Collection is the revenue engine inside every property platform. Yet most PropTech companies still rely on card processors charging 2-3% fees, direct debits taking 3-5 days to clear, or manual bank file uploads when collecting rent.

This creates friction for tenants, delays for landlords, and operational costs that scale linearly. Platforms competing on user experience can’t afford payment infrastructure introducing fees or delays.

Automated rent payment using open banking changes this fundamentally. Tenants authenticate through their banking app, payments settle within minutes, ledgers update automatically. No percentage fees. No clearing delays.

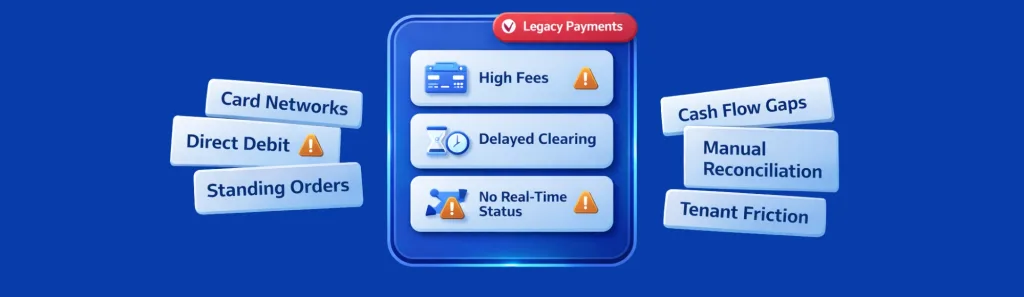

Why Rent Payment Infrastructure Fails in Most Property Platforms

Traditional methods rely on payment systems designed decades ago. Card processors extract percentage fees. Direct debits queue payments for multi-day clearing. Standing orders provide no confirmation until statements arrive.

What this creates:

- Card fees of £40-60 per £2,000 rent damaging tenant retention

- Failed direct debits discovered days after expected collection

- Manual reconciliation consuming finance team hours when collecting rent

- No real-time visibility into payment status

The fundamental issue: these methods weren’t designed for platform economics. Percentage fees penalise high-value properties. Clearing delays create cash flow gaps.

Modern rent collection service infrastructure solves this through direct bank connections rather than intermediary networks.

What Modern Rent Payment Automation Looks Like

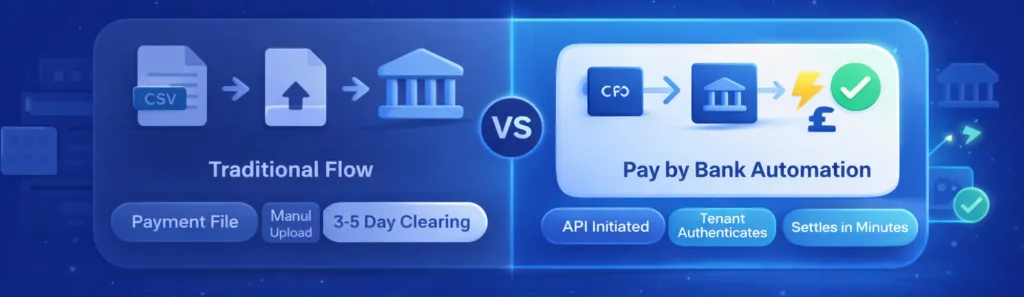

Traditional approaches treat collection as transactions through card networks or batch files. Automated rent payment treats it as direct payment initiation through regulated open banking rails when collecting rent.

When rent becomes due, your platform sends payment requests. Tenants authenticate using banking app credentials. The system initiates transfer directly, settles within minutes, and confirms completion back to your platform.

Ledgers update automatically. Finance sees transaction status in real-time. No manual uploads. No delayed confirmations.

How Automated Rent Payment Works Using Pay by Bank

The technical flow changes fundamentally:

Traditional: Platform generates payment file → Manual upload → 3-5 day clearing → Post-settlement reconciliation

Automated: Platform initiates via API → Tenant authenticates → Settlement within minutes → Real-time update

This eliminates entire operational layers. No file generation. No manual uploads. No delayed failure discovery.

