Budget billing allows you to pay a set amount for utilities, such as electricity and gas, each month. The service makes energy costs more predictable for consumers, despite fluctuations in energy usage as seasons change.

Introduction

In an ever-evolving financial landscape, understanding what utility bills are and their impact on your budget is crucial. Utility bills encompass a variety of services essential for daily living, from electricity and gas to water and, in many contexts, even phone bills. These recurrent expenses are not just another line item in your budget; they are fundamental components that can significantly affect your financial planning and stability. Grasping the utility bill meaning, which ranges from the basics of utilities examples to identifying what counts as a utility bill, is the first step towards smart financial management. Moreover, in the UK context, questions like “is a phone bill a utility bill?” or “is water a utility bill?” highlight the varied nature of utility expenses that households need to manage.

This article aims to provide a comprehensive overview of utility bills, offering insight into utility bill examples UK residents commonly face, including electricity, gas, water, and phone bills. You will gain an understanding of the types of utility bills, which not only answers the question, “what is a utility bill in the UK?” but also delves into strategies for managing these costs effectively. The article further explores methods to reduce your energy bills, outlines government assistance and support schemes available, and concludes with actionable advice to take control of your utility expenses. By equipping yourself with this knowledge, you can make informed decisions that enhance your budget management and contribute to more sustainable living practices.

Understanding Your Utility Bills

Utility bills are recurring expenses that play a significant role in household budgeting. In the UK, these bills cover essential services such as electricity, gas, water, and, in some cases, phone services. Understanding the types of utility bills and how they are calculated can help households manage their expenses more effectively.

Types of Utility Bills

The primary utility bills in the UK include electricity, gas, water, and phone bills. Each bill represents a different utility service that is essential for daily operations within a home. For instance, electricity and gas are crucial for heating, cooking, and running appliances, while water bills cover the usage of fresh water and the disposal of wastewater.

How Utility Bills are Calculated

Utility bills are calculated based on the consumption of the services. Energy companies measure electricity and gas usage in kilowatt-hours (kWh), while water usage is typically measured in cubic metres. The cost per unit of consumption will vary depending on the provider and the tariff selected by the household. It’s important for consumers to review their energy bills and understand the tariffs to find potential savings, even though options might be limited under current market conditions.

By closely monitoring and understanding these bills, individuals can make informed decisions about usage and potentially switch providers or tariffs to optimise costs, contributing to more effective financial management and sustainability in the home.

Ways to Reduce Your Energy Bills

Improving Energy Efficiency

One of the most effective ways to reduce energy bills is by enhancing home insulation. Adding insulation, such as loft insulation, can be a cost-effective measure, potentially saving up to £250 annually in a semi-detached house. For homes suitable for cavity wall insulation, although the initial cost is higher, approximately £2,700, the long-term savings are significant due to reduced heat loss through walls.

Using Appliances Efficiently

Understanding how much your appliances cost to run is crucial. Appliances like washer dryers are among the highest energy consumers. By learning which appliances use the most energy, households can make informed decisions about usage, potentially switching to more energy-efficient models which offer significant savings on running costs.

Reviewing Your Energy Bills for Savings

Regularly reviewing your energy bills can identify potential savings. Simple actions like draught-proofing can save around £40 a year by preventing heat escape through gaps around doors and windows. Additionally, turning off appliances from standby mode and using LED bulbs instead of traditional ones can further reduce annual energy expenditures.

Government Assistance and Support Schemes

Warm Home Discount Scheme

The Warm Home Discount Scheme provides crucial financial relief by offering a rebate to eligible households. This initiative is particularly aimed at supporting those who might struggle with heating costs during colder months. Further details and eligibility criteria can be accessed on the official GOV.UK website.

Winter Fuel Payment

For individuals born on or before 26 September 1955, the Winter Fuel Payment offers an annual one-off payment designed to assist with heating expenses during winter. Information on how to claim and the amount you could be entitled to is available on GOV.UK.

Cold Weather Payments

During extremely cold weather, Cold Weather Payments provide additional financial support to help cover extra heating costs. Eligibility for these payments is linked to receiving benefits such as Pension Credit, Income Support, and Universal Credit, among others. These payments are issued automatically to those who qualify when temperatures plummet.

Discretionary Assistance Fund (DAF)

The Discretionary Assistance Fund (DAF) offers grants under specific circumstances to individuals who require urgent financial assistance. This fund is designed to provide short-term relief in emergency situations. More comprehensive information and application details can be found on the relevant government platforms.

