Source of funds checks play a vital role in fighting money laundering. The Financial Action Task Force (FATF) emphasises that these checks help track money to its original source and verify its legal acquisition. This is a significant step to identify and prevent potential financial crimes.

Compliance officers often find it challenging to gather Source of Wealth (SoW) and Source of Funds (SoF) information. UK Anti-Money Laundering legislation requires these checks during enhanced due diligence, especially when dealing with Politically Exposed Persons (PEPs) or high-risk country transactions. The FATF recommends these verifications as part of a company’s Anti-Money Laundering (AML) compliance program. Companies need to collect various documents like pay slips, bank statements and business financial records.

Financial institutions typically start these checks when transactions go beyond set thresholds. To name just one example, this happens when amounts exceed £100,000 or when multiple transactions occur quickly. Modern financial systems have become too complex to handle these checks manually. More businesses now use specialised APIs that automate and standardise the process while meeting UK regulations. This piece will get into five of the best source of funds check APIs available for UK compliance in 2025.

1. Best API for UK-Focused Financial Compliance: Finexer

UK businesses working under FCA rules and Money Laundering Regulations 2017 need a fast, auditable, and cost-effective way to verify the origin of funds, especially when dealing with PEPs or high-value transactions. Finexer delivers this through a powerful Source of Funds Check API purpose-built for UK regulatory needs.

Finexer’s system uses Open Banking data to access verified income, one-off deposits, and account ownership in real time. Whether your compliance team is onboarding a client or reviewing high-risk transactions, Finexer replaces manual evidence collection with a secure, audit-ready digital process.

The API supports connections to 99% of UK banks and delivers structured reports that align with AML and EDD requirements. Unlike manual checks involving payslips and PDF statements, Finexer verifies the data directly from the bank, within minutes, not days.

Finexer works best for:

- UK-regulated firms looking to meet AML compliance requirements

- Accountants and platforms performing EDD on clients

- Teams needing real-time verification for high-value transactions

- Businesses replacing outdated manual SoF evidence processes

- Platforms that want faster onboarding without skipping compliance

Finexer features

Finexer includes several features designed for financial institutions and regulated firms:

- Real-time access to verified income and deposit data

- Name matching between the bank and the declared identity

- FCA-authorised AIS access to 99% of UK banks

- Audit-ready reports with consent and verification logs

- Supports both recurring (e.g., salary) and one-off deposits (e.g., asset sales)

Finexer pros

Finexer brings key benefits backed by regulatory insight and platform stability:

- Quick deployment in days, not months

- Flexible usage-based pricing, ideal for scaling or seasonal teams

- No need to collect pay slips or bank statements manually

- Developer-friendly with full white-label capability

- Built specifically for the UK’s regulatory and financial ecosystem

Finexer pricing

Finexer uses a transparent usage-based pricing model that scales with your needs. Whether you’re handling steady onboarding volumes or seasonal spikes, you only pay for successful requests. There’s no complex tiering or annual lock-in, just predictable costs that align with actual activity. Finexer Provides Affordable Pricing designed to support both early-stage teams and enterprise-grade operations.

How VirtualSignature-ID Uses Finexer for Source of Funds Verification

VirtualSignature-ID (VSID), a UK government-accredited provider of digital identity and eSignature services, supports legal and accountancy firms handling high-value property transactions. As part of its AML and onboarding workflows, VSID needed a way to verify the source of funds without relying on manual document uploads or slow approval processes.

By integrating Finexer’s Open Banking API, VSID now performs instant Source of Funds checks using real-time, consented bank data. This allows VSID to validate income, deposits, and account ownership within minutes, ensuring compliance with enhanced due diligence (EDD) under UK AML regulations.

With Finexer, VSID also enables secure client fund transfers and account verification, all within a single digital onboarding flow.

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package. They’ve proven to be more than a provider—they’re a trusted partner.”

— David Kern, CEO, VirtualSignature-ID

The result? Faster onboarding, fewer manual checks, and a compliant user experience trusted by professionals across legal and accounting sectors.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

2. Best API for Crypto-Related Source of Funds Checks: SumSub

Cryptocurrency businesses need specialised tools to check their funds’ sources. Blockchain transactions are anonymous, which creates unique challenges in identifying money laundering risks. SumSub has emerged as a standout solution in the UK market for 2025.

