Imagine this: it’s nearly midnight, and you suddenly need to send money to a friend. Not long ago, that would have meant waiting until the next business day for the payment to clear. Today, a few taps on your phone are enough to send funds instantly — no queues, no delays, and no card networks in the middle with instant P2P money transfer.

This is no small shift. The real-time payments network processed 266.2 billion transactions globally in 2023, a 42.2 percent year-on-year increase, as faster payment rails become the backbone of peer-to-peer transfers. The total value of instant payments is expected to grow from $22 trillion in 2024 to $58 trillion by 2028, highlighting how rapidly real-time transactions are replacing traditional methods worldwide.

At the centre of this change is instant Peer-to-peer money transfer, the ability to send and receive funds in seconds through your bank or an instant money transfer app. Whether it’s paying a friend, reimbursing a colleague, or moving money internationally, users now expect transactions to be as immediate as sending a message.

This blog breaks down how instant P2P transfers work, the technologies powering them, the benefits and limitations, and the top apps leading the charge in 2025.

Definition and Background of P2P Payments

An instant P2P money transfer refers to moving funds directly between individuals or businesses without relying on cash, cheques, or card networks. Peer-to-peer money transfer has existed for years, but the methods have shifted from slow bank processes to real-time systems.

Earlier online transfers often took hours or days to clear. The arrival of real-time payment infrastructure and Open Banking regulations enabled instant bank transfer capabilities that work round the clock. With mobile adoption, users can now send funds through an instant money transfer app almost as quickly as sending a message.

Today, instant P2P money transfer is a core part of everyday transactions, supporting personal payments, business settlements, and everything in between.

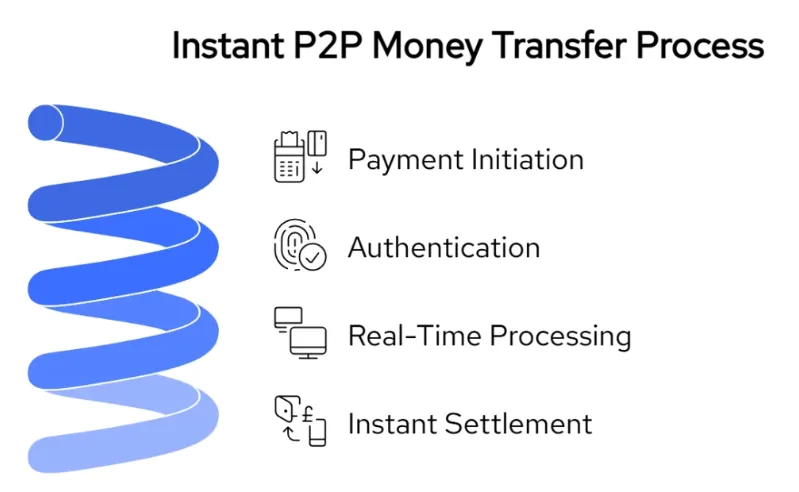

How Instant P2P Transfers Work

An instant P2P money transfer moves funds between two accounts in real time by connecting banks, payment networks, and authentication systems in a single flow.

1. Payment Initiation

The sender starts the transfer through their banking portal or an instant money transfer app. This step involves entering the recipient’s details and confirming the amount.

2. Authentication

Banks verify the sender’s identity using secure methods such as PINs, biometrics, or strong customer authentication (SCA). This prevents unauthorised transactions during a peer-to-peer money transfer.

3. Real-Time Processing

Once authenticated, the transaction is routed through real-time payment rails like the UK Faster Payments system. Unlike traditional transfers that settle in batches, instant bank transfer systems process each payment individually, allowing funds to arrive within seconds.

4. Instant Settlement

Both sender and recipient receive confirmation as soon as the transaction clears. The funds are immediately available in the recipient’s account, completing the instant P2P money transfer within moments.

Compared to older methods, this approach eliminates delays and provides immediate visibility of payment status, making it ideal for personal payments, small businesses, and on-demand transactions.

Popular P2P Transfer Methods

There are several ways to complete an instant P2P money transfer, each designed to make sending and receiving funds quick and convenient. The most common options are bank-to-bank transfers, mobile apps, and social payment platforms.

1. Bank-to-Bank Transfers

Many people prefer using their existing banking apps to send money directly. These transfers rely on real-time payment networks such as Faster Payments in the UK, allowing funds to arrive in seconds. This method suits those who want a familiar, bank-based experience.

2. Mobile Apps

The rise of the instant money transfer app has opened up faster payments to a wider audience. Apps like PayPal, Revolut, and Cash App allow users to transfer money with just a phone number or email, making peer-to-peer payments simple and fast.

3. Social Payment Platforms

Some messaging and social platforms now offer built-in payment features. Meta Pay and WeChat Pay are examples, enabling users to send funds while chatting. While adoption varies by region, they add another way to send money without switching apps.

Each of these methods serves different user preferences, but all contribute to the rapid growth of real-time peer-to-peer payments worldwide.

Benefits and Limitations

An instant P2P money transfer offers clear advantages, but there are also a few factors to keep in mind depending on the method and provider.

Benefits

- Speed

Funds typically arrive within seconds, making real-time payments ideal for personal transfers, urgent transactions, and business settlements. - Convenience

People can send money directly from their bank or through an instant money transfer app, often using just a phone number, email, or account detail. - Cost

Many peer-to-peer payment options have lower fees compared to card networks or international wire transfers.

