Legal workflows are often slowed down by a single recurring issue: accessing reliable financial data. From onboarding new clients to verifying the origin of funds, many firms still rely on outdated processes like emailed bank statements or manual document checks.

Open Banking for law firms changes that. It allows legal teams to securely access a client’s bank-verified data in real time, with their consent, directly from the source. This not only reduces paperwork and back-and-forth but also improves compliance outcomes by delivering clean, timestamped records ready for audit.

In fast-moving cases like property purchases, divorce settlements, or mis-selling claims, waiting days for financial documents can create bottlenecks. Open Banking removes these delays and gives lawyers what they need up front: real-time bank data, verified account ownership, and a clear financial trail.

Legal workflows often stall over financial data access: only 22% of firms inspected by the SRA were fully AML compliant in 2023–24, while 23% were outright non-compliant, often due to missing KYC or source of funds checks. Open Banking gives law firms a real-time, bank-verified solution to avoid these common failures.

This guide walks through eight key use cases where Open Banking is already making a measurable impact across the legal sector, helping firms onboard faster, meet regulatory demands, and reduce admin overhead.

Keep Reading or Jump to the section you’re looking for:

Open Banking Use Cases for Law Firms

| Use Case | Use Case Type | What It Solves | Key Benefit for Law Firms |

|---|---|---|---|

| KYC Verification | Onboarding / Identity | Verifies client identity via bank data (name, address, ownership) | Reduces friction and speeds up client intake |

| Source of Funds (Conveyancing) | Property / AML | Confirms origin of deposits used in purchases or transfers | Speeds up AML checks for property deals |

| Divorce & Family Law | Disclosure / Litigation | Collects financial history to support settlement and asset division | Improves disclosure accuracy and reduces disputes |

| Mis-Selling & Lending Claims | Litigation / Claims | Identifies unauthorised charges or loan issues through verified history | Strengthens evidence for client legal claims |

| AML & Due Diligence | Ongoing Compliance | Enables monitoring of high-risk or ongoing client accounts | Reduces manual review effort and flags financial anomalies |

| Corporate Risk Assessment | Commercial Law / Risk | Assesses directors’ or clients’ financial health pre-engagement | Improves risk decisions in commercial and corporate matters |

| Insolvency Casework | Insolvency / Eligibility | Collects full transaction records for DRO/IVA/bankruptcy assessment | Cuts case prep time and supports formal compliance submissions |

| High-Value Transaction Reviews | Property / EDD | Investigates large or suspicious payments across client accounts | Adds deeper AML coverage for high-risk property or trust cases |

1. Accelerating KYC Checks with Bank-Verified Identity

Problem

Know Your Customer (KYC) checks are mandatory before a law firm can act for a new client. But gathering ID documents, proof of address, and verifying ownership details often leads to delays, especially when clients send incomplete or outdated files.

Client Scenario

A private client team requests documents from a new commercial client. They receive a passport scan but no utility bill. After multiple follow-ups, the file sits in limbo for five days, delaying engagement and increasing onboarding admin for the firm.

How Open Banking Helps Law Firms Verify KYC

With Open Banking, identity verification becomes part of a secure, real-time process. Once a client gives consent, the firm can retrieve the account holder’s full name, address, and bank-confirmed identity, eliminating the need for manual document uploads.

This approach allows law firms to meet regulatory requirements without creating friction at the very first step of the client relationship.

Benefits for Solicitors

- Verified identity and address pulled directly from the client’s bank

- Less back-and-forth with clients over missing or expired documents

- Reduced onboarding time and higher completion rates

- Stronger data trail for KYC audit readiness

Why This Matters

Delays at the KYC stage can set the tone for the entire matter. Open Banking gives law firms a faster way to verify clients with data they already trust, improving compliance and client satisfaction from the start.

2. Tracing the Source of Funds in Property Transactions

Problem

When clients can’t clearly show where their deposit came from, property transactions get delayed or flagged for AML review. Relying on screenshots, PDFs, or partial statements makes it harder for solicitors to meet compliance requirements confidently.

Client Scenario

A conveyancer handling a £320,000 residential purchase needs to confirm that the deposit is not a gift or third-party loan. The buyer sends screenshots from two different accounts, but they’re missing context and dates. The file is escalated, and the exchange is delayed by two weeks.

