Category: Reviews & Comparisons

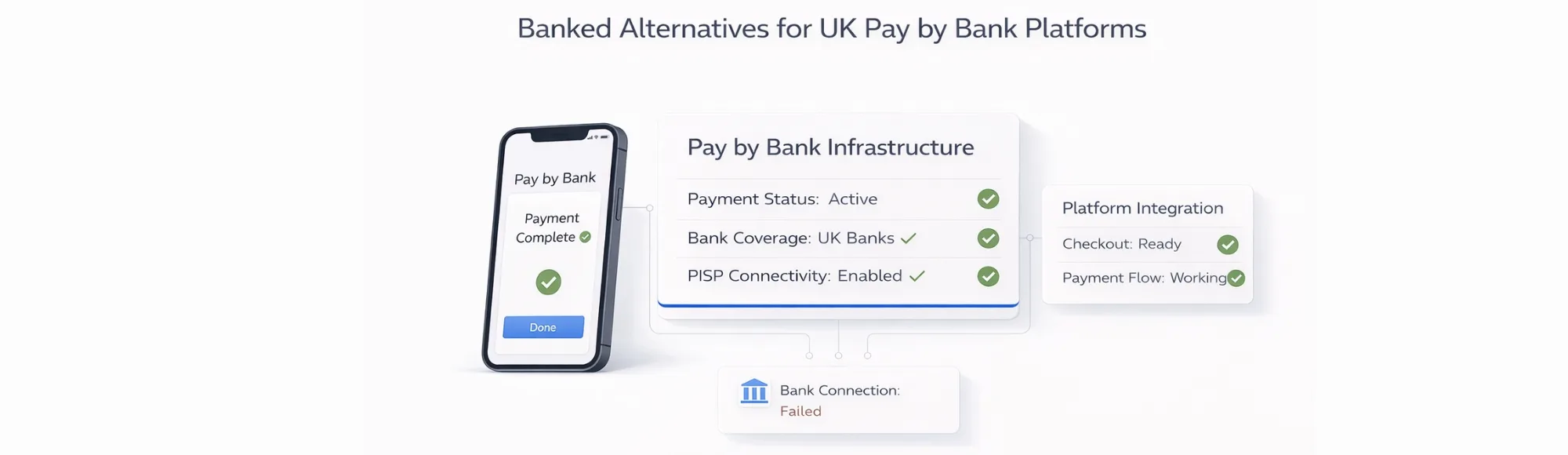

Top 6 Banked Alternatives for UK Pay by Bank Platforms

Compare 6 Banked alternatives for UK Pay by Bank platforms. Evaluate FCA-authorised PISP infrastructure options with stable connectivity and transparent pricing.