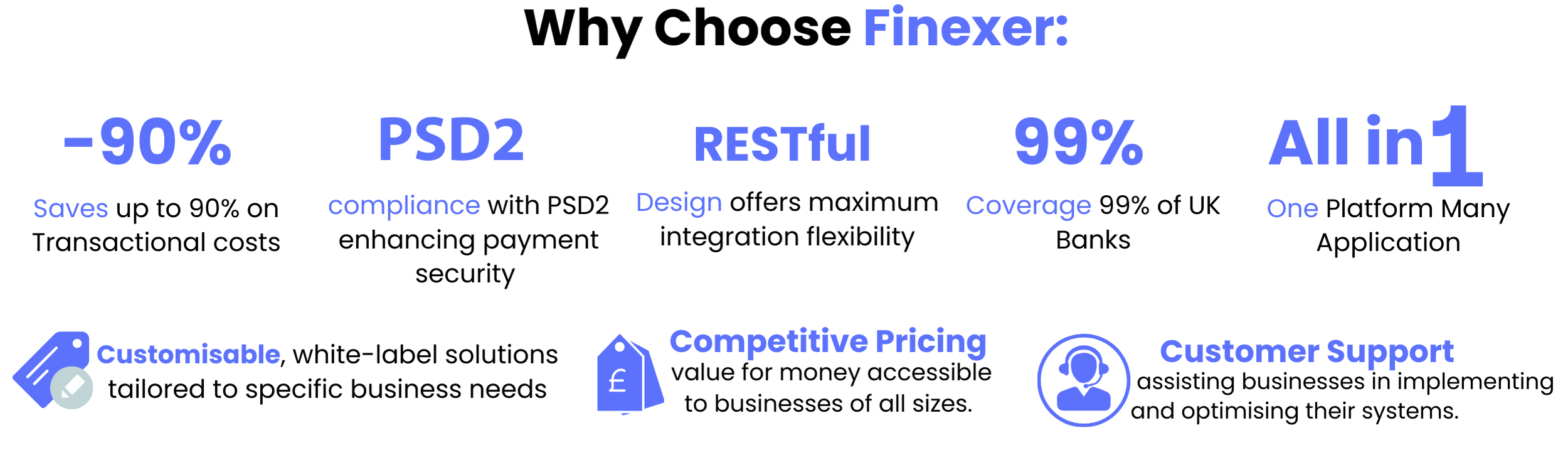

Why Finexer can be a better option for utility payment

✔Utility Bill Management: Streamlines and enhances the management of utility bills by addressing manual data entry errors, delayed payments, lack of transparency, inconsistent payment methods, high transaction costs, and security concerns

✔Open Banking Payments: Allows businesses to perform secure and seamless account-to-account transactions, optimising financial processes and enhancing customer experience

✔Data Connectivity: Provides real-time access to financial data, enabling businesses to offer tailored services and improve operational efficiency

Finexer’s open banking solutions are designed to simplify complex financial processes, making them more accessible and user-friendly for businesses of all sizes

Conclusion

Throughout this article, we’ve unravelled the complexities surrounding utility bills and their substantial influence on household budgets. By dissecting the types of utility bills prevalent in the UK, from electricity and gas to water and phone services, and exploring various strategies for managing these costs, we’ve provided a foundational guide designed to empower readers with the knowledge necessary for smart financial management. Furthermore, we’ve delved into practical advice on reducing energy bills, highlighting the importance of improving energy efficiency, using appliances judiciously, and regularly reviewing energy bills to uncover potential savings.

The discussion also extended to the vital assistance available through government schemes aimed at alleviating the financial pressures of utility expenses for eligible households. The significance of these measures cannot be overstated, offering not just monetary relief but also promoting a more sustainable approach to energy consumption. As we conclude, it’s clear that understanding and optimizing utility bills is not just about immediate financial benefits; it’s about contributing to long-term environmental sustainability and securing a stable financial future. Armed with this knowledge, UK residents are better equipped to navigate the challenges of utility management, ensuring these recurrent expenses bolster rather than burden their financial stability.

FAQs

What exactly is a utility bill?

A utility bill is a detailed statement showing charges for essential services that keep your household running smoothly. These services are fundamental to your home’s infrastructure.

What does ‘utility’ mean within the context of a budget?

In a budgetary context, utilities expense refers to the costs incurred over a specified period for essential services such as electricity, water, and heating. An accountant might distribute these costs across different departments based on their usage.

What constitutes a utility bill in the UK?

In the UK, utility bills cover services essential for the maintenance of your home or flat. Common utilities include water, electricity, natural gas, heating oil, internet services, telephone, and cable services such as Sky or BT Sport.

How are utility bills calculated in a business setting?

In a business context, utility bills comprise various components such as standing charges, taxes, government levies, and the actual energy consumed. The price paid for energy can fluctuate based on the wholesale cost, which is the rate at which your supplier purchases the energy.

Unlock seamless and secure utility bill payments with Finexer’s VRP – automate, save, and simplify today!