Tag: Instant Payment

-

Instant Payroll Payment Software: How Businesses Can Pay Employees in Real Time Without Bank Delay

Instant payroll payment software for UK businesses. Pay employees in real time, eliminate 3-day bank delays & improve retention with 99% UK bank coverage.

-

Bulk Payments: How Businesses Send High-Volume Bank Payments Efficiently in the UK

Learn how UK businesses handle bulk payments at scale, including key use cases, bulk vs batch differences, and modern payment infrastructure.

-

How SaaS Companies Can Reduce Involuntary Churn With Better Payment Flows

Want fewer failed renewals and steadier revenue? See how a more reliable payment method keeps customers subscribed Try Now A lot of churn in SaaS doesn’t happen because customers decide to leave. It happens because their payments fail. Card expiries, random declines, and SCA drop-offs quietly interrupt renewals — making it harder for teams to…

-

6 TrueLayer Alternatives for Payments in the UK

Looking for TrueLayer alternatives? Compare 6 UK-friendly Open Banking payment providers with faster go-live, stable PIS, and full control of your flows.

-

Choosing the Right Payment Initiation Platform in UK: A Checklist

Compare leading UK payment initiation platforms by coverage, pricing, speed, and support. Explore the best choice for your business in 2025.

-

What Is a Payment Initiation Service (PIS) and How It Works in the UK

Learn what a Payment Initiation Service (PIS) is, how it works in the UK, and why it’s changing the way businesses handle payments using open banking APIs.

-

7 Best Banking API Providers in the UK (2026 Guide)

Find the top UK banking API providers. See how Finexer, Salt Edge, Yapily, Plaid, Tink and TrueLayer stack up on coverage, pricing and integration speed.

-

The Most Cost-Effective Open Banking API for UK Businesses

Compare the most cost-effective Open Banking APIs for UK firms. Explroe pricing, coverage, and deployment insights

-

Transfer Funds Instantly: Fast, Secure Money Transfers in the UK

Learn how to transfer funds instantly in the UK with Faster Payments. Explore instant bank transfers, instant payouts, security, and key use cases.

-

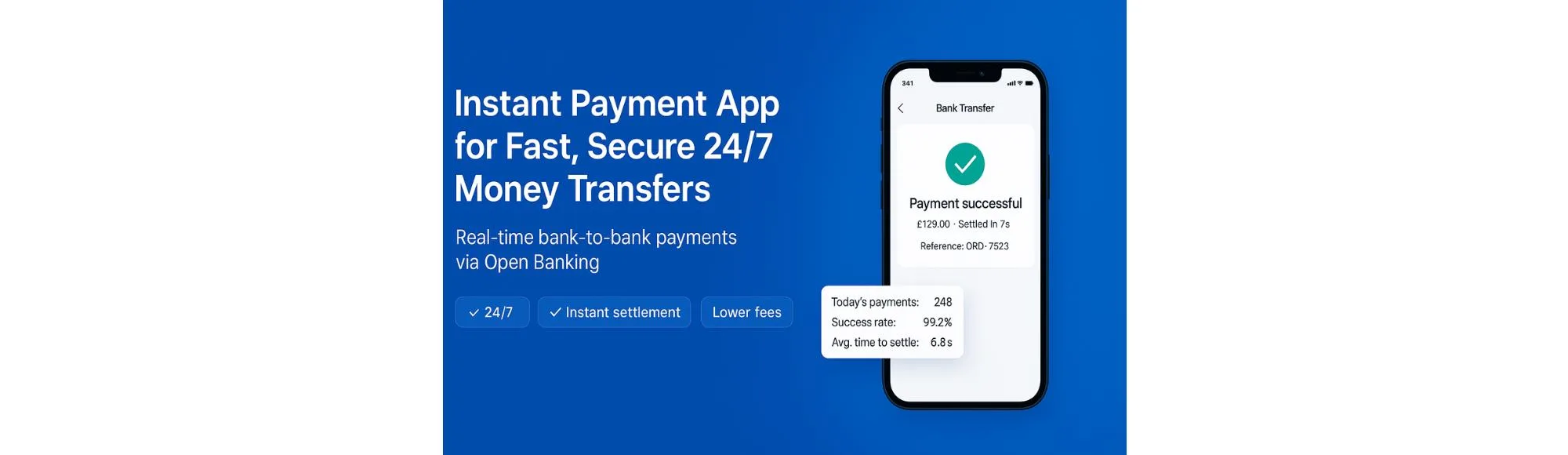

Instant Payment App for Fast, Secure 24/7 Money Transfers

Instant payment app for UK businesses: real-time bank transfers, 24/7 availability, lower fees than cards, and Open Banking Payment Initiation by Finexer.

-

Yapily vs Plaid: Which AIS Provider Fits Your Business in 2025?

