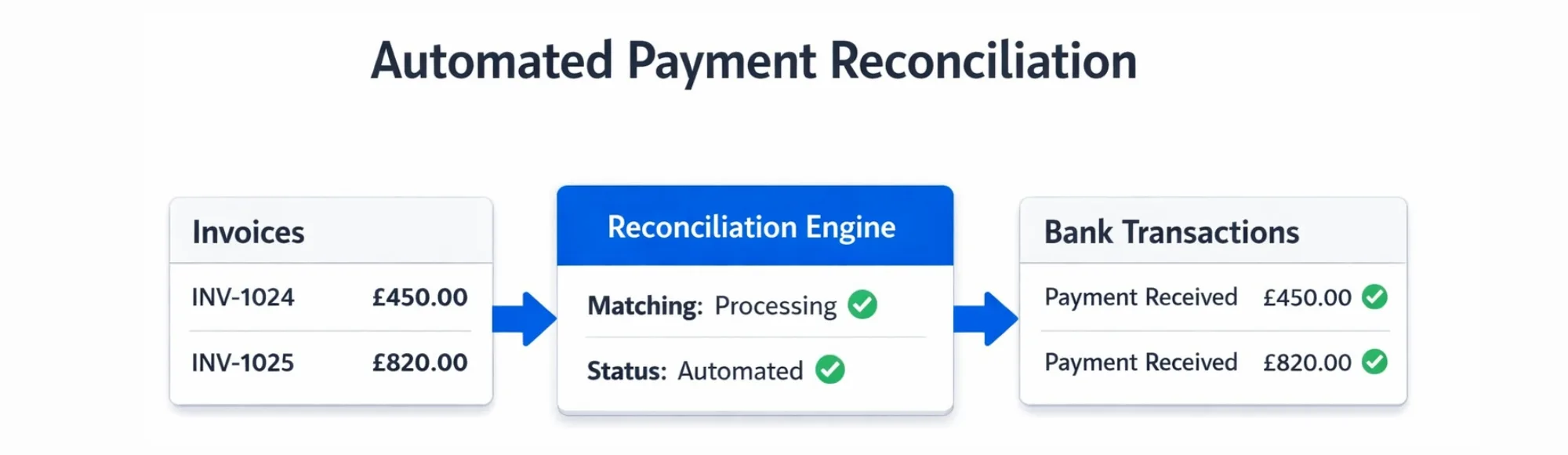

Automated Payment Reconciliation for UK Accounting Platforms

Automated payment reconciliation requires real-time bank transaction data. UK accounting…

