Small businesses often run on tight timelines.

They spot a growth opportunity, take on a bigger client, or prepare for seasonal demand but they don’t always have the capital ready to move quickly. When they turn to lenders, the process rarely matches the urgency.

Instead of a fast yes or no, they face paperwork, long turnaround times, and application forms that feel more suited to individuals than businesses.

That’s where the gap begins.

While the lending market has made strides in automation, the underlying challenge remains the same: most approval processes still rely on documents that tell an incomplete story.

- Bank statements uploaded as PDFs

- Manually submitted income records

- Risk scoring based on historic averages

It’s not that these businesses aren’t creditworthy, it’s that their actual financial activity is buried in static files, spreadsheets, and slow-moving reviews.

Open Banking changes this.

Instead of relying on what a business looked like last month, lenders can see what’s happening in real time. With the business’s permission, you get secure access to their current transaction data, cash flow trends, and spending patterns directly from their bank.

No uploads. No guesswork. Just data you can work with.

In this blog, we’ll explore how Open Banking removes the bottlenecks in small business lending, what it enables for credit teams, and why now is the right time to act.

Let’s start by looking at what slows lending down in the first place.

Where Traditional Lending Slows Down and Why That’s a Problem for Both Sides

Even when small businesses are stable and growing, the loan process often gets stuck in the same places.

And it’s not just frustrating for borrowers — it’s inefficient for lenders too.

What slows things down?

Most business loan applications still involve:

- Gathering multiple months of bank statements

- Uploading spreadsheets or scanned documents

- Waiting on manual reviews by underwriting teams

- Back-and-forth emails to clarify income sources or transaction history

Each of these steps adds time, and more importantly, introduces drop-off points. Some businesses don’t follow through. Others get declined because the paperwork doesn’t paint a full picture.

What’s missing?

Lenders often assess risk using static information:

- Past revenue

- Credit score

- Previous-year tax returns

But what about current activity? What about recurring income, on-time payments, or recent changes in cash flow?

This is the kind of detail that could help move a loan forward if it were visible.

And here’s the result:

- Strong businesses are rejected based on incomplete information

- Loan officers spend time reviewing documents instead of deploying capital

- Small lending teams can’t scale their approval process without more headcount

All of this creates unnecessary delays and missed opportunities on both sides.

📚 Alternative Credit Scoring Methods

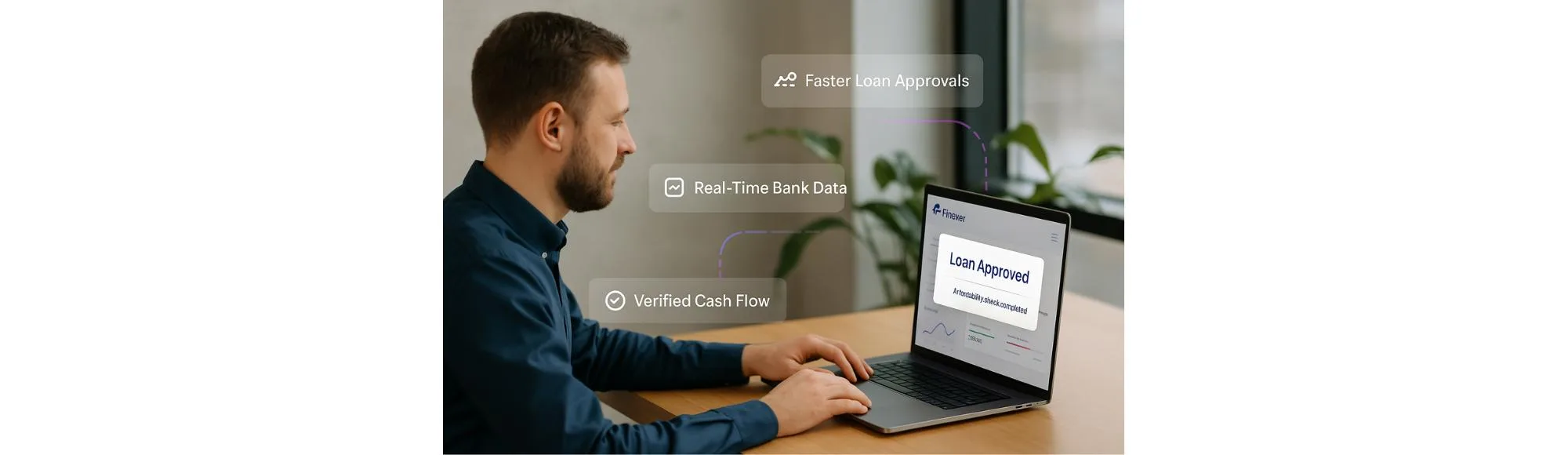

What Faster Loan Approvals Look Like for SMBs

A small business applies for a loan. Instead of uploading PDFs and waiting days for a decision, they simply connect their bank account. Within minutes, the lender gets a full view of their cash flow, account activity, and repayment patterns — all verified, all current.

