Tag: transaction data

Data Enrichment API for UK Financial Platforms

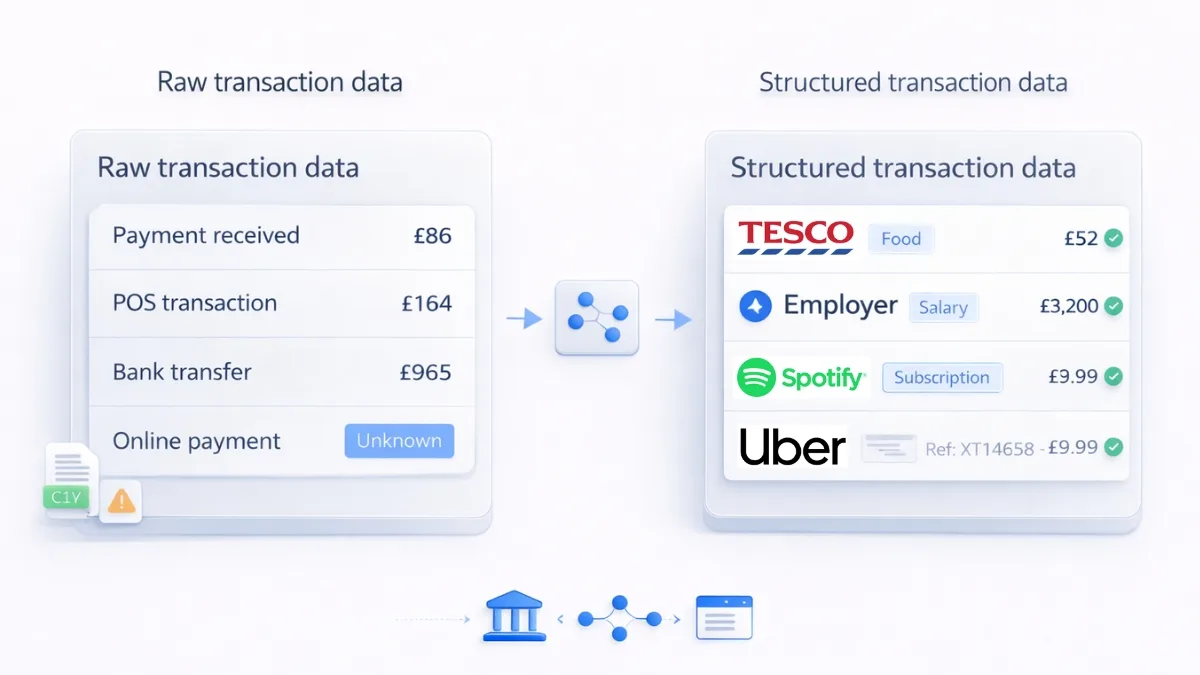

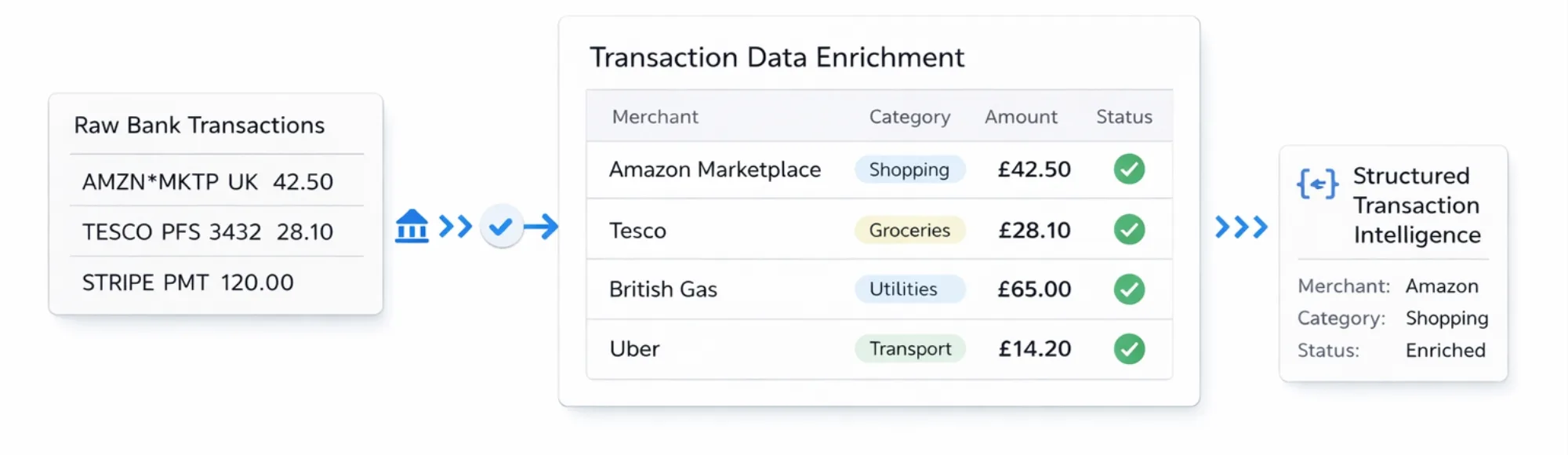

Need structured transaction data for your platform? Access enriched bank transaction data via open banking APIs Contact Now UK platforms building financial features cannot automate workflows when transaction data arrives unclear and unstructured. Accounting software, lending platforms, and fintech products need data enrichment API access providing merchant details, transaction categories, and structured information without manual…

Transaction Data Enrichment for Platforms: Turn Raw Bank Transactions into Usable Intelligence

FCA-authorised APIs for UK platforms. Evaluate enrichment infrastructure now

Proof of Funds: Fast Verification Without Manual Bank Statements

Verify proof of funds in seconds without bank statements. Discover how direct bank verification speeds onboarding and removes document fraud risk.

How to Choose an AIS Provider for Income Verification: A Step-by-Step Guide for 2026

Learn how to select the right AIS Provider for accurate income verification in 2026. Compare key features, compliance factors, and leading platforms.

How Enterprises Should Evaluate Bank Data Quality: A 12-Point Checklist

A practical, enterprise-friendly framework for evaluating Bank Data Quality, accuracy, enrichment, and compliance for real-time financial operations.

