Tag: Open Banking

6 Best Bulk Payment Systems for UK Businesses in 2025

Explore the top 6 bulk payment systems for UK businesses in 2025. Compare providers on coverage, speed, and cost to find the right fit for your payouts.

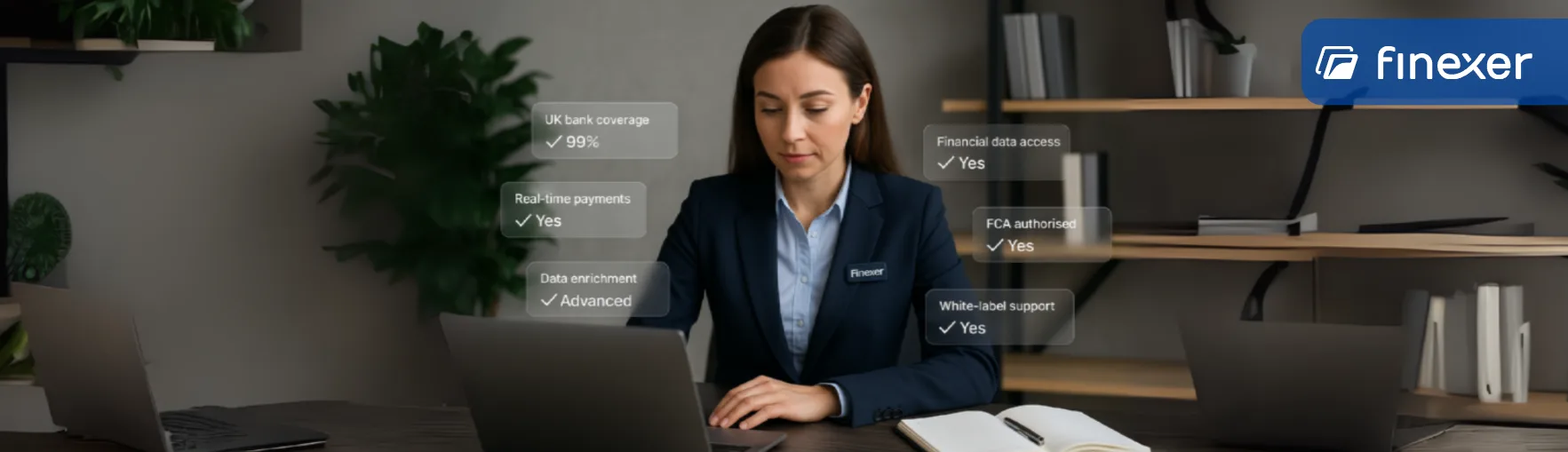

Finexer vs Moneyhub: Which Solution Wins for Income & Affordability Checks in the UK?

Looking for the right tool for UK income & affordability checks? This Moneyhub comparison breaks down features, compliance, and real use cases

With 15 Million Users, Open Banking is Now Essential UK Financial Infrastructure

As of Sept 2025, Open Banking has hit 15 million users in the UK. Discover how this API technology is transforming UK finance for businesses & consumers.

Marketplace Payouts via Open Banking in the UK

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Marketplace payouts are the backbone of every successful platform in the UK, powering seller earnings across retail marketplaces, gig economy apps, and rental platforms. The reliability and speed of these payouts directly influence seller trust…

![5 Best QR Code Payment Platforms in the UK [2026 Guide] 5 5 Best QR Code Payment Platforms in the UK [2026 Guide]](/wp-content/uploads/2025/09/QR-Based-Payment-Providers-jpg.webp)

5 Best QR Code Payment Platforms in the UK [2026 Guide]

Instant Settlement with Finexer Connect to 99% of UK banks and accept QR-based payments with zero setup fees! Try Now QR code payments are quickly becoming a reliable and cost-effective payment method for UK businesses. As more customers rely on mobile phones to shop and pay, scanning a QR code has become just as common…

Insurance Payment Methods in 2025: Top Solutions for UK Businesses

Start Collecting & Paying Instantly Cut costs and delays in insurance payments. Use Finexer to connect with 99% of UK banks for instant premium collections and claim payouts. Try Now The way customers pay for insurance is undergoing a major shift. For UK insurers, brokers, and online merchants selling insurance products such as travel, car…

![5 Best Third Party Providers for Account Information UK Businesses Can Trust [2025] 7 5 Best Third Party Providers for Account Information UK Businesses Can Trust [2025]](/wp-content/uploads/2025/08/TPP-for-account-information-UK-jpg.webp)

5 Best Third Party Providers for Account Information UK Businesses Can Trust [2025]

Get Bank Transaction data with Finexer Get FCA-authorised access to 99% of UK banks with Finexer’s Account Information API. Secure, compliant, and ready to integrate. Try Now Access to accurate and verified bank data has become essential for UK businesses, whether it’s for compliance checks, reconciliations, or customer onboarding. With Open Banking, this is no…