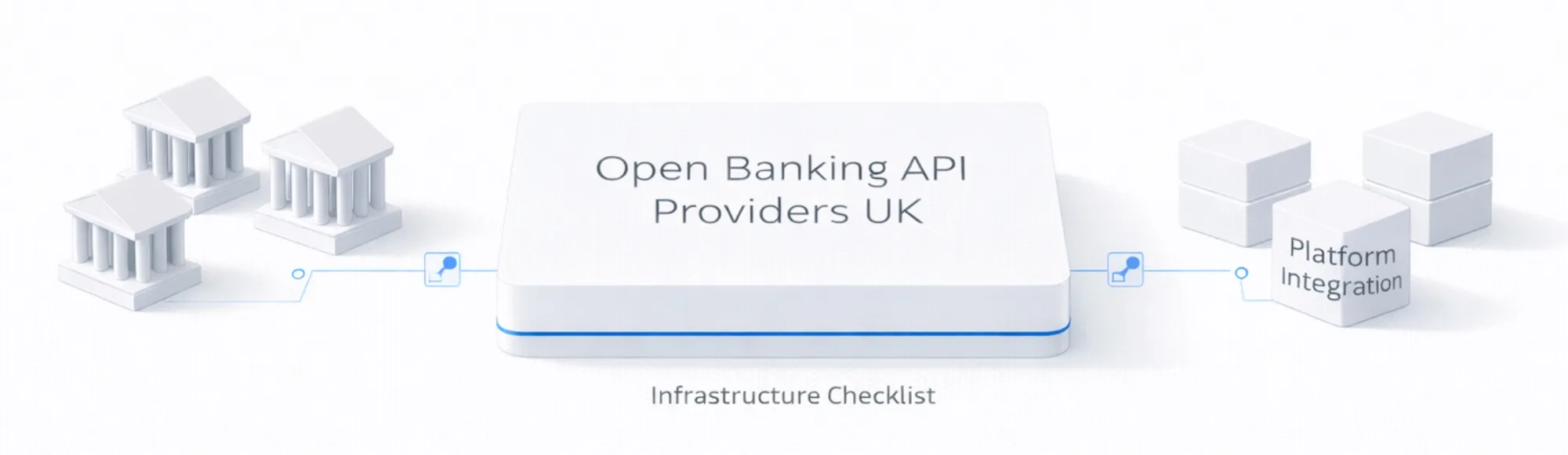

Best Open Banking API Providers UK (2026 Buyer Checklist)

Compare open banking API providers UK with infrastructure-focused checklist. Evaluate coverage, pricing, deployment beyond feature lists. FCA-authorised connectivity for platforms.

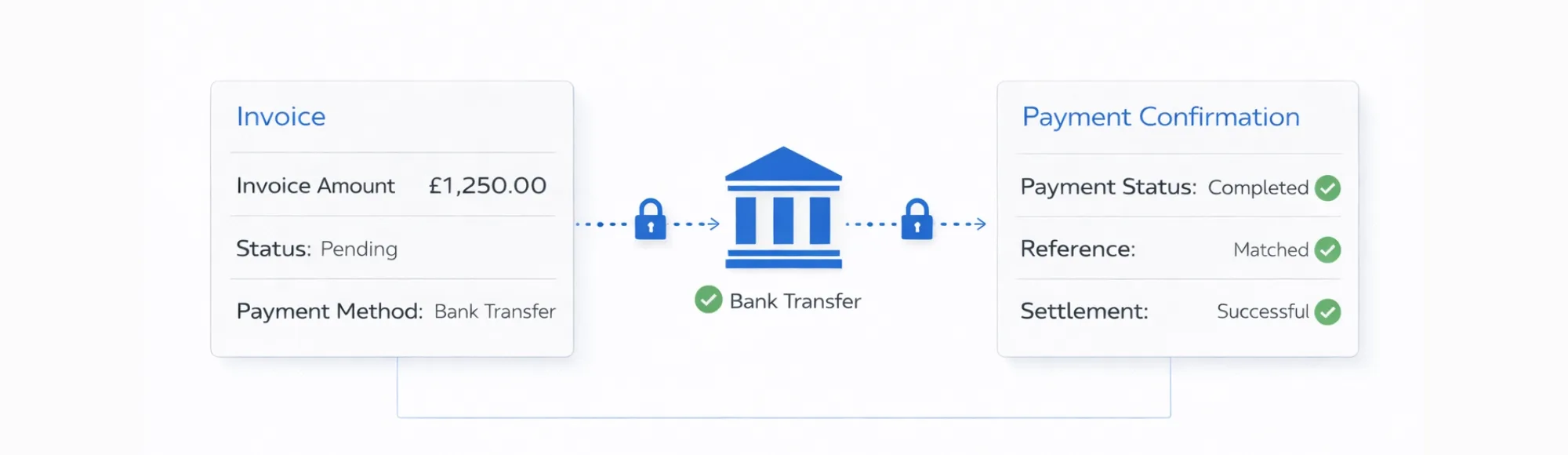

Pay by Invoice in the UK: A Smarter Way to Collect Payments

PISP payment infrastructure checklist for UK platforms. Evaluate providers with 99% bank coverage, consent handling, and webhook delivery. FCA-authorised Open Banking.

