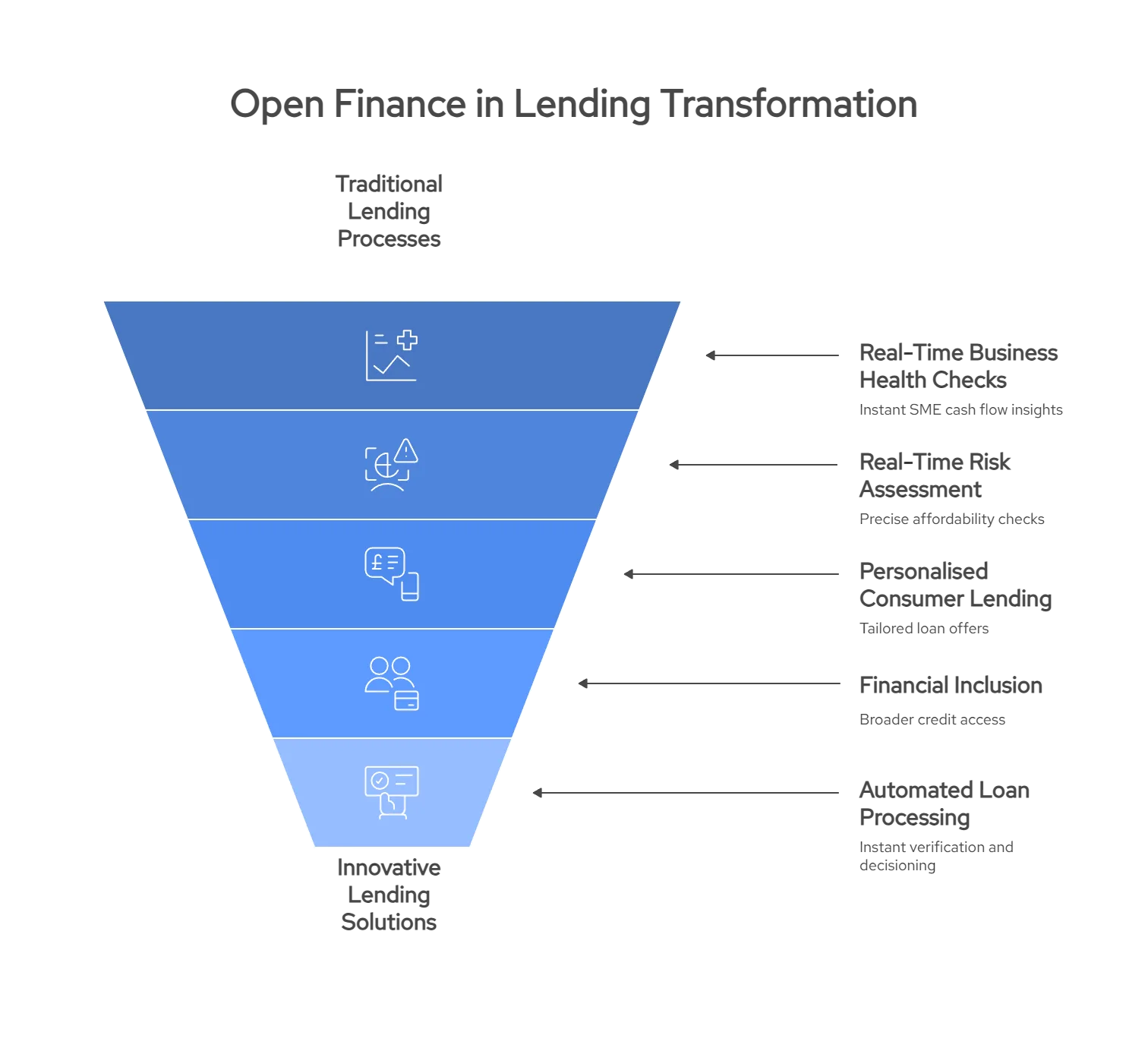

In the UK, lenders are under increasing pressure to make faster, fairer, and more accurate credit decisions. Traditional lending processes, reliant on static documents and historic credit reports, often fail to reflect a borrower’s current financial reality. Open finance in lending changes this by enabling secure, consent-driven access to a borrower’s complete financial picture covering bank accounts, savings, investments, pensions, and liabilities, all in real time.

