Subscription businesses in the UK lose customers not because they want to leave, but because their payments fail. Card declines, expired details, and failed Direct Debits create friction that pushes customers away.

Variable recurring payments through open banking change this. VRP payments are initiated directly from bank accounts, removing the reasons most recurring payments fail in the first place.

Churn happens when the payment process breaks down. VRP payments address the technical and operational failures that cause customers to leave, without requiring them to take action.

Why Do Recurring Payments Actually Fail?

Card payments fail for predictable reasons.

- Cards expire every few years.

- Banks issue new card numbers after fraud alerts.

- Customers change banks and forget to update payment details.

- Insufficient funds trigger declines, but customers don’t always receive clear notifications.

These failures create operational problems.

- Retry logic sends multiple attempts.

- Dunning emails go out.

- Customer support handles queries.

- Some customers simply stop engaging and the subscription ends.

Direct Debits avoid card expiry issues but introduce different problems.

- Setup takes time.

- Customers need to provide sort codes and account numbers.

- Failed payments still occur when account balances run low.

- The Bacs system processes payments slowly, creating delays between initiation and settlement.

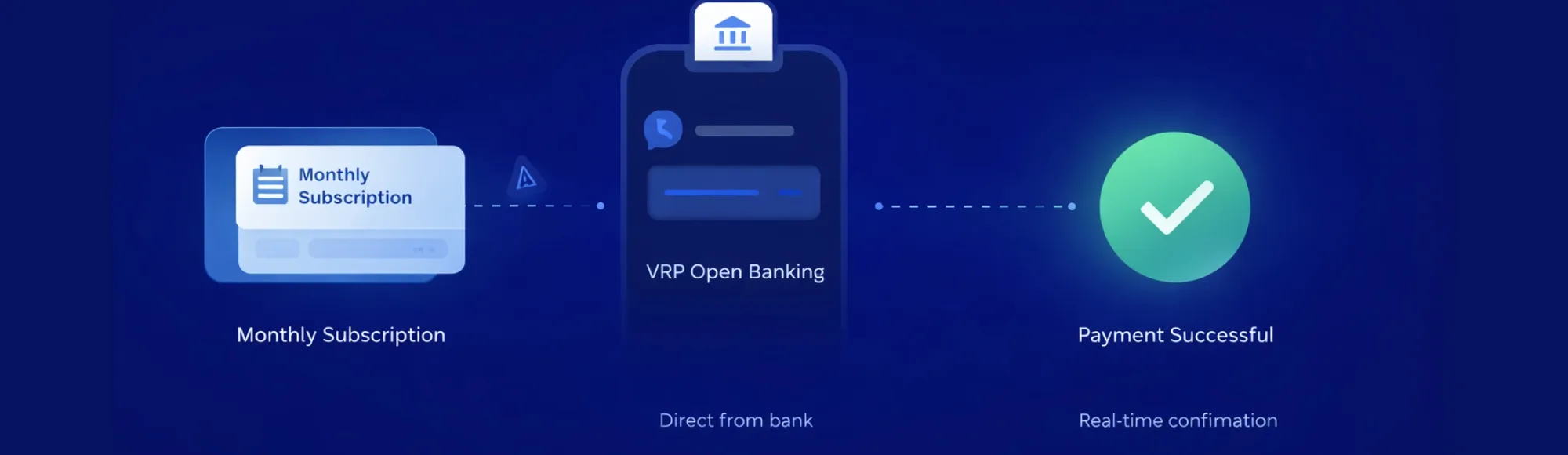

VRP payments work differently.

- The payment instruction connects to the customer’s bank account through open banking infrastructure.

- No card numbers.

- No manual setup.

customer authenticates once, and variable recurring payments handle future transactions automatically.

How Does Open Banking VRP Reduce Payment Failures?

Payment failures decrease when the underlying payment method doesn’t break. Cards expire. Bank accounts don’t. Open banking VRP uses the customer’s actual bank account, removing expiry-related failures from the equation.

Real-time account verification happens before payment initiation. The system checks if funds are available, reducing failed payment attempts. This matters for subscription businesses where retry attempts cost money and damage customer relationships.

Authentication happens through the customer’s existing banking app. No passwords stored. No security credentials managed by the merchant. The customer confirms the payment using the same login method they already use for banking. Strong Customer Authentication requirements are met without adding friction.

Settlement completes faster than traditional methods. VRP open banking processes payments through real-time rails rather than batch processing. Your finance team sees cleared funds sooner, improving cash flow predictability.

What Operational Changes Actually Reduce Churn?

Failed payment recovery processes create churn. Dunning emails remind customers that something went wrong. Multiple retry attempts appear as separate transactions. Customers receive messages about payment problems they didn’t know existed.

