Note: The information in this blog is subject to change

Apple Pay is widely used by customers, but for UK merchants, it might not always be the most cost-effective or inclusive option. From transaction fees and platform limitations to delays in settlements, several hidden issues can quietly reduce your margins and slow down your cash flow.

In this blog, we’ll examine where Apple Pay falls short and explore smarter Apple Pay alternatives that help UK e-commerce merchants lower costs, speed up settlements, and reach a broader customer base.

What Does Apple Pay Offer?

To fairly compare alternatives to Apple Pay, it’s important to understand what Apple Pay brings to the table.

As a mobile wallet, Apple Pay provides a higher level of security than traditional card payments. Card details are not shared with merchants, as the platform uses encrypted tokens instead. Users authenticate payments using biometrics like Face ID or Touch ID, and all information is securely stored on their Apple device.

For iPhone, iPad, and Apple Watch users, Apple Pay offers a quick and convenient checkout experience. With more than 1.4 billion iPhones in active use globally, this wallet is particularly appealing to digitally savvy generations such as Millennials and Gen Z, who value mobile-friendly experiences.

Overall, Apple Pay offers two main benefits when compared to card payments: improved security and a smoother mobile checkout experience that can reduce cart abandonment and support higher conversions.

Drawbacks of Apple Pay for Merchants

Despite these benefits, Apple Pay comes with several limitations that make it less than ideal for many merchants, especially in the UK.

- Delayed settlements: Apple Pay transactions are still processed via card networks. This means settlements typically take between one to three business days.

- Standard card processing fees still apply: Since it relies on card rails, Apple Pay charges the same fees as credit and debit card transactions. For example, Stripe and Square apply their regular rates to Apple Pay as shown below:

| Provider | Online Payments | In-Person Payments |

|---|---|---|

| Stripe | 1.5% + 20p | 1.4% + 10p |

| Square | 1.4% + 25p | 1.75% |

These processing fees can significantly reduce margins for high-volume merchants, especially in low-ticket transactions.

- Device exclusivity: Apple Pay only works on Apple devices. In the UK, over half of mobile users are on Android, and globally, Android holds more than 70% of the market share. Offering only Apple Pay means potentially excluding a large portion of your customers.

Apple Pay Alternatives: Pay-by-Bank and Other Digital Wallets

Here’s a side-by-side comparison of Apple Pay and other popular digital payment methods, including Open Banking options that eliminate card processing fees altogether.

| Feature | Pay-by-Bank (via Finexer) | Apple Pay | Google Pay | Samsung Pay | PayPal |

|---|---|---|---|---|---|

| Fees per Transaction | Lower costs (no card scheme or interchange charges) | Standard card rates | Standard card rates | Standard card rates | Card and FX fees for global transfers |

| Security Approach | Direct bank authentication with SCA and biometrics | Encrypted token system with Face ID or Touch ID | Encrypted card data with biometric checks | Biometric and PIN authentication | Multi-factor login with optional encryption |

| Checkout Experience | Optimised for mobile and desktop checkouts | Native to iOS; limited to Apple devices | Android-optimised interface | Works only on Galaxy devices | Requires account login at checkout |

| Settlement Time | Real-time fund transfers | 1 to 3 business days | 1 to 3 business days | 1 to 3 business days | 1 to 3 business days |

A Smarter Apple Pay Alternative: Pay-by-Bank with Open Banking

Unlike digital wallets, which often sit on top of card networks, Open Banking (also known as Pay-by-Bank) provides a fundamentally different way for customers to pay online.

With Open Banking, payments move directly between the customer’s bank account and yours, without involving card issuers or schemes. This results in lower transaction costs, faster settlement, and fewer intermediaries.

How Finexer Makes Open Banking Work for E-Commerce

Finexer is a UK-first Open Banking platform designed to meet the specific needs of growing e-commerce businesses. Whether you’re an online retailer, subscription-based service, or digital marketplace, Finexer offers a reliable and fully compliant way to accept payments via Pay-by-Bank.

Here’s how a Finexer-powered transaction works:

- At checkout, the customer selects “Pay by Bank”.

- They choose their UK bank from a pre-integrated list.

