If you’re in charge of paying contractors, you already know how often identity verification slows things down. The payment is ready, but the contractor hasn’t submitted the right details.. The payment is ready, but the contractor hasn’t submitted the right details.

This is where most delays begin. The pre-payment verification step, or more specifically, the lack of a reliable way to do it, causes back-and-forth emails, manual checks, and unnecessary stress for your accounts payable team.

Whether you’re dealing with sole traders, freelancers, or limited companies, one thing is clear:

You can’t process the payment if you don’t have verified contractor identity and account information upfront.

This guide is built for UK finance professionals looking to improve their contractor payments process, avoid compliance risks, and simplify how they meet payment documentation requirements.

Onboarding Challenges in Finance

According to recent industry insights, 61% of UK finance leaders report that verifying vendor or contractor information remains one of the most common onboarding challenges they face. (Source)

Why Identity and Business Verification Matter Before Payment?

In the UK, Contractor verification isn’t about filling out a single government form. It’s a broader process that involves confirming a contractor’s identity, business type, and bank account ownership before making a payment.

- The contractor’s legal name

- Their business structure (e.g. sole trader, limited company)

- Their UK bank account ownership

- Sometimes, a Unique Taxpayer Reference (UTR) or National Insurance Number for internal or external reporting

You might not be legally required to store this data in every case, but if you’re paying large volumes of contractors or working in regulated sectors, it’s essential for maintaining proper contractor compliance.

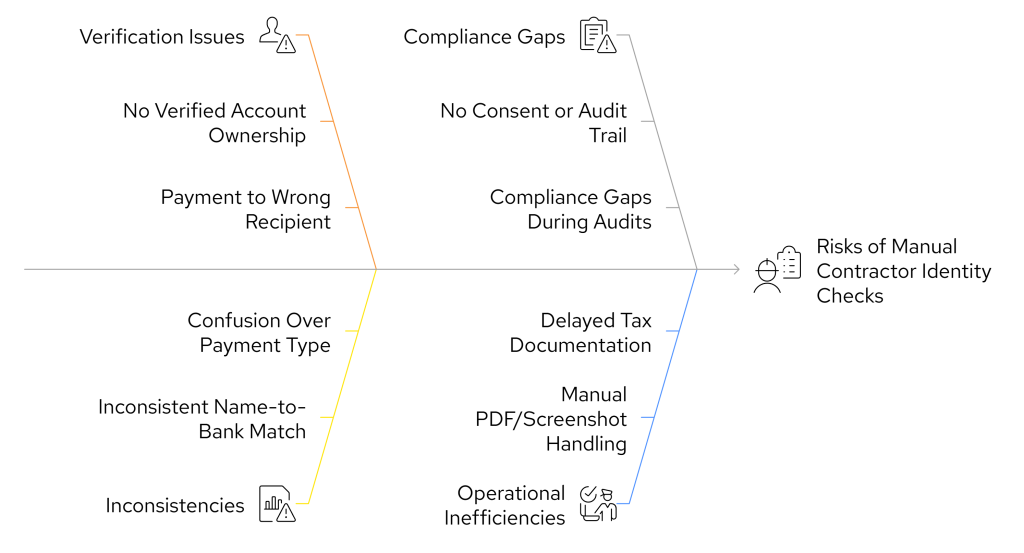

The Risks Behind Manual Contractor Identity Checks

When your process relies on PDFs, screenshots, and trust, it opens up your team to avoidable risks:

| Problem | What It Causes |

|---|---|

| No verified account ownership | Payments sent to the wrong person or wrong account |

| Inconsistent name matching | Confusion about whether you’re paying a business or an individual |

| No audit trail or consent | Gaps in compliance and poor documentation for HMRC or internal review |

| Time lost chasing information | Slower onboarding, strained relationships, and delayed contractor payments |

And the stakes only grow when you’re moving larger amounts of money.

Traditional Processes Aren’t Built for High-Value Contractor Payments

If you’re making regular payments to high-value consultants, law firms, subcontractors, or suppliers, the risk of error isn’t just an inconvenience — it’s a financial and reputational liability.

Manual collection methods may work for smaller, low-risk payouts. But once you’re dealing with regulated industries or large-sum payments, you need:

- Identity validation that’s verified at the source

- Real-time confirmation of bank account ownership

- Consent and compliance logs that stand up to scrutiny

- A faster way to meet your payment documentation requirements

This is where Finexer’s role becomes critical, not just for verifying identity, but for building a secure, compliant, and reliable contractor payments process from start to finish.

How VirtualSignature-ID Uses Finexer for High-Value Compliance

VirtualSignature-ID, a UK-based platform for legal and property professionals, needed to streamline identity verification and compliance during large property transactions. Their clients required:

- Proof of funds before executing deeds

- Instant identity validation

- Secure, compliant transfers to designated client accounts

- Automated AML and sanctions screening

With Finexer, VSID was able to:

- Pull bank-verified legal identity and account data in real time

- Validate client bank ownership before transferring funds

- Automate AML checks (PEPs, sanctions) without extra tools

- Disburse funds securely using payment initiation through Open Banking

This end-to-end process gave VSID’s clients the speed they needed to close transactions, and the compliance their regulators demanded, all without requiring users to upload a single document.

