Automated payroll processing has fundamentally changed how platforms handle salary payouts. Most payroll platforms still depend on batch files, bank portals, and multi-day settlement cycles. Even if your payroll calculations are automated, the actual movement of money often remains slow, manual, and opaque.

Payroll API infrastructure fixes this gap by embedding programmable payment rails directly into your payroll or HR platform. Instead of exporting files and waiting for BACS clearing, your system initiates payouts programmatically and receives confirmation in near real time.

This matters because payroll speed, reliability, and visibility are now product differentiators-not back-office features.

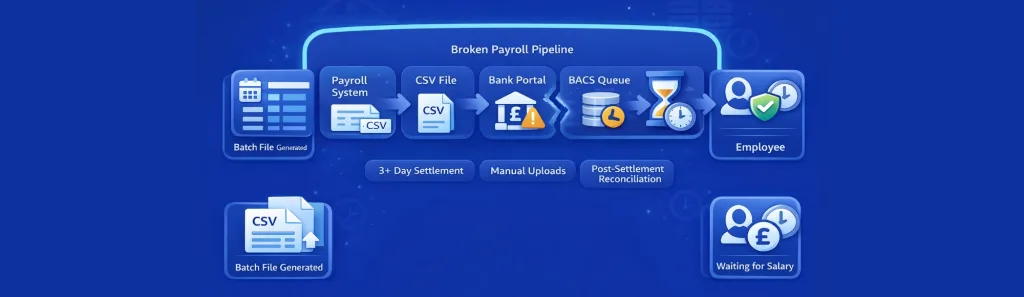

Why Traditional Payroll Processing Breaks at Scale

Most payroll platforms still rely on batch file submission to banking portals. Your system generates payment data, someone uploads the file manually or via SFTP, the bank queues it for BACS processing, clearing happens three working days later.

Traditional payroll software automates calculations, not money movement.

Most platforms still require:

- Generating payment files

- Uploading into bank portals

- Waiting multiple business days

- Reconciling after settlement

So whilst payroll appears “automated,” the settlement layer is not. Modern payroll infrastructure requires programmable payment rails through api payroll infrastructure, not file transfers.

What this creates from an infrastructure perspective:

- Payment approval to actual settlement requires 3+ working days

- Manual intervention needed for batch file submission

- Bank holiday periods extend settlement delays further

- Emergency payments still follow same multi-day clearing

- Scaling requires negotiating higher BACS submission limits

- Employee experience depends on banking infrastructure not your platform

The fundamental issue isn’t processing efficiency-it’s architectural dependency on batch clearing systems designed decades ago. Your platform’s payment speed is limited by infrastructure you don’t control.

