Tag: Open Banking

-

Guide:How Open Banking and AI Are Powering the Future of Personalised Finance

Need accurate bank data for AI models? Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now The financial services landscape is undergoing a dramatic shift. Today’s users don’t just want visibility into their money, they expect apps to understand their financial behaviours, anticipate their needs, and offer tailored recommendations.…

-

7 Business Functions Made Easier with an Account Information API

Get Instant Bank Data with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Manual document uploads. Delayed verifications. Incomplete financial data. For years, these have been the bottlenecks slowing down business operations across industries, from onboarding and credit checks to payouts and compliance reviews. But a better…

-

How B2B Companies Are Using Open Banking to Modernise Finance in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now For B2B companies tired of waiting on PDFs and manual uploads, Open Banking is the shortcut to faster decisions, cleaner data, and smoother payments. In a recent Mastercard survey spanning the U.S., U.K., Nordic countries,…

-

Legacy Payments Are Costing UK SMEs More Than They Think

Replace Legacy Payments with Instant Bank Transfers Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Despite the rise of modern digital finance tools, legacy payments are still deeply embedded in how many UK SMEs operate. Cheques, BACS transfers, manual bank reconciliation, and even faxed invoices continue to be…

-

6 Legaltech Platforms Using Open Banking to Modernise Law Firm Workflows in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now The legal sector has historically been slow to adopt financial technology, but that’s changing fast. A new wave of legaltech platforms is using Open Banking to help law firms cut delays, reduce manual reviews, and…

-

Choosing a Pay by Bank API: What Actually Matters for Your Dev Team

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Integrating a pay by bank API isn’t a usual decision; it’s a technical one. Your dev team is the first to see how well an API performs, and often the last to clean up when…

-

Open Banking Provider Evaluation Guide: What UK Firms Need to Know in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Open Banking providers in the UK offer more than just APIs, they shape how your product handles payments, access to financial data, and ongoing compliance. In 2025, the open banking provider evaluation process isn’t just…

-

Utility Billing Refunds UK: Why They’re Slow & How to Fix Them

Slow utility billing refunds are frustrating customers and costing providers time. This blog breaks down the hidden back-office issues behind refund delays and shows how UK utilities can fix them with faster, automated payment infrastructure.

