A utility bill is how much a house or an office is supposed to pay for electricity, gas and water each month.

Introduction

In today’s digital era, where convenience and efficiency are paramount, managing utility bill payments can often become a cumbersome task for businesses and individuals alike. With the advent of Open Banking technology, there lies a significant opportunity to revolutionise how we approach paying utility bills, offering a streamlined and user-friendly solution. The importance of simplifying the utility bill payment process cannot be overstated, as it not only enhances operational efficiency but also significantly reduces the likelihood of late payments, which can accrue inconvenient fees. Enter Finexer, an innovative company at the forefront of leveraging Open Banking technology to transform the utility bill payment landscape, making the process smoother and more accessible than ever before.

This article delves into how Finexer utilises Open Banking to address the pain points commonly associated with utility bill payments, such as the cumbersome process of managing multiple utility accounts, navigating complex payment platforms, and handling high convenience fees. Through a detailed exploration of Finexer’s advanced open banking solutions, real-world applications, and compelling case studies, readers will gain insights into how this forward-thinking approach can benefit both individuals and businesses alike. From reducing administrative burdens to offering a variety of convenient payment methods that cater to user preferences, Finexer’s platform represents a significant step forward in the way utility bills are paid. Whether it’s water bill payments, electronic payments, or autopay options, Finexer ensures that these transactions are seamless, secure, and efficient.

Challenges in Utility Bill Management & Its Solutions

Delayed Payments: Customers often experience delays in payment processing, which can result in late fees and disrupted services.

Instant Payment (A2A Payments)

✔ Automated Payment Processes: Ensures seamless and timely transactions, reducing the likelihood of late fees.

✔ Enhanced Financial Efficiency: Improves overall financial efficiency.

✔ Automated Payments: Users can set up automated payments that adjust to their financial status, ensuring bills are paid on time without manual intervention.

Application: Enables customers to pay their utility bills instantly using direct bank transfers, ensuring timely payments and reducing the risk of late fees.

Lack of Transparency: Customers may not have a clear view of their utility usage and billing details, leading to disputes and dissatisfaction.

Finexer ‘s Open Banking Data – Real-time Transaction Data:

✔ Provides real-time insights into transactions, balances, and account details.

✔ Facilitates accurate financial profiling.

✔ Enhances risk assessment.

✔Automated recurring payments VRP offer customers clear insights into their billing and usage

Application: Utility companies can leverage this data to offer tailored payment plans and improve customer service through better understanding of payment behaviors.

Inconsistent Payment Methods: Various utility providers might use different payment systems, causing inconvenience for users who have to manage multiple platforms.

Finexer ’s solutions provide a consistent payment experience across different utility providers. benefits:

✔ Simplifies the payment process for customers.

✔ Open banking platforms aggregate information from various bank accounts and payment systems into a single interface.

✔ Reduces the need to manage multiple platforms.

Provides an embedded payment experience via:

✔ In-app methods

✔ Online methods

✔ Payment link methods

✔ QR code methods

Application: Users can pay different utility providers directly from one application.

High Transaction Costs: Processing payments through traditional banking methods or credit cards incurs significant fees for both customers and utility companies.

Finexer ‘s Instant Payment (A2A Payments)

Benefits:

✔Reduces transaction costs by up to 90%

✔facilitates instant settlement

✔enhances security by eliminating card chargebacks

Application: Enables customers to pay their utility bills instantly using direct bank transfers, ensuring timely payments and reducing the risk of late fees.

Security Concerns: Traditional payment methods are prone to fraud and security breaches, causing concerns for both customers and providers.

Finexer ‘s Verification (KYC/KYB)

Benefits: ✔ Enhances security and compliance by verifying customer identity using bank data and facial recognition tools, reducing the risk of fraud.

Application: Ensures secure onboarding and authentication processes for new utility service customers, safeguarding against identity fraud.

Manual Data Entry and Errors: Traditional utility bill management involves manual data entry, which can lead to errors and inefficiencies.

✔ Automated Data Retrieval: Finexer ‘s open banking API automatically retrieves transaction data from bank accounts, eliminating manual entry and reducing errors.

✔ Automation speeds up utility bill management, allowing companies to focus on strategic tasks.

✔ Seamlessly integrates with existing utility management software, reducing data mismatches and errors.

