The pricing and company information featured in this article was sourced from official websites and public materials as of May 2025

Mollie is one of the most popular payment service providers in Europe, especially among e-commerce brands, SaaS platforms, and subscription businesses. Its appeal lies in simplicity: no monthly contracts, broad payment method support (like iDEAL, Klarna, and SEPA), and fast onboarding.

But when it comes to actual costs, many businesses end up surprised.

Here’s why:

- Mollie uses a blended pricing model, which hides interchange or scheme fees inside one fixed rate.

- Different payment methods come with different fees, often significantly higher than expected.

- Features like chargeback handling, currency conversion, and even refunds can add to the overall cost.

- Unlike some providers, Mollie doesn’t absorb these costs at scale, you pay per transaction, no matter your volume.

If you’re managing tight margins, subscription churn, or high refund rates, these small fees quickly add up.

That’s why this blog breaks it all down:

Whether you’re scaling a digital product or managing thousands of monthly payments, this guide will help you make smarter choices.

Mollie’s Pricing Structure: How It Works

Mollie uses a pay-as-you-go model with no setup or monthly fees. That sounds straightforward, but the real pricing depends entirely on how your customers choose to pay.

Let’s break it down by method:

Card Payments

Card payments are the most common but also among the most expensive:

| Card Type | Fee |

|---|---|

| Visa/Mastercard (EEA Consumer) | 1.8% + €0.25 |

| Visa/Mastercard (Commercial & Non-EEA) | 2.9% + €0.25 |

| American Express | 2.9% + €0.25 |

These rates are blended, meaning Mollie combines all scheme and interchange fees into one flat percentage. While simple, this can sometimes mask higher costs compared to providers that offer Interchange++ models.

Bank-Based Payment Methods

Mollie supports local and bank-based payment methods that are typically cheaper:

| Payment Method | Fee |

|---|---|

| SEPA Direct Debit | €0.25 |

| Bank Transfer (SEPA) | €0.25 |

| iDEAL (NL only) | €0.29 |

| Bancontact (BE) | 1.5% + €0.25 |

| Klarna: Pay Later / Slice It | 2.99% + €0.35 |

Bank-based payments are often preferred for recurring billing and invoice payments, but be aware that some like Klarna, come with higher percentage fees due to risk underwriting and deferred settlement.

International Payments

International cards, non-Euro currencies, and cross-border transactions may trigger currency conversion fees, which are:

- Typically around 2.5%–3% above the base exchange rate

- Not always disclosed clearly during the checkout setup

For businesses selling outside the Eurozone, this can significantly affect profitability.

Refunds & Chargebacks

Unlike some platforms, Mollie does not return the original transaction fee when a refund is issued. You also pay for refund processing:

- Refund Fee: €0.25 per transaction

- Chargeback Fee: €19–€35, depending on the card network and dispute

If you run a high-volume store with frequent returns or disputes (e.g. fashion, electronics, digital goods), these fees can become a major cost centre.

Does Mollie charge monthly fees?

No,Mollie operates on a per-transaction basis with no monthly minimums or platform fees.

Payout Timings & Hidden Costs That Add Up

Mollie might not charge setup or monthly fees, but payouts and operational costs can still affect your margins, especially if you’re managing cash flow closely.

Payout Schedules

Mollie offers three payout frequency options:

| Payout Frequency | Timing | Fee |

|---|---|---|

| Daily | Next business day | Free |

| Weekly | Chosen weekday | Free |

| Monthly | 1st business day | Free |

At a glance, these seem generous; there are no explicit payout fees. But keep in mind:

- Settlement times vary by method. Klarna and SEPA Direct Debit, for example, take longer to clear.

- Funds are typically batched by currency and method, which may delay overall reconciliation.

Currency Conversion Fees

If you accept payments in currencies other than your payout currency (e.g. GBP for EUR accounts), you’ll incur conversion costs.

- Mollie’s FX markup is around 2.5–3% on top of the interbank rate.

- This fee is often hidden within the exchange rate, not shown as a separate line item.

- If you’re invoicing in EUR but your bank account is in GBP, this cut can be painful.

Chargebacks, Refunds & Operational Friction

As mentioned earlier, Mollie does not refund processing fees on returned transactions. You pay:

- €0.25 per refund

- €19–€35 per chargeback, depending on the scheme

In industries like travel, e-commerce, and ticketing, disputes are common, and these fees add up fast.

Even more, the manual effort of reconciling refunds, partial Klarna settlements, and multi-currency payouts can cost hours each week, particularly for finance teams managing dozens of SKUs and price points.

Does Mollie provide real-time payouts?

No. Mollie processes payouts on a set schedule, i.e daily, weekly, or monthly. Even instant payments like cards or iDEAL don’t settle in real time. This delay may impact cash flow for marketplaces or platforms needing faster fund access.

Are Mollie’s fees the same for all payment methods?

No. Mollie uses blended pricing, and fees vary by method. For example, SEPA and iDEAL are cheaper than credit cards or Klarna, which have higher rates.

Open Banking: A Cost-Saving Alternative to Mollie

If you’re looking to reduce fees, speed up settlements, and simplify operations, Open Banking offers a strong alternative to traditional payment processors like Mollie.

