Category: Accounting & ERP

Automated Financial Data Categorisation for UK Platforms

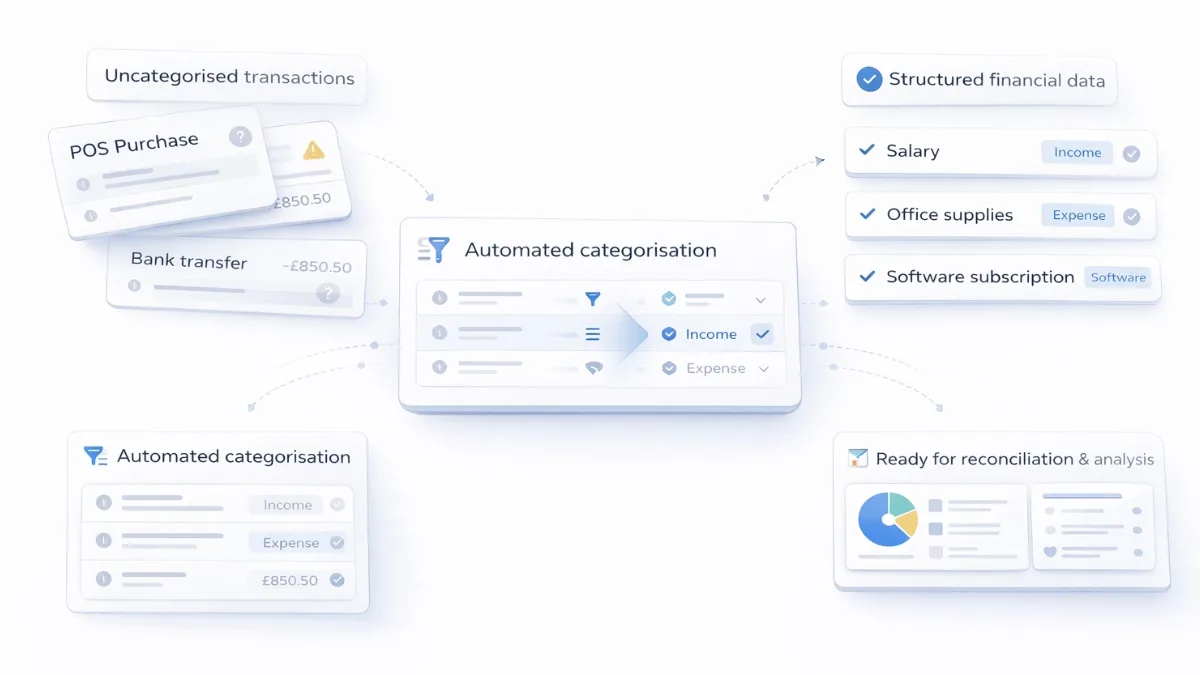

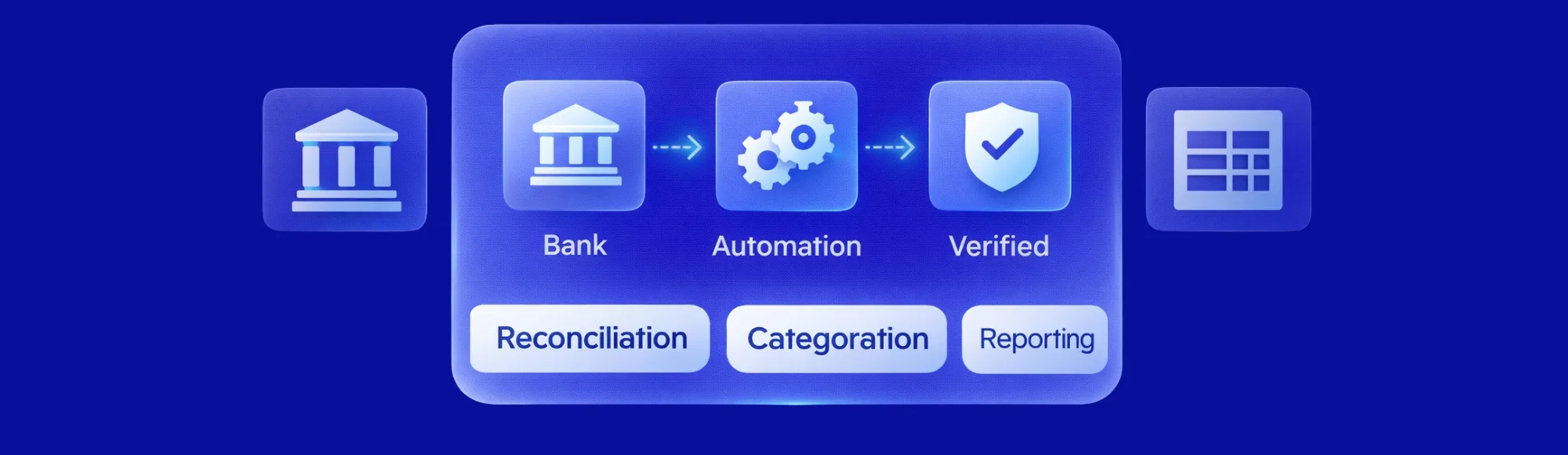

Automated financial data categorisation enables UK platforms to access structured bank transaction data automatically. Platforms integrate open banking APIs for categorised merchant details and spending classifications supporting automated reconciliation and financial analysis without manual processing.