How Law Firms Use Open Banking for Funds Validation

Open Banking enables firms to access verified transaction data directly from the client’s bank. The solicitor sees the incoming deposit, its origin, and account ownership, all categorised and timestamped. The process is completed in minutes, with no uploads or file chasing.

This gives firms the confidence to complete AML checks and move transactions forward without compliance uncertainty.

Benefits for Conveyancers

- Clear audit trail showing deposit source and transaction history

- Fewer delays caused by incomplete financial records

- Quicker exchange and reduced admin for the conveyancing team

- Stronger protection in case of AML review or complaint

Why This Matters

In property law, timing is everything. Open Banking helps law firms verify critical financial information faster, ensuring deals aren’t held up by documentation issues. Open banking can cut KYC costs by reducing time for non-billable tasks.

3. Uncovering Full Financial History in Divorce Cases

Problem

When divorcing clients are required to disclose income, spending, and assets, the process often breaks down. Documents are missing. Spreadsheets are outdated. One party may even delay cooperation, leading to stalled negotiations or court action.

Client Scenario

A family law solicitor requests three years of bank statements to assess assets and income before mediation. The client provides incomplete PDFs across multiple accounts. The team spends days reviewing them, and the hearing date is at risk.

How Open Banking Improves Family Law Disclosure

With Open Banking, solicitors can access categorised, real-time bank data across all client accounts, with consent and without delay. Transactions are automatically pulled and timestamped, making it easier to verify regular income, hidden liabilities, or irregular transfers.

The process also removes bias: instead of relying on selective evidence from either party, the data provides a full financial picture that’s difficult to manipulate.

Benefits for Family Law Firms

- More accurate disclosure in divorce and financial remedy cases

- Faster access to transaction history across joint and personal accounts

- Fewer disputes over hidden income or undisclosed spending

- Reduced preparation time for court or mediation

Why This Matters

In emotionally charged disputes, law firms need tools that help both parties move forward. Open Banking removes administrative delays and brings clarity to family law, making it easier to focus on resolution, not reconciliation of paperwork.

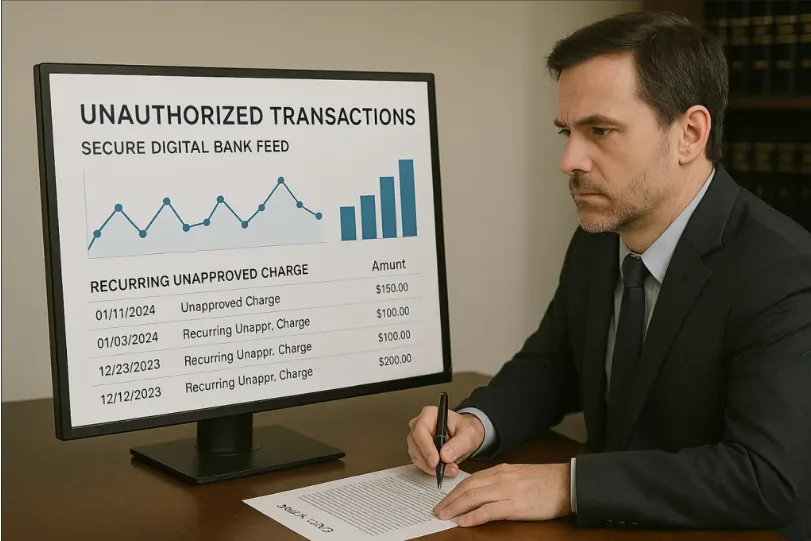

4. Building Stronger Mis-Selling & Lending Claims

Problem

In financial mis-selling or unauthorised lending cases, lawyers often need to prove that harm occurred, but clients rarely have the full record. Paper statements are missing. Key charges are overlooked. Without solid evidence, cases stall or collapse.

Client Scenario

A client claims they were repeatedly charged for a service they never authorised. The legal team requests statements across multiple accounts and time periods. Weeks pass, and the client can’t locate the documents. Progress halts, deadlines loom, and the firm risks under-serving the case.

