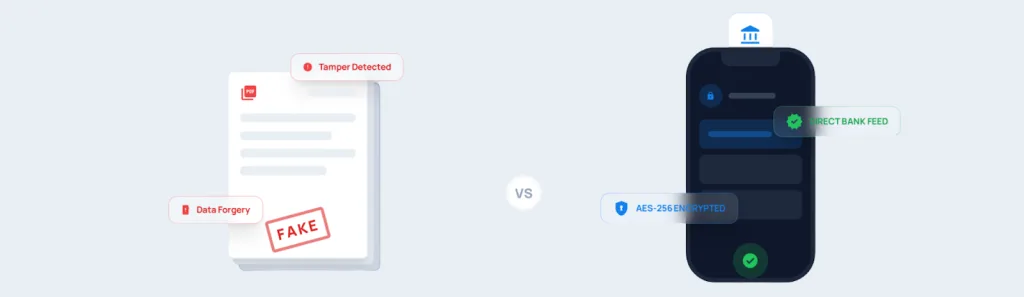

Uploading bank statements creates unnecessary delays. PDFs get edited. Screenshots can be tampered with. Manual verification takes days while deals wait and clients get frustrated. Proof of funds checks are required for property purchases, legal transactions, and high-value deals-but the traditional process slows everything down.

Real-time verification through Open Banking eliminates these issues. Bank data is accessed directly through FCA-regulated connections, giving businesses instant confirmation of available funds without asking clients to gather paperwork.

The verification happens in seconds, not days. This approach is commonly used by UK law firms, property platforms, compliance teams, and regulated financial services.

What is Proof of Funds Verification?

Proof of funds verification confirms that an individual or business has sufficient available funds in a UK bank account to complete a transaction. Open Banking allows this to be verified instantly without manual bank statements upload.

What Makes Manual Proof of Funds Checks So Slow?

Traditional methods require clients to download statements, redact sensitive information, and upload files. Your team then spends time checking document authenticity, verifying balances, and cross-referencing dates.

This process creates multiple failure points. Documents get rejected for poor quality or missing pages. Clients forget to include specific periods. Files arrive in formats your systems can’t process. Each round of back-and-forth adds days to onboarding.

LawTech firms handling property transactions face this constantly. Conveyancing delays because proof of funds takes a week. Client frustration builds. Deals risk falling through.

How Does Bank Data Verification Actually Work?

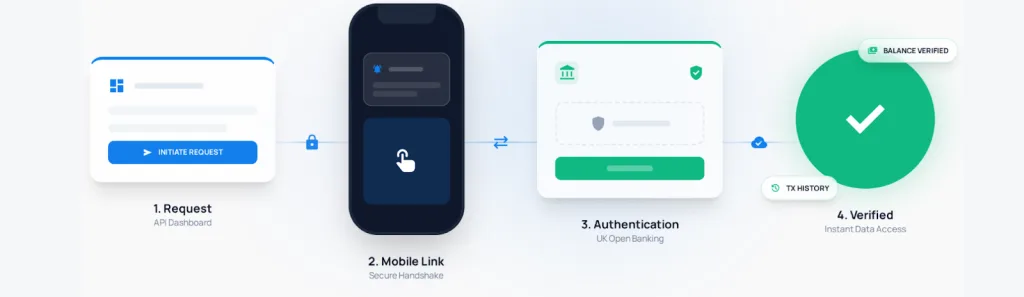

Open banking allows businesses to request permissioned, read-only access to a client’s bank account. The client authenticates directly through their bank’s app or online banking. No passwords are shared. No statements are downloaded.

The verification happens at the bank level. Account balances are checked in real-time. Transaction history is accessed if needed. The data comes directly from the source, making manipulation impossible.

This open banking proof of funds method is increasingly used by UK law firms and conveyancers. This method is used by UK businesses that need legitimate proof of funds verification without operational delays. The client experience takes under a minute. Your team gets instant confirmation.

What Are the Real Risks with PDF Bank Statements?

- Fake bank statements are easier to create than most businesses realise. Templates are available online. Basic PDF editing tools can change balances and dates. Even printed statements from legitimate banks can be altered before scanning.

- Manual verification catches obvious fakes but sophisticated edits slip through. Your team isn’t trained as forensic document analysts. The risk sits with your business when a transaction proceeds based on fraudulent documents.

- Direct bank verification removes this risk completely. The data comes from the bank’s systems, not from client-provided files. There’s no document to manipulate.

Does This Method Meet UK Compliance Requirements?

FCA regulation covers open banking access for Account Information Services. Providers need proper authorisation to access bank data on behalf of clients. This isn’t unregulated technology-it’s the framework UK banks use themselves.

Strong Customer Authentication is built into the process. Clients authorise access through their bank’s existing security measures. The business never handles login credentials. PCI compliance requirements are removed from your infrastructure.

Data is encrypted and transmitted securely via FCA-regulated Open Banking rails. Client information is transmitted securely through FCA-approved channels. The regulatory framework already exists to support this method.

How Quick Is the Verification Process?

Client receives a verification request. They click the link and select their bank. They authenticate through their banking app. Verification completes and results return to your system.

The entire process takes 30-60 seconds. No document gathering. No upload steps. No manual review queue. Your team sees confirmed balances immediately.

For businesses handling property purchases or high-value transactions, this changes timelines completely. What took a week now takes a minute. Client onboarding moves at transaction speed, not document processing speed.

Can This Replace All Document Requirements?

Proof of funds verification through bank data works for balance confirmation and transaction history checks. It doesn’t replace identity verification or other compliance requirements.

The method works best when integrated into existing workflows. Clients still need to complete KYC processes. Legal documentation still needs to be signed. But the specific step of proving available funds moves from a multi-day document exercise to an instant check.

UK businesses using this method report significant drops in client onboarding time. The bottleneck moves from waiting for documents to completing other necessary steps.

Below is how traditional proof of funds checks compare with open banking proof of funds verification in the UK.

Proof of Funds Verification – Method Comparison

| Criteria | Manual Bank Statements | Direct Bank Verification |

|---|---|---|

| Verification Time | 3–7 days | 30–60 seconds |

| Document Manipulation Risk | High – PDFs can be edited | None – data comes directly from bank systems |

| Client Experience | Multiple steps and document uploads | Single authentication, no uploads |

| Compliance | Relies on manual document review | FCA-regulated bank-level access |

| Staff Time Required | Manual review and validation | Automated with instant results |

| Failed Verification Rate | High due to document issues | Low with clear success or failure status |

Ready to Speed Up Client Onboarding?

Removing bank statement uploads from your verification process reduces delays and eliminates document fraud risk. UK businesses need methods that work with FCA regulations while actually improving operational speed.

Finexer provides direct bank verification through connections to 99% of UK banks. Clients authenticate once through their existing banking app. Results return instantly. Implementation happens 2-3 times faster than alternative solutions, with technical support provided during the 3-5 week onboarding period. Get started with Finexer and verify client funds without waiting for paperwork.

What is proof of funds in property transactions?

Proof of funds confirms a buyer has the money needed to complete a purchase. Direct bank verification provides this confirmation instantly without requiring statement uploads.

How do law firms verify proof of funds?

Law firms traditionally request bank statements, but direct bank verification through open banking provides faster, more secure confirmation of client account balances.

Can verification results be stored for compliance?

Yes. Verification results can be recorded with timestamps and audit trails for compliance documentation and future reference.

A regulated, faster way to verify proof of funds in the UK for legal teams, property management & accounting firms !