The total transaction value in the UK digital payments market is projected to reach over £340 billion (US$441.83bn) in 2025, with online transactions continuing to outpace in-store spending. For businesses, this means choosing the best payment gateway isn’t just a technical decision, it’s a critical factor in how quickly you get paid, how much you lose in fees, and how smoothly your customers complete a purchase.

The challenge? Not all UK payment gateways are created equal. Some platforms are ideal for small businesses and in-person retail, while others cater to high-volume ecommerce brands, global marketplaces, or fast-scaling SaaS companies. The fees vary widely too, from flat-rate pricing to blended interchange models, and so do payout speeds, platform compatibility, and integration support.

In this guide, we’ve reviewed the 7 best payment gateway services for UK businesses based on:

- How they handle secure online payments

- What you pay in UK transaction fees

- Payout timelines and ease of use

- Integration support with platforms like Shopify, WooCommerce, and mobile apps

- Which business models they’re best suited for

You’ll also find a side-by-side comparison table and real-world use cases to help you make the right choice, whether you’re just starting out or scaling into new markets.

Let’s begin with a quick overview.

Quick Comparison: Best Payment Gateways for UK Businesses

| Provider | Best For | UK Fees | Payout Time | Key Features | Global Support |

|---|---|---|---|---|---|

| Stripe | SaaS & online-first platforms | 1.4% + £0.20 | Same day–3 days | Custom checkout, subscriptions, 135+ currencies | ✔️ |

| Square | Small businesses & in-person sales | 1.75% POS / 1.4% online | 1–2 business days | POS hardware, free online store, invoices | ✔️ |

| Checkout.com | Scaling ecommerce brands | Custom pricing | Same day | Modular APIs, fraud tools, multi-currency settlement | ✔️ |

| Adyen | Enterprise & marketplaces | £0.11 + method fee | 1–2 business days | Unified commerce, risk engine, embedded payments | ✔️ |

| PayPal Braintree | Trusted brands & global reach | From 1.2% + fixed fee | 1–3 business days | PayPal + cards + wallets, recurring billing | ✔️ |

| Revolut Business | SMEs with international payments | From 1% + £0.20 | Same or next day | FX support, plugins, spend control tools | ✔️ |

| Shopify Payments | Shopify-based ecommerce stores | ~2% + £0.25 | ~3 business days | Built-in checkout, fraud tools, chargeback handling | ✔️ |

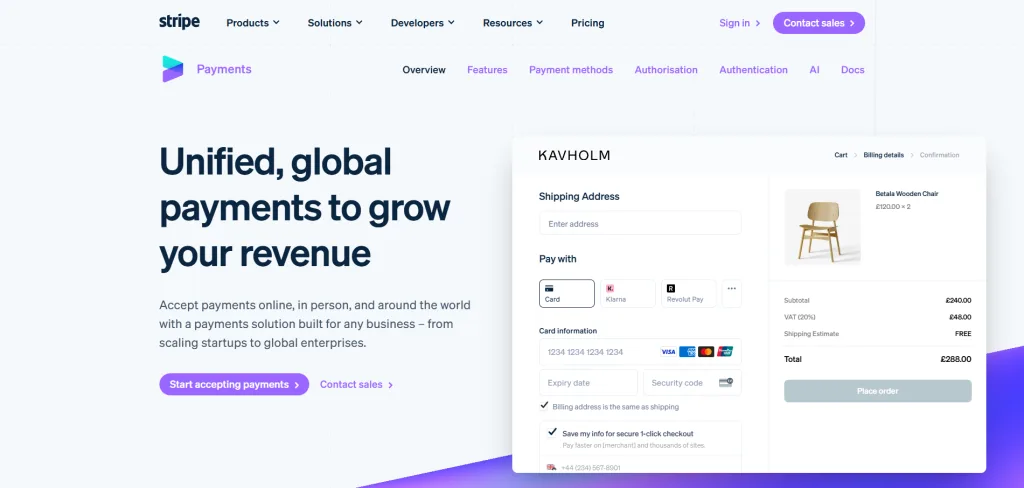

1.Stripe

The Problem It Solves

Businesses with global customers, subscription models, or developer-led checkout flows often struggle with rigid systems or clunky third-party plugins. Stripe solves this by offering a powerful, API-first platform that makes it easy to accept payments online in the UK and internationally, with full control over the payment experience.