![Top 5 Open Banking Third Party Providers for Payment Initiation [2025 Guide] 8 Top 5 Open Banking Third Party Providers for Payment Initiation [2025 Guide]](/wp-content/uploads/2025/08/open-banking-providers-for-payment-initiation-jpg.webp)

Top 5 Open Banking Third Party Providers for Payment Initiation [2025 Guide]

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now For UK businesses, handling payments is no longer just about debit or credit card rails. With the rise of Open Banking, firms now have the option to connect directly to customer bank accounts for faster,…

![Best Modulr Alternative for Embedded Payments in the UK [2025 Guide] 9 Best Modulr Alternative for Embedded Payments in the UK [2025 Guide]](/wp-content/uploads/2025/08/Modulr-embedded-payments-jpg.webp)

Best Modulr Alternative for Embedded Payments in the UK [2025 Guide]

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Embedded payments are the backbone of modern finance operations in the UK. Whether it’s payroll, supplier disbursements, or instant customer refunds, businesses now expect payments to run invisibly inside their platforms. Modulr is one of…

![Similar Open Banking Providers to Salt Edge for UK Businesses [2025 Guide] 10 Similar Open Banking Providers to Salt Edge for UK Businesses [2025 Guide]](/wp-content/uploads/2025/08/Similar-providers-like-Saltedge-jpg.webp)

Similar Open Banking Providers to Salt Edge for UK Businesses [2025 Guide]

Get Access to Open banking with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Salt Edge has established itself as one of the best-known names in open banking, powering both account information services (AIS) and payment initiation services (PIS) across Europe. With connections to over 5,000 banks…

Similar Open Banking Providers like Tink in the UK

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Tink is one of the most recognised names in open banking across Europe and the UK, offering both account information services (AIS) and payment initiation services (PIS). Its platform supports balance checks, Pay by Bank…

![Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide] 12 Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide]](/wp-content/uploads/2025/08/Open-banking-for-Multi-client-management-jpg.webp)

Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide]

Stop chasing client bank statements! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Handling data and bank feeds for multiple clients has long been a tedious part of accounting, chasing down PDFs, vetting spreadsheets, and wrangling statements from every bank. It’s inefficient, error-prone, and limits a firm’s ability…

How Open Banking APIs Are Transforming Accounting Firm Client Onboarding

Faster Onboarding with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now For UK accountants, client onboarding is no longer a back‑office formality; it’s a regulatory obligation and a client experience benchmark. Accounting firm client onboarding often still means chasing PDF bank statements, requesting utility bills, and manually…

Top 5 Open Banking Providers for Automated Bank Reconciliation in Accounting Platforms

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Why accounting platforms need automated bank reconciliation Manual reconciliation is one of the most time-intensive tasks in accounting. Firms still spend hours pulling PDF bank statements, cross-checking transactions, and correcting errors that slip through. For…

How Growing Accounting Firms Use Open Banking for Faster Client Payouts

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In the UK, growing accounting firms are under more pressure than ever to deliver faster client payouts. Whether it’s reimbursing expenses, processing payroll, or making supplier payments, waiting several days for funds to clear can…

Live Bank Feeds for Accountants: Plaid vs Tink vs Finexer— What Works in the UK?

Get MTD Compliant Live Bank Feeds with Finexer! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Live bank feeds for accountants are no longer a nice-to-have, they’re a daily essential. In the UK, where HMRC’s Making Tax Digital rules and real-time reporting are pushing firms toward automation, getting…

Open Banking Providers for UK Accounting Firms

Grow Your Firm Without the Admin Bottlenecks Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Mid-size and scaling accounting firms face a daily challenge: keeping financial data accurate, up to date, and easy to access without slowing down client work. Chasing bank statements, waiting for CSV files, and…