Automated Client Account Reconciliation for UK Platforms

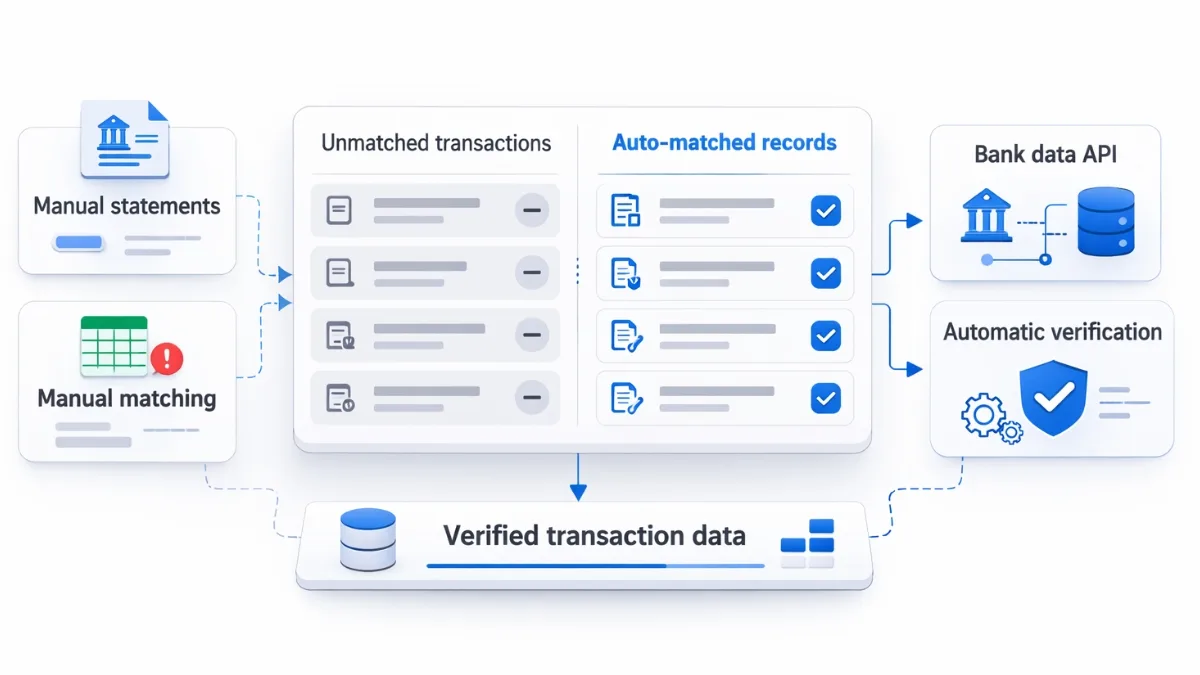

Automated client account reconciliation enables UK platforms to match transactions automatically using bank data APIs. LawTech, accounting, and fintech platforms access verified transaction data for compliance and audit workflows without manual statement processing.