What You Get

Stripe is one of the most widely adopted UK payment gateways, offering support for over 135 currencies and dozens of local and global payment methods, including cards, Apple Pay, Google Pay, bank transfers, and direct debits. It comes with built-in tools for invoicing, recurring billing, fraud detection, and even embedded finance capabilities.

Stripe also integrates directly with Shopify, WooCommerce, Magento, and custom websites, making it ideal for fast-scaling ecommerce or SaaS platforms.

Real Cost to You

Stripe charges 1.4% + £0.20 per UK card transaction and 2.9% + £0.20 for international cards. There are no monthly fees, but some advanced features may incur extra charges.

Ideal For You If…

- You operate in SaaS, ecommerce, or digital services

- You need customisable payment flows and developer flexibility

- You want global reach with strong local support

2.Square

The Problem It Solves

Many small businesses in the UK need an affordable, all-in-one solution for both in-person and online payments, without the hassle of setting up separate systems or merchant accounts. Square makes it easy to start accepting secure online payments and card transactions in-store with minimal setup and no monthly fees.

What You Get

Square combines point-of-sale hardware, invoicing, and an online checkout builder into one platform. It’s ideal for local retailers, cafes, salons, and tradespeople who need a fast, dependable way to accept payments in the UK whether that’s on a card reader or through a simple payment link.

It also includes a free POS app, team management tools, and integrations with popular ecommerce platforms like Wix and WooCommerce.

Real Cost to You

Square charges 1.75% per in-store card payment and 1.4% + £0.25 for UK online transactions. There are no setup or monthly fees.

Ideal For You If…

- You run a physical shop, mobile business, or hybrid store

- You want a unified system for POS and online sales

- You’re looking for small business payment solutions with transparent pricing

3.Checkout.com

The Problem It Solves

Growing ecommerce brands and global platforms often need more control over payment flows, currency management, and data visibility than basic tools provide. Checkout.com is one of the best payment gateways for businesses that want to optimise performance at scale while maintaining compliance and speed.

What You Get

As one of the most flexible UK payment gateways, Checkout.com offers direct access to 150+ local and international payment methods, modular APIs, and a powerful fraud detection engine. Its platform is built for secure online payments and gives you real-time insights into conversion rates, payment failures, and customer behaviour.

It’s designed for merchants with complex needs such as marketplace payouts, multi-currency settlements, or dynamic transaction routing, and supports fast integration with major ecommerce platforms and custom systems.

Real Cost to You

Checkout.com offers custom pricing based on business size, transaction volume, and location. While not the cheapest option, its tailored approach helps reduce hidden payment gateway fees in the UK, especially for high-volume merchants.

Ideal For You If…

- You’re a mid-sized or enterprise ecommerce business

- You want deep visibility into your payment data

- You need a scalable payment gateway service with global reach

📚 Guide to Checkout Process Optimisation

4.Adyen

The Problem It Solves

Large businesses often struggle to unify in-store, online, and mobile payments across regions. Adyen stands out among the best payment gateways by offering a single platform that connects all channels while giving you full control over checkout, risk, and reconciliation.

What You Get

Adyen is a high-performance option among UK payment gateways, built for enterprise-grade needs. It supports in-app payments, card terminals, ecommerce transactions, and embedded payment experiences, all from one back office. You also get advanced tools for fraud prevention, revenue optimisation, and compliance.

The platform is designed for secure online payments across 100+ currencies and supports local payment methods, including Klarna, Apple Pay, and bank transfers.

Real Cost to You

Adyen uses an interchange++ pricing model with a fixed £0.11 processing fee plus a fee based on the payment method. While it’s not the lowest in terms of payment gateway fees UK, it can be more cost-effective for large businesses with high volume or cross-border operations.

