Here’s what most compliance officers won’t tell you: they’re drowning in manual AML work. Automated AML checks for law firms solve this by connecting client verification directly to live databases-turning 30-45 minute manual processes into seconds-long automated screening.

Your team is probably spending half an hour per client, opening multiple browser tabs, cross-referencing sanctions lists, checking PEP registers, verifying Companies House records, and documenting everything in spreadsheets. Meanwhile, those sanctions lists update overnight. A client who seemed fine last month could appear on a watchlist today, but your manual records still show them as cleared.

That’s the compliance gap keeping law firm partners awake at night. Automated AML checks for law firms address this with continuous monitoring that catches changes the moment they occur, without requiring your compliance team to manually re-screen every client.

Why Manual AML Verification Creates Unnecessary Risk

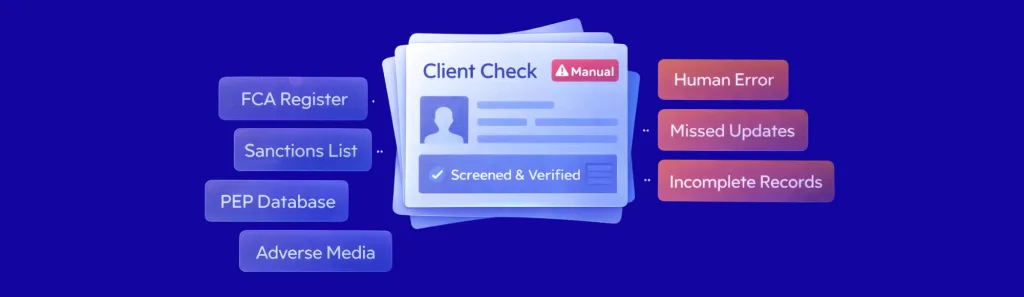

Let’s be honest about how this works in most practices. Someone on your team-probably whoever drew the short straw-opens the FCA register, searches Companies House, manually types client names into sanctions databases, checks adverse media, and copies findings into your documentation system.

This isn’t about questioning anyone’s competence. The issue is simpler: humans make mistakes when doing repetitive tasks dozens of times weekly. A mistyped name, a skipped database, forgotten documentation. These aren’t hypothetical risks-they’re Tuesday afternoon reality when your compliance officer is juggling 15 other matters.

UK law requires ongoing monitoring under the Money Laundering Regulations 2017. Not just onboarding checks-continuous surveillance. Your manually-checked client from six months ago? Their status could have changed, and unless someone manually re-screens them regularly, you won’t know until an audit uncovers the gap.

What Actually Happens With an AML Screening Tool?

Think of an aml screening tool for legal practices and automated AML checks for law firms as running simultaneous searches across every database you’d normally check manually-except it happens in seconds rather than hours. You input client details once. The system queries sanctions lists (OFAC, EU, UN), PEP registers, adverse media sources, and Companies House concurrently.

Results come back flagged. Not every client gets a green light automatically-the system highlights anything requiring your professional judgement. But instead of searching for needles in haystacks, you’re reviewing only the genuine concerns.

To see this in action for real lawtech scenarios, check Finexer’s use case here

Here’s where it gets interesting for legal practices: continuous monitoring. The aml compliance software for law firms and automated AML checks for law firms don’t stop after onboarding. They automatically re-screen your existing client base at intervals you set. Someone becomes politically exposed? Appears on a sanctions list? Your system alerts you immediately, not during your next audit when regulators ask why you missed it.

How This Differs From Your Current Manual Process

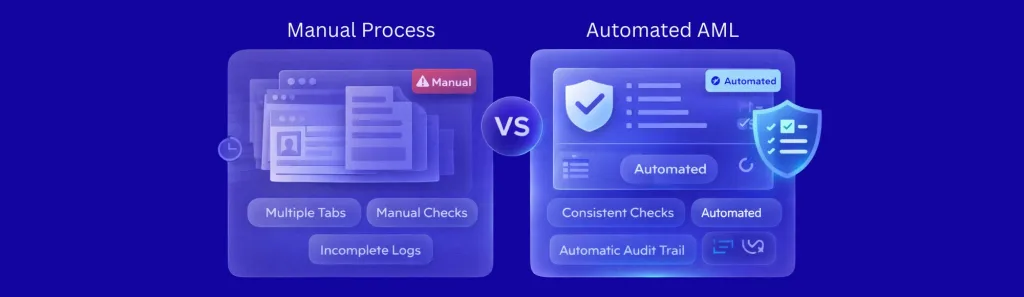

Picture your current Friday afternoon. Your compliance officer has five new clients to screen before the week’s end. Each one requires opening multiple tabs, searching various registers, documenting findings, and saving evidence files. Somewhere around client three, fatigue sets in. A database gets skipped. A screenshot doesn’t save properly. Documentation ends up incomplete.