SumSub source

SumSub’s Crypto Monitoring solution utilises multiple data sources to give a complete source of funds verification. Their system uses Crystal Blockchain as its foundation, a tool that regulators recognise and leading banks and crypto exchanges use. On top of that, it lets you integrate with other blockchain analytics providers:

- Crystal Intelligence (default source)

- Chainalysis (optional integration)

- Elliptic (optional integration)

These integrations help SumSub extract wallet addresses and check them against multiple databases to create detailed transaction risk reports. The system looks at both where funds come from and where they go to get a full picture of crypto transactions.

SumSub best for

SumSub shines in serving several key market segments within the cryptocurrency space:

- Crypto exchanges that just need strong AML compliance

- Fintech startups handling crypto transactions

- Non-regulated businesses wanting to stop fraudsters and boost pass rates

- Regulated businesses doing verification a smaller scale

- UK-based VASPs (Virtual Asset Service Providers) that must follow Travel Rule legislation

SumSub’s blockchain analytics expertise makes it valuable for businesses in the UK’s strict regulatory environment. The platform detects VASP-to-VASP payments and automates data transfers, which helps companies navigate the UK’s complex crypto compliance rules.

SumSub features

SumSub’s platform comes packed with features built for crypto-related source of funds checks:

- Automated crypto wallet risk scoring – Assesses both hosted and unhosted wallets right away

- Transaction flow analysis – Shows how funds move between users, entities, or wallets

- Risk level assessment – Shows risk scores from 0 to 1, with clear categories:

- 0 to 0.25: Low risk

- 0.25 to 0.6: Medium risk

- 0.6+: High risk

- UK-specific compliance tools – Custom questionnaires to collect source of wealth data

- Multi-currency support – Looks into Bitcoin, Ethereum, Bitcoin Cash, and ERC20/ERC721 tokens

- Travel Rule compliance – Links to over 1,700 VASPs to aid regulatory compliance

The platform’s SDK integration will give a 99.9% uptime through Web SDK, Mobile SDK, or RESTful API. This makes it reliable for businesses that can’t handle service breaks.

SumSub pros

SumSub brings several benefits, based on user reviews and tech specs:

- High verification pass rates – 95.86% average pass rate for the United Kingdom

- Quick verification – Users can sign up in under 30 seconds with user-friendly flows

- Extensive document support – Checks over 14,000 document types worldwide

- Configurable risk policies – Custom rules for transaction monitoring that line up with business needs

- End-to-end solution – KYC verification and transaction monitoring in one platform

- Legal compliance framework – A legally equipped method that aligns with FATF and FinCEN rules

Users love how easy SumSub is to integrate. To name just one example, see this review: “SumSub is easy to use, and their admin interface is effective”.

SumSub cons

SumSub has some drawbacks you should think over:

- No data enrichment for ID verification

- Liveness and video verification can get pricey and take time

- Users mention unclear reasons for applicant rejections

- Edge cases lack detail

- Pre-made rule bundles might need changes for specific businesses

- The crypto monitoring features take time to learn

SumSub pricing

SumSub has three main pricing tiers:

| Plan | Price | Features |

|---|---|---|

| Basic | £118.33 min. monthly commitment | ID Verification, Liveness & Face Match, Email/Phone verification |

| Compliance | £237.45 min. monthly commitment | Everything in Basic + AML Screening, Ongoing AML Monitoring, Proof of Address check |

| Enterprise | Custom pricing | Everything in Compliance + Advanced features like Non-Doc Verification, Business Verification, Travel Rule |

Setup comes free with no extra charges. You can try it free for 14 days with 50 free checks. The best part? You only pay for successful verifications.

The pricing works on a commitment basis – your minimum monthly payment. When you go over this amount, you pay extra checks at a prorated rate. Travel Rule compliance features sometimes come with six-month free trials.

UK crypto businesses will find SumSub’s mix of strong source of funds checks, detailed risk scoring, and local regulation compliance worth the premium price.

