Tag: Open Banking

7 Questions to Ask Before Choosing a Bank Data API

Setup Bank Data API Instantly with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now UK businesses are increasingly turning to direct bank connections to reduce payment costs and improve customer experience. With over 5 billion real-time transactions processed last year, the demand for reliable banking infrastructure has…

Source of Wealth API: Complete Guide for UK Firms

Learn how Source of Wealth APIs help UK firms verify client wealth faster. See how Finexer enables compliant, real-time verification using Open Banking data.

20 Open Banking Examples: Real Use Cases Transforming UK Finance

Explore 20 real open banking examples in the UK. Learn how businesses use instant payments, APIs, and real-time data and how Finexer helps power it all.

Securing the Open Banking Ecosystem: Technical Implementation Guide

Setup Open banking infrastructure 2-3x faster with finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Open banking APIs processed $57 billion in global transactions during 2023. APIs now handle 31% of all web traffic, but financial services ranks as the third-most targeted sector for web application attacks. This creates…

Best Bank Data Aggregation Tools for 2025 to Streamline Your Workflow

The information in this comparison table was sourced from publicly available material on each provider’s website and official documentation as of 10th October 2025 Bank data aggregation has moved from being a back-office function to a core operational requirement for regulated businesses in the UK and Europe. With open banking adoption now exceeding 63 million…

7 Best Financial Data Aggregators in the UK (2026 Guide)

Explore the 7 best financial data aggregator platforms in the UK. Compare coverage, features, and use cases to find the right fit for your business.

![Yodlee Aggregator: How It Works & Best UK Alternative [2025] 7 Yodlee Aggregator: How It Works & Best UK Alternative [2025]](/wp-content/uploads/2025/10/Yodlee-aggregator-api-jpg.webp)

Yodlee Aggregator: How It Works & Best UK Alternative [2025]

Learn how the Yodlee Aggregator works, its UK limitations, and why explore faster, affordable Open Banking alternative for 2025.

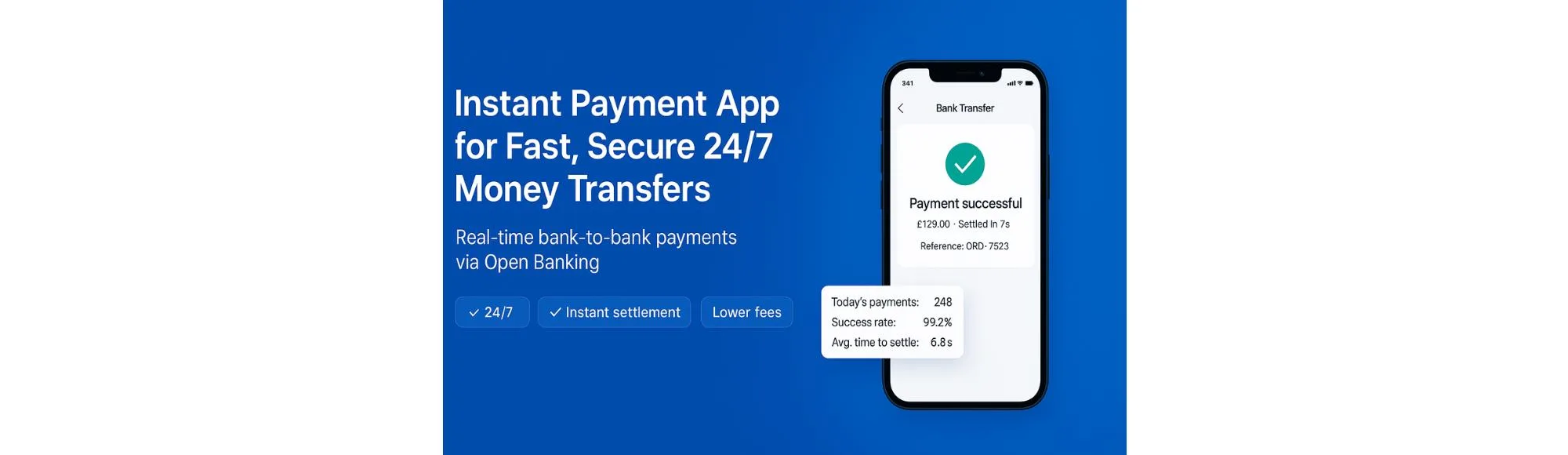

Instant Payment App for Fast, Secure 24/7 Money Transfers

Instant payment app for UK businesses: real-time bank transfers, 24/7 availability, lower fees than cards, and Open Banking Payment Initiation by Finexer.

