Tag: Instant Payment

Legacy Payments Are Costing UK SMEs More Than They Think

Replace Legacy Payments with Instant Bank Transfers Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Despite the rise of modern digital finance tools, legacy payments are still deeply embedded in how many UK SMEs operate. Cheques, BACS transfers, manual bank reconciliation, and even faxed invoices continue to be…

Choosing a Pay by Bank API: What Actually Matters for Your Dev Team

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Integrating a pay by bank API isn’t a usual decision; it’s a technical one. Your dev team is the first to see how well an API performs, and often the last to clean up when…

Utility Billing Refunds UK: Why They’re Slow & How to Fix Them

Slow utility billing refunds are frustrating customers and costing providers time. This blog breaks down the hidden back-office issues behind refund delays and shows how UK utilities can fix them with faster, automated payment infrastructure.

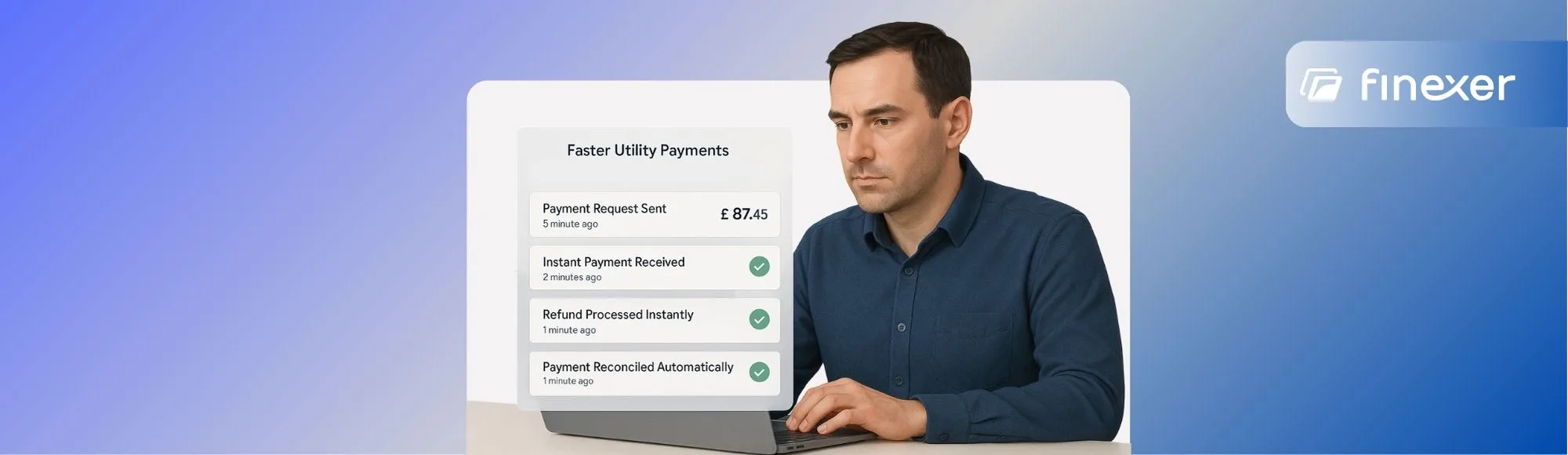

Open Banking for Utilities: Instant Payments, Refunds, and Reconciliation

Find how Open Banking for utilities helps UK providers get paid faster, issue real-time refunds, and reconcile automatically — all through secure, account-to-account transfers.

Open Banking for Payroll and Invoicing: One API for Salary Runs, Invoice Links, and Payee Checks

This blog covers 10 practical use cases of Open Banking for payroll and invoicing—like instant payouts, account verification, pay-by-bank links, live reconciliation, and more to help you reduce delays, errors, and admin.

