PayByBank is an account-to-account payment method that allows consumers to quickly transfer money directly between bank accounts, ensuring a seamless, secure, and cost-effective transaction experience.

What You will Discover:

In 2026, digital payment methods continue to advance rapidly, transforming the way businesses and consumers manage their financial interactions.

Pay-By-Bank an increasingly popular payment option enabling direct bank-to-bank transactions. Unlike traditional payment methods involving cash, cards, or third-party processors, PayByBank simplifies the payment process through secure, instant account transfers.

With seamless integration via Open Banking technology, PayByBank not only streamlines financial transactions but also addresses critical needs like transaction speed, cost-effectiveness, and security. As adoption expands globally, understanding it’s benefits and implementation will be crucial for businesses aiming to remain competitive in today’s digital economy.

Rapid Growth in Account-to-Account Payments

According to a recent study, account-to-account (A2A) payment transactions are expected to increase by 212% in the UK by 2027, indicating a significant shift towards direct bank transfers. Source: Payments Cards & Mobile

What is PayByBank?

It is a direct account-to-account payment method that enables consumers to make transactions instantly from their bank accounts without needing cash, cards, or third-party payment processors. By leveraging Open Banking technology, this method connects a customer’s bank account directly to a merchant’s account, ensuring faster and more secure payments.

Unlike traditional payment methods, It eliminates the need for card networks, reducing transaction fees and processing times. This payment solution is particularly beneficial for businesses looking to streamline payments while enhancing customer convenience.

Why is PayByBank Gaining Popularity in 2026?

The rapid adoption of PayByBank is driven by several key factors:

- Lower Transaction Costs – Without intermediaries like card networks, businesses save significantly on processing fees.

- Instant Payments – Transactions are completed in real-time, improving cash flow for businesses.

- Enhanced Security – Strong authentication methods minimise fraud and unauthorised transactions.

- Customer Convenience – Users can pay directly from their banking apps without needing to enter card details or remember multiple passwords.

With global trends favoring frictionless digital payments, PayByBank is positioned to become a leading payment solution for both businesses and consumers in 2026 and beyond.

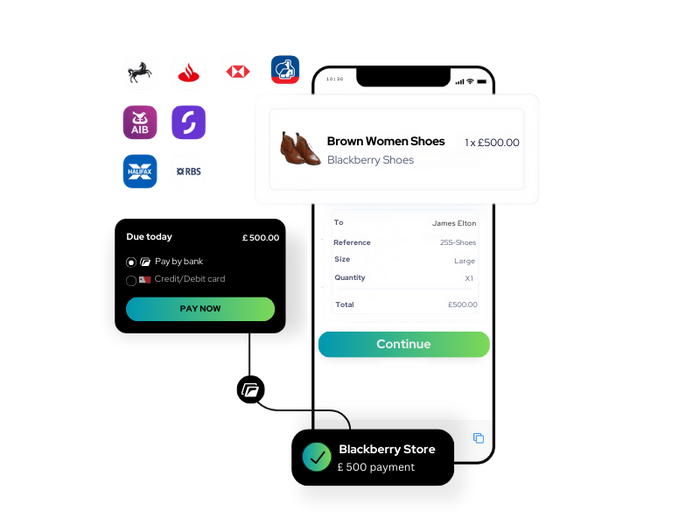

How PayByBank Works for Customers

It offers a seamless, secure, and efficient way for customers to make payments directly from their bank accounts. The process is designed to be intuitive and eliminates the need for cards or manual bank transfers. Here’s how it works step by step:

1.Choosing PayByBank at Checkout

When making a purchase, the customer selects PayByBank as the payment method. This can be done online, where they click a payment link, or in-store by scanning a QR code provided by the merchant.

2.Selecting Their Bank

The customer is presented with a list of supported banks. They simply choose their bank, and the transaction request is forwarded to their banking app.

3.Secure Authentication

To proceed, the customer securely logs into their banking app using standard authentication methods such as biometric verification (fingerprint or facial recognition) or passcodes.