-

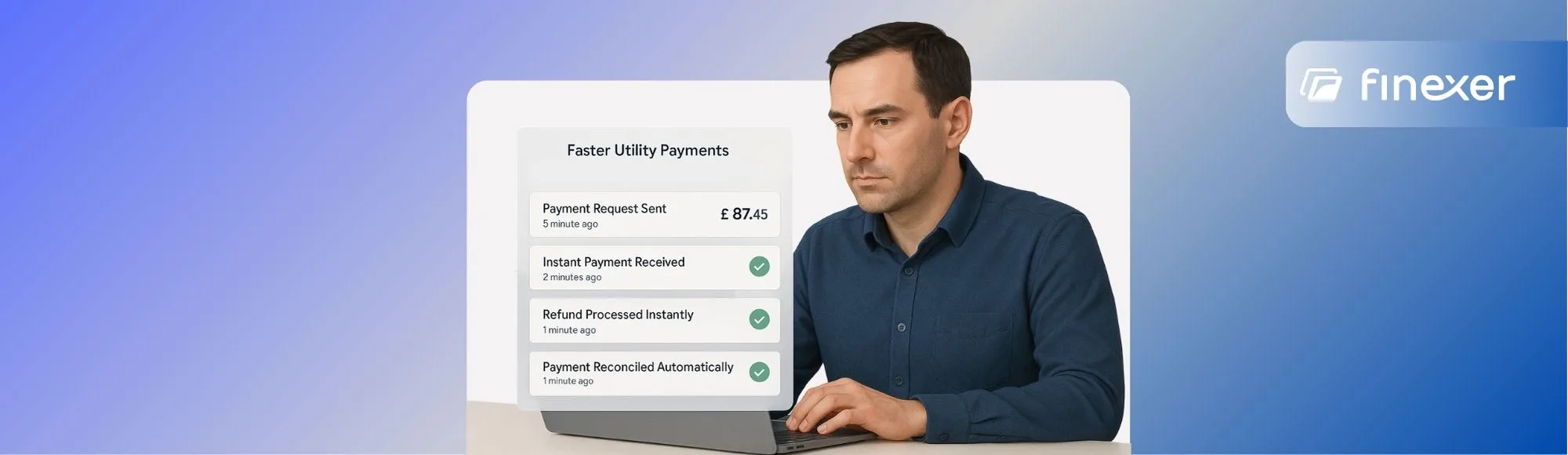

Open Banking for Utilities: Instant Payments, Refunds, and Reconciliation

Find how Open Banking for utilities helps UK providers get paid faster, issue real-time refunds, and reconcile automatically — all through secure, account-to-account transfers.

-

Open Banking for Payroll and Invoicing: One API for Salary Runs, Invoice Links, and Payee Checks

This blog covers 10 practical use cases of Open Banking for payroll and invoicing—like instant payouts, account verification, pay-by-bank links, live reconciliation, and more to help you reduce delays, errors, and admin.

-

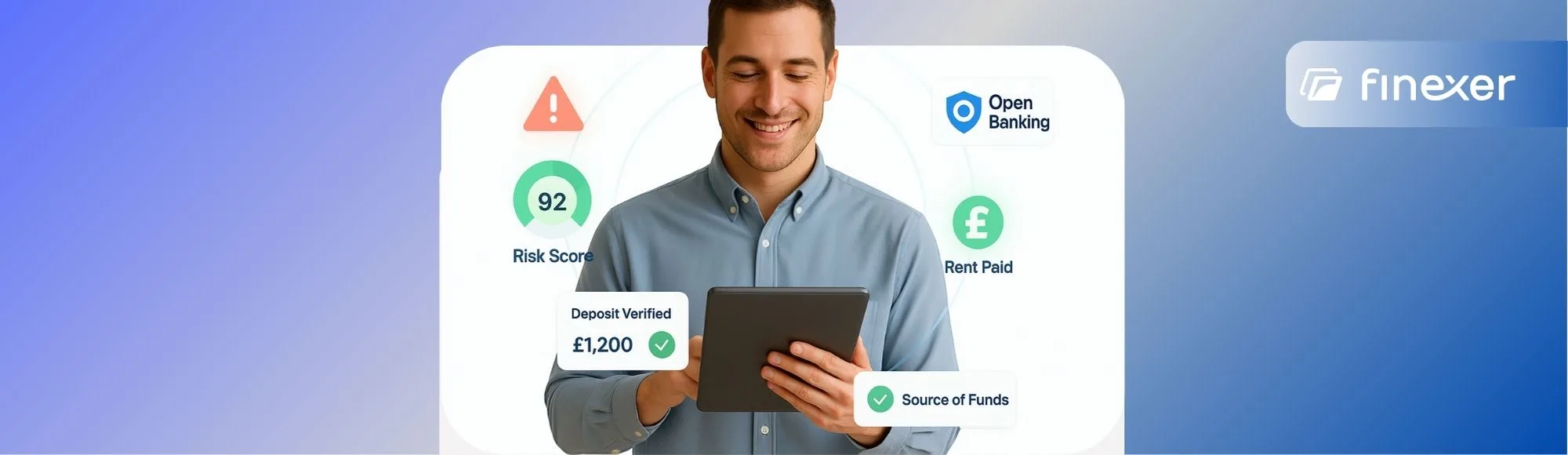

Case Study: The 5 Most Trusted Proptech Apps Using Open Banking in the UK Today

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now 13.3 million people in the UK already use Open Banking every month, a 40 % jump year-on-year. That momentum isn’t just sitting inside fintech; it’s powering a new wave of proptech apps that verify tenants…

