Introduction

The rapid evolution of the insurtech landscape is redefining the insurtech possibilities, bringing to the forefront a blend of technology insurance and innovative insurance solutions designed to streamline operations and enhance customer satisfaction. Amidst this transformation, the UK insurtech sector faces significant challenges, including slow claims processing, inefficient payment handling, fraud, compliance issues, and data management inefficiencies. These hurdles not only impact operational costs and customer satisfaction but also pose substantial threats to the longevity and success of insurtech companies. Enter Finexer, a beacon of innovation in the insurtech UK arena, offering open banking solutions tailored to overcome these industry-specific challenges comprehensively.

This article dives deep into the crux of the challenges plaguing the insurtech industry, with Finexer’s solutions shining as a testament to how open banking can redefine the future of digital insurance. From detailing practical steps for implementing these transformative solutions to exploring the potential for future innovation in tech insurance, we aim to provide insurtech insights that businesses across the spectrum—from startups to established insurance technologies firms—can leverage. Through Finexer’s pioneering approach, companies will discover how to enhance their operational efficiency, fortify security against fraud, and ultimately, provide an unrivaled customer experience. As we chart the course for a brighter, more streamlined insurtech future, the transformative power of Finexer’s open banking solutions takes center stage, promising a new dawn of efficiency and innovation in the UK insurtech landscape.

Challenges in the Insurtech Industry

The insurtech industry in the UK is grappling with several significant challenges that hinder its growth and operational efficiency.

- Slow Claims Processing: The slow pace of claims processing significantly affects customer satisfaction and elevates operational costs. Delays are often due to outdated systems that fail to meet the demands of modern insurance operations.

- Inefficient Payment Handling: Managing bulk payments involves complex processes that are prone to errors, further complicating financial transactions and leading to inefficiencies in payment handling.

- Fraud and Security Risks: Insurance fraud poses a substantial financial threat to the industry, impacting company revenues and increasing the burden on their security frameworks.

- Compliance and Verification: Regulatory compliance demands significant time and resources, making the verification processes cumbersome and costly.

- Data Management and Underwriting: There are notable inefficiencies in accessing and analyzing customer data, which hampers the underwriting process and affects the overall service delivery.

These challenges underscore the need for innovative solutions that can streamline processes, enhance security, and improve customer satisfaction in the insurtech sector.

Finexer’s Solutions for Insurtech Challenges

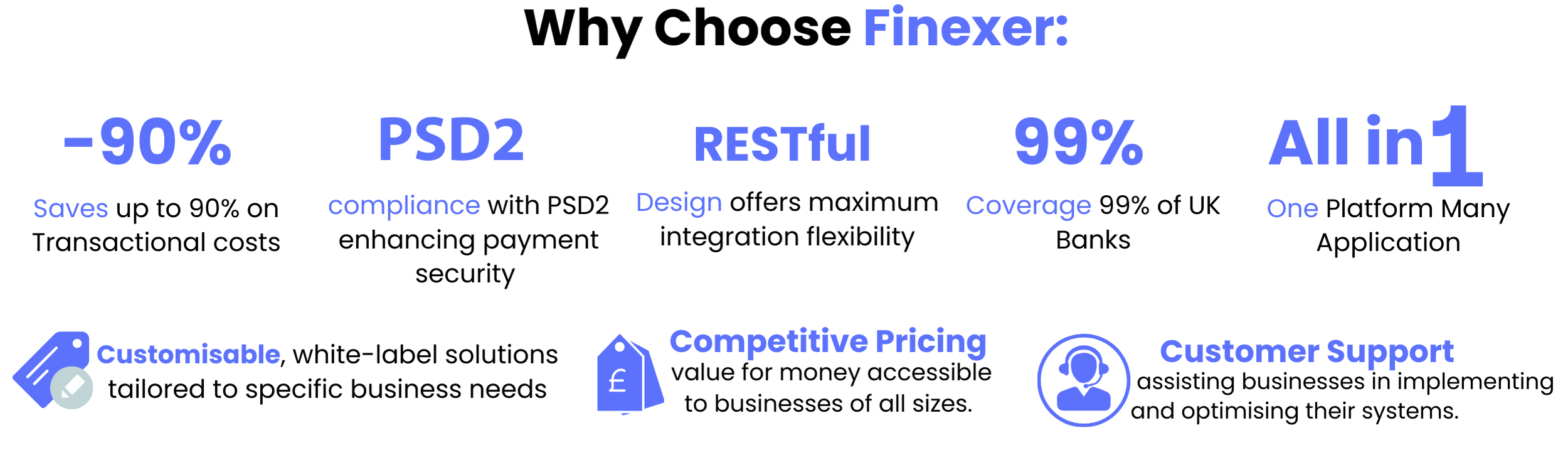

Finexer introduces transformative solutions tailored to address the pressing challenges within the UK insurtech industry, leveraging the power of open banking to enhance efficiency and security.

✔ Instant Payments

Solution Overview: Finexer’s Instant Payments product expedites claims processing, significantly enhancing customer satisfaction.

How It Solves the Problem: By accelerating payments, Finexer reduces administrative burdens, directly impacting customer trust and loyalty.

✔ Bulk Payouts

Solution Overview: The Bulk Payouts solution simplifies the management of bulk payments, minimizing errors and processing time.