Open Banking AIS: How to Access Financial Data Reliably

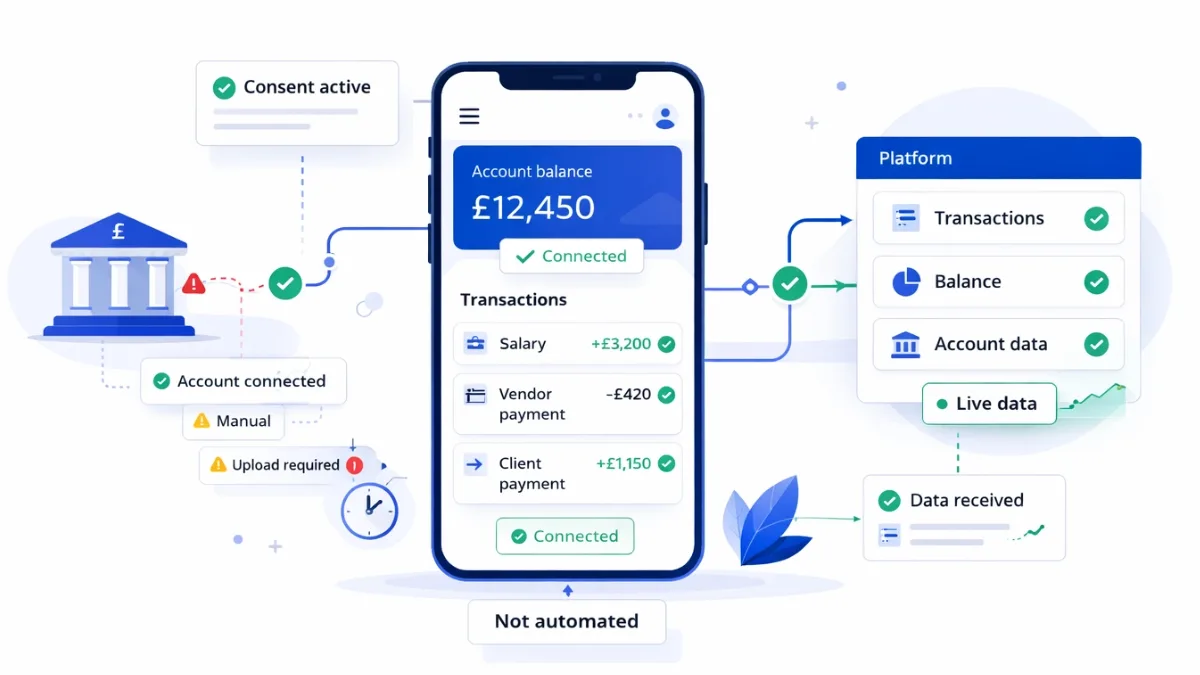

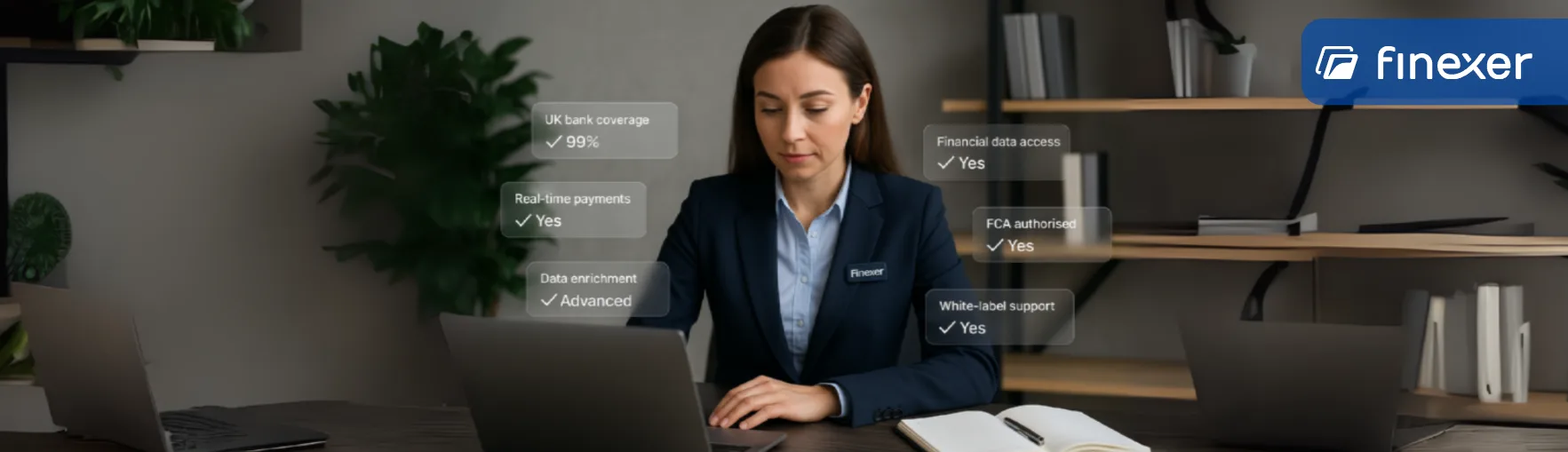

Open banking AIS infrastructure enables UK platforms to access bank account data reliably. Platforms evaluate FCA authorisation, bank coverage, connection reliability, and consent management when choosing AIS banking providers.