-

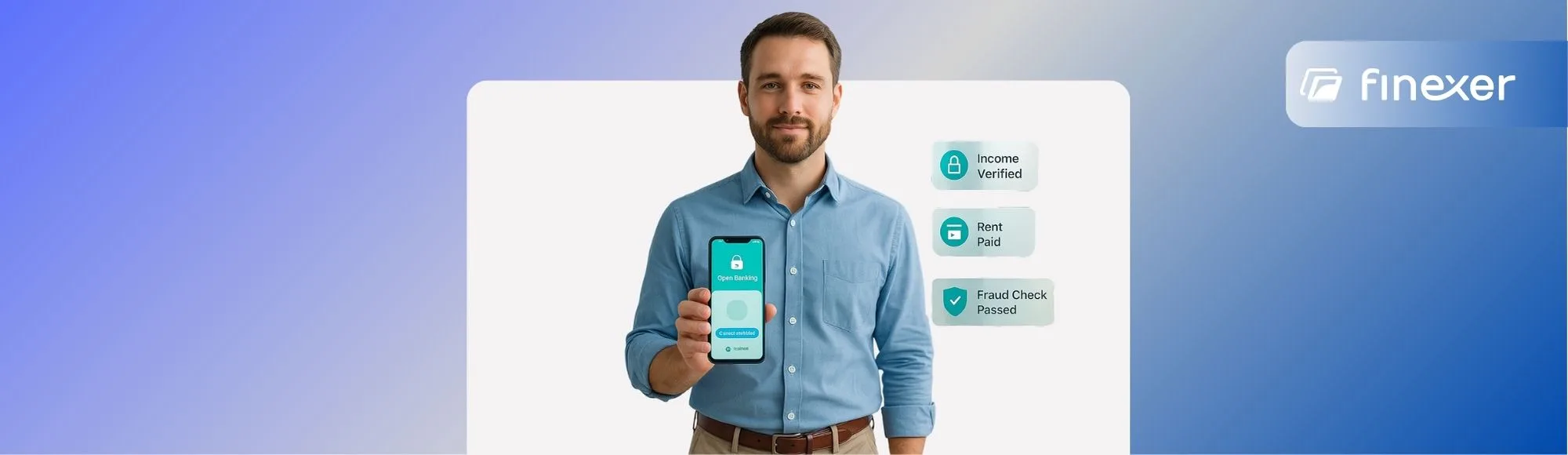

3 Things Letting Agents Can Do with Open Banking Data

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Over 55% of UK tenants now expect digital-first interactions with letting agents from affordability checks to payment tracking. But most agencies still rely on emails, PDFs, and manual document reviews to verify income, deposits, or…

-

Open Banking for Proptech: Tenant Affordability, Rent Collection, and Source of Funds

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Despite major advances in property technology, many platforms still rely on slow, manual finance checks leading to delays, fraud risks, and lost revenue across the rental journey. UK landlords lose an average of £1,085 for…

-

Why More UK Businesses Are Adding Payment Links to Their Invoices

Looking for a faster way to get paid? Finexer lets you send secure, branded payment links your clients can use to pay instantly! no cards, no apps, no errors. Try Now Still relying on clients to manually copy your bank details or enter card info? There’s a faster, simpler way to get paid and it’s…

-

Pay by Bank vs Card Payments: Real Fees and Speed Comparison for UK Retailers

Still Paying High Card Fees? Switch to Pay by Bank and save up to 90% on transactional costs Try Now UK payment habits are shifting faster than many retailers realise. In the debate of pay by bank vs card Payments, Open Banking “Pay by Bank” transfers hit 223.9 million in 2024, a 72 percent jump…

-

Open Banking for EPOS & Retail Payments: Pay by Bank, Refunds, and QR Checkout

Get Paid Faster with Finexer Connect to 99% of UK banks and offer Pay by Bank at any EPOS or retail checkout with no card fees or delays. Try Now Open Banking is quietly reshaping how payments work in retail. Instead of relying on expensive card networks or long refund timelines, merchants can now offer…

-

The Real Reason Behind Loan Rejection (And How to Fix It)

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Loan rejection is no longer just about bad credit or missed payments. Many lenders today are turning away applicants with seemingly good financial profiles, credit scores in the 700s, stable employment, and no outstanding defaults. So what’s going…