✔ Ensures accurate and verified data directly from financial institutions

Benefits of Using Finexer ’s Open Banking Technology

Cost Savings ✔

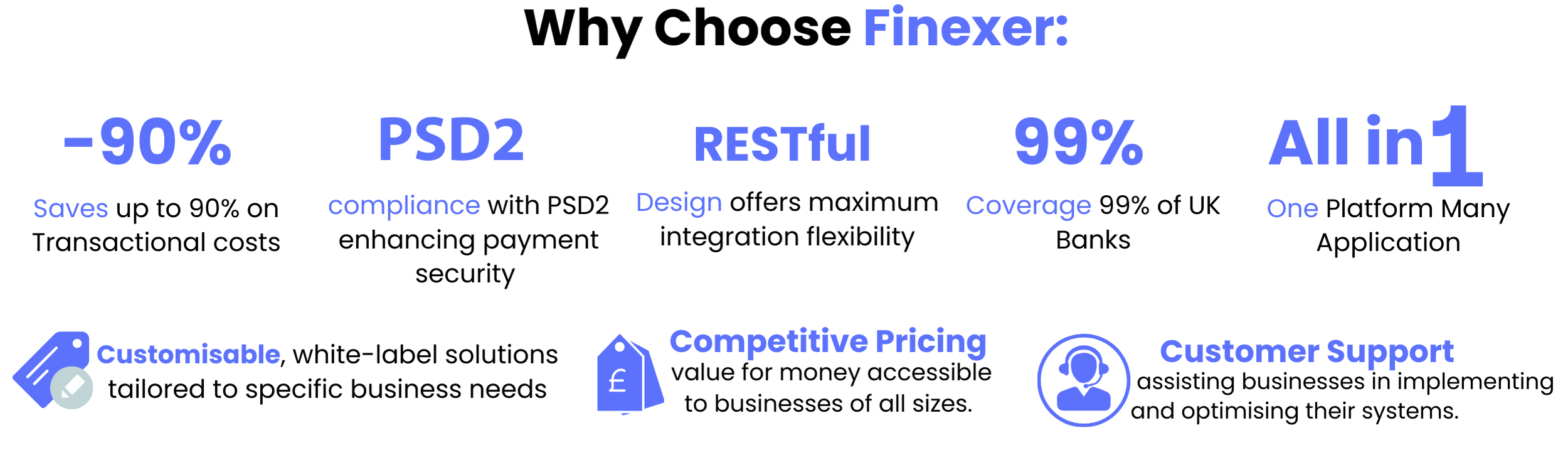

Finexer ‘s open banking solutions significantly reduce transaction costs for both businesses and consumers. By enabling direct bank-to-bank payments, the platform eliminates the need for intermediary processing fees, often associated with traditional payment methods. This streamlined approach not only cuts costs by up to 90% but also facilitates instant settlements, enhancing the financial efficiency of transactions.

Improved Financial Management ✔

Finexer provides real-time transaction data and enhanced financial insights, which are crucial for better financial decision-making. Businesses benefit from a comprehensive view of their financial activities, enabling them to manage cash flows more effectively. This access to instantaneous and detailed financial data ensures that businesses can respond quickly to financial changes and maintain robust financial health.

Increased Customer Satisfaction ✔

The user-friendly interfaces and flexible payment options offered by Finexer significantly enhance the customer experience. Customers enjoy the convenience of managing their payments effortlessly, which is further supported by the option for instant withdrawals, reducing wait times from days to seconds. This responsiveness and adaptability to customer needs foster greater customer satisfaction and loyalty, making Finexer a preferred choice for managing utility bill payments.

Integration with Financial Institutions ✔

Finexer ‘s open banking platform is designed to integrate seamlessly with financial institutions. This integration allows for real-time access to banking data, ensuring that transactions are both secure and efficient. By leveraging API connections, Finexer facilitates direct communication between businesses and banks, enhancing the financial operations without the need for intermediaries.

Real-Time Financial Data Access ✔

At the core of Finexer ‘s innovative approach is the provision of real-time financial data access. This feature empowers businesses to make informed decisions based on up-to-date financial information. Real-time data access is crucial for maintaining accurate financial profiles and performing dynamic risk assessments, which are essential for effective financial management.