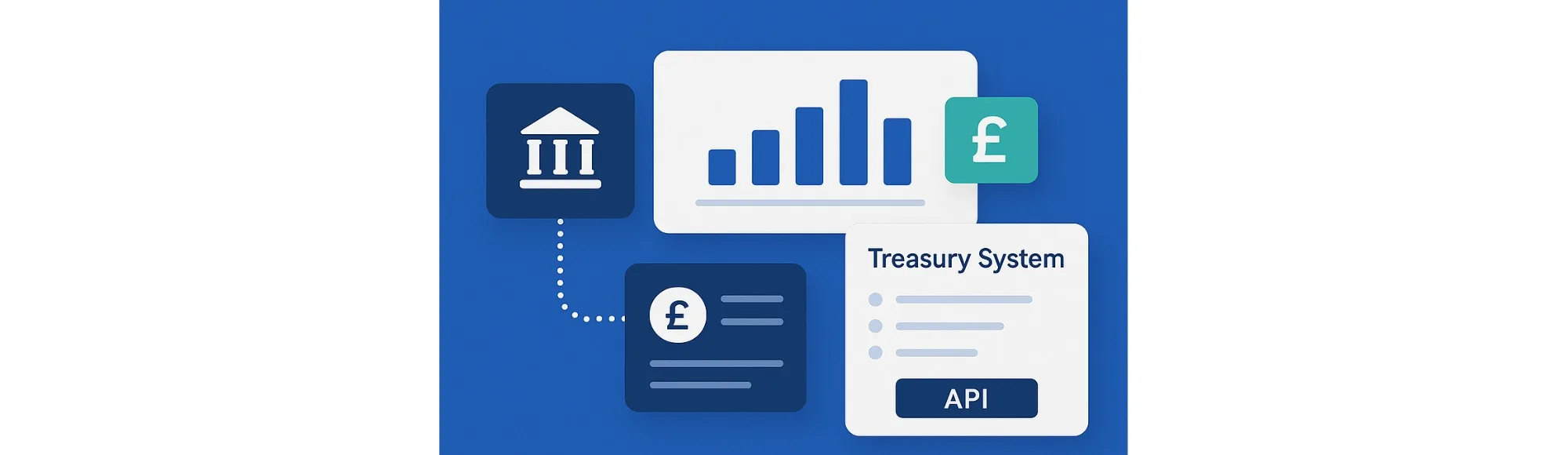

Open Banking API Integration for Enterprise Treasury Management Systems

See how UK enterprises enhance treasury management systems with real-time bank data via Open Banking APIs. Finexer provides fast, clean connectivity

Building Behavioural Insights from Open Banking Data (Without Breaching Consent)

Learn how lenders can build behavioural insights from consent-led Open Banking Data. Clear guidance on affordability, patterns, and compliant data use.

From Raw to Reliable: How Categorised Bank Data Transforms Credit Underwriting

Learn how categorised bank data strengthens affordability checks, reveals risk signals, and improves underwriting accuracy for UK lenders. Practical insights included.

Expense Claims Automation: 5 Ways Real-Time Bank Data Helps

Find how real-time bank data automates expense claims, prevents errors, and improves accounting accuracy for UK firms using Open Banking APIs.

A UK Lender’s Guide to Better Risk Assessments with Bank Data

Learn how UK lenders can use real-time bank data to build faster, fairer, and more accurate risk assessments.

Top Scalable Banking Data Aggregation Solutions for UK Businesses in 2026

Find the top scalable banking data aggregation platforms in the UK. Compare features, coverage, and performance to choose the right provider for your business.

Guide to Scalable Customer Retention with Open Banking UK

Discover how open banking boosts customer retention, guide to building lasting customer loyalty.

Planky Review for Data Aggregation and Alternatives in the UK (2025 Guide)

Find the best UK alternatives to Planky for Open Banking data aggregation — built for faster deployment, wider coverage, and flexible pricing.

The Most Cost-Effective Open Banking API for UK Businesses

Compare the most cost-effective Open Banking APIs for UK firms. Explroe pricing, coverage, and deployment insights

![Top 7 Source of Wealth APIs in the UK [Comparison Guide] 15 Top 7 Source of Wealth APIs in the UK [Comparison Guide]](/wp-content/uploads/2025/10/Source-of-wealth-APIs-in-the-UK-jpg.webp)

Top 7 Source of Wealth APIs in the UK [Comparison Guide]

Try Finexer for Instant Source of wealth Checks Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now As UK regulators tighten anti-money-laundering (AML) oversight, firms are rapidly shifting from manual document reviews to automated Source of Wealth (APIs). In 2024 alone, UK financial institutions increased their investment in compliance…

Historical Financial Data Aggregation: How It Works and Key Insights

Learn how historical financial data aggregation helps UK businesses access up to 5 years of bank data via regulated APIs for compliance, credit, and accounting.

![5 Best Bank Transaction APIs in the UK [2025 Guide] 17 5 Best Bank Transaction APIs in the UK [2025 Guide]](/wp-content/uploads/2025/10/bank-transaction-api-in-the-UK-jpg.webp)

5 Best Bank Transaction APIs in the UK [2025 Guide]

Compare the best Bank Transaction API providers in the UK. Evaluate coverage, enrichment, and payments to choose the right solution for your business.

Guide to Data Privacy in Account Data Aggregation

Learn how to implement data privacy keeping client data private and compliant through secure account data aggregation and consent-driven access in the UK.

7 Best Financial Data Aggregators in the UK (2026 Guide)

Explore the 7 best financial data aggregator platforms in the UK. Compare coverage, features, and use cases to find the right fit for your business.

![Yodlee Aggregator: How It Works & Best UK Alternative [2025] 20 Yodlee Aggregator: How It Works & Best UK Alternative [2025]](/wp-content/uploads/2025/10/Yodlee-aggregator-api-jpg.webp)

Yodlee Aggregator: How It Works & Best UK Alternative [2025]

Learn how the Yodlee Aggregator works, its UK limitations, and why explore faster, affordable Open Banking alternative for 2025.