This is exactly why automated AML checks for law firms are replacing manual workflows. Automated systems don’t get tired. They don’t skip steps. They don’t forget to document. Every single check runs identically, whether it’s Monday morning or Friday at 4:45pm. That consistency matters enormously when regulators review your processes.

Audit trails become automatic rather than reconstructed. You know exactly when each client was screened, which databases were checked, what results appeared. When the SRA asks for verification records, you’re producing comprehensive logs instantly instead of frantically compiling spreadsheets from memory.

The anti money laundering checks for law firms uk require don’t change based on workload. Having a system that applies identical verification standards regardless of how busy your team is isn’t luxury-it’s practical risk management.

What Makes a Good AML Screening Tool for Legal Practices?

Database coverage matters more than most people realise. You need UK-specific access-Companies House, FCA registers, UK PEP lists-alongside international sanctions databases. An aml screening tool for legal practices with gaps in coverage simply moves your compliance risk around rather than eliminating it.

Integration capability separates useful tools from frustrating ones. If you’re manually copying client data from your case management system into screening software, then copying results back, you haven’t actually automated anything. You’ve just moved the manual work to a different screen. Effective aml compliance software for law firms connects seamlessly with existing systems.

Real-time verification isn’t negotiable for UK practices. Batch processing that checks clients once daily creates windows where you’re working with yesterday’s information. In financial crime compliance, yesterday’s information can become today’s regulatory breach.

See how automated AML screening works in property transactions

Ongoing monitoring distinguishes comprehensive solutions from basic onboarding tools. Your system should automatically re-screen clients without prompting, alerting you only when their status changes. Otherwise, you’re back to manual tracking of when everyone needs rechecking. This is where modern aml screening tools for legal practices and anti money laundering checks for law firms converge-continuous verification without manual intervention.

How Finexer Addresses These Challenges for Law Firms

Finexer’s platform connects to 99% of UK banks through open banking. This means when you’re verifying source of funds-which UK regulations require for property transactions and high-value matters-you’re accessing actual banking data rather than requesting statements that clients can curate.

We provide dedicated onboarding support for 3-5 weeks. Not because the system is complex, but because every law firm’s compliance workflow is different. That support ensures automated AML checks for law firms integrate smoothly with your existing processes rather than disrupting them.

Legal practices using the platform report up to 90% reduction in time spent on routine AML tasks. That’s not theoretical efficiency-it’s measured time savings that your compliance team immediately notices. Those hours get redirected to higher-value work requiring human judgement.

Pricing works on usage rather than fixed subscriptions. You pay for screenings you actually run, not capacity you might need. For firms with variable client intake-quiet summer months, busy autumn-costs scale naturally with actual workload.

What are automated AML checks for law firms?

Systems that verify client identities and screen against sanctions lists, PEP registers, and adverse media automatically, then continuously monitor for status changes without manual database searches.

How does an AML screening tool handle data from multiple sources?

The tool queries multiple databases simultaneously through API connections, returning consolidated results flagged for review rather than requiring manual searches across separate systems.

What makes UK-focused AML compliance software different?

Direct access to UK-specific databases like Companies House and FCA registers, plus compliance with Money Laundering Regulations 2017 requirements specific to legal practices.

Can automated screening replace compliance officers entirely?

No-automated systems handle routine verification tasks, but professional judgement remains essential for reviewing flagged results and making risk-based decisions about client relationships.

How do anti money laundering checks for law firms maintain audit trails?

Every screening action logs automatically with timestamps, databases checked, and results found, creating complete audit documentation without manual record-keeping.

Ready to Automate Your AML Compliance?

See how Finexer reduces screening time by up to 90% whilst maintaining complete audit trails

Book Demo Now