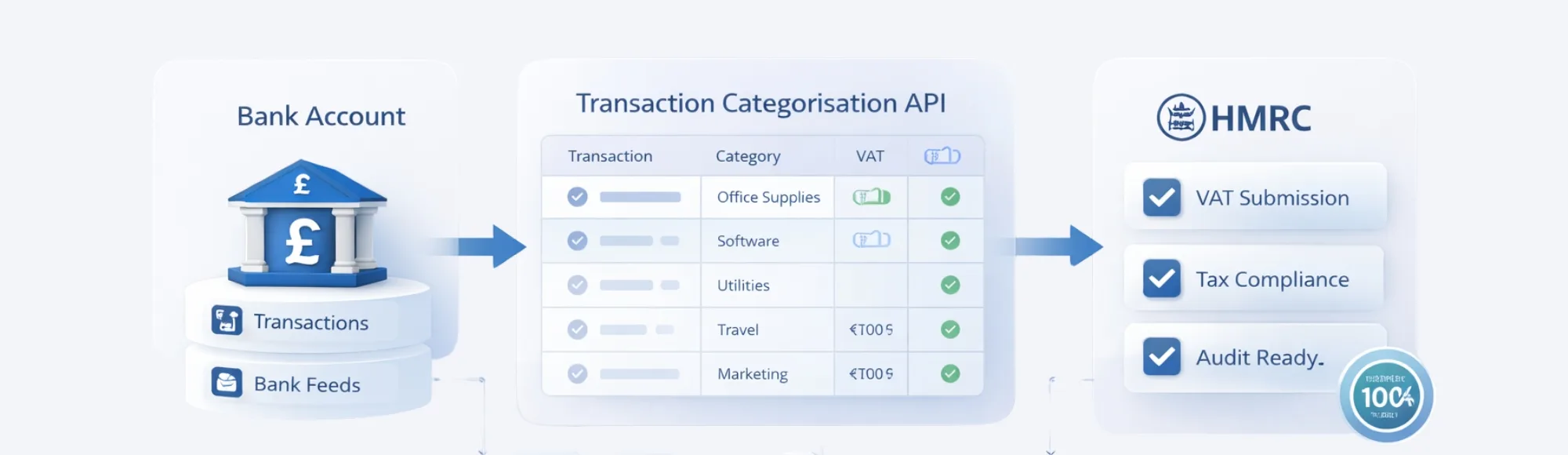

Transaction Categorisation API for Audit-Ready Bookkeeping: How UK Firms Reduce VAT Errors

See why transaction categorisation APIs outperform manual processing with faster setup, lower VAT errors, and automated audit trails.

Top 5 Refund Management Platforms Built for High-Volume Retailers

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Handling refunds at scale isn’t just a back-office task — for high-volume retailers, it can make or break the customer experience. In a world where return rates can reach up to 30% in ecommerce, having a clear,…

6 TrueLayer Alternatives for Payments in the UK

Looking for TrueLayer alternatives? Compare 6 UK-friendly Open Banking payment providers with faster go-live, stable PIS, and full control of your flows.

Most popular banking API examples

Explore the most popular banking APIs in 2025 — Plaid, Tink, Finexer and Yapily. Compare coverage, features, and compliance for UK fintech success.

Top Scalable Banking Data Aggregation Solutions for UK Businesses in 2026

Find the top scalable banking data aggregation platforms in the UK. Compare features, coverage, and performance to choose the right provider for your business.

6 Bank Feed Software Every Accountant Should Know in 2025

Find the best bank feed software for UK accountants and finance teams. Compare tools, Open Banking platforms, and reconciliation solutions built for accuracy.

7 Best Banking API Providers in the UK (2026 Guide)

Find the top UK banking API providers. See how Finexer, Salt Edge, Yapily, Plaid, Tink and TrueLayer stack up on coverage, pricing and integration speed.

Planky Review for Data Aggregation and Alternatives in the UK (2025 Guide)

Find the best UK alternatives to Planky for Open Banking data aggregation — built for faster deployment, wider coverage, and flexible pricing.

NorthRow Review: Pricing & Competitors for KYB/KYC in the UK

NorthRow review 2025: features, pricing model, strengths, and KYB/KYC competitors to compare before choosing your compliance platform.

Ecospend Review: Features, Pros & Cons, and the Best Alternative for UK Businesses

Read our Ecospend review and find out why Finexer is the faster, transparent Open Banking choice for UK businesses.

![5 Best Bank Transaction APIs in the UK [2025 Guide] 14 5 Best Bank Transaction APIs in the UK [2025 Guide]](/wp-content/uploads/2025/10/bank-transaction-api-in-the-UK-jpg.webp)

5 Best Bank Transaction APIs in the UK [2025 Guide]

Compare the best Bank Transaction API providers in the UK. Evaluate coverage, enrichment, and payments to choose the right solution for your business.