Consent-Driven Financial Data Aggregation: Secure Account Access Explained

Learn how financial data aggregation works, from consent to secure APIs. Benefits, challenges, regulations, and future trends explained clearly.

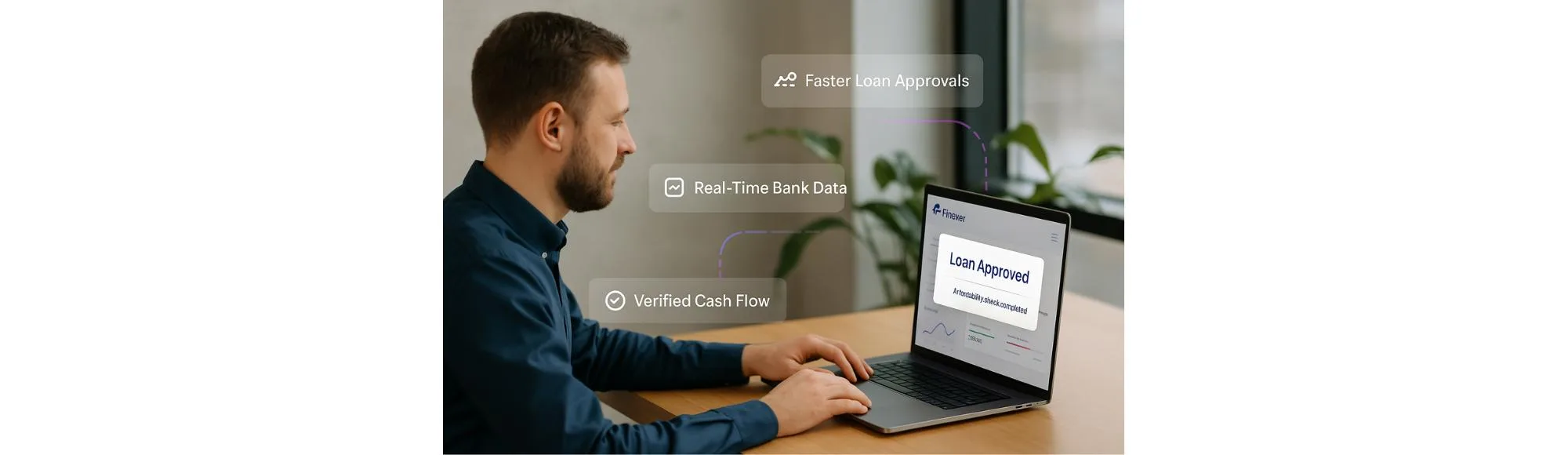

Achieve Faster Loan Approvals for SMB’s with Open Banking

Speed up small business lending decisions with real-time bank data. Learn how Open Banking enables faster loan approvals and smarter credit checks.

![Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide] 23 Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide]](/wp-content/uploads/2025/08/Open-banking-for-Multi-client-management-jpg.webp)

Best Open Banking Platforms for Multi-Client Management in Accounting Firms [2025 Guide]

Stop chasing client bank statements! Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Handling data and bank feeds for multiple clients has long been a tedious part of accounting, chasing down PDFs, vetting spreadsheets, and wrangling statements from every bank. It’s inefficient, error-prone, and limits a firm’s ability…

Finexer for Accountants: The Best Open Banking API for UK Firms in 2025

Get Instant Bank Data with Finexer Book a quick call to see how Finexer can replace your manual bank statement collection with instant, secure feeds from 99% of UK banks Try Now Why UK Accountants Need More Than Bank Feeds If you run a mid-sized or growing accounting firm in the UK, you’ve probably noticed…

6 Account Aggregation APIs Built for Wealthtech Platforms in 2025

Looking for UK based Account Aggregation API ? Access 99% of UK Banks with Categorised Data Built for Wealth Platforms Try Now Although fewer than one-third of affluent clients stick with a single platform, nearly 45% plan to move 25–50% of their assets to alternative providers, according to EY’s 2025 Global Wealth Research Report. The…

