Managing financial operations at scale is no longer just about processing payments or pulling bank feeds. Fintechs today are expected to deliver personalised experiences, real-time insights, and automated compliance all while moving fast and staying cost-efficient.

That’s where Open Finance comes in.

It’s more than just Open Banking. It gives you access to your customers’ complete financial picture from mortgages and pensions to investments and insurance via secure, consent-driven APIs. For UK fintech teams, this means building products that can do much more: automated onboarding, faster underwriting, smarter expense tracking, and better user retention.

A recent global survey found that almost half (48%) of respondents now consider Open Finance a “must have” a sharp increase from 38% the previous year, reflecting strong and rapidly growing demand for its capabilities in the financial sector.

What Is Open Finance?

Open Finance is an expanded framework that builds on Open Banking. While Open Banking gives regulated access to customer banking data such as transactions and balances, Open Finance extends this access across a wider range of financial data, including mortgages, pensions, investments, insurance policies, and savings.

This shift allows fintechs to deliver services that are not limited to banking alone. With customer consent, platforms can now create comprehensive financial experiences that combine data from multiple sectors into a single, actionable view.

Open Banking vs Open Finance: Key Differences

| Aspect | Open Banking | Open Finance |

|---|---|---|

| Data Scope | Bank accounts and transactions | Investments, pensions, mortgages, insurance, and more |

| Main Use Cases | Account aggregation, payment initiation, budgeting apps | Wealthtech platforms, lending automation, insurance verification, retirement planning |

| Consent Mechanism | Customer authorises data access via regulated third parties | Same consent model, expanded across financial service providers |

| Regulatory Framework | PSD2 (UK/EU) | Currently shaped by FCA consultations in the UK |

| Applicable Sectors | Fintech, banks, payments | Fintech, insurtech, wealthtech, accounting, credit and lending |

Why It Matters to Fintech Teams

For fintechs, Open Finance unlocks new data-driven workflows beyond payments and banking. It enables the development of personalised financial products, improves decision-making in lending and investments, and reduces manual intervention across operations.

Instead of simply offering a dashboard of accounts, fintech platforms can now provide:

- Real-time net worth summaries

- Automated investment and wealth tracking

- Income and expense analysis across institutions

- Insurance coverage insights tied to account activity

- Mortgage affordability calculations based on live financial behaviour

This wider data scope opens up new product lines, deeper insights, and more efficient back-end automation, all within the scope of user-permissioned, compliant data sharing.

How is Open Finance useful for fintechs?

It helps fintechs build smarter products by enabling access to richer financial data, supporting use cases like credit checks, wealth tracking, and cash flow analysis.

Is Open Finance regulated in the UK?

Not yet. The FCA is leading consultations, but many use cases can already be supported using Open Banking APIs and enriched data tools.

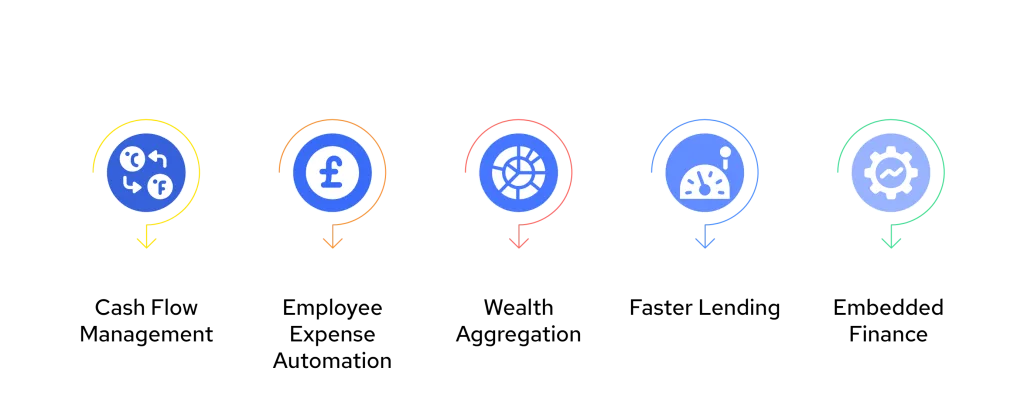

Open Finance Use Cases for Fintechs

Open Finance is not just a regulatory term; it has practical applications across nearly every function in a fintech stack. By accessing real-time, consented data across bank accounts, investments, pensions, and insurance, fintech platforms can build tools that reduce friction, increase visibility, and automate core financial operations.

Below are key use cases where Open Finance APIs deliver measurable value.