Case Study: The 5 Most Trusted Proptech Apps Using Open Banking in the UK Today

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now 13.3 million people in the UK already use Open Banking every month, a 40 % jump year-on-year. That momentum isn’t just sitting inside fintech; it’s powering a new wave of proptech apps that verify tenants…

3 Things Letting Agents Can Do with Open Banking Data

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Over 55% of UK tenants now expect digital-first interactions with letting agents from affordability checks to payment tracking. But most agencies still rely on emails, PDFs, and manual document reviews to verify income, deposits, or…

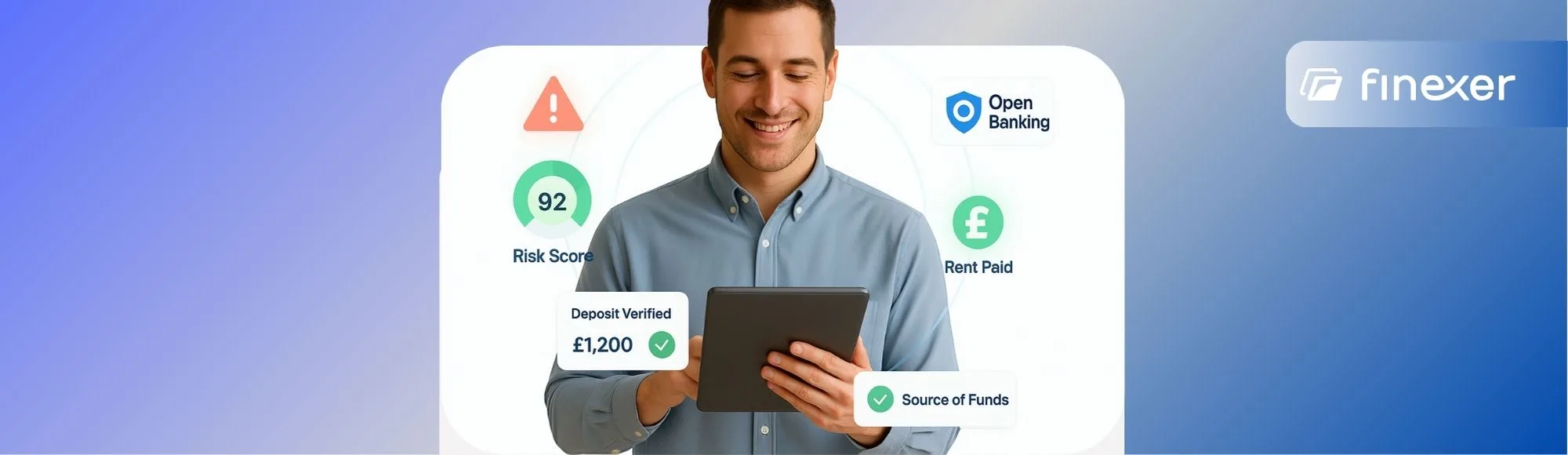

Open Banking for Proptech: Tenant Affordability, Rent Collection, and Source of Funds

Onboard Tenants Faster with Finexer Build a Compliance-Ready Rental Journey in 2026 with Finexer Try Now Despite major advances in property technology, many platforms still rely on slow, manual finance checks leading to delays, fraud risks, and lost revenue across the rental journey. UK landlords lose an average of £1,085 for every rental void, with…

Why More UK Businesses Are Adding Payment Links to Their Invoices

Looking for a faster way to get paid? Finexer lets you send secure, branded payment links your clients can use to pay instantly! no cards, no apps, no errors. Try Now Still relying on clients to manually copy your bank details or enter card info? There’s a faster, simpler way to get paid and it’s…

5 Best Payroll Services for Small Business: 2025 Guide

Tired of Payroll Delays? Connect with 99% of the UK Banks and Pay Staff Instantly, Scale Your Business without Limits Try Now Paying your team should be one of the simplest parts of running a business. But for most small firms, it quickly becomes a source of stress. Between HMRC deadlines, pension enrolment, variable hours,…

