Most UK businesses already use payment links. You send a URL, your customer clicks it, enters their card details, and the payment goes through.

The method works. But card fees keep eating your margins. Failed payments disrupt your cash flow. And you’re waiting days for settlements.

Open banking payment links change this. They connect your customers straight to their bank accounts. No card networks involved. No interchange fees. Settlement happens in seconds, not days. And you get real-time confirmation.

Why Traditional Payment Links Cost More Than They Should

Card processing fees vary. Sometimes you pay less, sometimes more. But they always take a percentage of every transaction.

Then there’s the waiting. Card payments take business days to reach your account. That ties up working capital. For businesses running tight on cash flow, those delays hurt.

Failed payments create another problem. Cards get declined for various reasons. Expired cards. Insufficient funds. Random authorisation failures. Each one means lost revenue and customer service time.

Chargebacks add risk you can’t fully control. Customers can dispute transactions months later. You pay fees whether you win or lose. High chargeback rates can trigger penalties from your processor.

What Are Open Banking Payment Links?

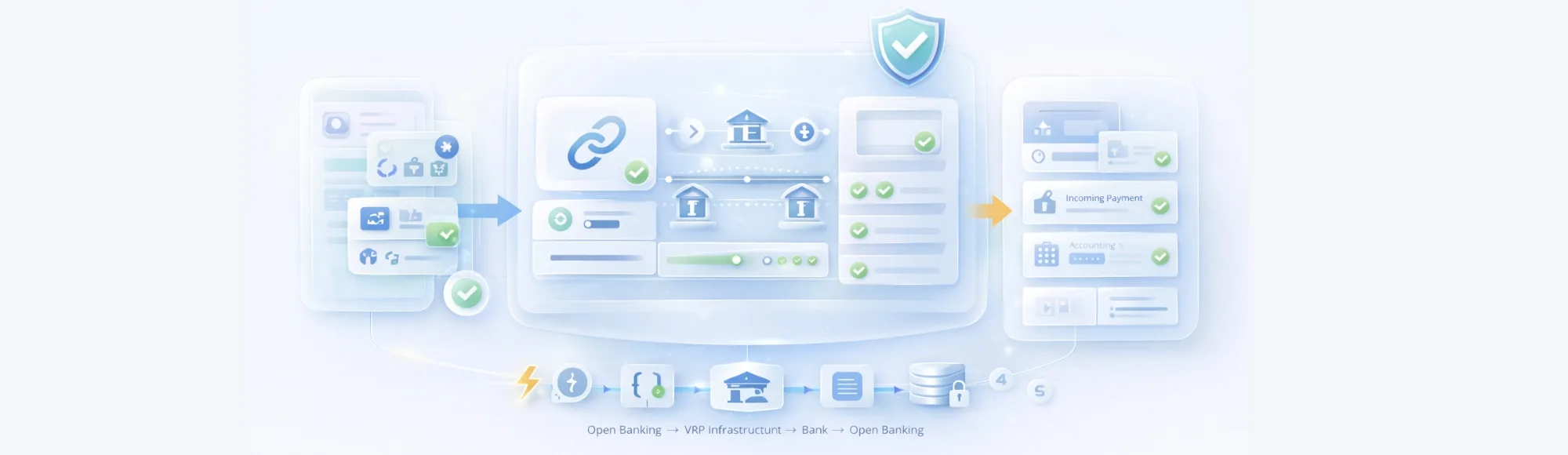

Think of them as pay-by-bank links. Your customer clicks the link. They choose their bank. They log in using their normal banking app. They authorise the payment. Done.

No card details get entered. No wallet apps needed. The payment instruction goes directly between banks through secure APIs.

The FCA regulates these connections. Strong Customer Authentication happens inside the customer’s banking app. That’s the security they already trust.

You get payment confirmation instantly. No waiting to see if funds will arrive. No wondering about settlement dates. The money moves and you know about it immediately.

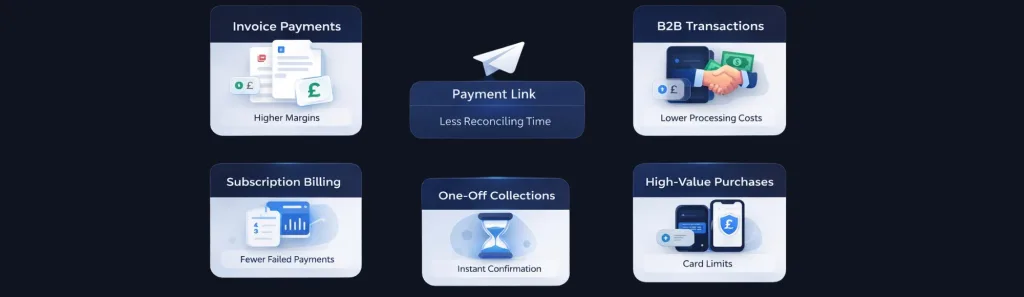

When Do Payment Links Make the Most Sense?

