Contactless payment systems have become essential for modern retail. Whether it’s a customer tapping a phone, smartwatch, or debit card or QR code scan the expectation is simple: fast, secure, and frictionless checkout.

In the UK, this shift isn’t just noticeable, it’s measurable.

According to UK Finance:

- 75% of debit card payments and 65% of credit card transactions are now contactless.

- 85% of adults regularly use contactless, making it the preferred method for in-store purchases.

For retailers, this means slow payment methods are no longer just outdated; they’re costly. Long queues, abandoned baskets, and frustrated staff are often the result of not keeping up with how customers want to pay.

But it’s not just about speed. The latest contactless systems also improve inventory tracking, automate receipts, and offer better fraud protection, while supporting everything from mobile pop-ups to multi-location stores.

In this blog, we’ve handpicked six must-have contactless payment solutions for 2025, each suited to different types of retail environments.

For every tool, we break down:

- Tagline/Value Proposition: What it does best and who it’s for.

- Best For: The ideal retail scenario, whether you’re selling on the high street or at a weekend market.

- Key Features + Benefits: From NFC tap-to-pay and digital receipts to reporting and fraud detection.

- Pros and Cons: The trade-offs that matter when you’re choosing a system.

- Pricing Overview: Transaction fees, hardware costs, and plan details.

- Ideal Use Cases: Real-world examples to help you match the tool to your business.

Whether you’re upgrading your till, launching a new store, or switching away from card-heavy fees, this guide will help you choose the contactless system that fits your needs, without the guesswork.

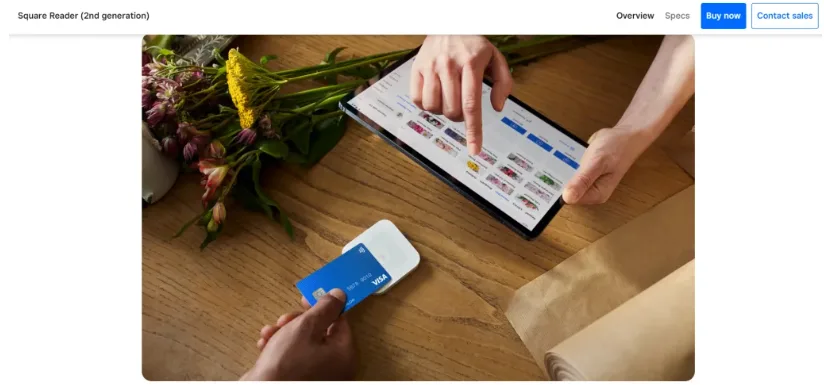

1. Square Contactless

Pocket-sized contactless payment system for fast, on-the-go sales.

Best For

Pop-up stalls, food trucks, market artisans, and boutique counters that want a low-cost reader with no monthly fee.

Key Features

- NFC Tap & Mobile Wallets: Accept Apple Pay, Google Pay, and contactless cards for two-second checkouts.

- Bluetooth EPOS Pairing: Sync sales and inventory automatically through the free Square POS app.

- Next-Day Payouts: Cash lands in your account the next business day; instant payout is optional.

- £19 Hardware: Lightweight reader; add an optional dock for countertop use.

Pros

- Tap-to-pay speed keeps queues short.

- Trusted brand builds shopper confidence.

- PCI-level encryption and tokenisation protect data.

- Easy to add more readers or switch on online checkout.

Cons

- Requires reliable Bluetooth and internet.

- Flat 1.75 % fee can pinch on high-ticket items.

- Integrations outside the Square ecosystem are limited.

Pricing

- Reader: £19 + VAT one-off.

- Transaction Fee: 1.75 % per in-person payment.

Ideal Use Cases

Craft fairs, mobile cafés, and salons needing quick, card-free checkouts with a portable contactless payment system.

📚 How Businesses save upto 90% on EPOS Transaction Fees

2. Zettle by PayPal

Affordable contactless payment system that blends quick tap-to-pay sales with PayPal’s trusted brand.

Best For

Small retailers, cafés, and mobile traders who want a no-subscription reader backed by PayPal, plus an upgrade path to a full POS terminal.

Key Features

- NFC Tap & Pay + PayPal QR: Accept cards, Apple Pay, Google Pay, and PayPal QR codes in under two seconds.

- Tap to Pay on Phone: Take contactless payments directly on compatible Android devices—no extra hardware needed.

- Integrated EPOS App: Zettle POS tracks sales, stock, and staff activity in one dashboard.

