In today’s legal landscape, financial mis-selling and irresponsible lending claims are among the most common disputes brought forward by consumers. Whether it’s payday loans issued without affordability checks or personal contracts sold with misleading terms, law firms are tasked with proving that clients were misled and that damage was done.

The challenge? Claims like these are often won or lost based on the quality of financial evidence.

That’s where bank data plays a crucial role. By examining transaction history, income patterns, recurring debts, and repayment behaviour, legal professionals can build a much stronger case, one grounded in verified data instead of client memory or inconsistent documents.

A recent wave of legal claims has emerged from the UK motor finance industry alone. Following a Financial Ombudsman investigation into undisclosed commissions, analysts now estimate that legal claims for mis-selling could exceed £30 billion in potential compensation across lenders and dealerships.

This staggering figure underscores the importance of data-backed evidence. In this guide, we’ll explore how law firms use bank data to strengthen legal claims, the types of mis-selling cases where it’s most valuable, and the role Open Banking now plays in accessing this information quickly and securely.

What Counts as Financial Mis-Selling or Irresponsible Lending?

Legal claims for mis-selling typically arise when financial products such as loans, credit agreements, or insurance are sold without proper transparency, suitability checks, or informed consent. In the UK, these cases often fall under the jurisdiction of the Financial Conduct Authority (FCA) and the Financial Ombudsman Service.

Common Types of Mis-Selling Legal Claims:

- Payday Loans: Issued without proper affordability assessments.

- Guarantor Loans: Where the guarantor wasn’t fully informed of their liability.

- PPI (Payment Protection Insurance): Sold to consumers who couldn’t use it or weren’t aware they had it.

- Motor Finance Agreements: Involving hidden commissions or inflated interest rates.

- High-Cost Short-Term Credit (HCSTC): With interest rates and terms that breach FCA affordability guidelines.

- Personal Contract Purchase (PCP): Misrepresented terms on car loans and balloon payments.

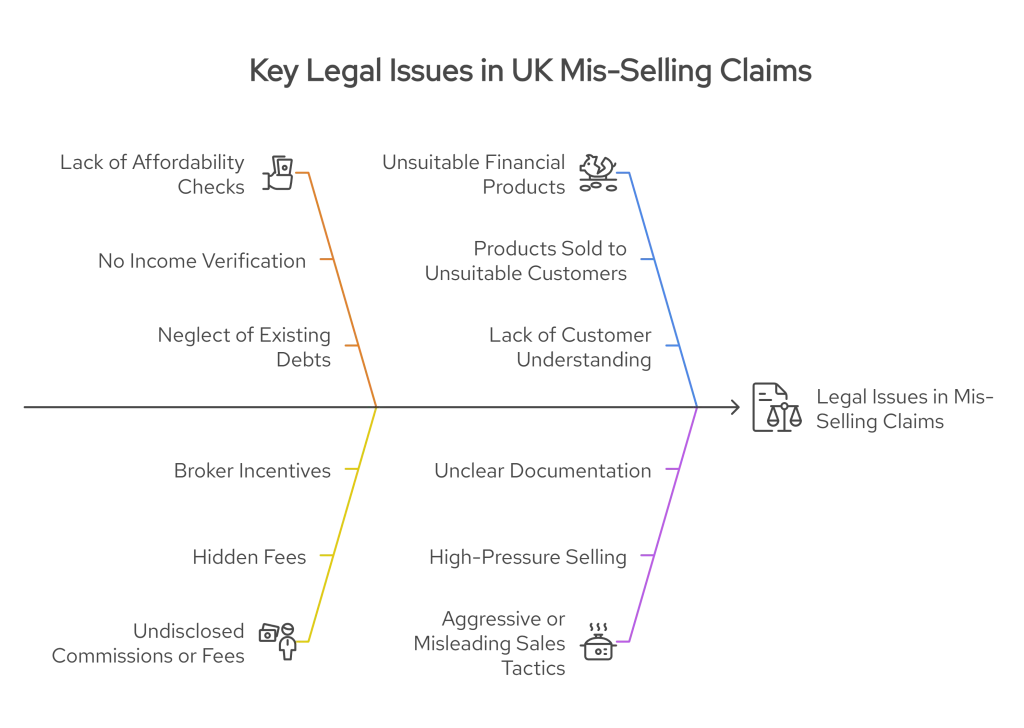

Key Legal Issues in These Claims:

- Lack of Affordability Checks

Lenders issued credit without verifying income, essential expenses, or existing debts. - Failure to Disclose Commissions or Fees

Many borrowers were unaware of incentives paid to brokers or sellers, affecting transparency. - Unsuitable Financial Products

Customers were sold products they didn’t understand, couldn’t afford, or didn’t need. - Aggressive or Misleading Sales Tactics

Pressure selling, lack of clear documentation, or misleading statements during the sales process.

Why Bank Data Is Critical in Legal Claims

For law firms handling financial mis-selling or irresponsible lending cases, bank data is one of the most decisive forms of evidence. It provides a real-time, tamper-proof view of a client’s financial situation before, during, and after the credit agreement, something that handwritten notes, questionnaires, or memory-based affidavits simply can’t match.

Here’s how bank data strengthens legal claims:

1. Proving (Un)Affordability at the Time of Lending

Using transaction data, law firms can clearly show:

- The client’s income stream and stability

- Monthly outgoings (rent, bills, dependents, etc.)

- Existing loans and obligations

This allows lawyers to demonstrate that the credit issued was unaffordable from the start, a breach of the FCA’s responsible lending rules.

2. Verifying the Timeline of Events

Bank statements help confirm:

- When the loan was paid out

- When repayments began

- Whether any lump-sum withdrawals or transfers were triggered by the agreement

This timeline is essential for pre-action protocols and assessing regulatory breaches.

3. Identifying Repeat Lending Patterns

In some legal claims, bank data reveals a series of back-to-back loans or refinancing deals, which is a red flag in mis-selling cases. It helps law firms uncover:

- Recurring payday loan cycles

- Rollovers or re-lending without affordability reassessment

- Multiple lenders operating simultaneously

4. Highlighting Hidden Fees or Commission Payments

Some transactions show unexplained deductions or irregular payment splits. These can signal:

- Undisclosed third-party commissions

- Admin or processing fees were not explained to the client

- Patterns that indicate exploitative lending

Bank data transforms speculation into structured legal proof. It reduces the burden on the claimant, ensures compliance with pre-litigation protocols, and gives solicitors the confidence to take on complex legal claims with a higher likelihood of success.

