Stop Requesting Bank Statements. Start Accessing Bank Data Directly.

Build better products without manual document uploads.

Book Demo NowAccount information service providers give platforms programmatic access to bank account data. No more asking users to download PDFs. No more manual verification of bank statements. No more outdated screenshots.

Your platform needs bank data to verify income, check affordability, or reconcile transactions. Users currently export bank statements and upload them. That process breaks frequently.

AIS fix this by connecting directly to banks. Users authorise once. Your platform receives structured transaction data automatically. The data arrives verified, current, and machine-readable.

This article explains what AIS actually do. How they work in practice. What changes when platforms integrate AIS providers. And what to look for when evaluating AIS APIs for real-time bank data.

What Problem Do Account Information Services Solve?

Platforms need bank data for dozens of operational workflows. Onboarding verification. Income checks. Affordability assessments. Transaction categorisation. Reconciliation.

Before AIS, users uploaded documents manually. That created several problems:

Document authenticity Screenshots can be edited. PDFs can be altered. Bank statements sent via email carry no verification. Platforms spent time and money validating authenticity.

Data freshness Uploaded bank statements show historical data. By the time a user exports a statement, uploads it, and your team reviews it – the data is already outdated. Financial decisions need current information.

Manual processing Someone has to open each PDF. Extract transaction data. Type it into your system. Categorise entries. Match formats across different banks. This doesn’t scale.

User drop-off Asking users to download bank statements, find the right file, and upload it creates friction. Many abandon the process before completing it.

AIS remove these bottlenecks entirely.

How Do Account Information Services Work?

Account information service providers connect to UK banks via Open Banking APIs. Here’s the technical flow:

User authorisation Your platform redirects the user to their bank’s Open Banking consent screen. The user logs in using their existing banking credentials. They authorise read-only access to specific accounts.

API connection Once authorised, the account information service provider calls the bank’s API. The bank returns structured transaction data: amounts, dates, merchant names, payment types, balances.

Data delivery Your platform receives this data via REST API. The data arrives in a standardised format regardless of which bank the user uses. Barclays, HSBC, Monzo – all return data in the same structure.

Ongoing access Depending on consent type, your platform can refresh data automatically. Users don’t need to re-authorise every time you need updated information.

This is how Open Banking data via AIS replaces manual document collection with automated bank connectivity.

What Changes After Integrating Account Information Services?

Platforms that move from manual bank statement uploads to account information service providers see immediate operational improvements.

Faster verification Income verification that previously took 2-3 days happens in minutes. Users authorise bank access. Your platform pulls transaction data. Verification logic runs automatically.

Higher completion rates Users don’t need to download, find, or upload files. They authorise access in their banking app. The friction that caused 30-40% of users to drop off during onboarding disappears.

Better data accuracy Bank-verified transaction data eliminates transcription errors, altered documents, and mismatched formats. Your platform works with source data directly.

Lower operational costs Manual document processing requires staff time. Account information services automate data collection. Operations teams focus on exceptions rather than processing every application.

Real-time insights Platforms can refresh bank data on demand. Affordability checks use current balances. Transaction categorisation stays updated. Financial dashboards reflect real-time positions.

What Should You Look For in an Account Information Service Provider?

If your platform is evaluating account information service providers, these capabilities matter:

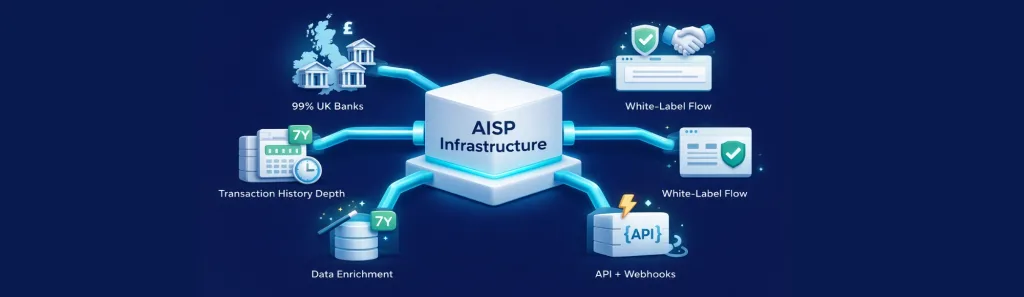

UK bank coverage Your users bank with dozens of providers. The AISP needs connections to 99% of UK banks-not just major high-street banks.

Transaction history depth Different banks provide different historical ranges under Open Banking. Look for providers that maximise available history (up to 7 years depending on the bank).

Data enrichment Raw transaction data needs categorisation. Merchant name standardisation. Payment type tagging. Look for AISPs that deliver enriched data, not just raw feeds.

REST API and webhooks Your engineering team needs clean API documentation and webhook support. Real-time notifications when new data is available. No polling.

White-label consent flows User experience matters. Look for providers that let you embed bank connection flows under your own branding without third-party redirects.

3-5 weeks of onboarding support AIS integration isn’t plug-and-play. Choose providers offering hands-on technical support during implementation.

How Does Finexer Provide Account Information Services?

Finexer is an FCA-authorised account information service provider that connects platforms to 99% of UK banks.

We handle:

- Bank API connectivity across all major UK banks

- User consent flows with white-label options

- Transaction data retrieval and enrichment

- REST API and webhook delivery

- Regulatory compliance and consent management

Your platform handles:

- User interface and experience

- Verification logic and business rules

- Data storage and processing

- Product features built on top of bank data

We’ve worked with platforms building income verification using AIS providers. The integration typically takes 3-5 weeks with hands-on support from our team.

If your platform is still asking users to upload bank statements manually, that’s the operational bottleneck account information services remove.

What I Feel About Account Information Services

Account information services have fundamentally changed how platforms access financial data. Before Open Banking, asking for bank statements was the only option. It worked poorly but there was no alternative.

Now platforms can access verified bank data directly. The user experience improves. Data quality increases. Operational costs drop.

But I’ve also seen platforms integrate account information service providers without thinking through the product experience. Just because you can access bank data doesn’t mean you should request it immediately during onboarding.

The best implementations ask for bank access at the moment it’s actually needed. For affordability checks before a purchase. For income verification when setting credit limits. For transaction history when users need reconciliation features.

Account information services are infrastructure. How platforms use that infrastructure determines whether it actually improves the user experience or just adds another consent screen.

We work with platforms thinking through these questions because the technical integration is straightforward. The product experience design requires more thought.

What is account information service?

Account information service is regulated access to bank account data via Open Banking APIs, allowing platforms to retrieve transaction history, balances, and account details with user consent.

What do account information service providers do?

Account information service providers connect platforms to banks via Open Banking APIs, handling regulatory compliance, consent management, and data delivery in standardised formats.

What is the difference between AIS and AISP?

AIS (Account Information Service) is the service itself. AISP (Account Information Service Provider) is the regulated entity authorised by the FCA to provide AIS.

How does Open Banking AIS work?

Users authorise read-only access to their bank accounts. The AISP calls the bank’s API. Transaction data is delivered to the platform via REST API in a standardised format.

Can platforms use multiple account information service providers?

Yes, but it adds integration complexity. Most platforms choose one AISP with comprehensive UK bank coverage rather than managing multiple provider relationships.

Ready to Replace Manual Bank Statements with Direct Bank Data Access?

See how Finexer’s Account Information Services connect your platform to 99% of UK banks.

Book Demo Now