- Fast Payouts: Daily deposits to your bank or PayPal balance with built-in buyer and seller protection.

Pros

- Flat 1.75 % fee keeps costs predictable.

- PayPal name inspires consumer trust at checkout.

- No monthly charges; pay only when you use the contactless payment system.

- Reader pairs with Shopify, BigCommerce, and Xero for smoother omnichannel selling.

Cons

- Requires solid internet; offline mode isn’t supported.

- Reader price (£29) is higher than some rivals.

- Limited native integrations beyond PayPal’s own ecosystem.

Pricing

- Reader: £29 one-off for new businesses.

- Transaction Fee: 1.75 % for in-person contactless and chip payments; 2.5 % for payment links.

Ideal Use Cases

Coffee kiosks, craft boutiques, and market vendors needing a reliable, fee-only-when-used contactless payment system that customers already recognise.

3.SumUp Air

Ultra-portable contactless payment system that fits in a pocket yet covers every major tap-to-pay method.

Best For

Mobile cafés, market traders, personal trainers, and service professionals who need a lightweight, battery-friendly reader with industry-low fees and no contracts.

Key Features

- Full-Range NFC Acceptance: Visa, Mastercard, Amex, Apple Pay, and Google Pay tap in under two seconds.

- All-Day Battery: Up to 500 transactions per charge, ideal for markets and pop-ups without constant power.

- One-App EPOS: The free SumUp app tracks sales, issues digital receipts, and exports data to accounting tools.

- Next-Day Settlements: Payouts hit your bank account the following business day with no extra cost.

Pros

- 1.69 % flat fee keeps costs lower than many rival contactless payment systems.

- Pocket-size hardware pairs via Bluetooth to any iOS or Android device.

- No monthly charges or contractual lock-ins.

- Built-in security and PCI compliance are handled by SumUp.

Cons

- Requires a stable phone data or Wi-Fi connection.

- Limited advanced POS functions compared with full EPOS suites.

- Reader cost (£39) is higher if not bought during frequent promotions.

Pricing

- Reader: £39 one-off (often discounted to £29 for new sign-ups).

- Transaction Fee: 1.69 % per in-person payment.

Ideal Use Cases

Street-food vendors, mobile beauticians, and fitness instructors want a low-fee, cable-free, contactless payment system that slips easily into a pocket or apron.

📚 Guide to Checkout Process Optimisation

4. Shopify POS Go

All-in-one handheld contactless payment system that brings Shopify’s omnichannel power to the shop floor.

Best For

Bricks-and-clicks retailers who already run a Shopify store and want staff to complete in-aisle sales, check inventory, and print or email receipts without leaving the customer.

Key Features

- Built-In Tap-to-Pay & Scanner: Accepts cards/Apple Pay/Google Pay and scans barcodes from the same 4.7-inch device.

- Instant Inventory Sync: Every sale updates online and in-store stock in real time—no manual reconciling.

- Wi-Fi + Optional LTE: Stay connected on busy shop floors or at pop-ups without relying on a fixed till.

- All-Day Battery Dock: Drop-in cradle keeps devices charged and ready for peak trading.

Pros

- True omnichannel checkout reduces queue build-up.

- Staff can upsell anywhere on the floor, boosting average order value.

- Shopify’s PCI-compliant encryption secures every tap.

- Works out of the box with Shopify’s marketing, loyalty, and analytics tools.

Cons

- Hardware cost (£299 + VAT) is higher than basic readers.

- Only integrates natively with Shopify Payments.

- Requires a Shopify POS Pro or Retail plan for advanced features.

Pricing

- Device: £299 + VAT (includes cradle).

- Transaction Fees with Shopify Payments: 1.7 % for Basic, 1.6 % for Shopify plan; lower on Advanced.

Ideal Use Cases

Lifestyle boutiques, apparel chains, and pop-up brand activations are seeking queue-free, in-aisle checkouts powered by an omnichannel contactless payment system.

5. Revolut Reader

Modern contactless payment system that merges low fees with Revolut’s multi-currency platform.

Best For

Independent retailers, service professionals, and pop-ups that already use Revolut Business and want same-day payouts plus card-present rates as low as 0.8 % + £0.02.

Key Features

- NFC & Chip Acceptance: Tap cards, phones, or smartwatches for under-two-second checkouts.

- Instant Multi-Currency Payouts: Settles takings straight into your Revolut Business account in pounds or 28 other currencies on the same day.

- Compact USB-C Charging Dock: Pocket-size reader with optional countertop cradle; connects via Bluetooth to iOS or Android.