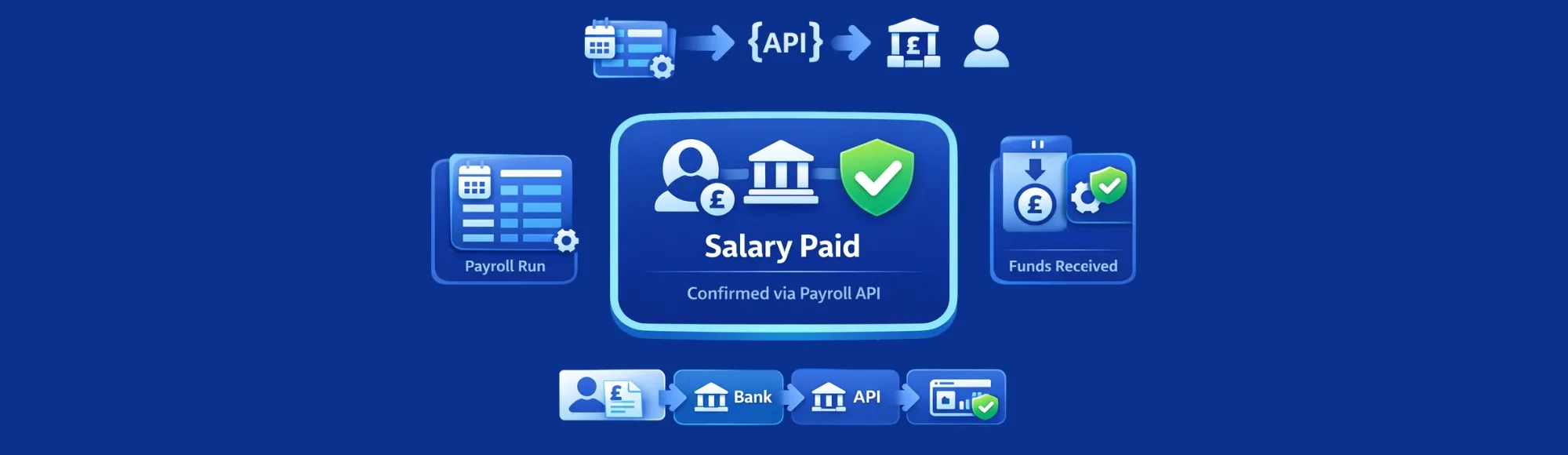

What Automated Payroll Processing Looks Like in Practice

With payroll API, your platform treats salary payouts as API operations-not files.

Flow:

- Payroll run completes

- Platform sends payout instructions via payroll API

- API initiates bank-to-bank transfers

- Platform receives confirmation and status updates

Each salary becomes an individual, traceable transaction.

No batch windows. No clearing queues. No portal uploads.

This is automation at the settlement layer.

What We See From Platforms Implementing API

Working with platforms transitioning from BACS to api payroll infrastructure reveals consistent architectural patterns. The operational changes extend beyond just payment speed:

Batch logic gets replaced with event-driven workflows. Traditional systems think in terms of daily or weekly payment runs. API architecture processes payments as events-approvals trigger immediate settlement rather than queueing for the next batch window.

Error handling shifts from post-processing to real-time validation. BACS failures surface days after submission when fixing them requires complete resubmission. Real-time APIs return immediate feedback per transaction. Failed payments get retried or escalated instantly rather than discovered during post-batch reconciliation.

Reconciliation becomes continuous rather than periodic. Traditional architectures reconcile payment files against bank statements after settlement completes. API architecture maintains transaction state in real-time. Your system knows payment status continuously, not eventually.

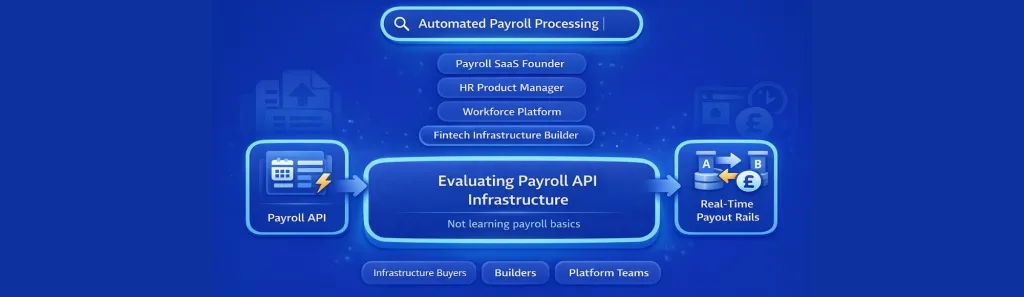

Who Searches “Automated Payroll Processing”?

These are not employees. These are builders evaluating payroll API infrastructure:

- Payroll SaaS founders implementing real-time payout systems

- HR software product managers

- Workforce platforms

- Fintechs building salary rails using payroll software API infrastructure

- Vertical SaaS handling payouts with api payroll

They are evaluating infrastructure-not learning what payroll is.

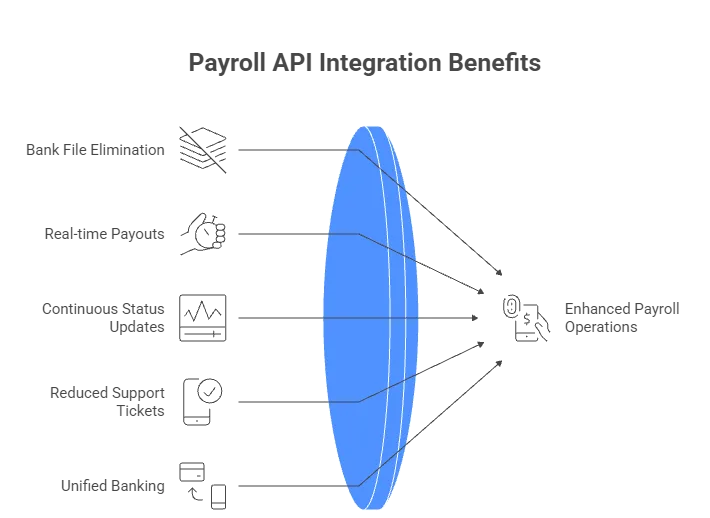

What Platforms Gain from Payroll API Integration

When platforms implement payroll software API infrastructure, several operational improvements emerge:

Eliminate bank file workflows – No more generating CSV/XML files, uploading to portals, or managing SFTP connections. Your platform controls initiation through API calls.

Remove multi-day settlement delays – Employee payouts settle within minutes instead of 3+ working days. Bank holidays no longer extend payment timelines.

Real-time payout status inside product – Your platform knows payment status continuously through webhook callbacks. No checking bank portals for settlement confirmations.

Fewer support tickets about missing wages – Employees receive immediate confirmation. Support teams stop fielding “when will my salary arrive” questions.

One payout system for all UK banks – Single api payroll integration reaches 99% of UK banks. No maintaining multiple banking relationships or payment methods.

Payroll API infrastructure turns payroll from a liability into a product feature.feature.

Traditional Payroll vs Automated Payroll Processing

| Layer | Traditional Payroll | Automated Payroll Processing |

|---|---|---|

| Initiation | File upload | API call via payroll API |

| Settlement | 3 working days | Minutes |

| Status | Bank reports | Webhooks |

| Errors | Discovered later | Immediate |

| Scaling | Bank limits | API throughput |

| Control | Bank-owned | Platform-owned |

Explore payroll API implementation patterns

The architectural difference impacts how you build payment workflows. Batch systems require queue management, delayed confirmations, and periodic reconciliation. It enables event-driven patterns with immediate feedback loops.

What to Look for in Payroll API Infrastructure

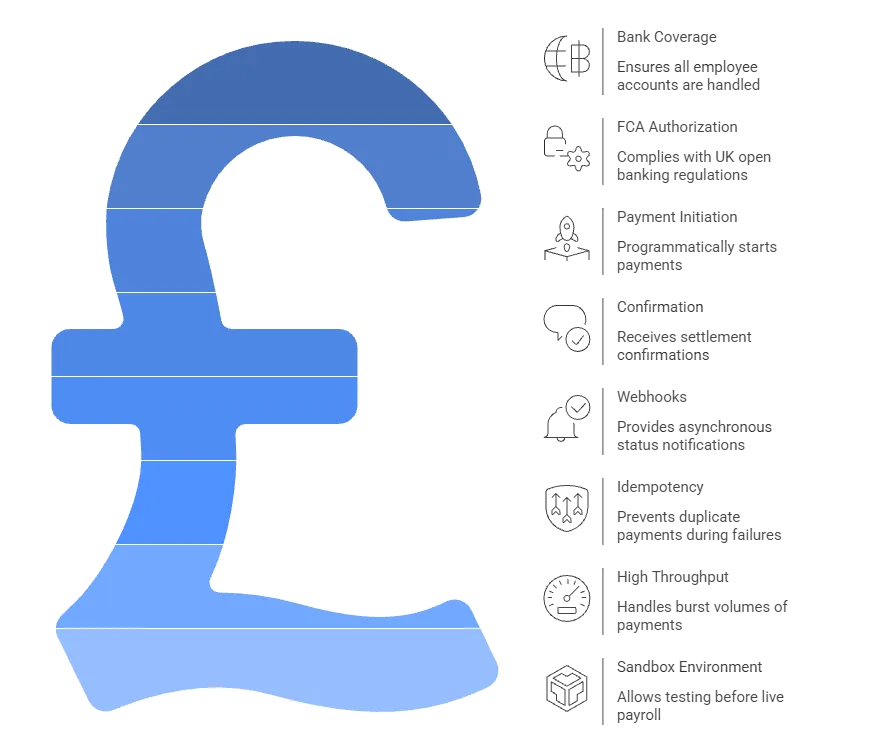

Bank coverage determines whether your api payroll integration handles all employee accounts or requires fallback to traditional methods. Partial UK coverage means maintaining two payment codepaths-real-time for supported banks, batch processing for others.