7 Best Financial Data Aggregators in the UK (2026 Guide)

Explore the 7 best financial data aggregator platforms in the UK. Compare coverage, features, and use cases to find the right fit for your business.

![Yodlee Aggregator: How It Works & Best UK Alternative [2025] 16 Yodlee Aggregator: How It Works & Best UK Alternative [2025]](/wp-content/uploads/2025/10/Yodlee-aggregator-api-jpg.webp)

Yodlee Aggregator: How It Works & Best UK Alternative [2025]

Learn how the Yodlee Aggregator works, its UK limitations, and why explore faster, affordable Open Banking alternative for 2025.

Yapily vs Plaid: Which AIS Provider Fits Your Business in 2025?

Compare Yapily and Plaid for AIS in the UK. See how they differ on bank coverage, business account access, and pricing

Yaspa Pricing & Review 2026: Payouts, Fees, Pros & Cons

Explore Yaspa’s 2025 pricing, payouts features, fees, pros and cons. Learn how its Open Banking payments and refund capabilities fit UK businesses.

Streem Connect Pricing for Accountants (2026 Guide)

Discover Streem Connect pricing for accountants in 2025. Learn about subscription fees, per-link costs, add-ons, and compare with Finexer’s flexible usage-based model.

Airwallex UK Pricing & Features: What UK Businesses Need to Know

Discover the key features and pricing plans of Airwallex UK business accounts in 2025. Learn about multi-currency accounts, payment fees, and corporate cards.

SumUp Pricing UK: What You’ll Really Pay in 2026

Cut Your Payment Fees with Finexer Instant bank-to-bank payments, no setup costs, and 3–5 weeks of integration support included Try Now Choosing a payment provider isn’t just about convenience; it directly affects your margins, your cash flow, and how quickly you get paid. For many small UK businesses, SumUp is the first name that comes…

Nuapay Alternatives UK Businesses Should Consider in 2025

Discover the best Nuapay competitors in 2025. Find top Account-to-Account payment providers and find the right alternative for UK businesses.

Top B2B Payment APIs for UK Businesses in 2025: Features, Compliance & Integration Guide

Discover the best B2B payment APIs in the UK for 2025. Comparing the top API services in the UK.

Best Third-Party Banking App in the UK for Businesses

Compare the best third-party banking app options in the UK. Discover business-ready features, Open Banking payments, and why Finexer is a top choice in 2025.

![Top White-Label Payments API in the UK [2025 Guide] 25 Top White-Label Payments API in the UK [2025 Guide]](/wp-content/uploads/2025/09/Top-white-label-payment-au-jpg.webp)

Top White-Label Payments API in the UK [2025 Guide]

Compare the best white-label payments APIs in the UK. See features, branding depth, compliance, and why Finexer stands out for instant Pay by Bank.

10 Best Digital Payments Solution

Compare the best digital payments solutions in the UK. See providers, costs, payout speeds, and find the right fit for your business in 2025.

Budget-Friendly Open Banking Solutions in the UK: A 2025 Guide

Find budget-friendly open banking solutions in the UK. Compare providers, pricing models, and cost-saving features for SMEs and startups.

6 Best Bulk Payment Systems for UK Businesses in 2025

Explore the top 6 bulk payment systems for UK businesses in 2025. Compare providers on coverage, speed, and cost to find the right fit for your payouts.

Finexer vs Moneyhub: Which Solution Wins for Income & Affordability Checks in the UK?

Looking for the right tool for UK income & affordability checks? This Moneyhub comparison breaks down features, compliance, and real use cases

![5 Best QR Code Payment Platforms in the UK [2026 Guide] 30 5 Best QR Code Payment Platforms in the UK [2026 Guide]](/wp-content/uploads/2025/09/QR-Based-Payment-Providers-jpg.webp)

5 Best QR Code Payment Platforms in the UK [2026 Guide]

Instant Settlement with Finexer Connect to 99% of UK banks and accept QR-based payments with zero setup fees! Try Now QR code payments are quickly becoming a reliable and cost-effective payment method for UK businesses. As more customers rely on mobile phones to shop and pay, scanning a QR code has become just as common…