The Financial Conduct Authority’s Open Finance Sprint 2025 brought together over 110 industry, technology, and regulatory stakeholders to explore how data-sharing could improve financial wellbeing, resilience, growth, and digital identity verification (FCA Open Finance Sprint Outcomes Report 2025). Participants highlighted key priorities for adoption, including standardised data formats, strong API security, and transparent consent mechanisms, alongside a framework that supports innovation while safeguarding consumers.

For lenders, the implications are clear: open finance can streamline loan origination, improve risk assessment, expand access for underserved borrowers, and enable more personalised credit products. In this guide, we’ll explore five UK-specific use cases where open finance is already transforming lending.

1. SME Lending: Real-Time Business Health Checks

For many UK small and medium-sized enterprises (SMEs), securing funding quickly can be the difference between capitalising on a growth opportunity and missing it entirely. Traditional SME lending often relies on outdated financial statements, manual bank statement uploads, or partial business records, which can slow down approval times and limit access to credit.

With open finance in lending, SME lenders can access live, consented financial data directly from a business’s bank accounts, payment processors, and accounting platforms. This enables them to assess real-time cash flow, recurring revenue patterns, outstanding liabilities, and seasonal fluctuations, providing a more accurate picture of financial health than static reports.

According to the FCA’s Open Finance Sprint 2025, one of the most promising opportunities in open finance is reducing friction in SME funding through instant data sharing and verification. This not only speeds up decision-making but also helps lenders serve SMEs with limited credit history, improving access to affordable finance.

For lenders, the payoff is clear: more informed risk assessments, faster loan origination, and the ability to offer tailored credit terms that reflect the business’s actual performance.

📚 Guide to 6 Alternative Credit Scoring Methods

2. Real-Time Risk Assessment & Credit Scoring

Accurate credit risk assessment is at the heart of responsible lending. Traditional scoring models often rely heavily on historical credit bureau data, which may overlook recent changes in a borrower’s financial situation. This can lead to risk miscalculations, either approving loans for applicants whose financial health has declined or rejecting creditworthy borrowers with limited traditional credit history.

Open finance in lending allows lenders to go beyond static credit files by incorporating live, consented financial data into their decision-making. This includes recent transaction histories, income streams, savings balances, investment holdings, and even recurring bill payments. By analysing these data points in real time, lenders can detect early signs of financial distress, assess affordability with greater precision, and make faster, evidence-based lending decisions.

Insights from the FCA’s Open Finance Sprint 2025 highlight the potential of alternative data sources to improve underwriting accuracy, particularly for thin-file and underserved borrowers. By leveraging open finance, lenders can create adaptive scoring models that better reflect a borrower’s current risk profile, helping to reduce defaults while expanding access to fair credit.

How does open finance improve credit scoring?

Open finance uses real-time financial data to improve credit scoring accuracy and assess borrowers more fairly than traditional methods.

What is open banking credit scoring?

Open banking credit scoring uses live account and transaction data to create accurate, up-to-date borrower risk profiles.

3. Personalised Consumer Lending

For many UK borrowers, loan products still follow a one-size-fits-all structure, fixed terms, rigid repayment schedules, and limited flexibility. This approach often fails to reflect the nuances of individual financial situations, leading to either underserved credit needs or unsustainable repayment plans.

With open finance in lending, lenders can design credit offers that are shaped by a borrower’s real financial behaviour. By securely accessing transaction data, income patterns, savings habits, and liabilities, lenders can tailor loan amounts, interest rates, and repayment schedules to match the borrower’s actual capacity and goals.

For example, a lender could structure a repayment plan that adjusts instalments in line with seasonal income changes for gig economy workers or self-employed professionals. The FCA’s Open Finance Sprint 2025 emphasised personalisation as a driver for both improved customer satisfaction and reduced default rates, making it a win-win for lenders and borrowers alike.

This level of customisation not only enhances the borrower experience but also helps lenders build long-term relationships, positioning them as responsive and consumer-focused in a competitive market.

4. Financial Inclusion for Underserved Borrowers

A significant segment of the UK population, from recent graduates and young professionals to self-employed workers and new arrivals, struggles to access credit because they lack an extensive credit history. These individuals are often referred to as thin file customers, and traditional credit scoring models tend to exclude them from affordable borrowing options.

