The FCA’s confirmation of commercial variable recurring payments has created a production-ready pathway for UK businesses to move beyond card and Direct Debit limitations. Commercial VRP is no longer experimental. Banks and payment providers can now design recurring payment products that compete directly with legacy methods. Businesses face a choice: prepare infrastructure now or watch competitors deliver better payment experiences.

Payment infrastructure decisions made today determine operational costs for years. The question is not whether commercial variable recurring payments will matter, but whether your business will be ready when customers expect it.

What Has the FCA Confirmation Actually Changed?

Regulatory approval for commercial variable recurring payments was granted by the FCA. This allows banks and open banking providers to build production-grade recurring payment products.

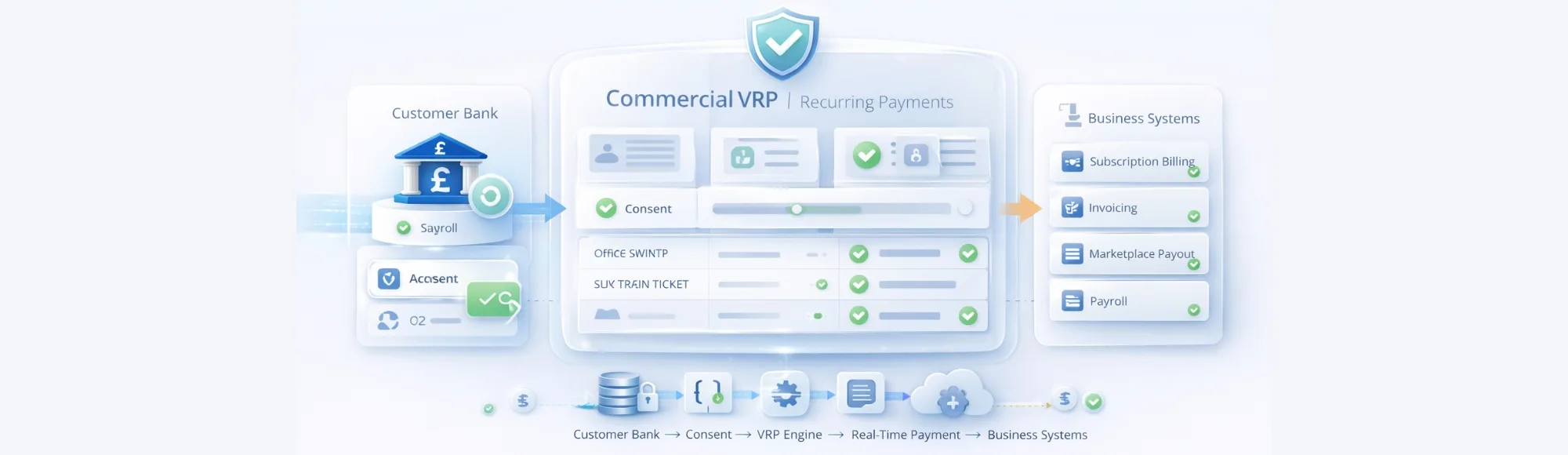

Previously, VRP functionality was limited to sweeping use cases. Now, subscription platforms, invoicing systems, and marketplaces can use commercial VRP for customer-initiated recurring transactions.

This FCA confirmation opens competitive pressure on traditional payment rails. Cards carry high failure rates and percentage-based fees. Direct Debit lacks flexibility for variable amounts and requires lengthy setup windows.

Commercial variable recurring payments address both problems through bank-to-bank transfers with customer-controlled consent. The technical capability now exists to replace cards in subscription billing. Learn more about variable recurring payments explained.

Which UK Businesses Should Care?

Commercial variable recurring payments impact any business model built on recurring payments:

- Subscription platforms: Reduced payment failure rates improve customer retention

- SaaS and marketplaces: Flexible billing for usage-based models

- Payroll and invoicing systems: Faster settlement with lower transaction costs

- Utilities and telecom: Variable amount support for consumption-based billing

- Property platforms: Automated rent collection with real-time reconciliation

VRP payments remove friction points that cards and Direct Debit create. Consent is granted once by the customer. Variable amounts are processed within agreed parameters. Settlement happens in seconds rather than days.

Why Delaying Adoption Creates Risk

Payment infrastructure decisions compound over time. Businesses locked into card-based recurring billing pay higher transaction costs on every payment. These costs scale with revenue.

Competitors launching vrp payments gain several advantages. Lower customer acquisition costs improve conversion rates. Transaction costs drop significantly when card network fees are removed. Real-time settlement replaces multi-day processing windows.