Automated Bill Payments ✔

Finexer revolutionises utility bill management by automating payment processes. This feature allows for seamless and timely transactions, reducing the likelihood of late fees and enhancing overall financial efficiency. Users can set up automated payments that adjust to their financial status, ensuring bills are paid on time without manual intervention.

Secure Transactions ✔

Security is a cornerstone of Finexer’s offerings. The platform ensures that all transactions are protected with top-tier encryption standards. By complying with PSD2 regulations, Finexer not only secures financial data but also builds trust with its users, guaranteeing that their financial transactions are handled with the utmost security and compliance.

Conclusion

Throughout the article, we’ve explored the significant challenges associated with utility bill payments and highlighted how Finexer’s innovative solutions, powered by Open Banking technology, effectively address these pain points. By streamlining the payment process, reducing transaction times, and providing real-time financial insights, Finexer not only alleviates the administrative burdens but also enhances the overall experience for both individuals and businesses. The benefits of adopting such advanced payment solutions are manifold, ranging from improved operational efficiency to increased satisfaction due to the flexibility and security offered to users.

Reflecting on the broader implications, the integration of Open Banking solutions like those developed by Finexer represents a transformative step for the financial and utility sectors. The convenience and efficiency that Finexer brings to utility bill payments underscore the potential for technology-driven approaches to revolutionise consumer and business financial transactions. As we move forward, the continued adoption and evolution of these platforms will likely serve as a catalyst for further innovation, improving the utility payment landscape significantly. Finexer ‘s commitment to simplifying payments through technology not only solves the immediate challenges faced by many but also paves the way for a more efficient, transparent, and user-friendly future in financial transactions.

FAQs

1.What types of utility bill payment solutions does Finexer offer?

Instant Payment Solutions: Finexer provides Account-to-Account (A2A) payments, allowing users to pay their utility bills instantly through direct bank transfers. This reduces the risk of late fees and ensures timely payments.

Automated Bill Payments (VRP): Automates the payment of recurring utility bills, ensuring bills are paid on time without manual intervention.

2.How does Finexer ensure security in utility bill payments?

Finexer uses secure Open Banking integrations for user authentication, significantly reducing the risk of fraud. All transactions are protected with top-tier encryption standards and comply with PSD2 regulations, ensuring secure utility bill payments.

3.What features are included in Finexer ‘s utility bill payment API?

Real-time Transaction Data: Provides up-to-date information on utility bill payments.

Balance Check: Tracks balances to ensure there are sufficient funds for upcoming utility bills.

Authentication: Retrieves necessary account details to facilitate seamless utility bill payments.

4.Can Finexer‘s utility bill payment solutions be integrated with existing systems?

Yes, Finexer’s APIs are designed for seamless integration with existing utility management software, reducing data mismatches and errors. This provides a consistent payment experience across different utility providers.

5.What support does Finexer offer during the implementation of utility bill payment solutions?

Finexer’s team of technical experts assists clients through the implementation process, ensuring a smooth transition and optimal integration of their utility bill payment solutions.

6.What pain points in utility bill management does Finexer address?

Manual Data Entry and Errors: Finexer’s API automatically retrieves transaction data from bank accounts, eliminating manual entry and reducing errors.

Delayed Payments: Ensures seamless and timely transactions, reducing the likelihood of late fees.

Lack of Transparency: Provides real-time insights into utility usage and billing details, enhancing customer satisfaction.

Inconsistent Payment Methods: Offers a consistent payment experience across various utility providers, simplifying the process for users.

High Transaction Costs: Reduces transaction costs by up to 90% through direct bank transfers.

7.What are the benefits of using Finexer for utility bill payments?

Cost Savings: Finexer‘s solutions significantly reduce transaction costs, cutting costs by up to 90% and facilitating instant settlements.

Improved Financial Management: Provides real-time financial insights, enabling better financial decision-making.

Increased Customer Satisfaction: Enhances the customer experience with user-friendly interfaces and flexible payment options.

Integration with Financial Institutions: Seamlessly integrates with financial institutions, ensuring secure and efficient transactions.

Automated Payments: Revolutionises utility bill management by automating payment processes, ensuring bills are paid on time.

Unlock seamless and secure utility bill payments with Finexer’s Request to Pay – automate, save, and simplify today!