Introduction

In the fast-evolving sphere of finance and technology, insurtech stands out as a beacon of innovation and disruption, redefining the insurance landscape in the UK. With digital platforms, embedded insurance, and underwriting processes being transformed, the insurtech sector is rapidly moving beyond traditional models. This growth not only highlights the potential for increased efficiency in claims processing and policy management but also signals a shift towards more personalised and accessible insurance services for consumers. Amidst this transformation, exploring the leading insurtech companies in the UK offers valuable insights into how technology and insurance are merging to meet the changing needs of individuals and businesses alike.

This article unveils 16 prominent insurtech companies that are spearheading these innovations within the UK market. From established giants like Aviva plc and Admiral Group plc to dynamic startups such as ManyPets and Superscript, we will delve into how each entity is leveraging technology to create transformative solutions in insurance. Covering a spectrum from virtual agents to parametric insurance and usage-based models, these companies are at the forefront of integrating open insurance and digital platforms to enhance customer experience and operational efficiency. Through a careful analysis of these insurtech leaders, readers will gain an in-depth understanding of the current landscape and future directions of insurance technologies.

1.Chesnara Plc

Overview

Chesnara Plc, a prominent UK-based insurance company, also operates within the Netherlands and Sweden. This entity is well-recognized for its comprehensive offerings in life insurance services and pension products, catering to a diverse clientele.

Market Cap

As of December 7, Chesnara Plc boasts a market capitalisation of $496.70 million, reflecting its significant presence and stability within the insurance sector.

Products and Services

The company’s core services include life insurance and pension products, designed to meet the needs of its varied customer base across multiple countries. These offerings underscore Chesnara Plc’s commitment to providing secure financial solutions and support throughout different stages of a customer’s life.

2.Ecclesiastical Insurance Office Plc

Overview

Ecclesiastical Insurance Office Plc, headquartered in Gloucester, England, is a distinguished entity in the UK insurance market. With a rich heritage dating back to 1887, the company has built a robust reputation over its 135 years of operation, primarily focusing on financial and specialist insurance services.

Market Cap

As of December 7, Ecclesiastical Insurance Office Plc boasts a market capitalisation of £548.46 million, positioning it as a significant player in the industry.

Background

The company’s longevity and sustained success are underpinned by its extensive experience in providing tailored insurance solutions. This deep-seated expertise allows Ecclesiastical Insurance Office Plc to cater effectively to the unique needs of its clients, reinforcing its standing within the competitive insurance sector.

3.Conduit Holdings Limited

Overview

Conduit Holdings Limited, recognised as one of the UK’s top insurance companies, operates as a pure-play reinsurance provider. The company focuses on delivering insurance services directly to other insurance firms, playing a pivotal role in the broader insurance ecosystem.

Market Cap

As of December 7, Conduit Holdings Limited boasts a market capitalisation of £987.10 million, underscoring its substantial impact and stability within the insurance sector.

Services

The company’s primary service involves offering comprehensive reinsurance solutions to insurance companies, enabling them to manage risk more effectively and sustainably. This service is crucial for maintaining the financial health and risk mitigation strategies of these companies.

4.Just Group PLC

Overview

Just Group PLC, headquartered in London, is a distinguished multinational financial services company primarily focused on providing innovative insurance products tailored for the retirement market. This organisation has established itself as a pivotal player in offering comprehensive retirement solutions, helping customers navigate their post-working years with financial security and peace of mind.

Market Cap

As of December 7, Just Group PLC reported a robust market capitalisation of $1.10 billion. This valuation reflects the company’s strong market presence and the trust it has garnered among investors and clients alike, positioning it among the top-tier insurance companies in the UK as we head into 2024.

Specialisations

Just Group PLC specialises in a range of insurance products designed specifically for retirees. These products are crafted to address the unique needs of this demographic, ensuring that they have access to essential financial services that support a comfortable and secure retirement. The company’s focus on this niche market demonstrates its commitment to serving the specialised needs of its clients, further cementing its role as a leader in the retirement insurance sector.

5.Aviva plc

Overview

Aviva plc, a prominent player in the UK insurance market, recently announced a significant acquisition that reinforces its position in the industry. On September 25, Aviva plc disclosed the acquisition of AIG Life UK, a company known for its individual and group protection products. This strategic move is valued at £460 million and is poised to considerably enhance Aviva’s standing in the protection market.

Key Acquisitions

The acquisition of AIG Life UK is a pivotal development for Aviva plc, as it expands the company’s client base substantially. This acquisition adds an impressive 1.3 million individual protection customers and 1.4 million group protection members to Aviva’s portfolio. This expansion is not only a testament to Aviva’s growth strategy but also strengthens its capabilities in serving a broader demographic.