Automation of Accounting Process Using Bank-Verified Data

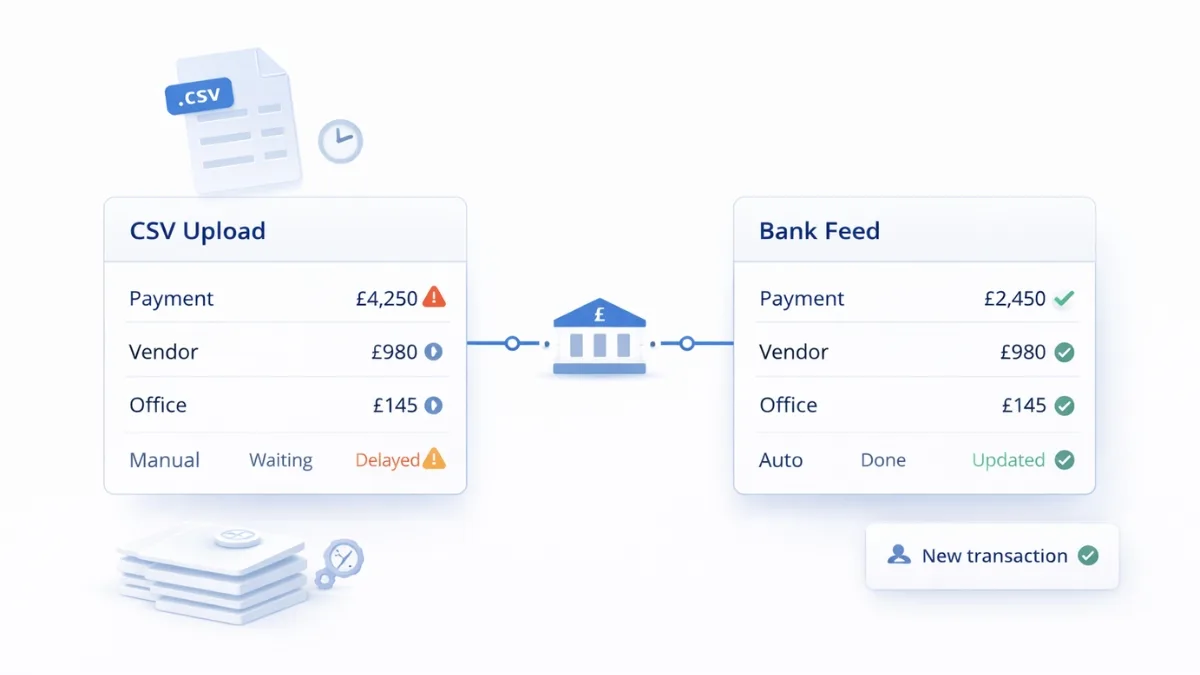

Automation of accounting process requires reliable bank transaction data. UK platforms use Finexer’s FCA-authorised Open Banking infrastructure to access verified feeds that enable automated reconciliation and reporting without manual uploads.