Markets where open banking payments uk adoption increases rapidly will see consumer expectations shift. Customers accustomed to instant bank transfers will view card-based checkout as outdated.

What Must Be Prepared Internally?

Implementing commercial variable recurring payments requires changes across payment operations:

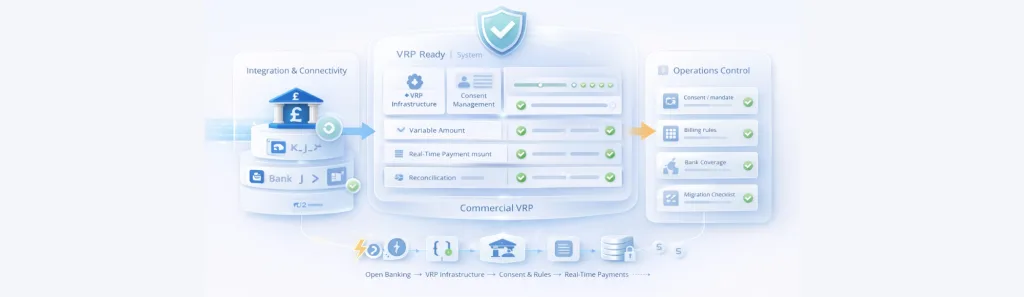

VRP-capable payment infrastructure must be integrated with existing systems. This includes connecting to open banking providers. Consent management needs implementing. Real-time payment status updates require handling.

Consent and mandate management becomes central to operations. Customers grant permission for payments within specific parameters. Systems must track consent status and handle modifications.

Variable amount controls require logic that cards don’t need. Billing systems must calculate amounts and verify they fall within limits. Explore Finexer’s VRP API for technical implementation.

Real-time reconciliation changes finance operations. Card payments settle in batches over days. Commercial VRP payments complete individually in seconds.

Bank coverage affects which customers can use VRP. Providers must connect to the banks customers actually use. Partial coverage creates operational problems.

Migration paths need planning. Customer communication takes time. System testing is essential. The transition from cards to vrp payments affects customer experience. Read the 101 guide to variable recurring payments for comprehensive guidance.

Use Case: How B2B Platforms Benefit

B2B platforms handling supplier payments gain speed with commercial variable recurring payments. Traditional bank transfers require manual initiation and reconciliation.

VRP payments automate the entire flow whilst maintaining the cost profile of bank transfers rather than card interchange fees. Usage-based billing models benefit from flexible amount handling. Direct Debit requires pre-notification for variable amounts.

Open banking payments uk process variable amounts within consent parameters without additional friction.

Where Finexer Fits Your VRP Strategy

Payment infrastructure decisions require providers that understand UK regulatory requirements. Finexer provides commercial variable recurring payments capabilities alongside account information services in a single platform.

99% UK bank coverage removes the risk that customer banks are unsupported. Coverage includes high street banks, digital challengers, and business banking platforms.

Faster deployment matters when payment costs affect margins today. Finexer deploys 2-3 times faster than market alternatives. Businesses receive 3-5 weeks of dedicated onboarding support.

Usage-based pricing aligns with actual transaction volumes. No fixed monthly fees create overhead for businesses with seasonal payment patterns.

White-label capabilities maintain consistent branding through the payment journey. This improves trust and completion rates.

UK-only focus ensures regulatory compliance. FCA authorisation is included. Secure customer authentication is built in. Migration support helps businesses transition from legacy payment providers.

The platform works with variable recurring payments api connectivity. Systems connect through one provider rather than managing multiple relationships. Saves up to 90% on transaction costs compared to card payments.

What is the difference between sweeping VRP and commercial VRP?

Sweeping VRP allows transfers between accounts owned by the same person, whilst commercial VRP enables recurring payments between different parties.

Do businesses need FCA authorisation to use commercial VRP?

No, businesses use authorised payment providers like Finexer that hold regulatory permissions.

How quickly can commercial VRP be integrated?

Businesses using Finexer deploy 2-3 times faster than alternatives, with 3-5 weeks of onboarding support.

Can commercial VRP handle refunds?

Yes, refunds are processed as standard bank transfers with full tracking and confirmation.

What happens if payment amounts exceed consent parameters?

Payments outside agreed parameters are automatically declined, protecting both businesses and customers.

Get Started with Commercial Variable Recurring Payments

Build compliant recurring payment infrastructure that scales UK-regulated open banking solutions with 99% bank coverage and faster deployment

Book Demo Now