Imagine a better and smarter way of handling multiple recurring payments, without losing control. Let me introduce you to the world of Commercial VRPs, the next major development in the world of open banking.

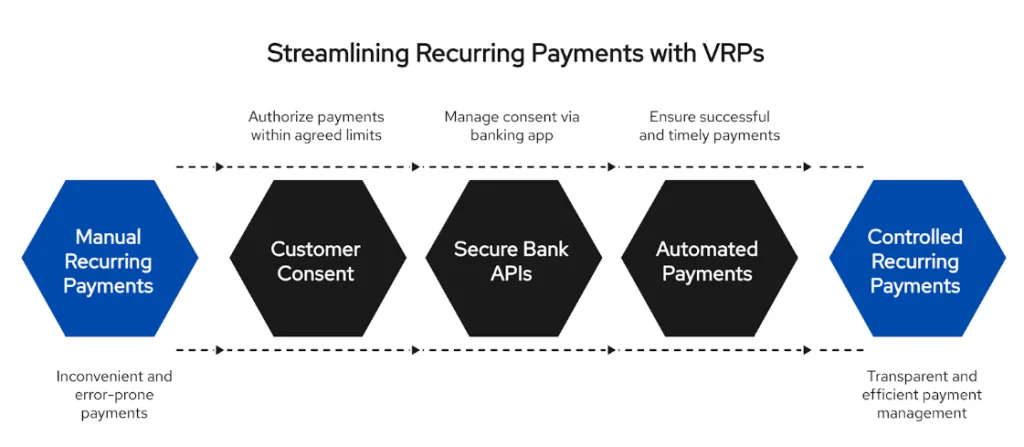

Growing rapidly in the UK and gaining immense traction across Europe, VRPs allow customers to handle and authorise payment providers to make multiple recurring payments on their behalf within previously agreed limits. As we know, Open Banking Limited says that there are now 22.1 million open banking payments every month in the UK and VRPs extend the powerful technology to ecommerce and subscriptions. For UK businesses this means more control over recurring payments and fewer failed transactions.

So what exactly are VRPs and why are they so important? Variable Recurring Payments are a type of payment instruction used in open banking to safely authorise a third-party vendor, such as a fintech company, to make a series of payments on their behalf. The customer provides consent a single time and the payments are done. Think of it this way: You decide to purchase a streaming service at a certain price per month, so instead of manually making payments, VRPs ensure successful payments and remove the need to remember due dates.

This consent is managed through secure bank APIs and can be viewed and revoked by the customer at any time via their banking app, offering a high level of transparency and control.

What is the difference between VRPs and direct debit?

VRPs give you more freedom and control than Direct Debits. With Direct Debits, changes or cancellations require contacting your bank or merchant. VRPs, powered by open banking, let you set limits on amount and frequency upfront, ensuring greater transparency, security, and flexibility.

Do VRPs work for all kinds of recurring payments?

Although banks and regulators are expanding VRPs for commercial use cases like subscriptions, utility bills, and loan repayments, they are currently primarily used for sweeping payments, or transferring funds between your own accounts. This is frequently referred to as “Commercial VRPs.”

Let’s discuss sweeping VRPs and how they are different from CVRPs.

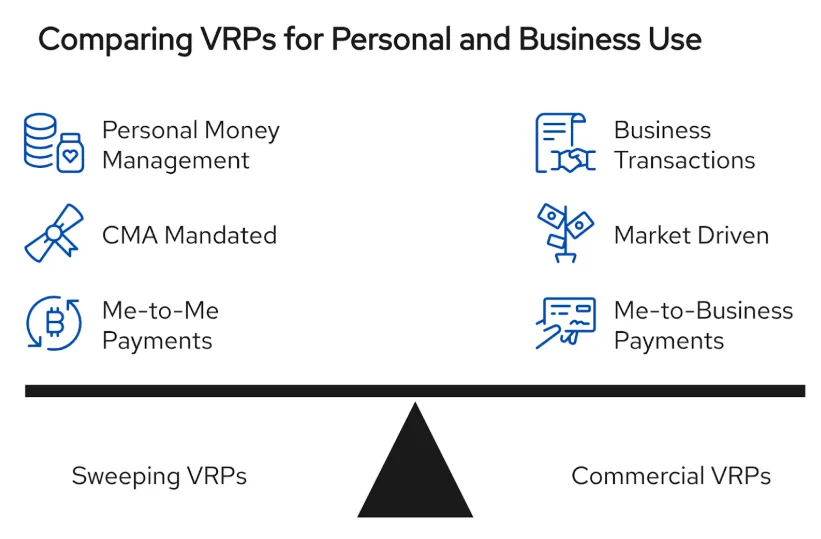

Sweeping VRPs are made for managing your own money. They let you move money between your own accounts automatically. Commercial VRPs are the next step in this technology, letting you pay businesses for goods and services on a regular basis. The main difference is who you are paying: yourself or someone else.