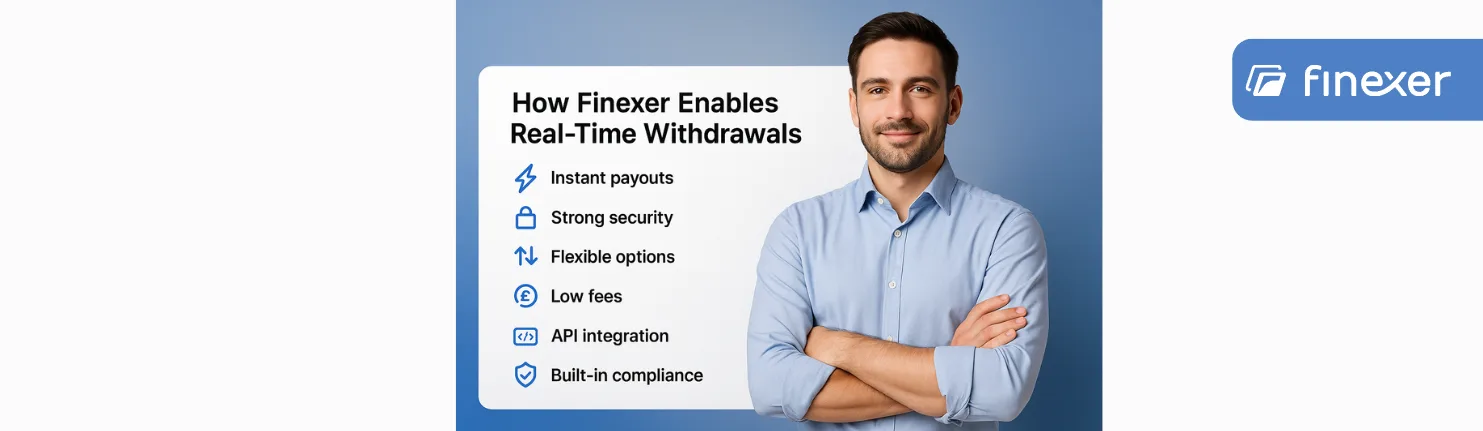

How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms

Get Instant Withdrawals with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now How Finexer Enables Real-Time Withdrawals for Payout-Heavy Platforms If your platform moves money daily, whether it’s paying contractors, refunding customers, or releasing commissions, you already know that traditional payout methods are painfully slow. Bank transfers…

Finexer VRP API: Set Up Variable Recurring Payments in the UK

Get Paid Faster with Finexer’s VRP Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Traditional recurring payment systems weren’t built for today’s UK businesses. Whether you’re handling loan repayments, donation billing, or subscription renewals, chances are you’re stuck with rigid, outdated tools, think standing orders, direct debits, or…

Risk Profiling with Real-Time Bank Data: A Wealthtech Perspective

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Managing client portfolios today requires more than ticking off a risk questionnaire. For UK wealth platforms, risk profiling must evolve to meet stricter compliance rules, changing client behaviours, and the demand for real-time personalisation. That’s…

How Finexer Powers Bulk Payments for UK Businesses

Now Pay Faster with Finexer! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now In the world of business finance, few functions are as routine or as risky, as bulk payments. Whether you’re disbursing salaries, paying out investor returns, settling refunds, or managing contractor invoices, bulk payment processing is…

6 Account Aggregation APIs Built for Wealthtech Platforms in 2025

Looking for UK based Account Aggregation API ? Access 99% of UK Banks with Categorised Data Built for Wealth Platforms Try Now Although fewer than one-third of affluent clients stick with a single platform, nearly 45% plan to move 25–50% of their assets to alternative providers, according to EY’s 2025 Global Wealth Research Report. The…

6 Reasons Wealth Management Platforms Are Adopting Open Banking APIs

Looking to modernise your wealth management platform? Access real-time financial data, onboard investors faster, and stay fully compliant, all with Finexer’s Open Banking API. Try Now Wealthtech platforms are under increasing pressure to deliver seamless, digital-first experiences, and traditional onboarding and data aggregation methods are increasingly out of step. According to a 2024 report by…

Insurance Fraud Prevention Just Got Easier with Live Bank Data

Say Goodbye to Fake Docs Connect with 99% of the UK Banks and Detect Policy Fraud Instantly Try Now Insurance fraud prevention is no longer a back-office task, it’s a frontline defence. From income misrepresentation to coordinated claim scams, fraud tactics have become faster, more digital, and harder to trace. Yet many insurers still rely…

How Insurance Uses Open Banking for Faster Claims, Verified KYC, and Real-Time Payouts

Still Reviewing Claims Manually? Finexer lets you assess claims using verified customer bank data securely and in seconds. Try Now Insurance processes often involve delays at critical points, such as onboarding, claim validation, and payouts. Manual checks, scanned statements, and back-and-forth emails increase costs and slow resolution times. Open Banking allows insurance providers to collect…

Ivy Pricing in 2026: Fees, Hidden Costs, and Smarter Alternatives

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now If you’re here trying to make sense of Ivy pricing, you’re not alone. Many finance teams hit the same wall: no public rates, no pricing calculator, and no clear idea of what it’ll actually cost…

Avoid High Transaction Fees: How Open Banking Cuts Costs for UK Businsess

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Most UK startups underestimate how much they lose to transaction fees until they look closely. Whether it’s paying contractors abroad, collecting customer payments, or processing everyday expenses, fees creep in from all angles: FX markups,…

Top Wise Alternatives & Competitors for UK Businesses

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Wise has made it easy for startups to hold and move money across currencies with minimal fees. But as finance operations become more complex with multiple entities, investors, budgets, and compliance layers, Wise starts to…

Bank Transfers Blocked or Delayed? Here’s What to Fix

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now A bank transfer in the UK is supposed to be fast, simple, and trackable. But for many people, especially those handling business payments, things don’t always go as planned. Sometimes the money doesn’t arrive when…

Ivy vs Tink vs Finexer: Open Banking APIs Compared

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Choosing between Ivy and Tink can be a key decision for fintech teams building payments, data access, or account verification flows. Both platforms operate across Europe, offer Open Banking APIs, and help businesses connect directly…