- They’re securely redirected to their banking app or site.

- Using Face ID, fingerprint, or a passcode, they confirm the payment.

- Funds are transferred directly and instantly to your business account.

This process is fully secure, regulated under PSD2, and built on FCA-authorised infrastructure in the UK.

Other Apple Pay Alternatives UK Merchants Might Consider

While Open Banking is becoming the preferred method for cost-effective, real-time payments, digital wallets like Google Pay, Samsung Pay, and PayPal are still widely used and may be worth offering depending on your audience.

Here’s a quick breakdown of each:

Google Pay

Google Pay is the most widely adopted Android mobile wallet and a natural complement to Apple Pay. It offers fast mobile checkouts with biometric security and encrypted card details.

Pros:

- Smooth checkout experience for Android users

- Built-in on most Android smartphones

- Familiar interface for millions of customers

Cons:

- Still runs on card rails, so transaction fees apply

- Not accessible to iPhone users

- Settlement delays of up to 3 working days

If your online store attracts a large Android user base, offering Google Pay alongside Pay-by-Bank can help avoid alienating that segment. However, you’ll still face the same processing fees and delays that come with card transactions.

Samsung Pay

Samsung Pay caters specifically to Galaxy users, allowing them to store and use their debit or credit cards via the Samsung Wallet app.

Pros:

- Biometric authorisation adds an extra layer of security

- Seamless experience for Galaxy device owners

- Contactless and online functionality

Cons:

- Limited to Samsung Galaxy devices

- Transaction processing is not instant

- Standard card network fees still apply

In the UK, Samsung is the second most popular smartphone brand after Apple. While Samsung Pay may be relevant for a portion of your customers, its limited compatibility and card-based structure mean it still falls short on cost and speed.

PayPal

PayPal is a long-established digital wallet that works across devices and allows users to pay via linked cards, bank accounts, or preloaded wallet balances.

Pros:

- Cross-platform functionality

- Large user base across the UK and globally

- Supports recurring billing, subscriptions, and one-click checkouts

Cons:

- Requires customers to log in or create an account

- Known for higher fees, especially on international transactions

- Still reliant on cards and direct debit rails

- Slower settlement times (up to 3 days)

In some regions, PayPal has partnered with Open Banking providers, but many UK transactions still rely on card-based rails. If you choose to include PayPal, consider also offering Pay-by-Bank to give customers a faster, lower-cost alternative.

📚How to Optimise your Checkout Process

Why Switch to Pay-by-Bank with Finexer

Finexer’s Open Banking infrastructure enables Pay-by-Bank payments that go directly from your customer’s account to your business account in real time. There are no intermediaries such as card issuers or wallets, which simplifies the payment flow and lowers the cost.

