The UK’s business environment is rapidly shifting towards digital payments. Digital payments in the UK are no longer a strategic option but a fundamental necessity for survival and growth rather than a strategic choice. UK Finance forecasts that cash usage will continue to decrease, potentially falling to around 6% of all payments by 2033.

But there are difficulties in negotiating this unfamiliar terrain. Recent studies show late payments are estimated to cost the UK economy almost £11 billion per year. Over 1.5 million businesses, or 28% of businesses, are affected by late payments each year. This draws attention to important problems with conventional payment methods, such as complicated reconciliation, high administrative costs, and poor cash flow.

The purpose of this guide is to give businesses an understanding of the digital payments in the UK landscape. We will examine the different kinds of digital payments that are available, ranging from well-known techniques like card processing to the quick uptake of digital wallets and mobile payments in the UK. We’ll also explore the subtleties of bank transfers, the transformative potential of Open Banking, and Finexer’s Request to Pay, a superior solution that is revolutionising business-to-business transactions. Businesses exploring digital payments in the UK can benefit from faster settlements and reduced fees.

Comparison of Digital Payment Methods for B2B Transactions

| Payment Method | Cost | Speed | Security | Reconciliation | B2B Suitability |

|---|---|---|---|---|---|

| Card Payments | High (1.5–3.5%) | 2–3 days | Medium | Manual | Medium |

| Digital Wallets | Medium (1–2%) | Same day | High | Semi-automated | Low |

| Bank Transfers | Low–Medium | 1–3 days | Medium | Manual | High |

| Request to Pay | Lowest | Instant | Highest | Real-time | Highest |

An Overview of Popular Digital Payment Methods in the UK

Card payments

The most well-known method of digital payment is traditional card processing. Businesses normally require a merchant account and a payment gateway in order to securely handle transaction data in order to accept debit and credit cards. Customer trust and widespread acceptance are the foundations of this approach. But there are serious disadvantages to B2B transactions: high interchange and processing fees (typically 1.5–3.5%) reduce margins, the possibility of expensive chargebacks is constant, and settlement times of two to three days can have a detrimental effect on cash flow. Additionally, upholding PCI DSS compliance entails additional administrative and security accountability.

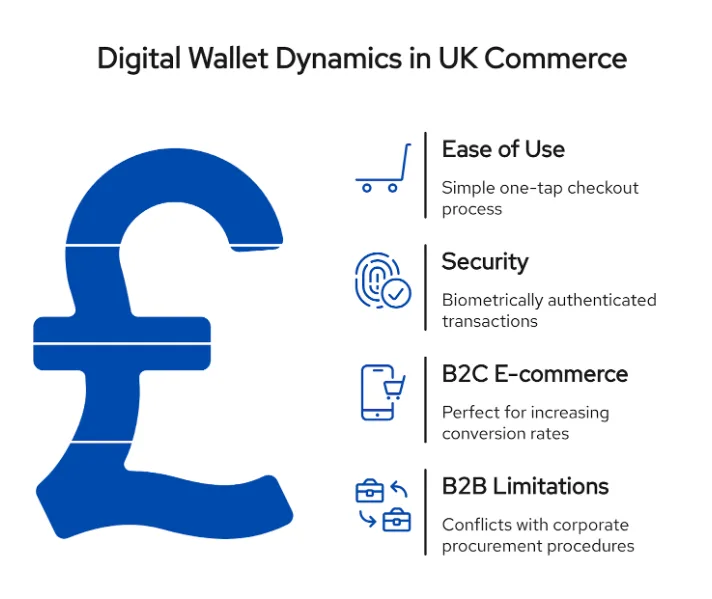

Digital wallets

The ease of use of digital wallets like Apple Pay, Google Pay, and Samsung Pay has fuelled the growth of mobile payment solutions. They are perfect for increasing conversion rates in B2C e-commerce because they provide a simple one-tap checkout process and safe, biometrically authenticated transactions. Despite being an important component of the UK’s contactless payments ecosystem, they have little use in business-to-business transactions. They are an awkward fit for business-to-business commerce because transactions are connected to individual customer cards and accounts, which conflicts with corporate procurement procedures and B2B invoicing.