Sweeping VRPs are like smart, automated cleaning for your money. This is where the vrp open banking journey began. The UK’s Competition and Markets Authority (CMA) told the nine biggest banks (the CMA9) that they had to offer this service for free.

The point was to help people handle their money better. Sweeping means moving money from one account to another that belongs to the same person. It’s a payment from one person to another.

Commercial VRPs are like shopping, while Sweeping is like cleaning. This is the next exciting step, a strong alternative to Direct Debit and a big step forward for the future of payments. Commercial VRPs let you pay a company for goods and services while still using the same secure technology. This “me-to-business” transaction opens up a world of opportunities for both customers and retailers. In contrast to the required Sweeping VRPs, progressive banks are voluntarily implementing commercial VRPs in response to consumer demand for improved fintech payment options.

Though Sweeping was created by the CMA, the commercial sector is currently driving the expansion of VRP payments in the UK. In order to introduce these safe recurring payments to the market, a number of significant UK banks have already introduced their own commercial vrps solutions in collaboration with payment processors.

As companies recognise the advantages of reduced transaction costs, decreased fraud, and increased payment success rates in comparison to conventional methods, adoption is gradually growing. It’s becoming crucial for any company trying to update its payment stack to comprehend and use open banking recurring payments.

How do Commercial VRPs work?

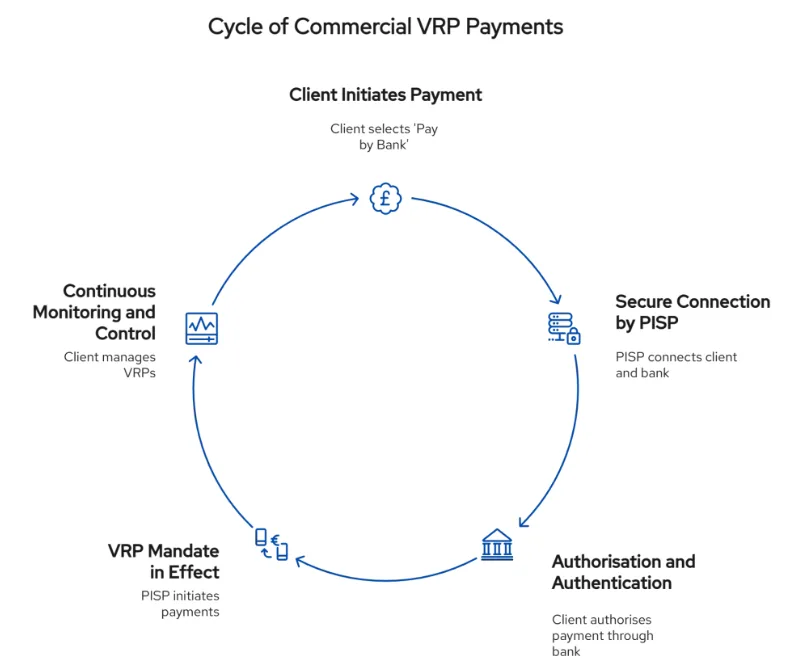

Naturally. This is a thorough, step-by-step guide that explains how Commercial VRPs operate, from initial setup to recurring payments. Although commercial VRPs (variable recurring payments) may appear complicated, the procedure is made to be extremely safe and easy to use. It employs a contemporary, API-driven methodology to replace antiquated techniques. The process for a normal VRP payment is broken down here.

Consider that the cost of a monthly subscription box you sign up for may change marginally every month.

Step 1: The Client Decides to Pay

You opt for “Pay by Bank” or a comparable option on the sign-up or checkout page. This starts the process of vrp payments. You are selecting a more straightforward and safe method of payment rather than inputting your card information.

Step 2: A Secure Connection Is Made by the PISP

The magic of Open Banking starts here. A licensed Payment Initiation Service Provider (PISP) is used by the company you are paying. The PISP serves as a safe middleman and is a regulated business. Its task is to use the bank’s official open banking payments API to link your company to your bank. Only with your express consent can payment instructions be safely exchanged via this API, which serves as a secure “doorway.”

Step 3: Authorisation and Authentication (The Consent Journey)

You are seamlessly redirected to your own reliable online banking portal or banking app by the PISP. You are never asked to give the company or the PISP your banking password or credentials, which is an important security measure.

Your bank will show you a clear “consent screen” explaining the VRP parameters within your comfortable banking environment:

- Payee: The name of the company you are giving permission to.