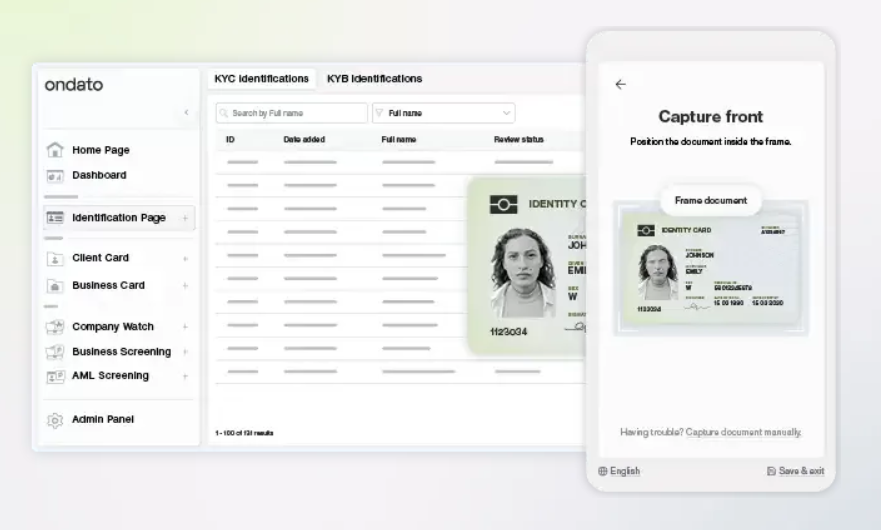

3. Best API for SME Compliance Teams: Ondato

SMEs often find it hard to build reliable AML processes with their limited resources. Ondato tackles this challenge by offering an all-in-one compliance solution that fits SME needs perfectly.

Ondato source

Ondato’s verification capabilities come from a wide range of global and local databases. The platform accesses business reports from 195 countries, shareholder information from 105 countries, and representative/manager/officer data from 188 countries. The platform verifies documents against more than 10,000 government-issued ID templates worldwide with 99.8% accuracy. This detailed approach lets Ondato verify passports, ID cards, driving licences, residence permits, and voter IDs.

The platform connects to international sanctions lists, politically exposed persons (PEP) databases, and adverse media sources. The system analyses IP addresses and email usage history to build a complete risk profile for potential clients.

Ondato best for

Ondato works best for:

- SME compliance teams that need a detailed solution with limited resources

- Financial institutions looking to automate KYC and AML processes

- Companies operating in multiple jurisdictions that need adaptable compliance tools

- Businesses want remote onboarding solutions while staying compliant

- Firms that need both individual and business verification on one platform

Small to medium-sized compliance teams find the platform highly efficient. A reviewer noted that Ondato “lowered the costs, improved the quality and speed of the players’ onboarding”.

Ondato features

Ondato offers these features to make compliance processes simpler:

- KYC and AML Verification – The platform completes identity verification in about 60 seconds, with average onboarding taking 30 seconds across 192 countries

- Business Verification (KYB) – Detailed company checks include ultimate beneficial ownership structure identification in 50 countries

- AML Screening – The system runs automated checks against PEP lists, sanctions databases, and reputational risk media

- Customer Due Diligence (CDD) – Advanced analytics help prioritise higher-risk activities

- Centralised Compliance Hub – One platform manages all customer data, ongoing monitoring, and additional checks

- Transaction Monitoring – Partnership integrations enable complete coverage of the client lifecycle

- Customisable Risk Rules – Users can create verification workflows based on specific regulatory requirements and risk profiles

- Age Verification API – Document-free age verification uses biometric evaluation

The platform combines these features to enable efficient customer due diligence, automated screening, and better compliance with evolving regulations.

Ondato pros

Customer feedback and technical capabilities show Ondato’s strengths:

- High Pass Rates – The platform achieves a 97% average pass rate across verification attempts

- User-Friendly Interface – Reviews praise the easy-to-use design, with one noting, “Ondato’s platform is easy to use, with a simple and intuitive interface”

- Flexible Deployment Options – Users can choose between cloud-based SaaS and on-premises solutions

- Multi-Language Support – Standard packages include at least 17 languages and dialects

- Comprehensive Monitoring – The system monitors natural and business entities against sanctions, PEPs, and expiry dates continuously

- Data Security – The platform maintains ISO 27001 certification with 24/7 security monitoring

- Automated Reports – Users get PDF Identity Reports with complete verification details

Financial institutions praise Ondato’s client service. A banking client said, “For years, Ondato’s automatic identification confirmation has been a reliable and efficient solution… we appreciate their quick response to our needs and willingness to make improvements when necessary”.