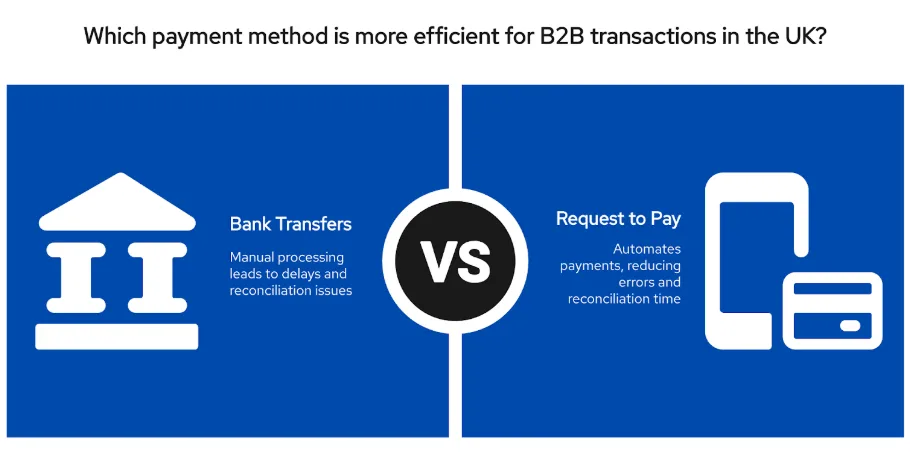

Bank transfers

The foundation of B2B transactions in the UK is bank transfers, which run on three main rails: Faster Payments (which allows for almost instantaneous transfers up to a certain limit), CHAPS (which allows for same-day, high-value transactions), and BACS (which allows for bulk payments and takes up to three days). Although they are safe and typically inexpensive, manual processing is their main flaw. Customers must start the payment process on their own, which frequently results in delays, erroneous payment amounts, or ambiguous payment references. Accounts teams have a serious reconciliation problem as a result, having to waste valuable time comparing payments to unpaid invoices.

Request to pay

Open banking enables licensed providers to make instant, secure payments directly from customers’ bank accounts using safe APIs, bypassing costly card networks. Strong Customer Authentication (SCA) improves security, and settlements happen instantly via Faster Payments with lower costs. Finexer’s Request to Pay leverages this to offer businesses instant A2A payments, real-time reconciliation, reduced fees, and seamless integration for a superior payment experience.

A messaging service called Request to Pay is built on top of the current payment system. It enables a company (the payee) to electronically request payment from a client (the payer). After receiving the request, the payer has the option to decline the payment, request more time, pay in full, or pay in part. It is incredibly well-suited for business-to-business (B2B) interactions because of its adaptability and straightforward communication.

What are the digital payments in the UK, and why are they important for UK businesses?

Any transaction that is conducted electronically without the use of actual cash is referred to as a digital payment. They are significant because digital payments increase efficiency, lower late payments, and improve customer experiences, and cash use is predicted to decline to just 9% by 2028.

Are digital wallets like Apple Pay suitable for B2B transactions?

No, B2C transactions are the primary purpose of digital wallets. Because they facilitate higher values, automation, and reconciliation, B2B payment methods such as bank transfers, Open Banking, and Request to Pay are better suited.

