Bulk payments are how UK businesses handle money when payment volumes grow. With 5.49 million SMEs generating £2.75 trillion in turnover, everyday tasks like payroll, supplier payments, refunds, and commissions quickly add up.

At low volumes, individual bank transfers may work. As volumes rise, finance teams face repeated approvals, manual uploads, and limited visibility into payment status. These issues already affect outcomes, with 8% of SMEs experiencing reconciliation delays.

UK payment volumes are expected to reach 55.8 billion transactions by 2033. At that level, how payments are organised matters as much as the payments themselves.

If you manage high-volume payments or review payment systems, this guide is for you. It explains how bulk payments work, how they differ from batch payments, and how UK businesses choose approaches that scale without adding admin or risk.

What are bulk payments?

Bulk payments mean sending multiple bank payments in one go instead of processing each transfer separately. The payments may go to different people, for different amounts, but they are managed through a single action or workflow.

Businesses typically use bulk payments for:

- Payroll and contractor payouts

- Supplier and invoice settlements

- Refunds and customer credits

The main benefit is not speed alone. Bulk payments reduce repeated steps, lower the chance of manual errors, and make it easier to track what has been paid and what has not.

In the UK, bulk payments can be sent through different methods, including bank portals, file uploads, or modern API-based systems. Each method works differently and offers varying levels of control and visibility.

Why would a business need to make bulk payments?

Most businesses do not start out needing bulk payments. The need usually appears when payment volume increases and manual processes stop working.

So, why would my business need to make bulk payments?

The answer is simple: because handling payments one by one becomes slow, error-prone, and difficult to control.

Below are the most common situations where business bulk payments become necessary.

Below are the most common situations where business bulk payments become necessary.

1. Paying employees and contractors

- Salaries and contractor fees often go out on the same date

- Individual approvals increase the risk of delays

- Bulk payments allow teams to release payroll in one controlled action

2. Settling supplier and invoice payments

- Growing supplier lists increase payment workload

- Manual exports and system switching slow teams down

- Bulk payments help send multiple invoice payments together with clear tracking

3. Processing refunds and adjustments

- Refunds are time-sensitive and customer-facing

- Repeating the same steps for each refund wastes time

- Bulk payments make it easier to process refunds in groups

4. Commission and recurring payouts

- Agents and partners are paid on regular schedules

- Manual handling creates unnecessary admin each cycle

- Bulk payments keep recurring payouts consistent and predictable

5. Managing payments at scale

- Higher volumes expose manual weaknesses

- Errors and reconciliation issues increase over time

- Bulk payments solutions reduce effort while maintaining visibility and control

Bulk payments vs batch payments

| Area | Bulk payments | Batch payments |

|---|---|---|

| Payment structure | Multiple distinct payouts released in one action | Similar payouts grouped into a single file |

| Payment types | Mixed payments, such as payroll, refunds, and settlements together | Usually single-type payments, for example payroll only |

| Processing style | Payments executed individually, often near real time | Payments processed together at set intervals |

| Flexibility | High, as individual payouts can succeed or fail independently | Lower, as errors often require resubmitting the full file |

| Change handling | Adjustments can be made without restarting the full payment run | Changes usually mean regenerating the payment file |

| Typical use | Ongoing and varied payment operations | Predictable and repetitive payment runs |

What to look for in a payment setup at scale

When payment volumes increase, most problems are not caused by failed transfers. They come from poor visibility, rigid workflows, and manual recovery when something goes wrong.

A scalable payment setup should reduce decision-making during payment runs, not add to it.

| Area | What to check | Why it matters at scale |

|---|---|---|

| Bank coverage | Works with the UK banks you already use | Avoids workarounds and fragmented processes |

| Volume handling | Clear limits and predictable behaviour at higher volumes | Prevents failed runs and last-minute delays |

| Approval flow | Single, controlled release point | Reduces approval fatigue and missed steps |

| Payment visibility | Status per payment, not just per run | Makes reconciliation faster and more accurate |

| Error recovery | Ability to retry or fix individual payments | Avoids restarting entire payment runs |

| Workflow fit | Fits existing finance or platform processes | Reduces operational disruption |

| Cost structure | Transparent fees as volume grows | Prevents unexpected cost increases |