Using Bank Data to Prove Financial Misconduct

Using Open Banking, law firms can access verified, time-stamped transaction data directly from the client’s bank, with consent. They can review recurring payments, identify lending patterns, and flag unusual activity like payday loans, overdraft spirals, or unapproved debits.

Instead of relying on client memory or partial PDFs, lawyers work with real-time bank data to build a stronger, defensible claim file.

Benefits for Litigation Teams

- Reliable financial evidence to support consumer protection and refund claims

- Faster discovery of recurring fees, overcharges, or unapproved lending activity

- Strengthens timelines and documentation for legal proceedings

- Reduces manual review and improves case file accuracy

Why This Matters

Legal claims often hinge on proving what actually happened. Open Banking gives law firms a direct line to the evidence, without depending on the client to find it. For mis-selling and lending disputes, that can mean the difference between compensation and a lost case.

5. Automating AML and Due Diligence Checks for Law Firms

Problem

AML compliance doesn’t end after onboarding. Law firms handling ongoing matters, high-risk clients, or politically exposed persons (PEPs) must continue to assess financial behaviour over time. But repeated document requests are slow, and clients rarely update their data voluntarily.

Client Scenario

A firm represents a client involved in multiple international transactions. An initial KYC check was done, but three months later, the compliance officer must re-verify their activity. Chasing new bank statements delays the case and introduces regulatory risk.

How Real-Time Access Simplifies AML Monitoring

Open Banking enables law firms to perform updated financial checks by accessing real-time bank data, with renewed consent from the client. Instead of requesting files manually, teams can review recent account activity, monitor for unusual transactions, and log all access for audit.

This supports ongoing due diligence in high-risk cases without burdening either the firm or the client.

Benefits for Compliance Teams

- Continuous visibility into high-risk client financial activity

- Reduced reliance on outdated documents or follow-up requests

- Improved internal controls and documentation for AML audits

- Less admin burden for compliance teams

Why This Matters

AML obligations evolve as cases progress. Open Banking allows law firms to meet those requirements without disruption, ensuring that compliance is not just a one-time event, but a maintained standard.

6. Enhancing Corporate Risk Assessment with Open Banking

Problem

When taking on corporate clients, law firms often rely on declarations, Companies House records, or outdated financial statements. But these documents rarely reveal the real-time financial health of a company or its directors, creating hidden exposure for the firm.

Client Scenario

A commercial law team is advising a client on a shareholder agreement. One director claims stable finances, but when a dispute arises, it becomes clear they’ve had repeated cash flow issues. No one verified their actual account data during the onboarding process.

How Firms Use Bank Data to Vet Corporate Clients

With client consent, law firms can use Open Banking to retrieve recent bank data for individuals or entities involved in commercial transactions. This allows the team to verify income, liquidity, and spending behaviour, giving a clearer view of risk before engagement.

For director vetting, cross-border partnerships, or investment structuring, real-time insights reduce the risk of onboarding financially unstable or misrepresented parties.

Benefits for Commercial Law Practitioner

- Better visibility into client financial standing before accepting instructions

- Faster risk assessments without waiting for uploaded statements

- Stronger basis for advising on agreements, guarantees, or structuring

- Improved file documentation for internal compliance teams

Why This Matters

In commercial law, overlooked financial risk can turn into costly disputes. Open Banking equips law firms with data-backed insights that support better decision-making from day one.