Market Impact

The strategic acquisition of AIG Life UK by Aviva plc is expected to generate robust revenue streams and fortify its market presence. Slated for completion in the first half of 2024, this acquisition is set to have a profound impact on the market, enhancing Aviva’s competitive edge and affirming its commitment to leadership in the UK insurance sector.

6.Admiral Group plc

Overview

Admiral Group plc, a top British multinational insurance services company, recently announced a strategic acquisition that underscores its commitment to expanding its product offerings. This move is set to enhance the company’s portfolio in home and pet insurance sectors.

Recent Acquisitions

Admiral Group plc disclosed its acquisition of RSA Insurance Group Limited’s direct Home and Pet personal lines insurance operations. The deal, valued at £82.5 million with an additional potential payment of £32.5 million based on policy migration, marks a significant expansion of Admiral’s capabilities in these areas.

Market Position

The acquisition is a strategic step for Admiral Group plc to diversify and strengthen its market position in the insurance industry. By integrating RSA’s operations, Admiral aims to accelerate its recently launched direct pet proposition and expand its home insurance business. This strategic move is also anticipated to bring over 300 employees into Admiral’s fold, enhancing its workforce and operational capabilities.

7.Willis Towers Watson PLC

Overview

Willis Towers Watson Public Limited Company, listed on NASDAQ as WTW, is a leading insurance company with a strong presence in the global market. Established with a commitment to enhancing the efficiency of insurance services, the company leverages advanced technology to address critical challenges within the industry.

Key Partnerships

On October 30, Willis Towers Watson announced a significant partnership with CSAA Insurance Group. This collaboration involves licensing Willis Towers Watson’s radar software, a sophisticated tool that employs advanced analytics and machine learning. The radar software is designed to identify weaknesses and cross-subsidies in pricing structures, which can be pivotal for insurance companies aiming to refine their financial strategies and service offerings.

Technological Innovations

The radar software exemplifies Willis Towers Watson’s commitment to technological innovation within the insurance sector. By enabling more accurate risk assessments and pricing adjustments, this tool helps insurance companies streamline their operations and offer fair assessment prices across various business lines, including personal, commercial, and life insurance. This not only enhances operational efficiency but also improves customer satisfaction by ensuring more tailored insurance solutions.

8.Hiscox Ltd

Overview

Hiscox Ltd, identified by its OTC marker HCXLY, is a prominent insurance company in the UK. It is renowned for its focus on business insurance services, catering to a broad spectrum of industries and needs.

Market Cap

As of December 7, Hiscox Ltd boasts a substantial market capitalisation of $4.60 billion. This valuation places it 8th on the list of leading UK insurance companies as we approach 2024, highlighting its significant role and stability in the insurance market.

Business Insurance Focus

Hiscox Ltd specialises in providing comprehensive business insurance solutions. These services are designed to meet the diverse and evolving needs of businesses, ensuring protection against a wide range of risks and liabilities. This focus on business insurance underpins Hiscox’s commitment to supporting the growth and resilience of its clientele.

9.ManyPets

Overview

ManyPets, established in 2017 and headquartered in London, has rapidly become a leading name in the pet insurance industry. Co-founded by Steven Mendel and Guy Farley, the company has garnered recognition for its innovative approach to pet insurance, covering 50,000 cats and dogs globally.

Funding

ManyPets achieved unicorn status in 2021, reflecting its significant impact and growth within the insurtech sector. Following a rebranding from Bought By Many in 2022, it aligned its UK operations with its global brand, pushing its valuation to £1.6 billion.

Service Offerings

ManyPets offers comprehensive insurance products for pets, including up to £15,000 in vet fee cover. Unique to ManyPets, customers benefit from 24/7 access to free video vet calls and the convenience of multi-pet discounts on the same policy. In 2019, the company introduced its clients to the FirstVet app, allowing direct video consultations with veterinarians anytime, enhancing the accessibility and ease of managing pet health. This customer-centric approach has been shaped by over 40,000 client reviews, ensuring their offerings meet the real needs of pet owners.

10.Superscript

Overview

Superscript, initially established in 2015 as Digital Risks, has evolved to cater specifically to small and medium-sized enterprises (SMEs) and high-growth technology firms. The London-based insurtech company underwent a rebranding in 2020, reflecting its broadened focus and commitment to addressing a wider array of business risks. This strategic pivot has positioned Superscript as a flexible and innovative provider in the UK’s vibrant insurtech landscape.