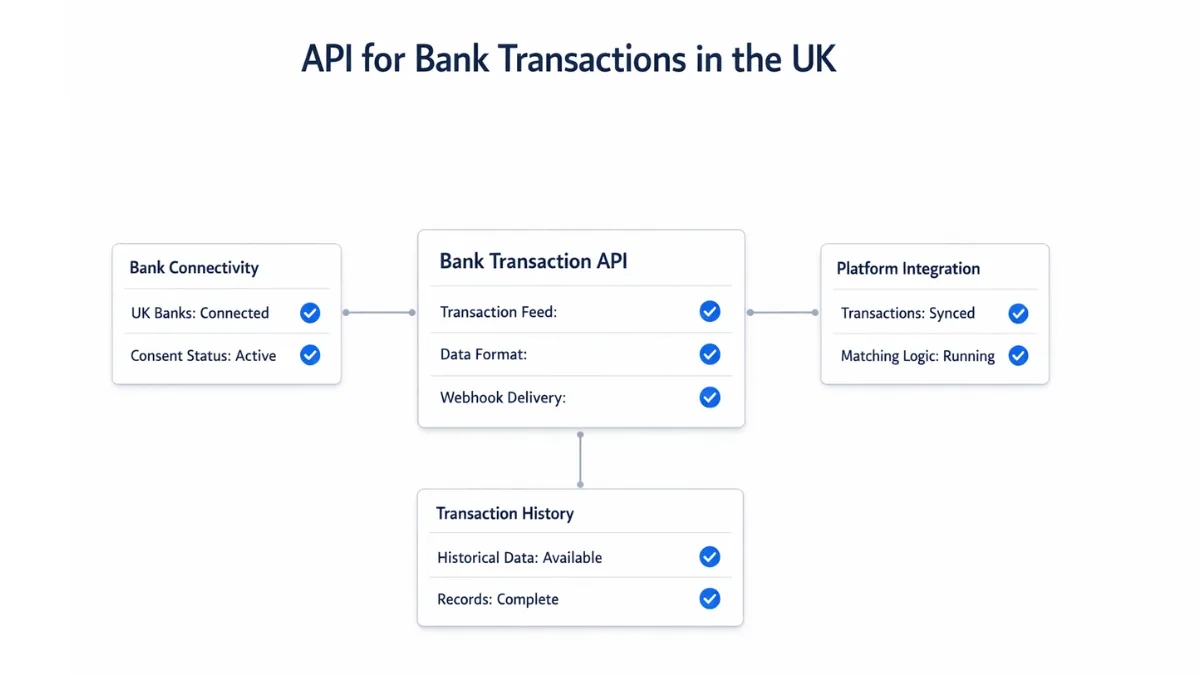

API for Bank Transactions in the UK: What Product Teams Should Check

API for bank transactions evaluation guide for UK product teams.…

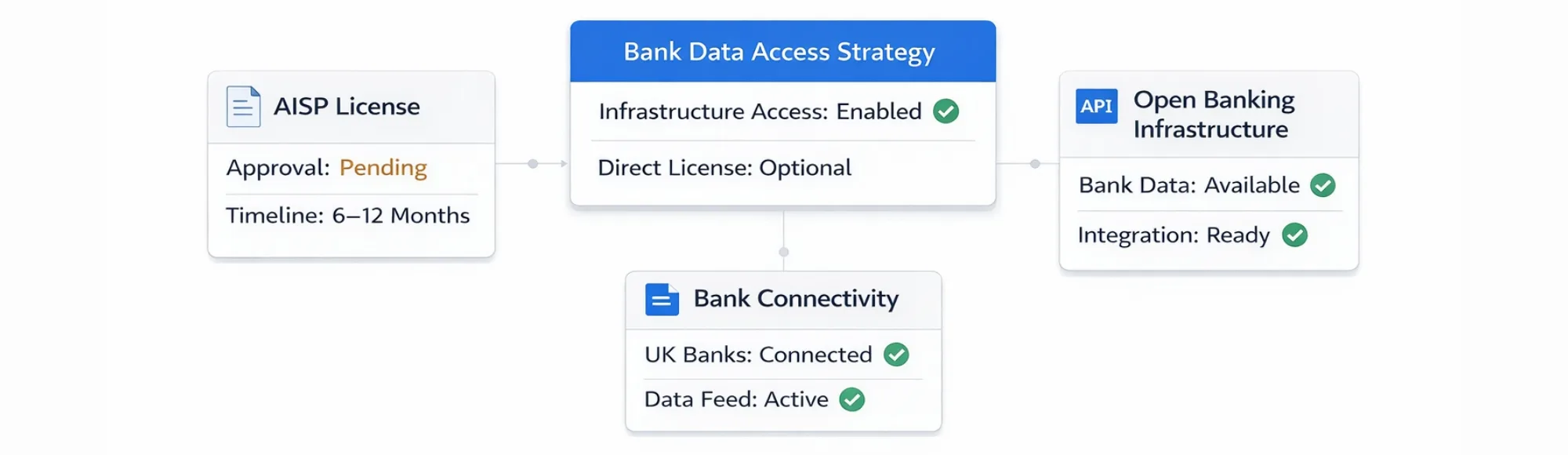

AISP License in the UK: What Founders Actually Need to Know

AISP license evaluation guide for UK fintech founders. Understand direct…

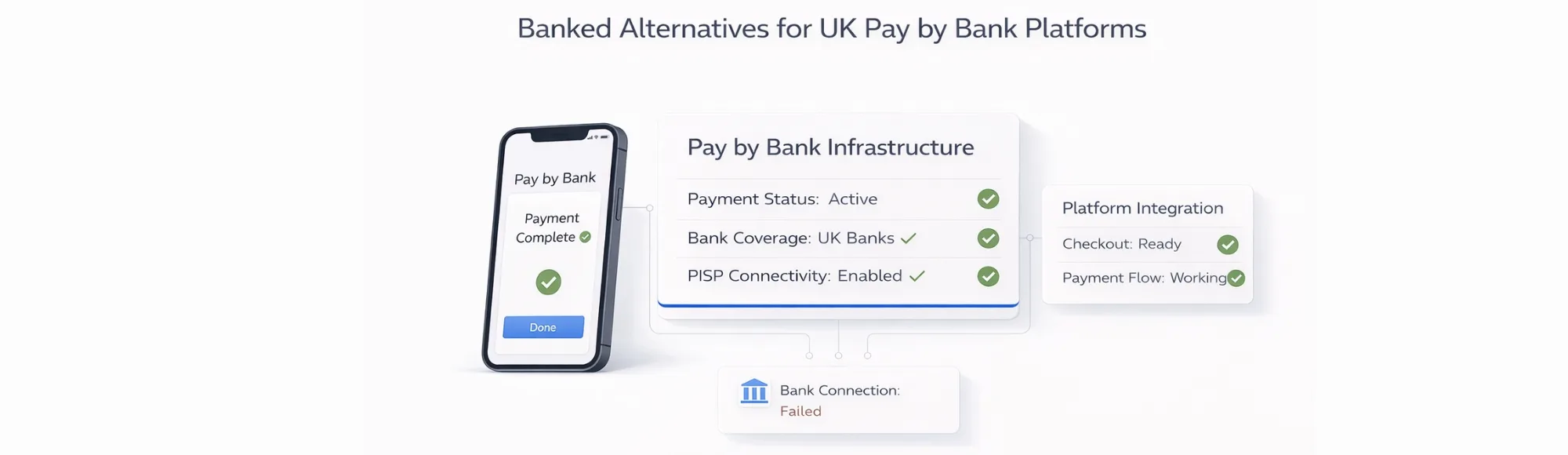

Top 6 Banked Alternatives for UK Pay by Bank Platforms

Compare 6 Banked alternatives for UK Pay by Bank platforms.…