How Law Firms Use Bank Data in Practice

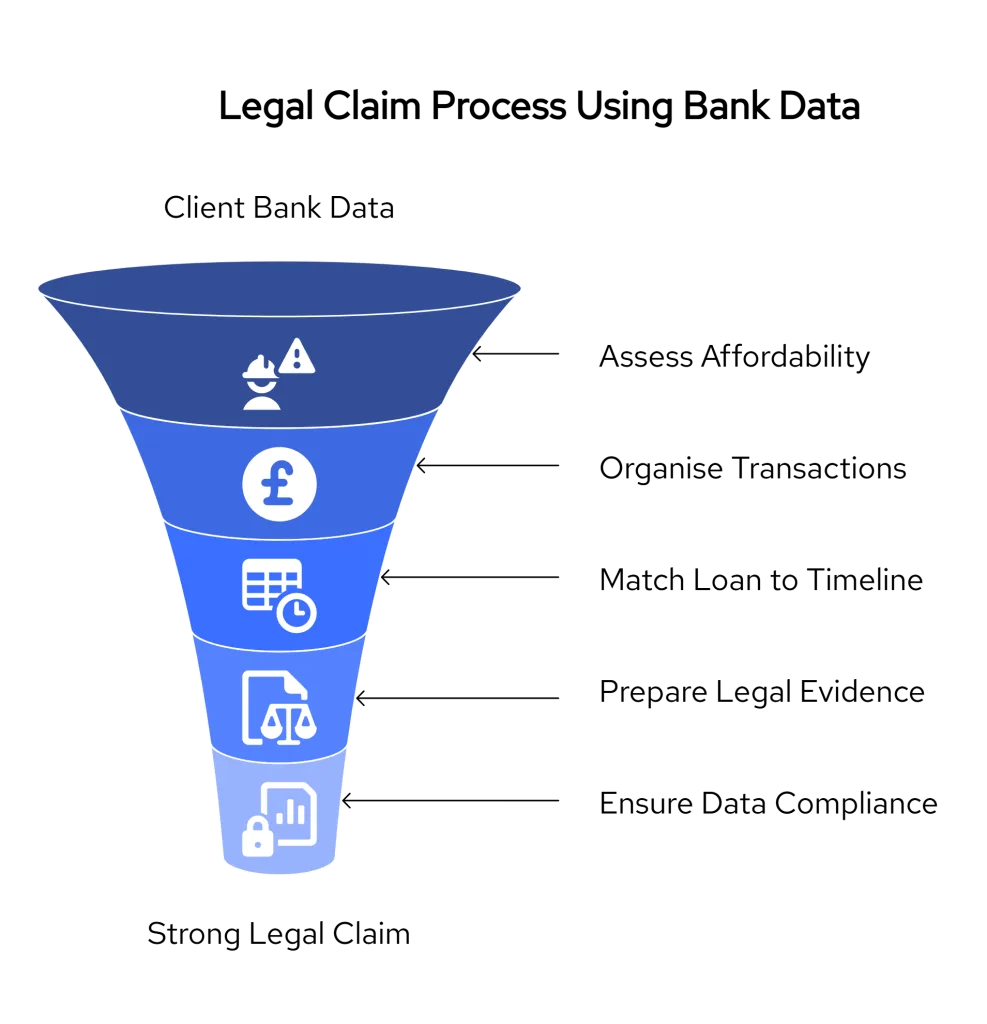

When building legal claims for mis-selling or irresponsible lending, most law firms follow a clear step-by-step process. It starts with the client’s permission to access their bank data and ends with submitting strong evidence as part of a formal complaint or legal action. Here’s how that process typically works.

1. Checking If the Loan Was Affordable

At the start of a case, the law firm looks at the client’s bank data to understand:

- Regular income (like salary or benefits)

- Living expenses (such as rent, bills, or childcare)

- Signs of financial stress (such as frequent overdrafts or payday loans)

This helps decide if the loan was truly affordable or if it added more pressure to an already tight budget.

2. Organising the Bank Transactions

Using bank data tools, law firms can:

- Download 3 to 12 months of transactions

- Sort spending into categories like food, rent, loans, and bills

- Spot repeated loan repayments or other risky patterns

This makes it easier to understand how the client managed their money at the time the loan was given.

3. Matching the Loan to the Timeline

Lawyers use transaction data to confirm:

- When the loan was received

- When repayments started

- What else was happening with the client’s money during that time

This helps show whether the lender acted responsibly or ignored warning signs.

4. Preparing the Legal Evidence

All of this data is then turned into a clear report. It can be used to:

- Make a complaint to the Financial Ombudsman

- Send a formal letter to the lender

- Support a case in court, if needed

The bank data provides solid proof, not just opinions or memory.

5. Following Consent and Data Rules

All data is collected with the client’s clear permission using approved tools. Law firms make sure:

- The data is kept secure

- Access is recorded for safety and tracking

- They follow GDPR and legal profession rules

Why Law Firms Choose Finexer to Power Legal Claims with Bank Data

Finexer is a purpose-built Open Banking platform trusted by legal professionals who need fast, permissioned access to verified bank data, especially for cases involving mis-selling, unaffordable lending, or repeat borrowing. Unlike generic finance tools, Finexer is designed to solve real bottlenecks in claims handling and evidence collection.