Business Model

Superscript has adopted a subscription-based model that allows businesses to access tailored insurance products that align closely with their specific needs. This model is supported by a robust online platform that facilitates a fully self-serve experience, enabling clients to effortlessly purchase coverage and manage their policies. The simplicity and efficiency of this system reduce administrative burdens and enhance user satisfaction, making insurance more accessible and adaptable for dynamic business environments.

Partnerships

In 2021, Superscript expanded its reach and capabilities through a significant partnership, becoming the sole UK insurance partner of the ecommerce giant, Amazon. This collaboration not only broadens the exposure of Superscript’s services but also integrates its insurance solutions with one of the world’s leading online retail platforms, thereby enhancing the accessibility and appeal of its offerings to a wider audience of business customers. This partnership underscores Superscript’s forward-thinking approach and its commitment to integrating with global commerce leaders to deliver superior insurance products.

11.Instanda

Overview

Instanda, headquartered in London, is revolutionising the insurance industry with its innovative no-code platform. This platform empowers insurance professionals to rapidly design and deploy insurance products without the need for extensive coding knowledge. By simplifying the creation and management of insurance offerings, Instanda is setting new standards in the industry’s operational efficiency.

Funding and Investors

Instanda has successfully raised $73.1 million (approximately £60 million) through the support of five investors. This substantial funding underscores the confidence and commitment of the investment community in Instanda’s business model and its potential to disrupt the traditional insurance market.

Platform Features

The core of Instanda’s offering is its software-as-a-service (SaaS) policy administration tool. This tool allows insurers and brokers to create, distribute, and manage insurance products with unprecedented speed and flexibility. The platform’s capabilities extend across various insurance domains, including property and casualty, as well as life and health sectors. Instanda’s global reach is supported by partnerships with major insurers, brokers, and underwriters across Europe, Australia, and the Americas, showcasing its international appeal and scalability.

13.Cytora

Overview

Cytora, based in London, is renowned for its advanced risk management platform, crafted by a team of expert data engineers and machine learning scientists. This platform is currently utilised by some of the leading insurers and Managing General Agents (MGAs) globally, including QBE, AXA XL, and Starr. The company’s core technology, the Risk Engine, allows commercial insurers to target and accurately price risks, significantly reducing frictional costs and enhancing underwriting precision.

Funding

Cytora has successfully raised £34 million in funding, supported by 15 investors. This financial backing underscores the confidence in Cytora’s innovative approach and its potential to transform traditional insurance practices through technology.

Technological Innovations

At the heart of Cytora’s offerings is its Risk Engine technology, a tool that has revolutionised the way insurers approach risk assessment and pricing. By leveraging artificial intelligence and data analytics, Cytora’s platform ensures that premiums are fair and accurately reflect the actual risks, thereby speeding up underwriting and claims processing. This not only improves efficiency but also aids insurers in offering more tailored and competitive insurance products.

14. By Miles

Overview

By Miles offers pay-per-mile car insurance, providing a cost-effective solution for low-mileage drivers. Instead of traditional annual premiums, customers pay a base fee plus a per-mile rate. This model caters to those who use their cars infrequently, such as commuters who often use public transport or people who work from home.

Market Cap

By Miles is a privately held company, and specific market capitalization details are not publicly disclosed. However, it has raised significant funding from investors, reflecting strong market confidence in its innovative model.

Products and Services

By Miles tracks mileage through a telematics device installed in the car, ensuring transparent and fair pricing. The company also allows policyholders to manage their insurance via a mobile app, making the process convenient and user-friendly. Customers benefit from fully comprehensive coverage and the ability to earn no claims bonuses for incident-free driving.

Technological Innovation

The telematics-enabled mobile platform puts the user in control while offering more transparent pricing and straightforward policy terms. This approach helps By Miles differentiate itself in an increasingly competitive market (Verdict) (The Digital Insurer).

15. Cuvva

Overview

Cuvva specializes in flexible, short-term car insurance policies. Users can get coverage by the hour, day, or week, making it ideal for occasional drivers, those borrowing a car, or individuals needing temporary coverage.

Market Cap

As a privately held company, specific market capitalization details for Cuvva are not publicly available. However, its successful funding rounds highlight strong investor interest and market potential.

Products and Services

Cuvva’s mobile app simplifies the insurance process, allowing users to quickly purchase and manage their policies. This innovative approach addresses the needs of modern, on-the-go lifestyles. The app provides instant quotes, allowing customers to get insured in minutes without the need for lengthy paperwork or phone calls.