Example use case: how to collect bulk payments via Finexer

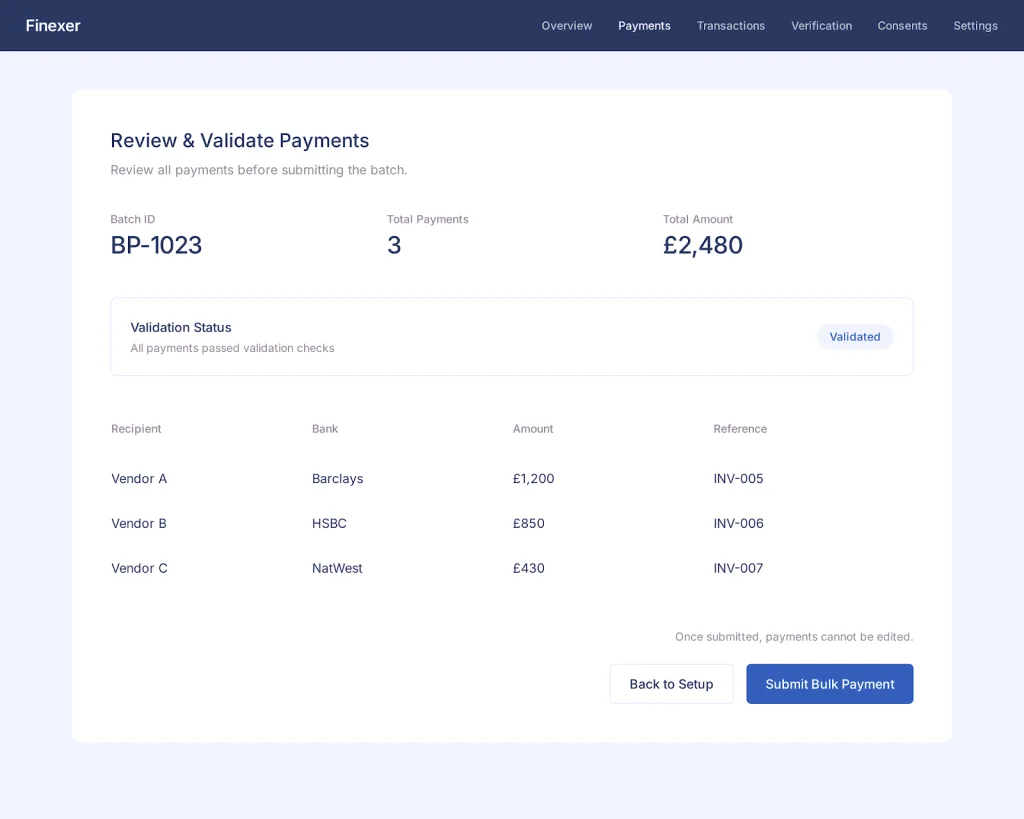

Here’s how a business uses Finexer to review and submit multiple payments from its existing finance workflow.

1. The business prepares multiple supplier payments and groups them into a single bulk payment run. This is done within its own system using one API connection to Finexer.

2. A summary view shows the batch reference, total number of payments, and total amount. Each payment remains visible with recipient, bank, amount, and reference.

3. Finexer validates all payments in the run before submission. This helps catch issues early and reduces the risk of failures after authorisation.

4. The user submits the payment run and authenticates directly with their bank using Strong Customer Authentication. Consent is granted for the full run in one step.

5. Each payment is executed separately via account-to-account transfers. Payment statuses are returned per transaction for reconciliation and audit.

This replaces manual uploads and repeated approvals with a controlled, auditable flow suited to high-volume payments.

Why businesses choose Finexer for bulk payments

1. Finexer’s API-first integration is built as infrastructure, not a workflow tool. Its APIs integrate into existing finance or product systems without forcing teams to change how payments are prepared or approved.

2. Payments are initiated through regulated UK Open Banking APIs covering 99% of the UK Banks. Users authenticate directly with their bank, keeping consent and security under bank-level controls.

3. Transaction-level visibility at scale as each payment returns its own status, making it easier to track outcomes, resolve exceptions, and reconcile payment runs without manual follow-ups.

4. Predictable execution for high volumes as Payments are authorised together but executed individually. This limits the impact of errors and avoids restarting entire payment runs.

5. Lower operational overhead because it requires no extra file uploads, repeated approvals, or fragmented bank portals. Payment runs move from review to execution through a single, auditable flow.

6. Affordable Usage-based pricing to help businesses manage growing payment volumes without committing to fixed tiers or overprovisioned setups.

Provide bulk payment capabilities to your customers with Finexer

As you’ve seen throughout this guide, offering bulk payment services does not need to be complex, expensive, or difficult to manage as volumes grow.

With Finexer, you can support your end-customers with bulk payment capabilities built on regulated UK Open Banking APIs.

Payments are authorised once, executed individually, and tracked at the transaction level, helping end-customers manage high-volume payments more efficiently without repeating manual steps.

Finexer integrates directly into existing systems and uses a usage-based pricing model, allowing payment services to scale in line with real demand rather than fixed assumptions.

For businesses looking to offer dependable bulk payment functionality to their customers, Finexer provides a practical infrastructure layer designed specifically for UK account-to-account payments.

How do bulk payments work with Open Banking?

Users authorise multiple payments through their bank using Strong Customer Authentication. Each payment is then executed individually.

Does Finexer manage payment workflows or approvals?

Finexer provides payment infrastructure. Businesses control preparation, review, and approval within their own systems or through finexer’s dashboard.

How is bulk payment pricing usually structured?

Providers like Finexer follows a transparent, usage-based model, aligning costs with actual payment volumes rather than fixed tiers.

Explore whether Finexer’s Open Banking infrastructure fits your payment volumes and existing workflows!