With open finance in lending, lenders can bridge this gap by securely analysing alternative financial data such as income from multiple sources, regular rent payments, subscription bills, and even digital wallet activity. This richer, consent-driven data set enables more accurate assessments of repayment ability, without relying solely on credit bureau files.

The FCA’s Open Finance Sprint 2025 identified open finance thin-file customers as a priority group for inclusion, noting that improved data access could expand fair lending to millions of UK consumers. For lenders, the benefit is twofold: serving a wider customer base while building a reputation for fairness and social responsibility.

By using open finance tools, lending decisions can be based on a complete, real-world picture of financial behaviour, opening the door to affordable credit for those historically left out of the system.

5. Automated Loan Processing & Origination

Manual loan processing can create bottlenecks that frustrate borrowers and increase operational costs for lenders. Traditional workflows often involve multiple document uploads, manual data entry, and repeated back-and-forth communication before an approval decision is made.

With open finance in lending, this process can be transformed into a streamlined, end-to-end digital journey. By connecting directly to a borrower’s financial accounts with their consent, lenders can instantly verify income, check account balances, assess liabilities, and confirm identity without manual intervention.

This real-time data access makes automated lending decisions possible. Loan origination systems can apply pre-set lending criteria, run affordability checks, and generate approval outcomes in minutes instead of days. The FCA’s Open Finance Sprint 2025 highlighted automation as a key driver for reducing processing times while maintaining compliance with FCA and PSD2 requirements.

For lenders, the result is faster time-to-offer, lower admin costs, and a more seamless customer experience. For borrowers, it means quicker access to funds and less friction in securing the credit they need.

How Finexer Enables Easy Access to Bank Data

For lenders exploring open finance in lending, the ability to retrieve accurate, verified bank data instantly is a critical advantage. Finexer’s API infrastructure is designed to connect UK lenders with 99% of banks nationwide, giving them secure, consented access to live account information in seconds.

Instead of relying on manual uploads or PDF statements, lenders using Finexer can pull transaction histories, account balances, and income patterns directly from the source, all with customer permission. This not only supports faster affordability checks and risk assessments but also reduces drop-offs during loan applications.

With developer-friendly integration, FCA-aligned compliance, and the flexibility to embed these capabilities into existing systems, Finexer helps lenders deliver the kind of streamlined, data-driven lending journeys the FCA’s Open Finance Sprint 2025 envisioned.

Ready to speed up loan approvals?

Integrate Finexer’s secure bank data API into your lending process and cut decision times from days to minutes.

Try NowThe Road Ahead for Open Finance in Lending

The FCA’s Open Finance Sprint 2025 made it clear: open finance in lending is no longer a theoretical concept; it’s a regulatory priority with a defined roadmap. By aligning with the FCA’s four opportunity areas, financial wellbeing, growth, resilience, and digital identity, lenders can move beyond static credit checks and deliver faster, fairer, and more inclusive lending experiences.

The building blocks identified in the Sprint standardised data, robust technology infrastructure, collaborative ecosystems, and sustainable commercial models give UK lenders a clear blueprint for adoption. The payoff is significant: real-time affordability checks, personalised loan offers, broader access for thin-file customers, and streamlined origination processes that meet both compliance and consumer expectations.

Looking ahead, the FCA’s Smart Data Accelerator will drive the next phase of innovation, with TechSprints on SME finance and mortgages set for late 2025. For forward-thinking lenders, this is the moment to pilot open finance solutions, partner with technology providers, and position themselves at the forefront of the UK’s evolving credit market.

The message is simple: open finance isn’t just reshaping how lending decisions are made; it’s redefining who gets access, how quickly they receive it, and how fair those decisions can be. Those who act now will shape the lending landscape for the next decade.

What are the FCA’s four open finance opportunity areas?

The FCA’s four areas are financial wellbeing, growth, resilience, and digital identity & verification.

How can UK lenders prepare for open finance?

UK lenders can prepare by adopting API standards, secure consent tools, and partnerships for digital identity verification.

What is the FCA Smart Data Accelerator?

The FCA Smart Data Accelerator tests high-impact open finance use cases like SME finance and mortgages to guide UK adoption.

Make lending faster, fairer, and data-driven! Join UK lenders using Finexer to access live bank data with zero setup fees