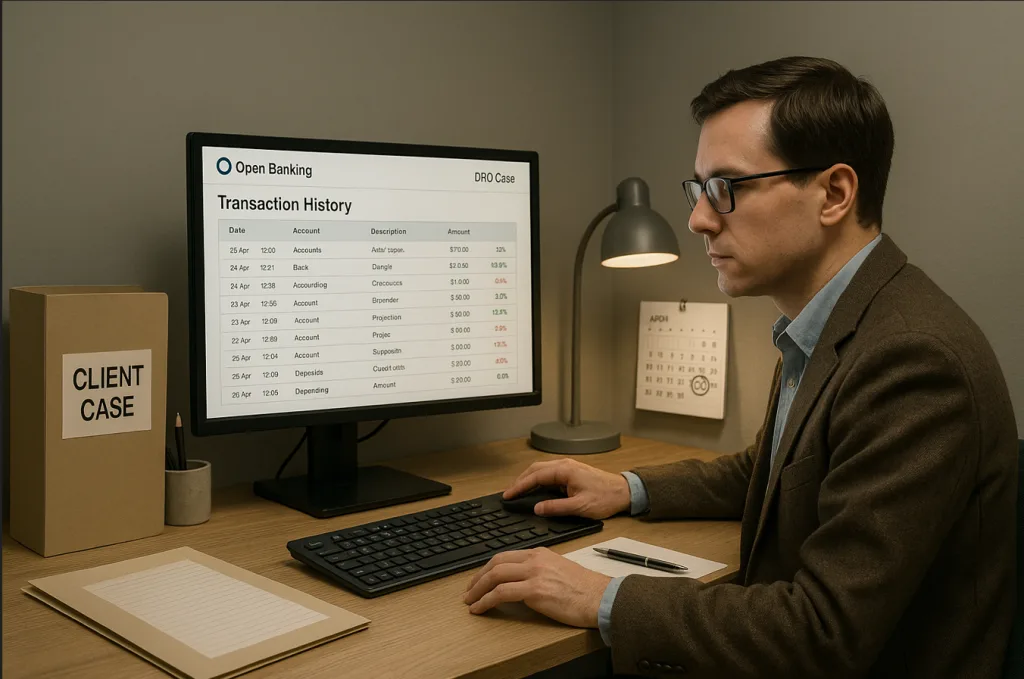

7. Streamlining Insolvency Case Preparation

Problem

In insolvency cases, gathering months of bank statements across multiple accounts is often the most time-consuming part of preparing an IVA, DRO, or bankruptcy application. Clients may not know how to retrieve their records, or may delay sending them, putting deadlines at risk.

Client Scenario

An insolvency solicitor needs three months of account activity to determine whether a client qualifies for a DRO. The client struggles to access online banking and sends partial screenshots over several days. The firm misses the target filing window, and the case is postponed.

How Open Banking Aids Insolvency Practitioners

With Open Banking, the client simply authenticates through their banking app. The firm immediately receives categorised, timestamped transaction data across all linked accounts. This allows practitioners to assess eligibility, build evidence for the Insolvency Service, and complete filings with confidence.

The process requires no manual uploads, no passwords, and no follow-up calls, saving days of work.

Benefits for Insolvency Solicitors

- Full bank history collected in minutes, not days

- Instant eligibility checks for DROs, IVAs, or bankruptcy filings

- More accurate case preparation and fewer document gaps

- Faster turnaround for client relief and regulatory submission

Why This Matters

Insolvency work is deadline-driven. Open Banking removes the delays that often stall or derail cases, giving firms the information they need to act quickly, support clients effectively, and meet their legal obligations with confidence.