- In-App EPOS Tools: Issue refunds, send digital receipts, and track basic sales data inside the Revolut Business app.

Pros

- Ultra-low 0.8 % + £0.02 fee beats many rival contactless payment systems for card-present sales.

- Same-day access to funds helps cash-flow-sensitive sellers.

- Multi-currency wallet avoids FX fees when spending abroad.

- No monthly subscription; pay only per transaction.

Cons

- Reader costs £49 upfront—higher than some entry-level options.

- Limited advanced EPOS features compared with full POS suites.

- Requires a Revolut Business account; not ideal if you bank elsewhere.

Pricing

- Reader: £49 one-off.

- Transaction Fee: 0.8 % + £0.02 up to £2k monthly; 1.2 % + £0.02 thereafter.

Ideal Use Cases

Consultants, mobile wellness practitioners, and market vendors who already bank with Revolut and want a low-fee, same-day payout contactless payment system.

6. Finexer: An Affordable Contactless Payment System Powered by Open Banking

| Benefit | What It Means for You |

|---|---|

| No Card Fees | Eliminate interchange and scheme charges entirely with direct bank-to-bank payments. |

| 99 % UK Bank Coverage | Customers from virtually any UK bank can pay instantly via their own mobile banking app. |

| Fast Deployment | Go live in days, not months, using plug-and-play APIs or ready-made EPOS plugins. |

| Flexible, Usage-Based Pricing | Pay only for successful transactions—no setup costs, monthly minimums, or cancellation fees. |

| White-Label Ready | Keep your brand front and centre while Finexer handles all compliance and payment rails. |

Key Features

- QR & Link-Based Checkout: Turn any screen, receipt, or email into a tap-to-pay moment, perfect for pop-ups and queue-busting counters.

- Real-Time Settlement & Auto-Reconciliation: Money clears within minutes and syncs directly to your accounting platform, slashing admin time.

- PSD2-Compliant Security: Bank-level authentication and encrypted rails cut fraud risk versus traditional contactless payment systems.

- Developer-Friendly Sandbox: Test, iterate, and launch without waiting on sales calls or lengthy certifications.

📚 Guide to open banking for EPOS

Finexer vs Card-Based Contactless Payments

| Feature | Finexer (Account-to-Account) | Card-Based Taps |

|---|---|---|

| Chargebacks | None—payments are final once the shopper approves in their banking app. | Frequent disputes; funds can be frozen for weeks. |

| Fees | Flat, usage-based rate with zero interchange or scheme costs. | Interchange + scheme + acquirer mark-ups on every sale. |

| QR Codes & Payment Links | Built-in—generate a QR or payment link in seconds, no extra hardware. | Often require third-party add-ons and “card-not-present” surcharges. |

| Automated Digital Receipts | Auto-sent and instantly reconciled to your EPOS/accounting software. | Typically manual or locked behind premium add-ons. |

| Settlement Speed | Near-instant between UK bank accounts. | One to three business days; slower on weekends. |

| Fraud & PCI Burden | Strong Customer Authentication, no card data stored, no PCI paperwork. | Card data can be skimmed; full PCI-DSS compliance required. |

“We were looking for a partner that could not only meet our current needs but also anticipate and support our growth. Finexer delivered exactly what we needed, from compliance-ready software to seamless integration with our existing systems.” – David Kern, CEO of VirtualSignature-ID.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWrapping Up

As contactless payments continue to dominate in-store spending across the UK, retailers can no longer treat them as optional. The right contactless payment system doesn’t just reduce queue times; it directly impacts customer satisfaction, staff efficiency, and long-term cost savings.

From mobile card readers like Square and SumUp to full-featured POS platforms like Lightspeed, each solution listed here offers a unique fit for different business types and sizes. But for retailers focused on cutting fees, speeding up settlement, and eliminating chargebacks entirely, Finexer offers a compelling alternative.

With real-time bank-to-bank payments, built-in QR codes, no monthly charges, and zero card fees, Finexer gives retailers a future-proof way to accept payments without the complexity or cost of traditional terminals.

What is a contactless payment system?

A system that lets customers tap a card or phone to pay securely using NFC or QR code technology

How are card and account-to-account payments different?

Card payments involve fees and chargebacks; A2A payments like Finexer go direct from bank to bank with no intermediaries.

Can I use contactless payments with my EPOS?

Yes. Most modern systems, including Finexer, integrate easily with popular EPOS platforms.

Ready to Simplify Payments and Cut Card Fees? Finexer offers a faster, more affordable contactless payment system