- Maximum Payment Amount: The most money that can be paid in one go (e.g., £50).

- Cycle Limit: The highest sum that can be consumed in a specific time frame (e.g., £100 per month).

- Expiration Date: When the consent will automatically expire, such as in a year.

Then, using the standard, high-security method provided by your bank—usually Face ID, a fingerprint scan, or your banking passcode—you give your consent. This procedure, called Strong Customer Authentication (SCA), makes sure that the payment mandate can only be approved by you.

Step 4: The VRP mandate is in effect

The VRP mandate takes effect as soon as you consent to it. As long as they adhere to the guidelines you recently approved, the PISP is now able to initiate payments on the company’s behalf.

The company notifies the PISP when your next subscription box, which costs, say, £45, is prepared for shipment. Your bank receives a secure instruction from the PISP through the Open Banking Payments API. The bank processes the payment instantly through the Faster Payments network because the amount (£45) falls within the £50 single payment limit and the £100 monthly limit you set. Most importantly, there is nothing you need to do. Every time you make a payment, you don’t have to log in or authenticate again.

Step 5: Constant Monitoring and Control

VRP’s transparency and control are what give it its power. Whenever you want, you can:

View Mandates That Are Active: You can view a comprehensive list of all the VRPs you have authorised by logging into your banking app.

Revoke Access Instantly: You can quickly revoke the VRP consent from your banking app with just one tap if you want to end your subscription. This instantly prevents the company from accepting any more payments.

Compared to conventional methods, this entire flow offers a better experience. Because the customer has complete control and there are no unexpected price changes or card details to steal, the relationship between the company and its customers is more transparent and trustworthy.

The advantages of VRP are revolutionary. This open banking payment method offers businesses instant settlement, reduced expenses, and fewer unsuccessful payments. Customers benefit from increased financial security, transparency, and control. Additionally, the system stimulates competition and innovation throughout the market, resulting in a more contemporary and effective financial ecosystem for everybody.

Use Cases of Commercial VRPs

Outstanding use cases for commercial VRPs demonstrate its adaptability beyond straightforward card-on-file transactions. VRPs are perfect for variable utility bills and subscriptions for customers. They simplify SaaS fees and supplier invoices in business-to-business transactions. Charities can provide flexible recurring donations, and governments can streamline tax collection. Every use case demonstrates the widespread appeal of this potent financial tool across various industries by substituting antiquated techniques with a more secure, customer-controlled payment system.

Are Variable Recurring payments safe?

Very safe, indeed. VRPs are among the safest ways to make payments. The bank-grade security of Open Banking serves as the foundation for the entire procedure. Using multi-factor authentication (such as Face ID or fingerprint), you authorise payments within your own banking app, and the merchant never receives your banking information.

How can my business start implementing VRPs?

The majority of companies don’t use bank APIs directly. Rather, you collaborate with a Payment Initiation Service Provider (PISP) that has a license. By handling the technical integration, these providers (such as Finexer) make it simple to incorporate VRP as a “Pay by Bank” option into your billing or checkout process.

What should your next steps be?

The Unavoidable Transition to More Intelligent Payments

The transition from difficult, slow, and unsafe payment methods to Commercial VRPs’ immediate, safe, and customer-focused business model is not merely a fad; it is the direction of digital commerce. We’ve seen that VRPs, which are based on the strong Open Banking foundation, provide a clear improvement over more conventional systems like card payments and direct debits.

So as a business,

Don’t wait for your payment methods to break down. Speak with your payment provider about their Open Banking and VRP options right now. Request a demo, assess the integration procedure, and determine the possible return on investment (ROI) from lower fees and increased revenue.

How Finexer Can Help:

Finexer makes it simple for your company to implement and master Variable Recurring Payments. Our solution is built to deliver on four key promises:

- Seamless Integration Go live with VRPs, minus the complexity. We handle the intricate Open Banking integration, providing a single, developer-friendly solution that plugs directly into your current systems. You get a future-ready payment option, hassle-free.

- Significant Cost Savings Move beyond the high fees of conventional methods. Finexer’s VRP solution offers upto 90% lower transaction costs compared to cards or Direct Debits.

- Superior Customer Experience: Empower your customers with the new gold standard in payments. Finexer’s VRP solution lets them authorise and manage payment mandates directly within their own trusted banking app, offering unparalleled control and transparency that builds lasting loyalty.

- Future-Ready Payments Stay ahead of the curve in a changing landscape. We ensure your payment infrastructure remains compliant and up-to-date with the latest in financial technology and regulations.

Are you prepared to discover the advantages of VRPs? For a demo, get in touch with Finexer right now!