Consent-Driven Financial Data Aggregation: Secure Account Access Explained

Learn how financial data aggregation works, from consent to secure APIs. Benefits, challenges, regulations, and future trends explained clearly.

Best Practices for Reducing Compliance Cost for UK Lenders

Learn how Open Banking reduces the compliance cost for lenders in the UK by automating checks, improving accuracy, and cutting manual effort

Yapily vs Plaid: Which AIS Provider Fits Your Business in 2025?

Compare Yapily and Plaid for AIS in the UK. See how they differ on bank coverage, business account access, and pricing

A guide to reducing Customer Due Diligence costs for UK law firms

Practical guide for UK law firms to cut customer due diligence costs. Learn workflows, tools, and where savings truly come from for AML compliance.

Yaspa Pricing & Review 2026: Payouts, Fees, Pros & Cons

Explore Yaspa’s 2025 pricing, payouts features, fees, pros and cons. Learn how its Open Banking payments and refund capabilities fit UK businesses.

Streem Connect Pricing for Accountants (2026 Guide)

Discover Streem Connect pricing for accountants in 2025. Learn about subscription fees, per-link costs, add-ons, and compare with Finexer’s flexible usage-based model.

Airwallex UK Pricing & Features: What UK Businesses Need to Know

Discover the key features and pricing plans of Airwallex UK business accounts in 2025. Learn about multi-currency accounts, payment fees, and corporate cards.

SumUp Pricing UK: What You’ll Really Pay in 2026

Cut Your Payment Fees with Finexer Instant bank-to-bank payments, no setup costs, and 3–5 weeks of integration support included Try Now Choosing a payment provider isn’t just about convenience; it directly affects your margins, your cash flow, and how quickly you get paid. For many small UK businesses, SumUp is the first name that comes…

Reducing Property Management Costs: The Digital Payment Advantage

Struggling with high fees? Find how open banking can slash property management costs and automate rent collection.

Law Firm Cost Management for UK: How Finexer Can Cut KYC and Payment Expenses

Law Firm Cost management made simple for UK law firms, Cut KYC and payment costs, boost compliance, and improve efficiency with Finexer.

Instant Payment Systems: Transforming Business Payments in the UK and Beyond

Adopt instant payment systems to transform your business. Learn how to improve cash flow, reduce operational costs, and lower transaction fees today.

Best Merchant payment services in the UK: 4 Cost-effective options for 2025

Compare cost-effective merchant payment services in the UK. Discover top providers, pricing, and how to cut up to 90% of transaction costs with Pay by Bank.

Trusted PSD2-Compliant APIs for Secure Payments and Bank Data in the UK

Discover the leading PSD2-compliant API providers in the UK for 2025. Explore FCA-authorised platforms offering secure payment initiation and account data APIs.

Nuapay Alternatives UK Businesses Should Consider in 2025

Discover the best Nuapay competitors in 2025. Find top Account-to-Account payment providers and find the right alternative for UK businesses.

Best Online Gaming Payment Gateway for UK Businesses

Explore top online gaming payment gateway UK options for secure, fast iGaming payments & withdrawals in 2025.

Guide to AIS Open Banking Features in the UK: Implementation and Business Benefits

Discover how AIS open banking features transform UK businesses with real-time bank data, secure APIs, and automation.

10 Best Digital Payments Solution

Compare the best digital payments solutions in the UK. See providers, costs, payout speeds, and find the right fit for your business in 2025.

The Ultimate Guide to Choosing an iGaming Payment Provider in 2025

Choose the best UK iGaming payment provider. Explore top methods, security, open banking, and Finexer’s tailored solutions.

Budget-Friendly Open Banking Solutions in the UK: A 2025 Guide

Find budget-friendly open banking solutions in the UK. Compare providers, pricing models, and cost-saving features for SMEs and startups.

Instant Payments for Retail Success: Best EPOS Payment Providers UK 2025

Find the UK’s best EPOS payment providers for 2025. Our guide compares Square & Zettle with Open Banking for instant, low-cost payments.

Open banking for UK energy suppliers: reduced costs and churns

Discover how Open Banking helps UK energy suppliers cut transaction costs, speed up payments, and reduce customer churn.

6 Best Bulk Payment Systems for UK Businesses in 2025

Explore the top 6 bulk payment systems for UK businesses in 2025. Compare providers on coverage, speed, and cost to find the right fit for your payouts.