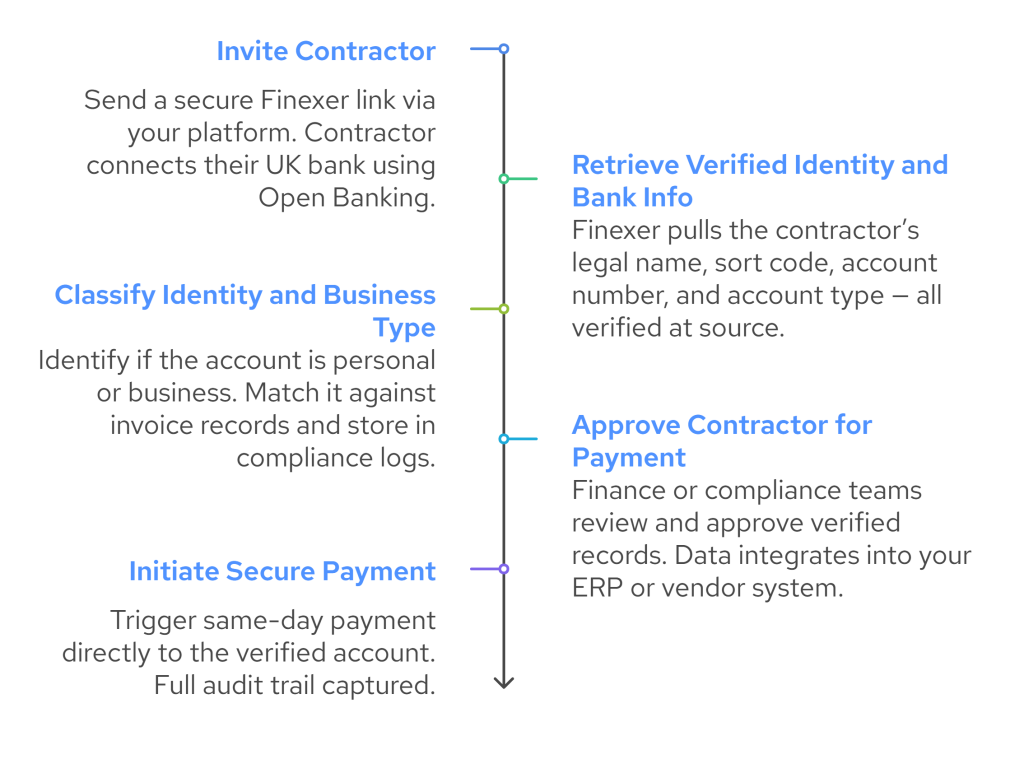

How to Use Finexer to Automate Contractor Onboarding and Payment Execution

If your current onboarding process involves email threads, PDF uploads, or manual entry of bank details, it’s not just slow, it’s fragile. With Finexer, you can replace all of that with a real-time, verified process that connects identity, account ownership, and payment in one secure flow.

Here’s how it works, step-by-step.

Step 1: Invite the Contractor to Connect Their UK Bank Account

Your system, whether it’s an internal onboarding form or a finance platform, generates a secure Finexer link. The contractor clicks the link and authenticates with their UK bank account using Open Banking.

✅ This takes less than a minute and works with 99% of UK banks.

Step 2: Finexer Retrieves Verified Identity and Account Information

Once the connection is authorised, Finexer automatically pulls:

- Full legal name of the account holder

- Sort code and account number

- Account type (e.g. personal, sole trader, or business account)

- Metadata useful for classification and risk flagging

This eliminates the need to collect identity documents, utility bills, or account screenshots — everything is verified at source.

Step 3: Identity and Business Classification (Where Applicable)

While UK banks don’t store UTRs or National Insurance Numbers, Finexer enables your team to:

- Confirm account ownership matches invoice records

- Identify business vs personal accounts for correct classification

- Store this as part of your contractor verification and compliance logs

You’ll be able to meet internal payment documentation requirements and prove due diligence without chasing paperwork.

Step 4: Approve the Contractor for Payment

With verified identity and bank details in place, your finance or compliance team can confidently approve the contractor. If needed, this data can also be passed into your ERP, accounting, or vendor management system.

✅ This reduces onboarding drop-offs and shortens your payment cycle significantly.

Step 5: Initiate the Payment Securely

If you’re ready to pay, Finexer also supports Payment Initiation Services, allowing you to:

- Trigger same-day payments directly to the contractor’s verified bank account

- Avoid card networks or manual transfers

- Keep a full audit trail of who authorised the payout, when, and for how much

✅ This completes the cycle from identity verification to payment execution, without leaving your system or switching tools.

What You Get in Return

| Benefit | Outcome |

|---|---|

| Faster contractor onboarding | Save time by verifying identity and account details in minutes rather than days |

| Stronger identity and bank verification | Reduce fraud risk and ensure you’re paying the correct contractor with verified bank data |

| Audit-ready consent and data logs | Easily meet your internal compliance checks and external HMRC reporting requirements |

| Automated payments | Trigger secure, real-time contractor payments directly from your onboarding system |

| Save up to 90% on transaction costs | Avoid card fees and intermediary charges with direct bank payments via Open Banking |

What is contractor identity verification in the UK?

It’s the process of confirming a contractor’s name, business type, and bank ownership before making payments.

Why verify contractor identity before payment?

It prevents fraud, ensures correct payments, and supports audit-ready records for compliance and internal checks.

How do I verify a contractor’s identity and bank details?

Use an Open Banking platform like Finexer to retrieve real-time, bank-verified identity and account data securely.

Book a quick demo to see how Finexer simplifies contractor verification and payments!