1. Cash Flow Management for SMEs

Small and mid-sized businesses often lack the tools to proactively manage cash flow. With Open Finance APIs, fintechs can fetch real-time account data, invoice activity, and upcoming liabilities to offer dynamic cash flow forecasting. This allows businesses to spot shortfalls early, prioritise payments, and make informed decisions about credit or supplier negotiations.

2. Employee Expense Automation

Manual expense processing remains a pain point for growing companies. Open Finance enables automatic transaction validation, categorisation, and reconciliation, removing the need for manual reviews or PDF submissions. Employees link their accounts, submit receipts, and finance teams get a verified, real-time view of spending with minimal oversight.

3. Wealth and Investment Aggregation

For individuals managing assets across multiple platforms, Open Finance provides a unified financial snapshot. Platforms can aggregate pension data, investment performance, and insurance holdings into a single interface. This is particularly valuable for wealthtech apps offering personalised advice or portfolio insights based on live financial activity.

4. Faster Lending and Credit Risk Evaluation

Instead of relying on static documents or outdated credit reports, fintech lenders can use Open Finance APIs to access verified income, spending patterns, and financial obligations in real time. This accelerates credit decisions, supports affordability assessments, and reduces risk by relying on fresh, structured data.

5. Embedded Finance and Ecosystem Products

Beyond traditional financial platforms, Open Finance data can be embedded into procurement software, payroll systems, insurance apps, or even property management platforms, enabling smart financial actions based on verified data streams.

Each of these use cases can be implemented with Finexer’s Open Finance API infrastructure, which covers 99% of UK banks and supports categorised, compliant access to financial data beyond traditional accounts.

Open Finance Use Cases Enabled by Finexer

Open Finance may still be in a regulatory consultation phase, but many of its most valuable use cases can already be implemented using Open Banking APIs, provided the data is enriched, categorised, and made usable. That’s exactly what Finexer enables.

As an FCA-authorised Open Banking provider, Finexer offers infrastructure that supports Open Finance-style workflows without the delay of future regulation or costly internal development.

Key Use Cases Finexer Supports

| Use Case | How Finexer Helps |

|---|---|

| Cash flow monitoring | Categorised account data feeds from 99% of UK banks, updated in real time |

| Income verification | Verified income data from bank transactions — no PDFs or payslips needed |

| Wealth snapshot | Aggregated data across personal and business accounts with custom categories |

| SME expense management | Real-time transaction data for automated reconciliation and reporting |

| Faster onboarding | Access to structured financial data via consent link, reducing manual checks |

Finexer’s APIs are designed for product teams who want to launch fast, integrate cleanly, and scale without regulatory friction. While Open Finance regulation is still developing, the core building blocks are already here, through Open Banking, done right.

Why Choose Finexer for Open Finance

If you’re building a fintech product in the UK, the success of your Open Finance implementation depends on two things: the quality of data access, and how quickly you can deploy. Finexer is designed to help you on both fronts.

Here’s what sets it apart.

Built for UK Fintechs

Finexer focuses entirely on the UK market, offering:

- Coverage of 99% of UK financial institutions

- FCA-authorised infrastructure for Account Information and Payment Initiation

- Consistent performance across business banking and personal finance data

You won’t face the gaps or limitations often seen with international-first providers.

Developer-First Integration

Finexer’s APIs are built to support modern fintech development cycles:

- Clean, well-documented endpoints for account aggregation, categorisation, and payments

- Transparent webhook system for real-time updates and user events

- Fast deployment with optional white-labeling support

Most teams go live 2–3x faster than the market average, reducing both engineering cost and time-to-value.

Flexible Pricing

Whether you’re processing 100 or 10,000 API calls per month, Finexer offers usage-based pricing without expensive monthly minimums. This makes it viable for:

- Startups testing new Open Finance use cases

- Scaleups looking to consolidate vendors and reduce API costs

- Enterprise teams expanding across workflows like lending, wealth, or reconciliation

Finexer provides real, predictable value without overcommitment or seat-based fees.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowHow does Finexer help fintechs adopt Open Finance?

Finexer provides FCA-compliant Open Banking APIs that allow fintechs to access, categorise, and act on financial data from 99% of UK banks. These APIs are developer-first, quick to integrate, and designed to support Open Finance-style workflows such as lending, wealth management, onboarding, and reconciliation.

Who can benefit from Open Finance APIs?

Fintechs, insurtechs, wealth platforms, and lenders can use Open Finance APIs to automate workflows, personalise experiences, and reduce manual checks.

How does Open Finance improve credit decision-making?

It gives lenders access to verified income, spending, and financial obligations in real time, leading to faster and more accurate risk assessment.

Build Open Finance Workflows Without Regulatory Headaches Using Finexer’s UK-Focused API Infrastructure