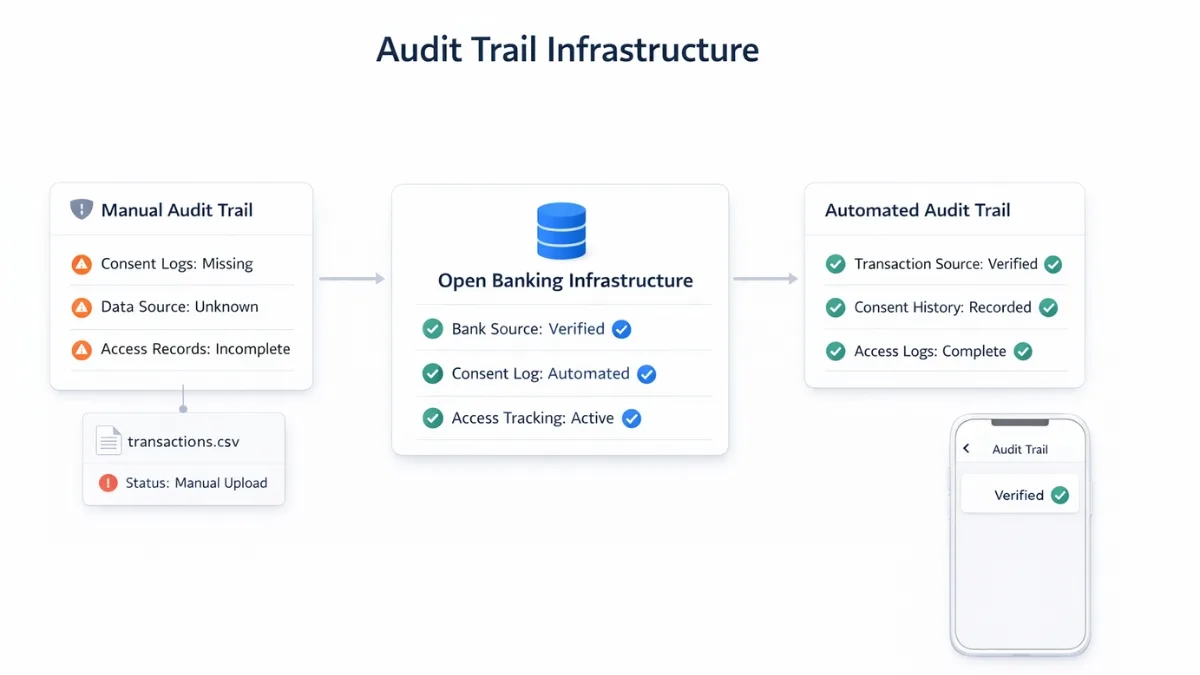

Audit Trail Infrastructure for UK Fintech Platforms

Audit trail in financial platforms tracks data origin and consent. UK platforms use Open Banking infrastructure to automate verified transaction records.