What Is Open Banking?

Open Banking enables direct bank-to-bank payments, cutting out card networks, intermediaries, and wallet providers. With a verified bank connection, customers approve a payment through their own banking app, and the funds land in your account instantly.

Why Businesses Are Making the Switch

Here’s how Open Banking compares on key payment pain points:

| Factor | Mollie (Card & Wallet) | Open Banking (Pay by Bank) |

|---|---|---|

| Transaction Fees | 1.8%–2.9% + fixed cost | From £0.10–£0.30 (flat) |

| Settlement Time | 1–2 business days | Instant (real-time) |

| Refund Fees | €0.25 | Optional or £0–£0.10 |

| Chargebacks | Common | None (payments are final) |

| Currency Conversion | 2.5–3% | Avoidable with domestic rails |

| User Experience | Redirects, logins | Biometric bank approval |

Who Benefits the Most?

- Marketplaces & gig platforms: Faster vendor payouts

- E-commerce brands: Lower cart abandonment, reduced fees

- Subscription platforms: Cleaner billing with fewer disputes

- SaaS or B2B products: More predictable cost model

Can Open Banking replace all Mollie payment methods?

Not all, but for core use cases like card payments, subscriptions, and invoice-based billing, it offers a simpler, cheaper route with fewer intermediaries.

How to Accept Open Banking Payments with Finexer

You don’t need complex integrations or merchant accounts to start accepting bank payments. Here’s how Finexer makes it simple:

1. Send a Payment Link or Show a QR Code

Create a secure payment link or QR code and share it however you like, via email, SMS, or invoice. Your customer taps, selects their bank, and approves the payment using Face ID or passcode. No signup, no delays.

2. Drop Finexer into Your Product via API

Running a platform or managing recurring flows? Finexer’s API lets you trigger payments on demand, get instant status updates, and log every transaction, without redirecting your users.

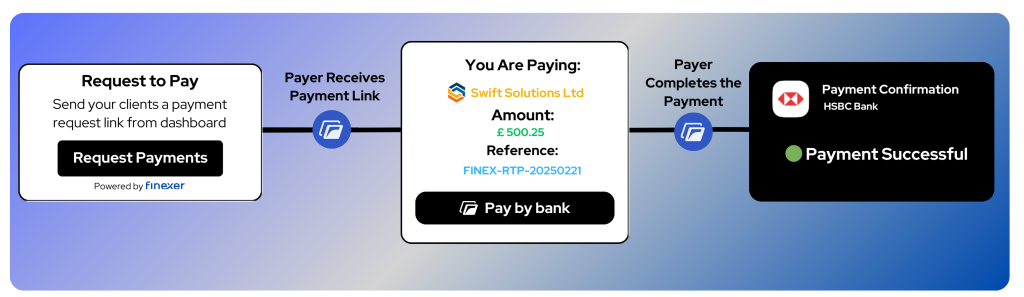

3. Use “Request to Pay” from the Dashboard

Want to prompt a customer or client to pay without chasing? Just hit “Request to Pay” in the Finexer dashboard, and they’ll get a branded link that opens directly in their bank app, ready to authorise.

4. Pay Staff or Suppliers with Batch Payments

Upload one file, approve once, and send payments to everyone at once, whether it’s payroll, expense reimbursements, or invoice settlements. It’s built for teams that move fast.

How Finexer made Open Banking Affordable

| Feature | Finexer | Traditional Providers |

|---|---|---|

| Setup Fees | £0 | Often £200–£500 |

| Monthly Fees | Fixed, affordable for growing businesses | £20–£100+ |

| Transaction Pricing | Usage-based, scales with volume | % fee + fixed costs per method |

| Card Network Charges | None (bank-to-bank only) | 1.5%–3.5% + scheme fees |

| Feature Access | All essentials included in every plan | Tiered or paywalled |

| Chargeback Risk | None (payments are final) | High, plus £15–£25 per dispute |

| Settlement Speed | Instant (1–15 minutes) | 1–3 business days |

| Refund Fees | Optional, low-cost via API | Often £0.25–£0.50 per refund |

What Our Clients Say

Leading UK platforms choose Finexer not just for the technology, but for the partnership, support, and commercial clarity that comes with it.

Trusted by Regulated Identity Providers

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.”

— David Kern, CEO, VirtualSignature-ID

Finexer powers VSID’s open banking layer, helping them deliver secure, compliant KYC and Source of Funds solutions to top-tier legal and accountancy firms.

Built for Business-First Open Banking

“Our business isn’t about the volume of consents—it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

— Penny Phillips, Chief Commercial Officer, Sysynkt

Sysynkt found that most open banking providers were built for consumer apps. Finexer stood out with a business-first model tailored to complex financial operations.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How is Open Banking cheaper than Mollie?

Open Banking avoids card networks, so there are no interchange or scheme fees. With Finexer, you only pay a flat, low transaction cost, no chargebacks, no FX markups, no hidden extras.

Can I use Open Banking and Mollie together?

Yes. Many platforms use Mollie for cards and Finexer for bank payments. You can offer both at checkout to give customers a secure, low-cost “Pay by Bank” option.

No setup fees. No cancellation fees. Just pay for what you use! Try Finexer Now 🙂