Technological Innovation

Cuvva uses advanced algorithms to offer real-time pricing and policy issuance, ensuring that customers only pay for what they need when they need it. This flexibility helps customers avoid the high costs of traditional long-term policies (Verdict) (The Digital Insurer).

16. Urban Jungle

Overview

Urban Jungle provides home insurance tailored to the needs of renters and homeowners. Utilizing modern technology, the company offers flexible and affordable policies.

Market Cap

Urban Jungle is a privately held entity, and specific market capitalization details are not publicly disclosed. Its growth and expansion efforts are backed by substantial funding from investors who recognize its market potential.

Products and Services

Urban Jungle focuses on simplifying the insurance process and providing competitive pricing through a digital-first approach. Customers can easily purchase and manage their policies online, ensuring a hassle-free experience. The company offers contents insurance, renters insurance, and home insurance, designed to be flexible and affordable.

Technological Innovation

By leveraging technology, Urban Jungle can offer tailored insurance products that meet the unique needs of its clients. This approach caters particularly well to younger, tech-savvy individuals looking for straightforward insurance solutions (Verdict) (The Digital Insurer).

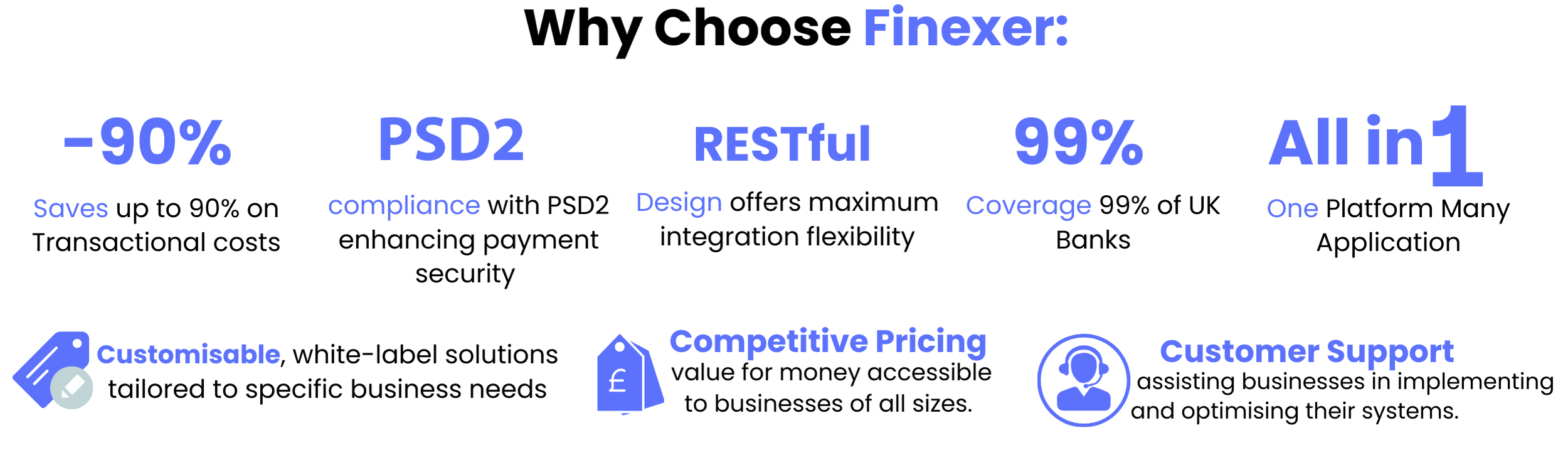

Empowering Insurtech with Finexer

Finexer’s solutions are designed to address three key operational challenges:

- Insurance Fraud Prevention ✔:

- Finexer’s real-time monitoring and advanced analytics help detect and prevent fraudulent activities early, reducing potential losses.

- The financial impact is significant, protecting the insurer’s bottom line.

- Compliance and Verification ✔:

- Ensuring compliance with regulatory standards can be time-consuming and costly. Finexer simplifies this process, reducing the risk of penalties and damage to reputation.

- Streamlined customer and business verification processes enhance operational efficiency.

- Efficient Underwriting ✔:

- Accessing and analyzing customer data for underwriting is often inefficient. Finexer’s technology enables quicker and more accurate risk assessments.

- This leads to better pricing of insurance products and reduces the incidences of overpricing or underpricing.

By integrating Finexer’s solutions, insurers can offer more tailored products, respond faster to claims, and enhance overall customer satisfaction. This positions Finexer as a key player in the advancement of open banking payment solutions within the insurtech sector.

Enhance efficiency and prevent fraud in your insurance business with Finexer! Book a Demo Now 🙂