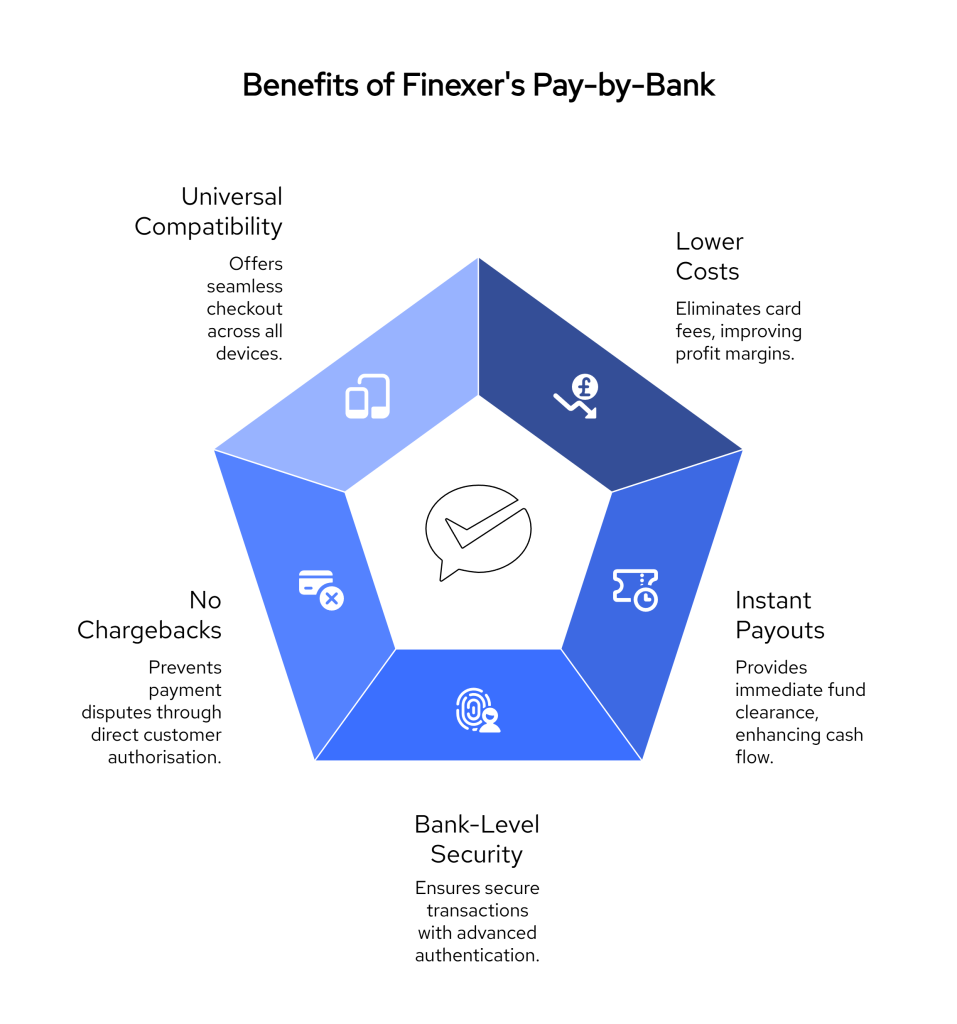

Here’s why more UK businesses are moving away from traditional card-based wallets like Apple Pay and switching to Finexer:

1. Lower Transaction Costs

Unlike card payments, Pay-by-Bank doesn’t involve scheme or interchange fees. With Finexer, you avoid the layers of processing charges that typically come with credit or debit card transactions. This leads to better margins, especially for high-volume merchants and those selling low-ticket items where percentage-based fees make a big impact.

2. Instant Payouts

While card-based wallets typically take one to three working days to settle, Finexer moves funds immediately. The payment clears in seconds and lands directly in your business account, giving you faster access to cash and reducing working capital gaps.

3. Stronger Payment Security

Finexer uses bank-grade APIs regulated by the FCA and PSD2. Every transaction requires the payer to authenticate directly with their bank, typically using fingerprint, face ID, or a secure passcode. Card details are never shared, reducing the risk of fraud and data leaks.

4. No Chargebacks

Because customers actively authorise each payment through their bank, chargebacks don’t apply to Pay-by-Bank transactions. This means fewer disputes, no reversal fees, and greater peace of mind for merchants handling large volumes of online sales.

5. Optimised for Mobile and Web

Like Apple Pay, Finexer is designed to create a smooth mobile checkout experience. But unlike Apple Pay, it isn’t limited to a specific device or OS. Whether your customer is using an iPhone, Android phone, or desktop browser, the payment journey remains consistent and conversion-friendly.

Get Started

Connect and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

What is the best Apple Pay alternative for UK e-commerce?

The best Apple Pay alternative for UK e-commerce businesses is Pay-by-Bank via Finexer. It allows customers to pay directly from their bank account, eliminating card fees and offering instant settlements across 99% of UK banks.

Is Open Banking more secure than Apple Pay?

Yes, Open Banking payments through Finexer are highly secure. They require strong customer authentication (SCA) and are processed using regulated, bank-level APIs. Unlike card-based wallets, no card data is shared or stored, reducing fraud risks and chargebacks.

Does Finexer charge card processing fees?

No, Finexer’s Open Banking solution eliminates card network fees entirely. Since payments are processed directly through the customer’s bank, there are no scheme or interchange fees typically associated with debit or credit card transactions.

Ready to Reduce Fees and Get Paid Faster? Try Finexer Now for your Business and Start Saving Money 🙂