This is how faster loan approvals work when powered by live bank data.

Why Real-Time Data Matters

Most SMB loans are still assessed using old documents — bank statements, credit scores, or tax returns. These don’t always reflect recent performance, especially for businesses with seasonal or irregular income.

With real-time credit decisioning, lenders can:

- View actual cash flow as of today

- Spot recurring income and regular payments

- Understand financial behaviour without waiting on paperwork

This isn’t about rushing — it’s about making faster, more accurate decisions.

For Lending Teams: Less Admin, More Throughput

Using bank data for lending reduces the time spent on:

- Chasing missing documents

- Manually verifying income

- Interpreting outdated data

Fewer delays. More approvals. Less resource strain.

For SMBs: Credit That Matches Their Timeline

SMBs often need funding fast to order stock, pay staff, or take on new clients. When approval takes too long, they lose momentum.

With faster loan approvals:

- They get funding when it’s actually needed

- The process involves fewer steps

- Their financial health is judged on real performance, not just paperwork

How widespread is open banking adoption among small businesses?

How is real‑time bank data different from traditional financial documents?

How to Start Using Bank Data in Your Lending Workflow

Faster loan approvals don’t require rethinking your entire lending infrastructure. What they need is access to accurate, real-time financial data, presented in a way that’s easy to act on. That’s exactly what Finexer enables without adding friction to your current process.

Using Finexer’s FCA-regulated Open Banking APIs, lenders can securely access a business applicant’s live bank data (with consent) and complete their affordability assessments in minutes, not days.

Step 1: Secure Consent-Based Access to Bank Data

With Finexer, the data connection process is simple and compliant:

- The applicant receives a secure redirect to their business bank

- They approve access to their transaction data

- You instantly receive account-level insights for a fixed review window

No uploads. No delays. Just verified, live bank data for lending decisions.

This drastically reduces drop-offs in the application process and gives credit teams more confidence in the data they’re reviewing.

Step 2: Apply Real-Time Credit Decisioning

Once access is granted, your team can immediately begin reviewing the applicant’s current financial behaviour using real-time credit decisioning — all through Finexer’s API dashboard or your integrated tools.

You’ll see:

- Daily inflows and outflows

- Cash buffer trends over time

- Regular income and spending patterns

- Overdraft reliance and repayment habits

This level of visibility enables fairer and faster loan approvals, especially for SMBs with variable income or limited credit history.

Step 3: Operationalise Faster Loan Approvals Without Overhauling Your Stack

Finexer integrates directly with your existing loan origination system or back-office tools. Whether you use manual review, scorecards, or automated rules, real-time data feeds in seamlessly.

| Lending Stage | Without Finexer | With Finexer |

|---|---|---|

| Bank Statement Collection | Manual uploads, multi-day delay | Instant access via secure API |

| Affordability Checks | Based on past statements | Based on current cash flow |

| Risk Profiling | Estimated via credit score proxies | Data-driven, verified from bank |

| Time to Approval | 3–5 days (or longer) | Same day or within hours |

By embedding Finexer, your credit team can improve throughput without increasing headcount or review fatigue.

Step 4: Start with One Loan Product

You don’t have to apply Open Banking across your entire portfolio on day one. Many lenders using Finexer start with:

- First-time small business loans

- Short-term working capital products

- Credit line reviews or renewals

This allows your team to evaluate the impact quickly and expand usage once internal confidence builds.

Bringing Speed and Accuracy Together

For lenders, the challenge has never been about wanting to say yes, it’s about having the right data to make that decision quickly and confidently.

When it comes to faster loan approvals, small businesses don’t just need access to funding. They need it at the right time, with a process that’s efficient, fair, and grounded in how their business actually performs.

That’s what Open Banking enables and what Finexer delivers.

Why Use Finexer?

Finexer provides a fully FCA-regulated Open Banking platform that allows you to:

- Access real-time credit decisioning data from 99% of UK business banks

- Evaluate affordability using verified bank data for lending

- Cut document handling and manual review

- Approve credit faster without compromising accuracy

Whether you’re handling short-term working capital loans, revolving credit lines, or new borrower onboarding, Finexer helps you move from days to hours without adding risk.

How does open banking help achieve faster loan approvals?

Open banking enables lenders to access live financial data directly from a business’s bank account, once the borrower gives permission, making affordability checks and underwriting faster and more accurate

Turn faster loan approvals into your competitive advantage. Get started today!