Technical integration requirements that matter architecturally:

FCA-authorised infrastructure – Compliance with UK open banking regulations isn’t optional for platforms handling payroll

UK bank coverage – Access to 99% of UK banks ensures virtually all employees receive payments without fallback methods

Payment initiation + confirmation – RESTful endpoints initiating payments and receiving settlement confirmations programmatically

Webhooks for status – Asynchronous notifications about payment status changes without polling

Idempotency support – Safe retry handling preventing duplicate salary payments during network failures

High throughput – Rate limiting designed for burst volumes when paying hundreds or thousands of employees simultaneously

Sandbox environment – Testing environment matching production behaviour for thorough integration before live payroll

Compare payment initiation API approaches

Common Mistakes When Implementing Payroll API

From observing platform integrations with api payroll infrastructure, several implementation challenges consistently emerge:

No idempotency → duplicate salary risk – Network failures happen. Without proper idempotency keys, retry logic risks paying employees twice. Effective implementations design idempotent workflows from the start.

No webhook handling → blind system – Traditional systems reconcile uploaded files against settlement confirmations. API-based systems track individual transaction states through webhook callbacks. Without webhooks, your platform doesn’t know payment status.

Mixing batch + API flows – Some platforms try maintaining BACS for some employees whilst using payroll software API for others. This creates complexity managing two reconciliation systems and payment timing models.

No reconciliation state machine – The reconciliation logic needs to handle partial successes, retries, and eventual consistency rather than all-or-nothing batch outcomes.

Why Many Payroll Platforms Haven’t Modernised Yet

The persistence of batch processing reveals integration complexity more than technical capability.

Most legacy payroll systems were built around batch assumptions.

Moving to payroll software API requires changing:

- State management – From batch queues to individual transaction tracking

- Payment orchestration – From file uploads to API calls with payroll software API

- Error handling – From post-batch reconciliation to real-time validation

- UX expectations – From “processing” to “completed” immediately

It’s architectural work-not a feature toggle.

Additionally, banking relationship inertia plays a role. Established BACS arrangements with existing banks feel safer than adopting newer open banking infrastructure, even when regulatory frameworks and settlement speeds favour the transition.

How Finexer Provides Payroll API Infrastructure

Finexer provides API infrastructure built on FCA-authorised Open Banking connectivity.

Platforms use Finexer to:

- Initiate salary payouts programmatically

- Reach approximately 99% of UK banks

- Receive payment confirmation

- Build their own payroll logic on top

Finexer does not calculate payroll. Finexer does not impose workflows. Finexer is infrastructure.

The platform provides 3-5 weeks of dedicated onboarding support. This ensures payroll API integration aligns with your specific platform architecture rather than forcing workflow changes to match generic implementation patterns.

Payroll platforms using API infrastructure report significant operational improvements. BACS submission windows disappear. Employee settlement complaints drop because payment timing becomes predictable. Your platform controls payment experience rather than depending on external clearing infrastructure.

Pricing works on actual payment volume rather than fixed fees. This aligns costs with your platform’s transaction patterns-whether consistent monthly salaries or variable contractor payouts-without requiring capacity forecasting or minimum commitments.

The API integrates through standard REST endpoints with comprehensive webhook support. Your engineering team gets sandbox access matching production behaviour for thorough testing before live deployment. Documentation covers authentication, payment initiation, status polling, webhook handling, and error scenarios.

What is automated payroll processing?

Using payroll API to initiate and confirm salary payouts programmatically instead of uploading bank files to clearing systems.

Is this a payroll system?

No. Finexer provides payout infrastructure, not payroll calculation software. You build your payroll logic, we provide the payment rails.

Does this replace BACS?

It bypasses batch clearing by using pay-by-bank rails through open banking, settling payments in minutes instead of days.

Who should use this?

Payroll SaaS platforms, HR software providers, workforce management systems, fintechs building salary infrastructure, and vertical SaaS handling employee payouts.

How quickly do payments actually settle through payroll API?

Minutes from API initiation to funds appearing in employee accounts, compared to 3+ working days for BACS clearing cycles.

Ready to Build with Payroll API?

See how Finexer’s payroll API powers real-time salary payouts using pay-by-bank infrastructure

Book Demo Now