Limitations

- Transaction Limits

Banks and apps often set caps on daily or monthly transfers, which can affect higher-value payments. - Geographic Coverage

Not all methods work across every region or currency, especially when sending money abroad. - Security Risks

Because transactions happen quickly, errors or fraudulent activity may be harder to reverse compared to slower payment methods.

While these factors vary by platform, the combination of speed, lower costs, and ease of use has made peer-to-peer payments a trusted option for day-to-day transfers.

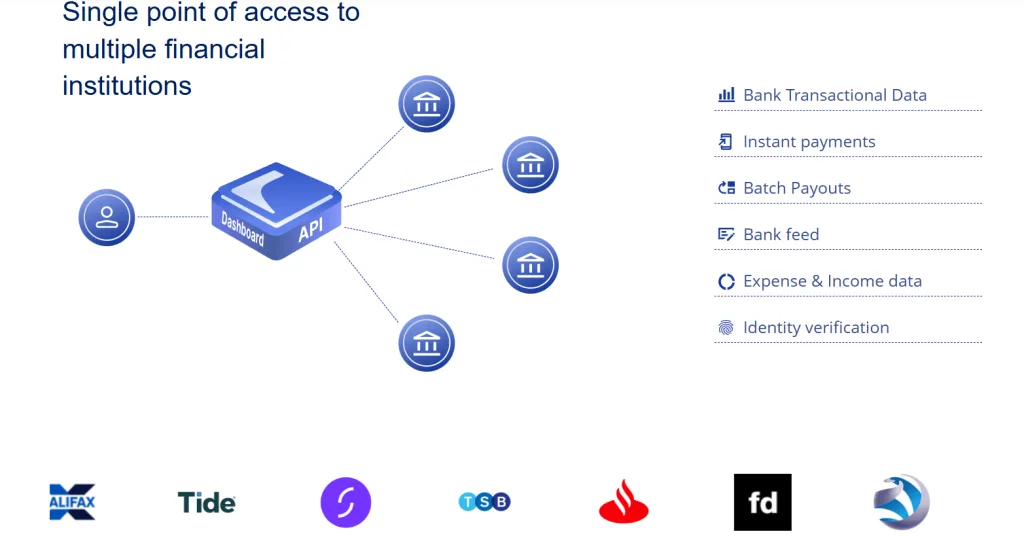

Build Peer-to-Peer Payment Platforms with Finexer’s Payment Initiation API

If you’re a business looking to power instant transfers between users in the UK, Finexer’s Payment Initiation API gives you the core infrastructure to do it without needing to become a regulated payment institution or build banking connections yourself.

Using Finexer, you can create peer-to-peer payment platforms, internal payout systems, or add real-time transfer features to your existing products. The API works on top of the UK’s Open Banking framework and Faster Payments network, making it ideal for marketplaces, fintech apps, accounting tools, property platforms, and other services that move money between users.

How Businesses Can Use the API

- Collect Recipient Details

Your platform gathers and stores the recipient’s sort code and account number. Optional name-checking (Confirmation of Payee) can be added to reduce errors. - Initiate Payments from the Sender’s Bank

Your system calls Finexer’s Payment Initiation endpoint with the recipient details, amount, and reference. Finexer returns a redirect URL for the sender’s bank authentication. - Authenticate and Transfer

The sender completes Strong Customer Authentication with their bank. The payment then moves directly through Faster Payments, usually within seconds. - Get Instant Status via Webhooks

Finexer notifies your system once the payment completes, allowing you to update balances, display confirmations, or trigger follow-up actions.

Why This Works for Businesses

- Regulated infrastructure – Finexer is FCA-authorised, so you don’t need separate licensing to initiate payments.

- No card fees or wallet float – funds move directly between user bank accounts.

- Real-time settlement – ideal for UK domestic transfers covers 99% of the UK Banks

- Flexible integration – works for P2P platforms, marketplaces, financial apps, or internal disbursement tools.

- No setup fees + onboarding support – get started quickly with 3–5 weeks of hands-on guidance.

By integrating Finexer’s API, businesses can launch peer-to-peer payment functionality without building complex banking rails turning what used to take months into a matter of weeks.

How secure is peer-to-peer money transfer compared to traditional banking methods?

Peer-to-peer money transfer uses the same banking rails and authentication standards as traditional banks. Through regulated Open Banking APIs, each payment is authorised directly by the user via their bank, with Strong Customer Authentication. This removes the need for card storage and reduces third-party risk.

What is peer-to-peer money transfer?

Peer-to-peer money transfer is the direct movement of funds between two bank accounts without using cards or cash. Payments are made through real-time banking networks, typically reaching the recipient within seconds. It’s commonly used for personal transfers, bill splitting, payouts, and business transactions.

How does peer-to-peer money transfer work?

The sender initiates a payment through their bank or a connected service. After authentication, the payment is sent through real-time networks like Faster Payments in the UK. Funds usually settle within seconds, and both parties receive instant confirmation of the completed transfer.

Which platform is primarily used for peer-to-peer money transfer in digital banking?

This varies by region. In the UK, most digital banking platforms rely on Faster Payments combined with Open Banking APIs to support direct transfers. Finexer’s infrastructure allows businesses to integrate this capability into their own platforms without building their own banking connections.

Launch instant bank transfers in your workflow. Book a demo and use Finexer’s API with no setup cost!