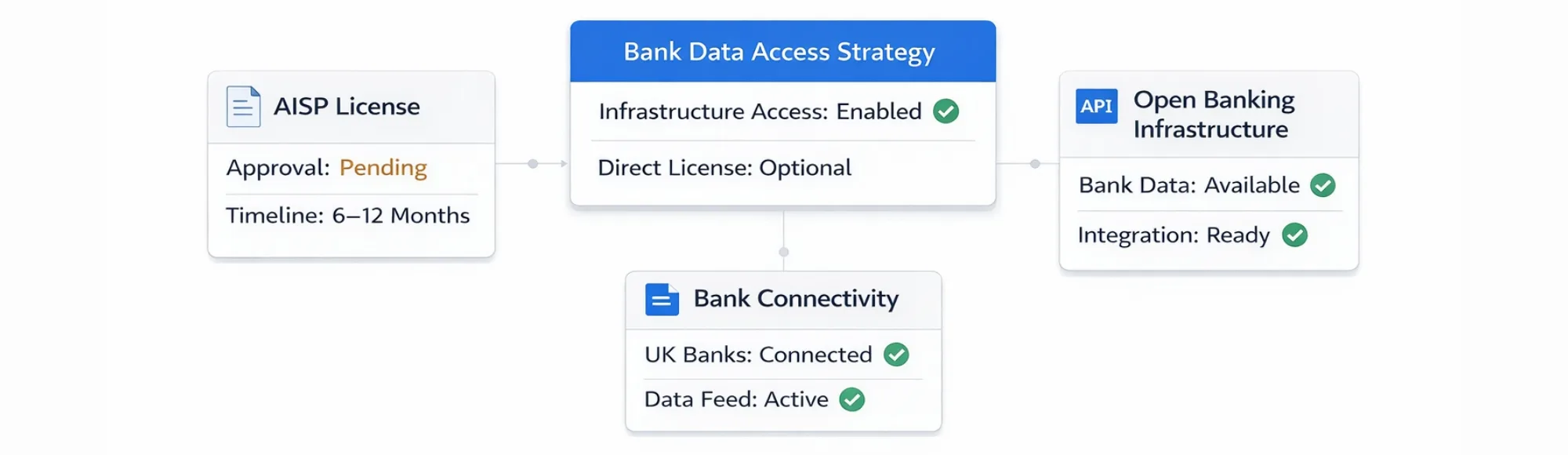

AISP License in the UK: What Founders Actually Need to Know

AISP license evaluation guide for UK fintech founders. Understand direct FCA authorisation vs infrastructure model for bank data access. Make informed regulatory decisions.

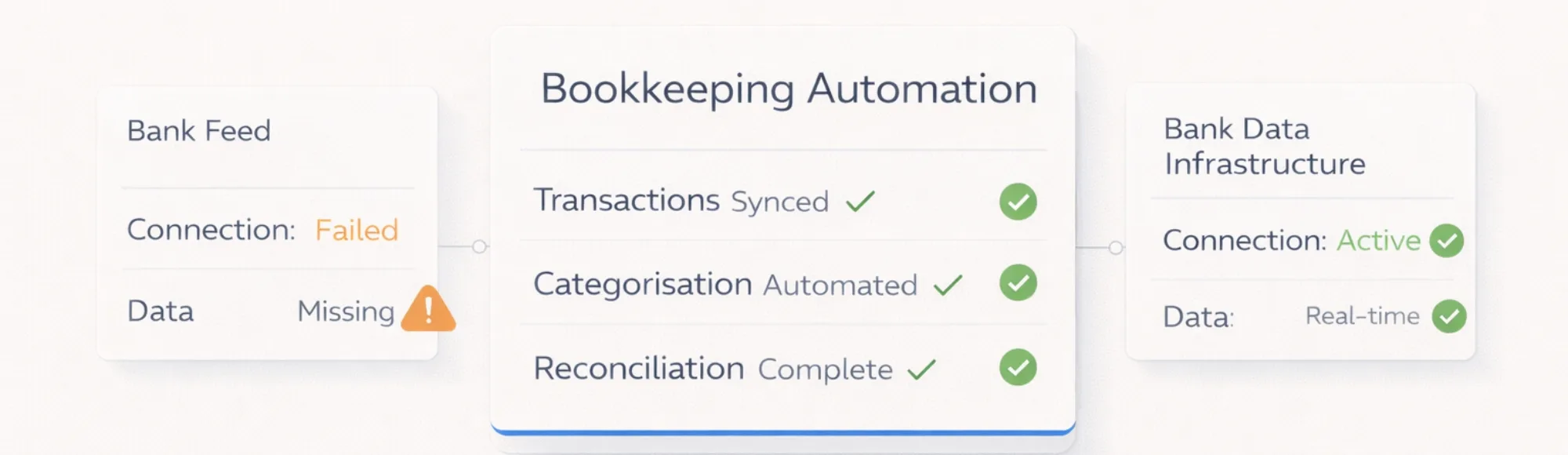

Bookkeeping Automation Software in the UK: What Actually Powers It

Bookkeeping automation software needs reliable bank data infrastructure. See how Open Banking powers automation features for UK accounting platforms.

Rent Affordability Check: Verify Tenants with Bank-Verified Data

Rent affordability check with bank-verified income data. Finexer’s Open Banking infrastructure for letting agents. Book a demo for automated tenant verification.

AML Software for Accountants: Transform Compliance with Bank-Verified Data

Access bank-verified transaction data for AML compliance. FCA-authorised Open Banking infrastructure for UK accounting firms. Faster source-of-funds verification.