Some business situations benefit more than others:

- Invoice payments where margins matter and you need cash quickly

- B2B transactions where processing costs add up fast

- Subscription billing where failed payments cause customer churn

- High-value purchases that bump up against card limits

- One-off collections requiring immediate confirmation

Businesses handling these payment types report less time spent reconciling. Fewer customer support queries about payments. Better cash flow predictability. Read more about request-to-payment links.

When Do Businesses See the Biggest Impact?

UK businesses processing high volumes of B2B payments or invoices typically see the most significant cost reductions. Those waiting days for card settlements benefit from immediate confirmation. Companies spending hours on payment reconciliation find the automated data flow particularly valuable.

The operational improvements often matter as much as direct cost savings. Less time chasing failed payments. Fewer customer service queries. Cleaner financial reporting.

Find out how much your business could save

How Do Finexer Payment Links Work?

Setting up is straightforward. You create payment links through Finexer’s API or hosted interface. Add the amount and customer details. Generate the link.

Share it however you normally communicate. Email. SMS. Embedded in your invoices. The link works across all channels.

Your customer clicks through. They see a list of UK banks covering 99% of accounts. They pick theirs. Authentication happens in their banking app. Once they approve, funds transfer immediately.

Finexer operates through FCA-authorised infrastructure. You don’t need to become a payment institution. The platform connects with your existing accounting systems. Webhook notifications keep your systems updated automatically.

Most businesses go live within 3-5 weeks with onboarding assistance. That’s about half the time traditional payment gateways require. Technical support during setup prevents delays. Check out Finexer’s payment solutions.

How Open Banking Differs from Card Payment Links

The cost structure changes completely. Card payment links charge percentage-based fees that scale with transaction size. Open banking uses fixed fees per transaction. For higher-value payments, that difference becomes substantial.

Settlement timing matters for working capital. Card payments take days to reach your account. Open banking confirms in real-time. You can release goods, update systems, or move to the next transaction immediately.

Authentication feels different to customers. Cards require entering details plus additional verification steps. Banks just need their normal login. Many customers find this simpler and more trustworthy.

The chargeback risk disappears. Once a bank payment is authorised, it’s confirmed. No dispute window months later. No unexpected revenue reversals. That certainty helps with financial planning.

Why UK Businesses Choose Finexer

Finexer focuses purely on UK account-to-account payments. No complications from international payment routing. Coverage reaches 99% of UK banks. You won’t lose transactions because someone’s bank isn’t supported.

Pricing is usage-based. You pay for transactions you actually process. No fixed monthly fees for capacity you might not use. No tier structures that don’t match your volume patterns.

White-label options keep customers in your brand environment. They don’t get redirected to unfamiliar payment pages. Brand consistency improves trust, particularly for high-value transactions.

Technical support runs through the 3-5 week onboarding period. The platform works with your existing infrastructure rather than requiring changes. API documentation provides clear integration guidance for your development team.

Getting Started with Payment Links

Initial setup connects through API integration or Finexer’s hosted payment interface. You specify payment amounts, customer information, and any custom fields your reconciliation process needs.

Onboarding assistance covers technical integration, testing, and workflow optimisation. Exact timing depends on your existing systems and internal processes.

Generate payment links individually or in bulk, depending on your requirements. Webhook notifications handle payment status updates. Your order processing and accounting systems stay synchronised automatically.

What is a payment link?

A shareable URL that lets customers complete payments by clicking through to a payment interface.

How do open banking payment links work?

They connect customers to their bank accounts through FCA-regulated APIs, removing card networks from the payment process.

Can I send payment links via email or SMS?

Yes, share them through any channel including email, SMS, invoices, or embedded on websites.

Are payment links secure?

Customers authenticate through their banking app using existing security credentials, which removes card data exposure.

How quickly do pay-by-bank payments settle?

Payment confirmation arrives in real-time, with funds typically settling within seconds through UK banking infrastructure.

Start Reducing Payment Costs

Connect your accounting system to HMRC with reliable bridging software and efficient payment infrastructure.

Book a Demo Now