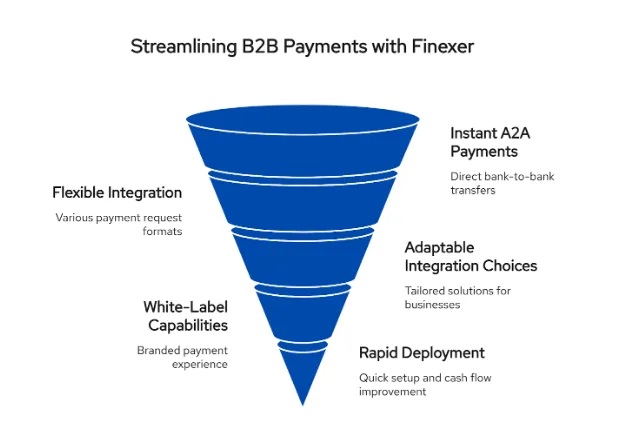

Finexer’s Request to Pay: A Superior B2B Choice

The purpose of Finexer’s Request to Pay solution is to assist UK companies in improving cash flow, streamlining business-to-business transactions, and accepting payments online. It also lowers administrative expenses and streamlines reconciliation by utilising the newest digital payment technologies available in the UK.

Here are some of its most notable attributes:

Instant Account-to-Account (A2A) Exchanges

Finexer facilitates safe, direct online payments from a customer’s bank account to your business account via Open Banking. These transactions do not experience the delays that come with traditional bank transfers or card payments.

Various Formats for Integration

The platform makes it simple for UK businesses to implement eCommerce payment solutions by providing a variety of payment request methods:

- Use messaging apps or email to send payment links.

- Create QR codes for online or in-person payments.

- For a flawless user experience, make use of in-app features.

- Businesses can better accommodate customer preferences thanks to this adaptability, which also increases conversion rates and reduces friction.

Adaptable Integration Choices

Whether you’re a small business or a large enterprise, Finexer provides integration flexibility to suit your needs:

- Dashboard interface: For teams without specialised IT staff, a straightforward, user-friendly dashboard makes it possible to manually create and monitor payment requests.

- API integration: To save time and cut down on errors, Finexer’s robust API automates invoices, payment reminders, and reconciliation for more complicated needs.

White-Label Capabilities

To establish a polished, branded experience that increases consumer confidence in your UK payment gateway, personalise the payment interface with your logo, colours, and messaging.

Rapid Deployment

Compared to traditional payment solutions, Finexer allows businesses to go live up to three times faster. A quicker deployment translates into immediate cash flow improvements, easier access to merchant account UK services, and the ability to begin accepting online payments in the UK.

Business Benefits of Finexer’s Request to Pay

The goal of Finexer’s solution is to give UK companies access to online payment options that boost productivity and profitability. Here are some advantages for your company.

- Immediate Settlement

- Reconciliation by Automated

- Cutting Expenses

- Increased Security

- Compliance with FCA Regulations

Are You Prepared to Change the Way You Pay or Get Paid?

Don’t allow expensive fees and delayed payments to hinder your company. You can streamline your cash flow, cut processing costs, and instantly accept payments online in the UK with Finexer’s Request to Pay.

Start now to discover how an Open Banking-powered solution that is fully FCA-regulated can help your company save time, reduce expenses, and improve security.

What do we derive from this guide?

In the UK, the move to digital payments is inevitable. Companies that use cutting-edge solutions like Finexer’s Request to Pay, mobile payments, and contactless payments benefit from quicker settlements, cheaper fees, and easier reconciliation. Adopting advanced digital payments solutions like Finexer ensures your business stays competitive. Businesses can maintain their competitiveness and provide consumers with easy, safe payment experiences by utilising Open Banking, digital wallets, and trustworthy merchant account UK services.

Regardless of your company’s size—startup, SMB, or enterprise—now is the ideal moment to implement a cutting-edge bill pay service and make sure your company is prepared for the UK’s eCommerce payment future.

Ready to transform your payment processes? Discover how Finexer’s Request to Pay can streamline your business transactions, reduce fees, and improve cash flow.

Which digital payment methods are best suited for UK businesses?

Payment options like bank transfers, Open Banking, and Finexer’s Request to Pay, which provide immediate settlements, reduced fees, and automated reconciliation, are most advantageous to UK businesses.

How does Finexer’s Request to Pay benefit UK businesses?

Instant account-to-account payments, fee reductions, reconciliation automation, and FCA-compliant security for business-to-business transactions are all provided by Finexer’s Request to Pay.

Secure your payments for the future now. Get in touch with our team today!