Ondato cons

Ondato has some limitations:

- Manual Activation Required for Screenings – A reviewer noted, “Screenings are not automated, we have to turn on them manually for each new customer”

- API Integration Challenges – Some clients found initial API integration difficult, stating “Implementation with API and back office of the company has work to be done”

- Limited Automation in Some Areas – Some processes still need manual intervention

- Higher Pricing for Small Businesses – Very small operations might find the cost prohibitive

- Setup Time Investment – Configuration takes significant time, though reviews say “the time investment in the setup process was well worth it”

Ondato pricing

Ondato’s tiered pricing plans fit different business needs:

| Plan | Monthly Fee | Per Verification Cost | Key Features |

|---|---|---|---|

| Growth | €259 | €0.95 | OS access for 3 users, 10,000+ ID verification, unlimited data retention |

| Expansion | €569 | €0.85 | OS access for 5 users, additional features like custom branding, 3h monthly consultation |

| Enterprise | Custom | Custom | Unlimited OS access, unlimited consultation, custom development |

| KYB Standard | €569 | +€0.15 (for sanctions/PEP) | Business reports, monitoring, 3 users |

| KYB Enterprise | Custom | Custom | Unlimited users, custom data sources |

Smaller teams can use Ondato’s Officer platform, which costs €59 to €249 per month plus data fees per user.

Verifications take less than 60 seconds on average, much faster than manual processes that might take days or weeks. Video call identity verifications cost an extra €0.10 per minute.

SME compliance teams that want to automate source of funds checks while staying compliant will find Ondato’s mix of flexible pricing, detailed features, and easy-to-use interface matches their needs perfectly.

4. Best API for Real-Time Monitoring: SEON

The ever-changing world of financial transactions demands up-to-the-minute monitoring. This monitoring is vital to check sources of funds effectively. SEON emerges as a solution that gives businesses quick insights into suspicious activities.

SEON source

SEON verifies sources of funds by using an extensive array of digital footprint data points. Traditional systems only look at official documents. However, SEON analyses over 300 proprietary signals from digital identities. Their system enriches data through:

- Email and phone number verification across 90+ social and digital platforms

- IP address geolocation and analysis

- Device fingerprinting and emulator detection

- Behavioural biometrics that track cursor movements and typing patterns

The platform added more social and digital lookups. Users can now check 92 platforms when running manual lookups or using their Phone and Email APIs. Fraudsters rarely build legitimate digital footprints connected to fraudulent details, which makes this approach exceptional.

SEON best for

SEON works best for:

- Online businesses that need up-to-the-minute fraud prevention

- Fintech companies that need transaction monitoring

- E-commerce platforms fighting bonus abuse and multi-accounting

- Gambling operators are detecting fraudulent registrations

- Payment gateways that need quick risk assessment

Organisations handling high transaction volumes find this solution valuable. A Senior Analyst said: “We were looking at another provider, but they came back to us with a 4-6 months integration window. With SEON, it was literally a phone call, sandbox tests on Monday and by the end of the week, it was done”.

SEON features

SEON’s platform includes several key features to verify sources of funds:

- Up-to-the-minute transaction monitoring – Flags anomalies immediately instead of using batch processing. Teams can act quickly before threats escalate

- Customisable rules engine – Businesses can set precise rules without engineering support or coding experience

- Machine learning capabilities – Uses rules-based monitoring with behavioural insights and machine learning to detect emerging patterns

- AML compliance tools – Screens automatically against sanctions, crime, PEP, and RCA watchlists using fuzzy matching to minimise false positives

- Single API integration – Users access fraud and AML data signals through one integration point

- No-code environment – Risk teams can set their own thresholds and create custom logic without technical help

SEON analyses various signals to check sources of funds. These include device fingerprinting, IP addresses, digital footprints, transaction velocities, and behavioural patterns. This analysis provides deeper insights into compliance risks and potentially fraudulent activities.