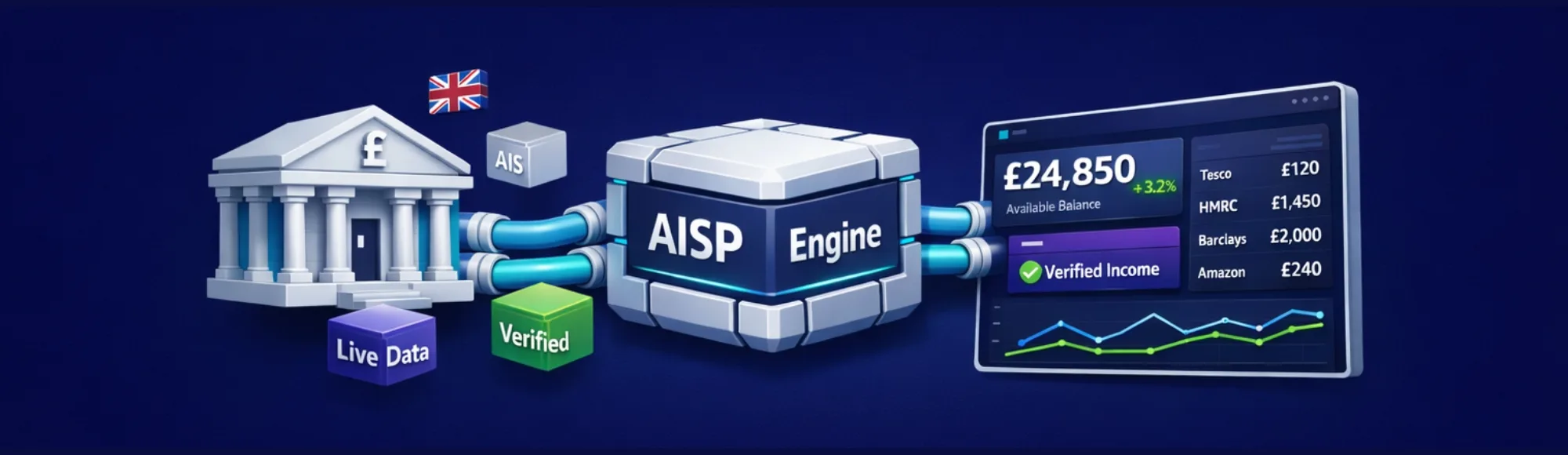

AISP Open Banking: Build Faster AIS Banking Access for Your Platform

aunch faster with AISP Open Banking in the UK. Access verified AIS banking data from 99% of banks. Build verification & aggregation. Book a demo.

Bank Account Aggregation API for SaaS & Fintech Platforms

Aggregate bank accounts via Open Banking APIs. Access enriched, consent-based transaction data across 99% of UK banks. Book a demo with Finexer.

Account Information Service (AIS): How Platforms Access Bank Data via Open Banking

Access verified UK bank data with Finexer’s account information service. Connect to 99% of banks via Open Banking APIs. Book a demo today.

Accounting Workflow Automation: How Modern Finance Teams Automate Reconciliation, Categorisation, and Reporting

Get Accounting Workflow Automation with Finexer Cut manual processing time, improve accuracy & automate reconciliation with real-time bank connectivity Contact Now You’ve probably been there: it’s month-end, your finance team is buried in spreadsheets, manually matching hundreds of transactions. Someone’s chasing down a missing payment reference whilst another team member is three hours into reconciling…

Bank Feed API for UK Accounting SaaS: What to Build First for Faster Growth

Build bank feed APIs for UK accounting SaaS that actually work. Get 99% UK bank coverage and deploy faster with Finexer’s regulated platform.

The Ultimate Guide to Automated Bank Reconciliation: Cost Savings for UK Accounting Firms in 2025

Discover how UK accounting firms can significantly reduce costs and save time in 2025 with automated bank reconciliation.

![Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide] 16 Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide]](/wp-content/uploads/2025/08/Open-banking-for-Multi-client-management-jpg.webp)

Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide]

Stop chasing client bank statements! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Handling data and bank feeds for multiple clients has long been a tedious part of accounting, chasing down PDFs, vetting spreadsheets, and wrangling statements from every bank. It’s inefficient, error-prone, and limits a firm’s ability…

How Open Banking APIs Are Transforming Accounting Firm Client Onboarding

Faster Onboarding with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now For UK accountants, client onboarding is no longer a back‑office formality; it’s a regulatory obligation and a client experience benchmark. Accounting firm client onboarding often still means chasing PDF bank statements, requesting utility bills, and manually…