How Insurance Uses Open Banking for Faster Claims, Verified KYC, and Real-Time Payouts

Still Reviewing Claims Manually? Finexer lets you assess claims using verified customer bank data securely and in seconds. Try Now Insurance processes often involve delays at critical points, such as onboarding, claim validation, and payouts. Manual checks, scanned statements, and back-and-forth emails increase costs and slow resolution times. Open Banking allows insurance providers to collect…

No KYC Casinos: What They Are and Why Operators Are Switching

Fast Onboarding for Casinos Starts Here Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now The term no KYC casino is everywhere in 2025, often promising faster access, fewer drop-offs, and frictionless play. But for regulated operators, skipping KYC isn’t really an option. What platforms actually want is fast…

How to Build a Scalable Finance Stack as a VC-Backed Startup

Learn about Scalable finance stack for VC-backed startups using APIs.

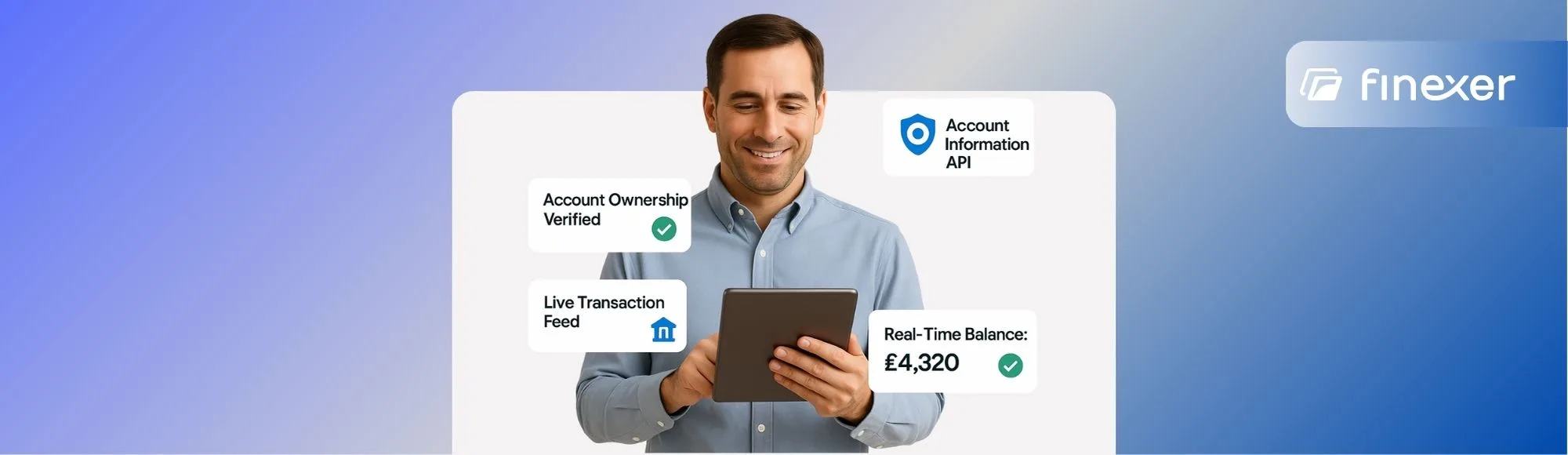

7 Business Functions Made Easier with an Account Information API

Get Instant Bank Data with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now Manual document uploads. Delayed verifications. Incomplete financial data. For years, these have been the bottlenecks slowing down business operations across industries, from onboarding and credit checks to payouts and compliance reviews. But a better…

6 Legaltech Platforms Using Open Banking to Modernise Law Firm Workflows in 2025

Get Paid Faster with Finexer Connect with 99% of the UK Banks and Scale Your Business without Limits Try Now The legal sector has historically been slow to adopt financial technology, but that’s changing fast. A new wave of legaltech platforms is using Open Banking to help law firms cut delays, reduce manual reviews, and…