Ideal For You If…

- You operate across physical stores, online shops, and mobile apps

- You need a unified payment gateway service that scales globally

- You want real-time payment insights and chargeback controls

5.PayPal Braintree

The Problem It Solves

For many businesses, offering trusted payment options like PayPal, Apple Pay, and credit cards is essential for increasing conversions, especially with international customers. Braintree, a PayPal service, solves this by combining multiple payment gateway services into one integration while keeping checkout friction low.

What You Get

Braintree is one of the best payment gateways for businesses that want flexible, multi-channel payment acceptance. It allows you to process cards, PayPal, Google Pay, Apple Pay, and even recurring billing through a single dashboard. The platform is optimised for secure online payments, with built-in fraud tools and support for 3D Secure 2.0.

As one of the more established UK payment gateways, Braintree also offers strong brand recognition and trust, a useful factor in boosting customer confidence at checkout.

Real Cost to You

Braintree fees vary by method, but typical payment gateway fees in the UK start from 1.2% + fixed fee per transaction. There are no setup or monthly fees, but cross-border or non-card payments may be priced separately.

Ideal For You If…

- You want to offer PayPal and wallets alongside cards

- You operate in e-commerce, subscription, or mobile-first environments

- You need a UK payment gateway that’s easy to implement and globally recognised

6.Revolut Business

The Problem It Solves

Small to mid-sized UK businesses dealing with cross-border clients often face high FX charges, delayed settlements, and limited control over currency accounts. Revolut Business addresses this by offering a fast, all-in-one platform for secure online payments, foreign currency handling, and business spend management.

What You Get

Revolut Business is a modern alternative to traditional UK payment gateways, combining local account details, multi-currency wallets, and payment links in one dashboard. It supports card acceptance, plugins for platforms like WooCommerce and Magento, and API access for customised payment gateway services.

With same-day or next-day payouts and built-in FX tools, it’s one of the best payment gateways for UK-based businesses expanding into Europe or managing international suppliers.

Real Cost to You

Fees start from 1% + £0.20 per online transaction, with competitive FX rates and no setup fees. Depending on your plan, additional costs may apply for premium services or priority support. Overall, it offers one of the most affordable payment gateway fees in the UK for international-facing SMEs.

Ideal For You If…

- You regularly invoice or receive payments from abroad

- You want banking, card acceptance, and FX in one place

- You’re looking for low-cost payment gateway services without high overhead

7.Shopify Payments

The Problem It Solves

Many ecommerce businesses struggle with disconnected systems, separate gateways, third-party transaction fees, and delayed payouts. Shopify Payments eliminates those pain points by offering a native solution that simplifies secure online payments directly within the Shopify platform.

What You Get

Shopify Payments is one of the most seamless UK payment gateways for ecommerce merchants. It supports all major credit cards, Apple Pay, Google Pay, and local payment methods all without needing to integrate an external provider. You also get access to built-in fraud analysis, chargeback support, and synced order tracking.

As an end-to-end payment gateway service, it’s fully embedded into the Shopify dashboard, allowing you to manage products, payments, and fulfilment in one place.

Real Cost to You

Transaction fees depend on your Shopify plan, starting around 2% + £0.25 per online sale. There are no additional gateway fees, which can make it more cost-effective than third-party providers when evaluating payment gateway fees UK for Shopify-based stores.