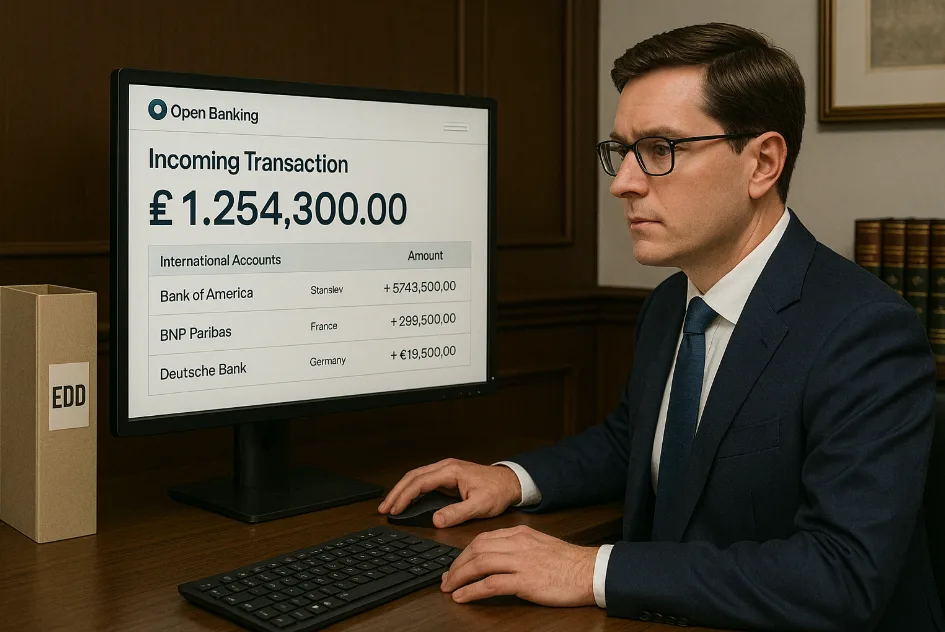

8. Handling High-Value Transactions with EDD Precision

Problem

Large or irregular transactions often trigger enhanced due diligence (EDD) requirements under AML regulations. But law firms rarely have a streamlined way to investigate these payments beyond requesting static bank statements, which can be redacted, incomplete, or difficult to analyse quickly.

Client Scenario

A property law firm is handling the purchase of a £1.2 million commercial unit. The buyer provides a lump-sum deposit, but the source is unclear and appears to involve multiple offshore accounts. Manual review delays exchange, and the transaction is flagged for regulatory reporting.

Using Open Banking for Enhanced Due Diligence

Open Banking allows the firm to request real-time access to the client’s accounts with consent. The legal team can trace large incoming funds, monitor unusual patterns, and verify the account holder, all within a secure, regulated framework.

The data is categorised and timestamped, making it easier to document and explain the transaction flow in case of audit or escalation.

Benefits for Property & Trust Law

- Rapid review of high-value transactions without manual reconciliation

- Better visibility into layered or offshore payments

- Stronger compliance for EDD and AML audit purposes

- Faster case progression in property, M&A, or trust matters

Why This Matters

When the transaction size increases, so does the scrutiny. Open Banking gives law firms a clear, auditable view of how funds entered the picture, reducing regulatory exposure and giving clients a smoother path to completion.

How Finexer Makes Open Banking Affordable for Law Firms

Finexer gives law firms a faster, more compliant way to access verified financial data without the high integration costs or long onboarding delays common with enterprise-grade providers. Whether you’re verifying the source of funds in a conveyancing case or collecting financial records for ongoing due diligence, Finexer provides a secure, consent-driven flow backed by full UK bank coverage.

Unlike platforms built for developers alone, Finexer offers both an API and a ready-to-use web dashboard, allowing solicitors and compliance staff to run checks without writing a single line of code. Clients authenticate directly through their banking app, and the data returned is categorised, timestamped, and exportable for audit.

What sets Finexer apart is its transparent pricing model. There are no upfront platform fees or fixed-term contracts. Law firms pay only when a check is completed, making it easier to scale Open Banking into daily workflows without worrying about unused licences or minimum commitments.

For firms handling high volumes of KYC, AML, or source of funds checks, Finexer offers usage-based pricing that keeps costs predictable and compliance on track.

Success Story

“Our clients in the legal and accountancy sectors expect the highest standards of efficiency and security, and Finexer’s solutions help us deliver on those expectations every day,” said David Kern, CEO of VirtualSignature-ID.

A recent partnership with VirtualSignature-ID (VSID) highlights how law firms can benefit from Finexer’s Open Banking capabilities in practice. By using Finexer’s pre-built, FCA-compliant software, VSID reduced operational costs and simplified its client verification workflows, cutting down processing time while maintaining high compliance standards.

The result was not just internal efficiency, but stronger delivery to end clients. With faster onboarding and access to real-time financial data, VSID was able to support legal and accounting professionals with the speed and accuracy they expect.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowIs Open Banking legal for law firms to use?

Yes. Open Banking is regulated under UK law. With client consent, law firms can use it to access financial data while staying compliant with SRA, AML, and GDPR standards.

Do clients need to share passwords or login credentials?

No. Clients approve access through their bank app using a secure redirect; they never share credentials with the law firm or with Finexer.

Can bank data replace traditional KYC documents?

In most cases, yes. Law firms can verify identity, account ownership, and source of funds using real-time bank data instead of relying on PDFs or utility bills.

Finexer gives law firms secure, real-time access to bank-verified data. No paperwork. No delays. Test our software now!