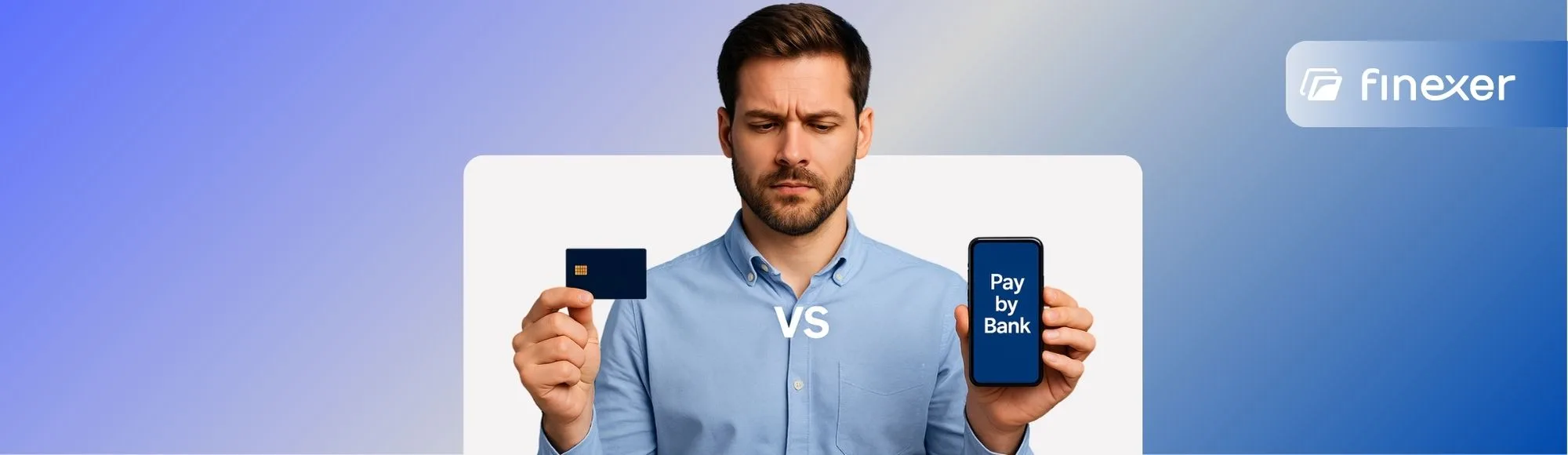

Pay by Bank vs Card Payments: Real Fees and Speed Comparison for UK Retailers

Still Paying High Card Fees? Switch to Pay by Bank and save up to 90% on transactional costs Try Now UK payment habits are shifting faster than many retailers realise. In the debate of pay by bank vs card Payments, Open Banking “Pay by Bank” transfers hit 223.9 million in 2024, a 72 percent jump…

Open Banking for EPOS & Retail Payments: Pay by Bank, Refunds, and QR Checkout

Get Paid Faster with Finexer Connect to 99% of UK banks and offer Pay by Bank at any EPOS or retail checkout with no card fees or delays. Try Now Open Banking is quietly reshaping how payments work in retail. Instead of relying on expensive card networks or long refund timelines, merchants can now offer…

Volt Open Banking Alternatives to Look For in 2025 for UK Businesses!

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Looking for a Volt Open Banking alternative that’s faster to deploy, easier to manage, or better aligned with your business model? Volt is a well-recognised platform in the Open Banking space, known for enabling real-time account-to-account (A2A) payments…

![10 Best Subscription Billing Software for UK SaaS & Startups [2025] 14 10 Best Subscription Billing Software for UK SaaS & Startups [2025]](/wp-content/uploads/2025/06/Subscription-Billing-Software-jpg.webp)

10 Best Subscription Billing Software for UK SaaS & Startups [2025]

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Subscription billing is essential for SaaS companies. It ensures consistent revenue, supports flexible pricing models, and reduces manual effort in managing recurring payments. According to Chargebee, up to 35% of recurring payments fail, with some…

Top 5 Ordopay Alternatives for Secure Open Banking Payments in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Ordopay has positioned itself as a modern way to accept Open Banking payments in the UK, offering a clean interface, fast bank transfers, and a merchant-friendly setup. But for businesses scaling up or operating in…

Atoa Pricing for Retailers: 2026 Transaction Fee Breakdown

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now If you’re a UK retailer tired of card machine costs eating into your margins, Atoa might be the pricing model you’ve been waiting for. With transaction fees starting from just 0.7% and no need for…