Ideal For You If…

- You already use Shopify or plan to build your store on it

- You want a plug-and-play payment gateway service with no extra setup

- You prefer an all-in-one ecommerce + payments experience

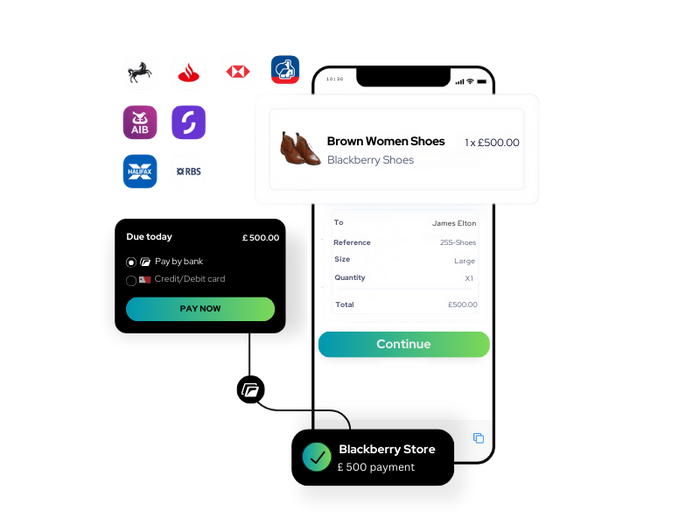

Finexer: An Affordable Pay by Bank Option

The Problem It Solves

Traditional UK payment gateways typically charge between 1.4% and 3% per transaction, plus flat fees, payout delays, and chargeback risks. These costs eat into margins, especially for high-volume merchants, platforms, and regulated firms.

Finexer removes these layers by enabling secure online payments through regulated Open Banking APIs, giving you a faster, cheaper, and more compliant way to move money, without relying on cards.

What You Get with Finexer

Finexer isn’t just another payment gateway service. It connects directly to your customer’s bank, letting you accept and send funds via Pay-by-Bank instantly and securely. You get:

- Save up to 90% on transaction costs compared to card-based gateways

- Instant or same-day payouts, with no intermediaries or delays

- Zero chargebacks, all payments are bank-authorised

- Support for QR payments, payment links, and batch disbursements

- Real-time account verification, income data, and source of funds checks

- Full PSD2 and Open Banking compliance in the UK

- Developer-ready SDKs (Node, Python, Java) for fast integration

- Deploys 2–3x faster than the market

- 3–5 weeks of hands-on onboarding support

Finexer is purpose-built for businesses that want to simplify their payment flows while keeping costs low and compliance tight.

Ideal For You If…

- You want to reduce payment gateway fees UK without compromising on speed

- You operate in sectors like finance, law, or accounting and need built-in compliance tools

- You need faster access to funds for refunds, payroll, or payouts

- You’re ready to modernise your stack beyond traditional UK payment gateways

Conclusion: Choose the Best Payment Gateway for How Your Business Operates

The rise of digital commerce in the UK has made choosing the best payment gateway more important than ever. From transaction fees to payout speed, integration options to fraud protection, each platform comes with strengths tailored to different types of businesses.

Here’s what to keep in mind:

- Stripe is ideal for SaaS platforms and developers needing full checkout control

- Square suits small UK businesses looking for unified POS and online payments

- Checkout.com and Adyen are built for scale, with enterprise-grade APIs and global support

- Braintree delivers strong brand trust and wallet-based checkout

- Revolut Business helps SMEs save on FX and cross-border transaction fees

- Shopify Payments is best for merchants already using the Shopify platform

- And for those seeking a card-free, cost-efficient alternative, Finexer offers a modern Open Banking solution that saves up to 90% in fees and deploys 2–3x faster than the market

No matter your size or sector, selecting the right provider from the top UK payment gateways ensures faster, safer, and more affordable transactions. Prioritise what matters most to your business, whether that’s cost, compliance, customisation, or speed and choose a payment gateway service built to support your growth.

What are the best payment gateways for WooCommerce?

Stripe, PayPal, and Finexer work well with WooCommerce, offering easy setup, fast payouts, and low-cost Pay-by-Bank options for UK merchants.

Which payment gateway is best for small business in the UK?

Square and Finexer are top picks for small UK businesses, offering fast setup and lower transaction costs than traditional providers.

What are the top payment gateways for ecommerce in 2025?

Stripe, Checkout.com, and Finexer support ecommerce brands with scalable APIs, global reach, and cost-saving Pay-by-Bank payment options.

Which payment gateway is best for international transactions?

Adyen and Revolut are great for cross-border payments. Finexer also enables direct global payouts with no card network FX fees.

Which payment gateways work best with WordPress?

Stripe, PayPal integrate easily with WordPress. Finexer supports QR and link-based checkout for fast, secure bank transfers.

Still Comparing Payment Gateways? See how Finexer stacks up as an affordable, card-free alternative for UK businesses 🙂