Compare Yapily and Plaid for AIS in the UK. See how they differ on bank coverage, business account access, and pricing

-

Yaspa Pricing & Review 2026: Payouts, Fees, Pros & Cons

Explore Yaspa’s 2025 pricing, payouts features, fees, pros and cons. Learn how its Open Banking payments and refund capabilities fit UK businesses.

-

Airwallex UK Pricing & Features: What UK Businesses Need to Know

Discover the key features and pricing plans of Airwallex UK business accounts in 2025. Learn about multi-currency accounts, payment fees, and corporate cards.

-

Law Firm Cost Management for UK: How Finexer Can Cut KYC and Payment Expenses

Law Firm Cost management made simple for UK law firms, Cut KYC and payment costs, boost compliance, and improve efficiency with Finexer.

-

Instant Payment Systems: Transforming Business Payments in the UK and Beyond

Adopt instant payment systems to transform your business. Learn how to improve cash flow, reduce operational costs, and lower transaction fees today.

-

Nuapay Alternatives UK Businesses Should Consider in 2025

Discover the best Nuapay competitors in 2025. Find top Account-to-Account payment providers and find the right alternative for UK businesses.

-

10 Best Digital Payments Solution

Compare the best digital payments solutions in the UK. See providers, costs, payout speeds, and find the right fit for your business in 2025.

-

Budget-Friendly Open Banking Solutions in the UK: A 2025 Guide

Find budget-friendly open banking solutions in the UK. Compare providers, pricing models, and cost-saving features for SMEs and startups.

-

Instant Payments for Retail Success: Best EPOS Payment Providers UK 2025

Find the UK’s best EPOS payment providers for 2025. Our guide compares Square & Zettle with Open Banking for instant, low-cost payments.

-

![5 Best QR Code Payment Platforms in the UK [2026 Guide] 20 5 Best QR Code Payment Platforms in the UK [2026 Guide]](/wp-content/uploads/2025/09/QR-Based-Payment-Providers-jpg.webp)

5 Best QR Code Payment Platforms in the UK [2026 Guide]

Instant Settlement with Finexer Connect to 99% of UK banks and accept QR-based payments with zero setup fees! Try Now QR code payments are quickly becoming a reliable and cost-effective payment method for UK businesses. As more customers rely on mobile phones to shop and pay, scanning a QR code has become just as common…

-

Insurance Payment Methods in 2025: Top Solutions for UK Businesses

Start Collecting & Paying Instantly Cut costs and delays in insurance payments. Use Finexer to connect with 99% of UK banks for instant premium collections and claim payouts. Try Now The way customers pay for insurance is undergoing a major shift. For UK insurers, brokers, and online merchants selling insurance products such as travel, car…

-

![Best Modulr Alternative for Embedded Payments in the UK [2025 Guide] 22 Best Modulr Alternative for Embedded Payments in the UK [2025 Guide]](/wp-content/uploads/2025/08/Modulr-embedded-payments-jpg.webp)

Best Modulr Alternative for Embedded Payments in the UK [2025 Guide]

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Embedded payments are the backbone of modern finance operations in the UK. Whether it’s payroll, supplier disbursements, or instant customer refunds, businesses now expect payments to run invisibly inside their platforms. Modulr is one of…

-

How Growing Accounting Firms Use Open Banking for Faster Client Payouts

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In the UK, growing accounting firms are under more pressure than ever to deliver faster client payouts. Whether it’s reimbursing expenses, processing payroll, or making supplier payments, waiting several days for funds to clear can…

-

Finexer for Accountants: The Best Open Banking API for UK Firms in 2025

Get Instant Bank Data with Finexer Book a quick call to see how Finexer can replace your manual bank statement collection with instant, secure feeds from 99% of UK banks Try Now Why UK Accountants Need More Than Bank Feeds If you run a mid-sized or growing accounting firm in the UK, you’ve probably noticed…