Rent Payment Architecture Overview

| Layer | What It Does |

|---|---|

| Payment Initiation | Sends payment request to tenant bank |

| Authentication | Tenant logs into banking app |

| Settlement | Moves funds between bank accounts |

| Confirmation | Returns settlement status |

| Ledger Update | Records payment automatically |

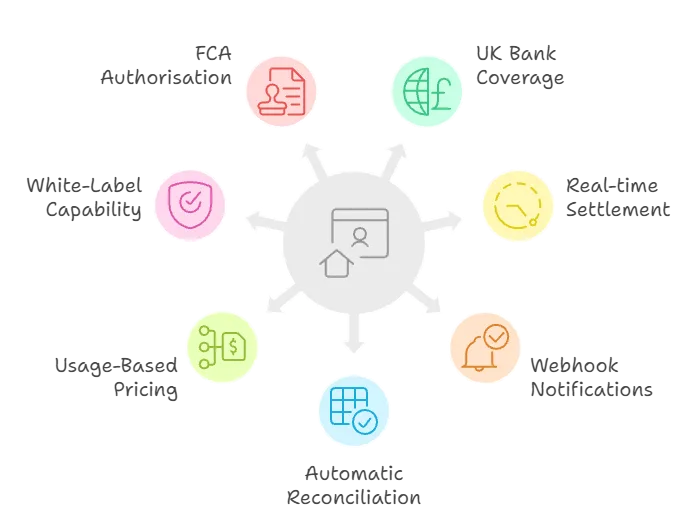

Core Capabilities a Rent Collection Service Must Provide

When evaluating infrastructure for automated rent payment and collecting rent, prioritise these requirements:

UK bank coverage – Access to 99% of UK banks means tenants pay through existing accounts

Real-time settlement – Minutes from authentication to funds arrival

Webhook notifications – Immediate callbacks when payments settle or fail

Automatic reconciliation – Transaction status updates enabling ledger reflection without manual matching

Usage-based pricing – Costs aligned with volume rather than percentage fees

White-label capability – Branded experiences maintaining platform identity

FCA-authorised infrastructure – Compliance for platforms handling tenant funds

Real Platform Use Cases

Property platforms implement rent collection service across different scenarios when collecting rent:

- Monthly collection with automatic retry logic

- Partial payment handling for instalments

- Deposit collection through same rails

- Rent arrears recovery using identical flows

Compliance and Reliability in the UK Market

Rent payment infrastructure must operate under UK regulatory frameworks when collecting rent. Finexer operates open banking connectivity using FCA-authorised infrastructure.

This means authentication follows regulated standards, payment data handling complies with GDPR requirements, and settlement happens through banking rails subject to financial services oversight.

For platforms, this reduces compliance burden. You integrate with infrastructure already operating under proper authorisation.

Why Infrastructure-First Wins Over Tools

The market offers two approaches: complete tools trying to be all-in-one solutions, or flexible infrastructure that adapts to your needs.

Tools impose workflows and UI decisions. Infrastructure provides flexibility.

This matters because property platforms differentiate through user experience.

How Finexer Powers Automated Rent Payment

Finexer provides open banking infrastructure for property platforms:

- Payment initiation across 99% of UK banks

- Secure tenant authentication flows

- Real-time settlement confirmation

- Webhook notifications for payment completion

- Sandbox environment for testing

The platform provides 3-5 weeks of dedicated onboarding support ensuring integration aligns with your platform architecture.

Pricing works on actual payment volume. No percentage fees penalising high-value properties.

What I Feel Like

After watching platforms implement infrastructure, those that succeed treat it as invisible plumbing that just works.

They invest engineering effort in user experience, not in building authentication flows or managing banking relationships.

The platforms that struggle try building everything themselves. They discover payment infrastructure requires ongoing maintenance that diverts engineering capacity from their actual product.

Collection is critical but shouldn’t be your competitive differentiator. Superior tenant onboarding creates platform value.

What is automated rent payment?

Direct payment initiation from tenant bank accounts through open banking APIs, settling within minutes with automatic ledger updates rather than cards or direct debits.

How does it differ from direct debits?

Real-time settlement with instant confirmation versus 3-5 day clearing cycles, plus immediate failure detection.

Can rent collection service infrastructure handle all UK banks?

With 99% UK bank coverage through regulated open banking, virtually all tenants pay through existing accounts.

What happens when rent payment fails?

Immediate failure notification with reason codes enabling platforms to prompt tenants for alternate accounts instantly.

How does this integrate with existing systems?

Through RESTful APIs providing payment initiation, status webhooks, and transaction data that existing systems consume.

Ready to Build Better Rent Payment Flows?

See how Finexer can power your rent payment infrastructure

Book Demo Now