-

![Case Study: 6 Lending Platforms That Use Open Banking to Speed Up Approvals [2025] 18 Case Study: 6 Lending Platforms That Use Open Banking to Speed Up Approvals [2025]](/wp-content/uploads/2025/06/6-Lending-platforms-that-use-Open-banking-jpg.webp)

Case Study: 6 Lending Platforms That Use Open Banking to Speed Up Approvals [2025]

Get Bank Data Instantly with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Loan applications shouldn’t drag on for days just because someone’s bank statement needs printing, exporting, uploading, and then reviewing manually. But that’s still the bottleneck many lenders face: outdated documentation, back-and-forth with applicants, and…

-

Open Banking for Lending: Income, Affordability, and Faster Approvals

Get Instant Affordability Checks with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Lending is no longer just about credit scores and forms, it’s about data access, speed, and trust. From personal loans to SME working capital, credit providers face two stubborn bottlenecks: confirming income accurately and…

-

What Is P2P Lending? How It Works & Open Banking’s Role in 2025

Verify Income Instantly with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Peer-to-peer (P2P) lending is transforming how people access credit and invest. Instead of relying on traditional banks, borrowers connect directly with individual investors through online platforms, streamlining the process and reducing overhead. This model is…

-

5 P2P Lending Platforms Connecting Borrowers and Investors

Instant Affordability Assessment with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Accessing credit shouldn’t feel like hitting a wall, and earning passive income shouldn’t require a stock market degree. That’s where P2P lending platforms come in, offering a direct connection between borrowers who need funds and investors looking to…

-

Volt Open Banking Alternatives to Look For in 2025 for UK Businesses!

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Looking for a Volt Open Banking alternative that’s faster to deploy, easier to manage, or better aligned with your business model? Volt is a well-recognised platform in the Open Banking space, known for enabling real-time account-to-account (A2A) payments…

-

Top 5 Ordopay Alternatives for Secure Open Banking Payments in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Ordopay has positioned itself as a modern way to accept Open Banking payments in the UK, offering a clean interface, fast bank transfers, and a merchant-friendly setup. But for businesses scaling up or operating in…

-

5 Atto Alternatives Built for Lenders, Insurers, and Letting Agents in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Income verification has evolved from a manual form–filling process to a rapid, real–time workflow. In fact, a recent Equifax study found that a car finance lender achieved a 90 % opt‑in rate when offering Open Banking…

-

4 Fraud Prevention Technologies Every Retailer Should Deploy

Accept Payments Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Retail fraud is no longer just a card-skimming issue. From in-store refund scams to online account takeovers, UK retailers are seeing sharper, more frequent attacks, and unfortunately, many businesses are still playing catch-up. According to…

-

Atoa Pricing for Retailers: 2025 Transaction Fee Breakdown

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now If you’re a UK retailer tired of card machine costs eating into your margins, Atoa might be the pricing model you’ve been waiting for. With transaction fees starting from just 0.7% and no need for…

-

Bud vs Armalytix vs Finexer: Best for Verified Audit Data in 2025?

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now When you’re preparing financial audits, KYC checks, or compliance reports, raw bank statements aren’t enough. You need verified audit data that is accurate, categorised, and sourced directly from the bank to meet regulatory standards and reduce manual review…

-

Yodlee vs Salt Edge: Which Platform Handles Consent, Coverage & Control Better?

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now If you’re weighing up Yodlee vs Salt Edge for your financial product or integration, compliance is just the starting point. Both platforms support Open Banking, but their coverage, developer experience, and how they handle UK bank connections vary…

-

8 Automated Invoice Processing Tools Built for UK Growing Businesses

Get Paid Faster with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Every time an invoice lands in your inbox, someone has to open it, extract the details, log it into your system, and forward it for approval. Multiply that by 50, 100, or even 300 times a month, and…

-

Plaid vs Tink: Who Delivers Cleaner Transaction Data for UK Fintechs?

Get Instant bank Data with Finexer Connect with UK Banks and Scale Your Business without Limits Try Now Messy transaction data isn’t just a developer headache; it’s a product killer. For UK fintechs building personal finance tools, SME credit platforms, or real-time risk models, raw bank feeds often arrive cluttered with vague merchant references, inconsistent…