SEON pros

Client feedback and published results show several advantages:

- Quick integration – Implementation takes as little as 5 days

- Most important fraud reduction – Users report 87% fewer fraudulent transactions after implementation

- Strong ROI – Customers see 8x ROI overall and up to 32x ROI for marketing campaign protection

- Up-to-the-minute processing – Results come in under one second, even with thousands of simultaneous transactions

- Multi-accounting detection – Detects 190% more duplicate accounts at registration

- Excellent customer support – Reviews often mention responsive and helpful support

- Better resource allocation – Compliance teams can focus on improving policies and procedures

SEON cons

SEON has some limitations to think about:

- Pricing concerns – Reviews mention high costs for smaller businesses and those in regions with lower purchasing power

- Limited free tier – Free version allows only 10 custom rules and 500 manual checks monthly

- Generic solution focus – Some competitors have more industry-specific features

- Limited behavioural insights – One comparison noted fewer advanced behavioural metrics than specialised alternatives

- Data costs – Using extensive data sources can increase overall costs

SEON pricing

SEON uses a tiered pricing structure:

| Plan | Key Features | Limits |

|---|---|---|

| Free | Basic fraud prevention tools | 10 custom rules, 500 manual checks/month, 2 queries/second |

| Starter | Enhanced API access | 50 custom rules, 1,000 API calls/month, 10 queries/second |

| Professional | Enterprise-grade protection | Unlimited rules, unlimited API calls, 10–100 queries/second |

The Starter plan costs about £475 monthly. SEON offers a pay-per-API-request model alongside fixed monthly subscriptions. This model lets businesses adjust costs based on their needs and growth without changing contracts.

SEON’s pricing stands out because of its usage-based approach. Companies pay only for actual API calls, which works well for businesses with varying transaction volumes.

5.Best API for Risk-First AML Screening: ComplyAdvantage

For firms handling high-risk clients or operating across jurisdictions, Source of Funds checks are just one part of a broader compliance framework. ComplyAdvantage is a UK-based provider focused on real-time AML screening, transaction monitoring, and automated risk scoring. Its Source of Funds capabilities sit within a wider API toolkit designed for regulated businesses with complex compliance demands.

Using AI and dynamic data feeds, ComplyAdvantage screens for PEPs, sanctions, and adverse media while enabling firms to build policies that trigger SoF or SoW requests when specific thresholds are crossed—ideal for institutions applying enhanced due diligence under MLR 2017.

Best For

Mid-market and enterprise firms are embedding risk-based SoF checks into end-to-end AML frameworks, including onboarding, monitoring, and transaction vetting.

Key Features

- Real-time PEPs, sanctions, and watchlist screening

- Smart policy triggers for Source of Funds verification

- Risk scoring based on geography, client profile, and transaction behaviour

- Transaction monitoring with suspicious activity detection

- API-based rule engine for onboarding and client reviews

Pros

- Deep data coverage for screening high-risk individuals and businesses

- Ideal for firms using dynamic risk models in onboarding

- Fully customisable policy engine

- API-first architecture with strong documentation

- Trusted by UK-regulated institutions and fintechs

Cons

- Not suited for firms seeking a standalone Source of Funds solution

- Pricing can be steep for low-volume users

- Requires in-house compliance knowledge to set effective rules

Pricing

ComplyAdvantage offers custom pricing based on user volume, screening frequency, and feature access. Pricing typically follows a per-screening or per-seat model, with enterprise options available. This structure is ideal for teams that want to build full AML automation, not just perform one-off checks.

What are the sources of funds checks, and why are they important?

Source of funds checks are procedures used to verify the origin of money in financial transactions. They are crucial for preventing money laundering, ensuring compliance with regulations, and maintaining the integrity of financial systems.

How do API-based sources of funds checks differ from manual processes?

API-based checks automate and standardise the verification process, offering faster results, improved accuracy, and the ability to handle high volumes of transactions. This contrasts with manual checks, which can be time-consuming and prone to human error.

What features should businesses look for in a source of funds check API?

Key features to consider include comprehensive data coverage, real-time monitoring capabilities, customisable risk rules, integration ease, and compliance with UK regulations. The ability to reduce false positives and provide detailed audit trails is also valuable.

How do these APIs help businesses comply with UK regulations?

These APIs help businesses meet UK compliance requirements by automating checks against sanctions lists, PEP databases, and adverse media. They also assist in conducting enhanced due diligence when required, such as for high-risk transactions or politically exposed persons.

Start Running Source of Funds Checks Without the Complexity! Book a Quick Demo 🙂