4.Payment Confirmation

The customer reviews the transaction details, ensuring everything is correct before authorising the payment directly from their bank account.

5.Instant Payment Processing

Once confirmed, the transaction is processed immediately. The merchant receives an instant payment notification, and the funds are securely transferred without any delays.

Why Customers Prefer PayByBank

- Faster Transactions – Payments are processed instantly, with no waiting times for fund transfers.

- No Card Details Required – Customers don’t need to input or store sensitive card information, reducing security risks.

- Simplified Checkout – A streamlined payment process reduces friction, improving customer satisfaction.

- Enhanced Security – Strong customer authentication ensures every transaction is protected from fraud.

As more consumers embrace direct bank payments, PayByBank is becoming a preferred choice for secure and frictionless transactions in 2026.

📚 Guide to Bank Transfer Modes

How Transactions Are Processed

While PayByBank simplifies the payment process for users, its back-end operations involve advanced banking infrastructure and Open Banking technology. Here’s a closer look at how transactions are securely processed:

1. Open Banking APIs Power the Transactions

PayByBank relies on Open Banking APIs to create a direct and secure link between the customer’s bank and the merchant’s payment provider. These APIs facilitate real-time authentication and payment processing without requiring traditional card networks.

2. Strong Customer Authentication (SCA) Ensures Security

To approve transactions, customers must go through Strong Customer Authentication (SCA)—typically biometric verification or passcodes—ensuring that only authorised users can initiate payments. This significantly reduces fraud risks compared to card-based payments.

3. Instant Payments with Reduced Fees

Unlike card payments, which involve multiple intermediaries and processing fees, PayByBank transactions are direct. This means lower costs for businesses and near-instant fund transfers, improving cash flow and reducing settlement delays.

4. Lower Chargeback Risks for Businesses

Because PayByBank transactions require direct authentication from customers before payment is authorised, they are less susceptible to fraud or chargebacks—a key advantage for merchants. Once a payment is confirmed, it is final and irreversible.

Why This Matters for Businesses

- Eliminates reliance on traditional card networks (Visa, Mastercard) and their processing fees.

- Speeds up fund transfers, improving cash flow efficiency.

- Strengthens security and fraud prevention with bank-level authentication.

- Reduces chargebacks, making it a more reliable payment method.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Choose Finexer for PayByBank?

Finexer provides a fully optimised PayByBank solution designed for businesses that need secure, low-cost, and real-time payments. With seamless Open Banking integration, businesses can accept direct account-to-account transactions without the high fees associated with card payments.

Key Advantages:

- Instant Transactions – Funds are settled immediately, improving cash flow.

- Lower Fees – Avoid card network charges and reduce transaction costs.

- Strong Security – Compliant with PSD2 regulations, using bank-grade authentication.

- Easy Integration – Works with major banks and requires minimal technical setup.

- Reliable Support – 24/7 business assistance and real-time payment insights.

Finexer ensures that businesses get the best payment efficiency without unnecessary intermediaries. Get started today to reduce costs and streamline transactions.

Is PayByBank secure, and how does it protect against fraud?

Yes, PayByBank is highly secure. It follows Strong Customer Authentication (SCA) protocols, requiring biometric verification or passcodes to authorise transactions. Since payments are processed directly between banks without card details, the risk of fraud, chargebacks, and data breaches is significantly reduced.

Do customers need a special app to use PayByBank?

No, customers do not need to download a separate app. They simply select PayByBank at checkout, authenticate the payment through their existing banking app, and complete the transaction instantly.

How can businesses integrate PayByBank into their checkout process?

Businesses can integrate PayByBank through Open Banking-enabled payment providers like Finexer. Integration is typically done via an API or a plug-in for e-commerce platforms, allowing customers to choose PayByBank as a payment option seamlessly.

Need Faster & Secure Payments ? We are here to help, book a Demo and get started with instant bank to bank payments!