Here’s how it helps law firms operate faster, build stronger case files, and stay fully compliant.

1. Real-Time Access to Up to 12 Months of Bank Data

With Finexer, law firms can request a secure bank data connection from clients and receive categorised transaction data within minutes, not days. No more delays from waiting on PDFs or chasing incomplete records. You get the full affordability picture instantly.

2. Categorised Data Built for Legal Case Review

Finexer automatically tags each transaction (income, debt repayments, gambling, benefits, bills, etc.) and includes filtering tools that highlight key risk indicators:

- Evidence of financial stress

- Missed payments or defaults

- Overlapping high-cost loans

- Undisclosed deductions

This helps claims teams quickly build a fact-based narrative around affordability, transparency breaches, and harmful lending behaviour.

3. White-Labelled Client Consent Flow

Finexer gives you a fully customisable, FCA-compliant data access journey branded with your firm’s name and logo. This not only improves trust and conversion during client onboarding but also ensures:

- Secure consent logs

- Expiry-based access

- Full audit trail for regulatory peace of mind

4. Designed for Scale Without Adding Admin Burden

Whether you’re managing 20 claims or 2,000, Finexer removes repetitive document handling. It integrates seamlessly into your existing case management workflow, so your team can:

- Speed up initial case reviews

- Reduce human error

- Get to settlement or complaint submission faster

5. No Long-Term Contracts or Setup Delays

- Law firms can go live with Finexer in days, not months. Pricing is usage-based, so you only pay for the data you need, with no upfront integration cost.

- Finexer is used by claims management firms, solicitors, and legal tech teams who need secure, categorised financial data to win more cases faster and with less risk.

- If you handle affordability disputes or lending-related legal claims, Finexer gives you the data infrastructure to scale confidently and reduce manual review times.

“Our clients in the legal and accountancy sectors expect the highest standards of efficiency and security, and Finexer’s solutions help us deliver on those expectations every day,” David Kern, CEO of VirtualSignature-ID

Get Started

Legal Claims Require Trusted Data. Finexer Delivers It. Speed up affordability reviews and legal file Prep!

Try NowWrapping Up

For law firms handling legal claims involving mis-selling, unaffordable lending, or hidden charges, access to real-time bank data is no longer just useful, it’s foundational. This data brings objectivity, structure, and speed to what were once slow, paper-heavy processes.

With Finexer, law firms gain more than just data access. They get a purpose-built platform designed specifically for legal use cases:

- Categorised and filterable transactions built for affordability reviews

- Branded, FCA-compliant consent flows that build client trust

- Real-time access with audit trails and GDPR protection

- 3–5 weeks of hands-on support during onboarding, ensuring your team integrates the system with confidence

Finexer enables legal teams to reduce onboarding delays, minimise admin work, and file stronger cases without long contracts or high setup costs.

How can law firms use Open Banking for legal claims?

Law firms use Open Banking platforms to access verified bank data, helping them prove affordability issues and build stronger mis-selling claims.

What is the best way to collect bank data for mis-sold loan cases?

The best method is through FCA-regulated Open Banking tools like Finexer, which provide fast, secure, and permissioned access to client transaction history.

Can bank data support mis-selling claims in the UK?

Yes. In the UK, bank transaction data is commonly used to support claims against payday lenders, PCP car finance, and other mis-sold products.

Do UK courts and the Ombudsman accept Open Banking data as evidence?

Yes. Both courts and the Financial Ombudsman Service accept verified bank data from regulated providers as part of legal claim submissions.

Start Building Stronger Legal Claims with Finexer! Book a walkthrough today and see how Finexer helps legal teams 🙂

![Legal Claims for Mis-Selling: How Law Firms Use Bank Data as Evidence 1 How Law Firms Use Bank Data in Legal Claims [2025 Guide]](/wp-content/uploads/2025/06/Legal-Claims-by-law-firms-jpg.webp)