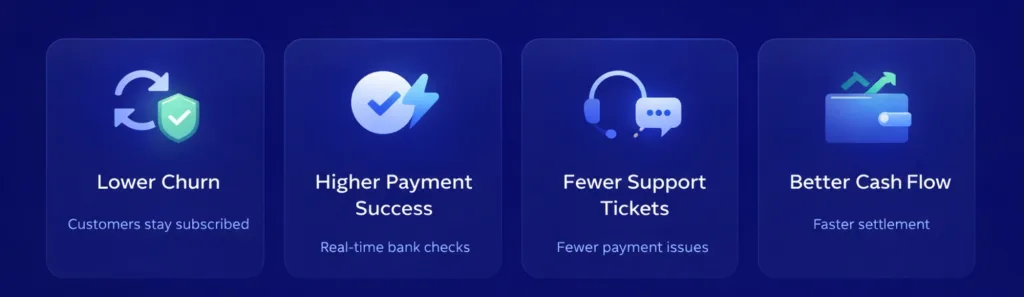

Variable recurring payments reduce the volume of failed payments, which means fewer dunning emails and support tickets. The operational load decreases because the payment method itself is more reliable.

Involuntary churn drops when fewer payments fail. Customers who want to continue their subscription don’t leave because of payment infrastructure problems. The Finexer VRP API handles recurring billing without the failure patterns that affect card-based systems.

Reconciliation work decreases when payment data comes through cleanly. Bank transfers include clear reference information. Your accounting system receives structured data rather than partial information from card networks. Finance teams spend less time matching payments to customer accounts.

Where Does Finexer Fit in UK Recurring Billing?

Finexer provides VRP payment infrastructure for UK subscription businesses. The platform connects to 99% of UK banks, covering high street banks, digital challengers, and business banking platforms. Your customers can pay regardless of which bank they use.

Deployment happens 2-3 times faster than market alternatives. Technical integration completes in weeks, not months. Onboarding support lasts 3-5 weeks, helping your development team implement open banking VRP without extended delays. This matters when churn is affecting revenue today.

Usage-based pricing charges for actual transactions. No fixed monthly fees that don’t match your payment volume. Businesses in growth phases or those with seasonal patterns pay for what they use. Transaction costs can be reduced by up to 90% compared to card payment fees, and the savings increase with volume.

White-label capabilities maintain your brand throughout the payment journey. Customers stay in your environment, using your interface, with your trust signals present. The payment experience matches your brand rather than redirecting to third-party pages.

How Should Variable Recurring Payments Be Implemented for Recurring Billing?

The implementation process for variable recurring payments starts with customer consent. Customers authenticate through their bank and authorise recurring payments within defined parameters. They control maximum amounts and payment frequency.

Your billing system sends payment instructions to Finexer’s API when charges are due. The VRP authorisation handles the payment without requiring customer action for each transaction. Payment status updates arrive in real-time, providing immediate confirmation or failure notification.

Payment limits can be adjusted based on your pricing model. Customers see transparent terms during setup. They understand what they’re authorising, which builds trust compared to storing card details for future use.

FCA regulation governs VRP open banking providers in the UK. Finexer operates as an authorised Payment Initiation Service Provider, ensuring regulatory compliance. Security happens at the bank level, removing PCI compliance requirements from your infrastructure.

Failed payments still occur when account balances are insufficient, but the failure rate is substantially lower than card-based systems. When failures happen, customers receive clear notifications from their bank, making resolution simpler.

What Results Should UK Businesses Expect?

Lower involuntary churn shows up within the first billing cycle after VRP payment implementation. Customers who would have churned due to expired cards or failed Direct Debits remain active subscribers.

Payment success rates improve when bank connectivity is reliable and payment status updates happen in real-time, compared to card-based recurring billing systems.

Customer support volume decreases as payment-related issues drop. Fewer failed payments mean fewer customer inquiries, reducing operational costs. Your support team handles product questions rather than payment problems.

Cash flow improves from faster settlement. Real-time payments clear immediately rather than waiting for batch processing. Your finance team has better visibility into actual revenue and can plan accordingly.

How do VRP payments differ from Direct Debits for recurring billing?

VRP payments clear instantly and check account balances before processing. Direct Debits run in batches and may fail several days after you submit them

Can customers cancel VRP payment authorisations?

Yes. Customers cancel VRP authorisation directly in their banking app whenever they want, keeping control over recurring payments.

What happens if a VRP payment fails?

You get an instant notification explaining why it failed. This lets you fix issues quickly instead of running multiple retry attempts.

Do VRP payments work with all UK subscription models?

VRP payments support fixed and variable subscription amounts, provided customers authorise the payment parameters during initial setup.

How long does VRP payment implementation take?

Technical integration typically completes in 3-5 weeks with Finexer’s onboarding support, significantly faster than traditional payment infrastructure changes.