5 Key Benefits of Using a Cloud POS System for Growing Retail Businesses

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Retail has shifted far beyond the checkout counter. Today’s retailers need tools that can manage sales, stock, staff, and data across locations, online platforms, and time zones. That’s where cloud POS systems come in. Unlike traditional point-of-sale setups…

Still Struggling with Utility Billing? These 6 Platforms Solve It in 2025

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Utility billing is undergoing a rapid transformation in 2025 as providers face mounting pressure to modernise. With the rollout of smart meters and increased regulatory focus on billing accuracy, traditional systems are being replaced by automated platforms designed…

Neonomics Pricing Analysis: Is It Worth Your Money in 2026?

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Neonomics promises a modern, API-first approach to payments and data aggregation, with coverage across Europe and Open Banking compliance at its core. But for UK businesses evaluating Open Banking providers, the cost structure remains a grey area.…

Think Mollie Is Cost-Effective? Here’s What the 2026 Pricing Really Looks Like!

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now The pricing and company information featured in this article was sourced from official websites and public materials as of Jan 2026 Mollie is one of the most popular payment service providers in Europe, especially among e-commerce brands,…

6 Best Embedded Payments APIs in the UK: A 2025 Comparison Guide

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Bringing payments inside your product is no longer a “nice to have”; it’s the new standard for B2B platforms looking to improve user experience, increase margins, and own the full financial journey. Whether you’re building an accounting…

How Expense Automation Helps UK Accountants Process Claims

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Expense claims are one of the most common back-office frustrations. Between chasing receipts, entering amounts manually, and tracking down approvals, UK accounting teams often spend more time managing expenses than reviewing them. The process is slow, repetitive,…

Batch Payment Processing for Accounting Software Users: A 2025 Guide

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now You’ve done the work. Invoices are approved, and suppliers are waiting. Your accounting system can generate the payment list, but now comes the part no one talks about: getting those payments actually out the door. This is…

Bank Payment Delays: Why Cheques Arrive Late and Faster Alternatives

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Still waiting for a cheque to clear? You’re not alone. Many UK businesses continue to experience bank payment delays, even in 2025. A supplier sends an invoice, the finance team processes it, and then… a paper cheque…

PayPal vs Apple Pay vs Google Pay: What UK Merchants Should Know Before Choosing

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Choosing the right payment platform is a critical decision for any business aiming to improve customer experience and reduce transaction friction. While digital wallets like Google Pay, Apple Pay, and PayPal dominate the market, each offers different…

5 Step Guide to Collecting B2B Payments Without Damaging Client Relationships

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now If you’re managing finance in a B2B business, you’ve likely felt the strain of unpaid invoices firsthand. The average UK SME is owed over £21,000 in overdue payments at any given time. Across Europe, over 45% of…

Top Apple Pay Alternatives for UK Businesses in 2025

Accept Online Payments with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Note: The information in this blog is subject to change Apple Pay is widely used by customers, but for UK merchants, it might not always be the most cost-effective or inclusive option. From transaction fees and…

![Top Open Banking Platforms for UK Vendor Payments [2025] 27 Top Open Banking Platforms for UK Vendor Payments [2025]](/wp-content/uploads/2025/04/Vendor-Disbursement.jpg)

Top Open Banking Platforms for UK Vendor Payments [2025]

For many UK-based vendors and platforms, disbursing payments to suppliers is still a time-consuming, error-prone task. Whether you’re managing weekly invoices or daily contractor payouts, the manual work involved — from uploading spreadsheets to chasing payment statuses — adds up fast. That’s where modern banking integration solutions come in. Thanks to Open Banking, you can…

7 Best Accounting Workflow Software in 2025 for Growth

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Keeping track of recurring deadlines, team responsibilities, and client deliverables is one of the biggest challenges accounting firms face, especially as they grow. Spreadsheets, sticky notes, and email threads can only take you so far. Eventually, things…

Bank Transaction API: Detailed Guide for UK Startups

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Businesses today run on data—but when that data lives inside a bank account, getting it out securely, reliably, and in real time is a challenge. That’s where Bank Transaction APIs come in. Whether you’re a fintech startup,…