-

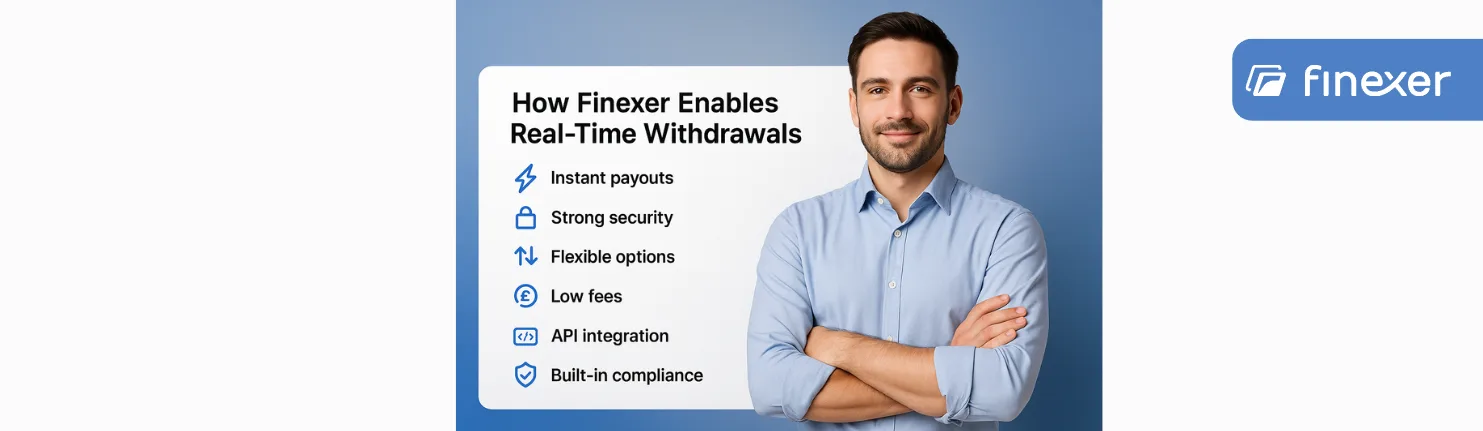

How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms

Get Instant Withdrawals with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms If your platform moves money daily, whether it’s paying contractors, refunding customers, or releasing commissions, you already know that traditional payout methods are painfully slow. Bank transfers…

-

Finexer Instant Payments API for UK Businesses

Pay Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In today’s economy, speed is a baseline expectation. Yet, most UK businesses are still stuck waiting one to three working days for a bank transfer to clear. Payroll runs get delayed, supplier relationships are strained, and…

-

How Finexer Powers Bulk Payments for UK Businesses

Now Pay Faster with Finexer! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In the world of business finance, few functions are as routine or as risky, as bulk payments. Whether you’re disbursing salaries, paying out investor returns, settling refunds, or managing contractor invoices, bulk payment processing is…

-

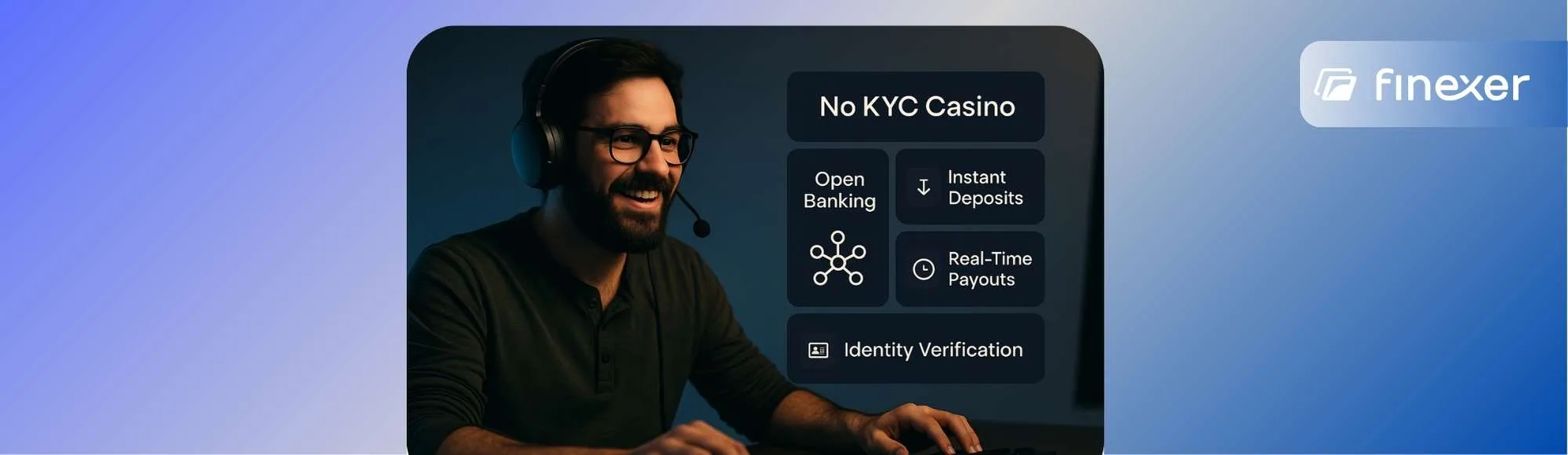

No KYC Casinos: What They Are and Why Operators Are Switching

Fast Onboarding for Casinos Starts Here Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now The term no KYC casino is everywhere in 2025, often promising faster access, fewer drop-offs, and frictionless play. But for regulated operators, skipping KYC isn’t really an option. What platforms actually want is fast…

-

Open Banking for iGaming: Payouts, KYC & Deposits

Finexer helps iGaming platforms offer instant deposits, real-time payouts, and fast KYC using Open Banking for a smoother, compliant player journey.

-

How to Build a Scalable Finance Stack as a VC-Backed Startup

Learn about Scalable finance stack for VC-backed startups using APIs.