Top 5 Open Banking Providers for Automated Bank Reconciliation in Accounting Platforms

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Why accounting platforms need automated bank reconciliation Manual reconciliation is one of the most time-intensive tasks in accounting. Firms still spend hours pulling PDF bank statements, cross-checking transactions, and correcting errors that slip through. For…

Finexer vs Yapily for Accounting Compliance: What Mid-Sized Firms Need to Know

Compliant Open banking with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now For mid-sized accounting firms in the UK, accounting compliance is not just a box-ticking exercise; it’s a core part of protecting clients and avoiding penalties from regulators like HMRC and the FCA. With stricter rules…

Choosing the Right Open Banking Provider for Source of Funds Checks in Accounting

Instant Source of funds checks with Finexer Connect with 99% of the UK Banks and See how Finexer simplifies source of funds verification for accountants Try Now For accounting firms, verifying the source of funds in client transactions is no longer a back-office formality. Regulators such as the FCA and HMRC place strict obligations on…

How Growing Accounting Firms Use Open Banking for Faster Client Payouts

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In the UK, growing accounting firms are under more pressure than ever to deliver faster client payouts. Whether it’s reimbursing expenses, processing payroll, or making supplier payments, waiting several days for funds to clear can…

Finexer for Accountants: The Best Open Banking API for UK Firms in 2025

Get Instant Bank Data with Finexer Book a quick call to see how Finexer can replace your manual bank statement collection with instant, secure feeds from 99% of UK banks Try Now Why UK Accountants Need More Than Bank Feeds If you run a mid-sized or growing accounting firm in the UK, you’ve probably noticed…

Open Banking Providers for UK Accounting Firms

Grow Your Firm Without the Admin Bottlenecks Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Mid-size and scaling accounting firms face a daily challenge: keeping financial data accurate, up to date, and easy to access without slowing down client work. Chasing bank statements, waiting for CSV files, and…

Finexer vs TrueLayer: Income Verification for Accountants

See Finexer’s AIS in Action Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now How Open Banking Powers Income Verification for Accountants For years, income verification for accountants was a slow, document-heavy process. Clients had to provide payslips, tax returns, or scanned bank statements, and accountants spent hours cross-checking…

How Expense Automation Helps UK Accountants Process Claims

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Expense claims are one of the most common back-office frustrations. Between chasing receipts, entering amounts manually, and tracking down approvals, UK accounting teams often spend more time managing expenses than reviewing them. The process is slow, repetitive,…

![A Guide to Affordable Payroll Automation Without the Complexity for Mid Size Businesses [2025] 26 A Guide to Affordable Payroll Automation Without the Complexity for Mid Size Businesses [2025]](/wp-content/uploads/2025/05/Affordable-Payroll-Automation.jpg)

A Guide to Affordable Payroll Automation Without the Complexity for Mid Size Businesses [2025]

Pay Instantly with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Managing payroll in a mid-sized business goes beyond sending out salaries. It involves coordination across departments, accurate calculations, timely submissions, and compliance with tax requirements, all under pressure to keep costs down. That’s where affordable payroll automation…

Batch Payment Processing for Accounting Software Users: A 2025 Guide

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now You’ve done the work. Invoices are approved, and suppliers are waiting. Your accounting system can generate the payment list, but now comes the part no one talks about: getting those payments actually out the door. This is…

Stop Matching Invoices Manually: Automate Payment Reconciliation with Finexer

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now When One Payment Covers Ten Invoices, Your Team Pays the Price It sounds simple: your client sends you a lump-sum payment for several outstanding invoices. But when that money hits your account, it’s anyone’s guess which invoices…

Open Banking Compliance for UK Accountants: A Practical FCA Guide

Compliant & Secure Open Banking with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Open banking compliance is becoming essential for accountants in the UK. As more firms adopt tools that connect directly to client bank accounts, understanding the regulatory side of real-time data access is no longer…

Business Central Integration with Live Bank Feeds: A 2025 Guide for UK Finance Teams

Get Instant Bank Data with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Microsoft Dynamics 365 Business Central is a powerful ERP platform, but it is widely adopted by growing UK businesses for its flexibility in managing finance, operations, and reporting. But when it comes to live banking…