Operational Impact: This streamlined approach boosts operational efficiency, preventing common financial transaction errors.

✔ Fraud Prevention

Solution Overview: Finexer’s Fraud Prevention tool strengthens security measures, mitigating financial risks associated with insurance fraud.

Financial Impact: Enhanced security protocols ensure substantial protection against potential financial losses.

✔ Verification (KYC/KYB)

Solution Overview: The Verification product ensures compliance with regulatory standards, significantly reducing legal risks.

Operational Impact: It facilitates a smoother onboarding process, improving overall customer experience by ensuring compliance more efficiently.

✔ Open Banking Data (AIS)

Solution Overview: This service utilizes advanced data analytics to improve underwriting accuracy and offer customized insurance solutions.

Customer Impact: Tailored insurance products based on precise risk assessments enhance customer satisfaction and retention, fostering trust and loyalty.

Practical Steps for Implementing Open Banking Solutions

To effectively implement open banking solutions in the insurtech industry, companies should focus on three critical areas:

- Choosing the Right Open Banking Provider: Select a provider that prioritizes customer understanding, efficient operations, and growth. Providers like Finexer and Noda offer comprehensive services ranging from payment facilitation to financial analytics, utilizing advanced technologies to ensure secure and efficient transactions.

- Upgrading Technology Infrastructure: Insurers must modernize their legacy systems to fully leverage open banking capabilities. This involves integrating advanced APIs that allow seamless communication with third-party providers, ensuring both compatibility and compliance with current regulatory standards.

- Building Partnerships with Fintech Companies: Collaborating with fintech firms can provide insurers with cutting-edge open banking solutions and innovative products tailored to the dynamic needs of the market. These partnerships help insurers stay competitive by enhancing their product offerings and improving customer experiences through personalized services and efficient data management.

Future Potential and Innovation in Insurtech

Emerging trends in insurtech, driven by open banking, are poised to redefine the insurance landscape. By harnessing detailed financial data, insurers can offer more personalized and accurately priced policies. This shift not only promises enhanced customer satisfaction but also introduces significant operational efficiencies.

Long-term Benefits for Insurers and Customers

The integration of open banking facilitates a smoother claims process, significantly reducing administrative overheads and improving the speed of service. Moreover, the ability to detect and prevent fraud more effectively helps in safeguarding the financial interests of both insurers and customers. As regulatory frameworks evolve, the adoption of open banking by insurers is expected to increase, fostering a more competitive and innovative market environment.

Conclusion

As we navigate through the ever-evolving landscape of the insurtech industry, it’s clear that the integration of Finexer’s open banking solutions offers a promising pathway to addressing the industry’s core challenges. Slow claims processing, inefficient payment handling, fraud, and compliance issues, along with data management inefficiencies, have notably hindered the growth and operational success of the sector. Finexer’s pioneering approach, leveraging the power of open banking, not only confronts these challenges head-on but also sets a foundation for reinvigorating customer trust, improving operational efficiencies, and enhancing security measures.

The acknowledgment of these transformative solutions and their wide-reaching implications signals a significant shift towards more personalized, efficient, and secure insurance offerings. By streamlining operations and embedding cutting-edge technology into the very fabric of their processes, insurtech companies stand to gain immensely. The potential for growth and innovation in the sector is boundless, with open banking acting as a catalyst for change. Thus, adopting Finexer’s solutions not only propels companies forward in the short term but also aligns them with a future where the insurtech industry flourishes, buoyed by efficiency, innovation, and an unwavering commitment to customer satisfaction.

FAQs

What is open banking and why is it important for insurance companies?

Open banking allows third-party providers, such as insurtechs and fintechs, to securely access consumer or business accounts held by banks and insurers through APIs. This access, granted with the account holder’s consent, helps these providers offer innovative products and services tailored to customer needs.

The data from open banking provides valuable insights into consumer and business behavior, facilitating the creation of new products and services and enabling faster, more diverse payment options. While its potential in the insurance sector is currently underutilized, companies like Blink are leveraging it to validate the financial impacts of insured events on businesses.

What are the advantages of open banking for insurance companies and consumers?

For consumers, open banking enables personalized pricing, quotes, products, and services based on a comprehensive understanding of their risks and needs derived from various data points. For insurance companies, it accelerates innovation that legacy systems may struggle to deliver quickly and cost-effectively. Companies can introduce ancillary services that add value for both business partners and customers.

Open banking can revolutionise financial management, giving consumers control over their accounts and enabling them to access, monitor, and manage their finances more effectively. It can also deliver personalized offers and services based on account and spending data analysis, creating commercial opportunities for businesses.

How much are insurance companies taking advantage of open banking?

Some companies, like PingAn, BBVA, Santander, and ING, have embraced open banking opportunities. However, many are hesitant due to concerns about losing control of the value chain and potential margin erosion. Legacy systems also show slow adaptation. There is a need for more education on the benefits and security of open banking for both consumers and companies.The decentralised nature of open banking can be a barrier to consumer confidence. Services based on open banking must offer significant value to encourage behavior change and address security and control concerns, which are key aspects of our product planning.

So is open banking safe?

Yes, open banking adheres to the same stringent protocols and regulations as the financial services industry, ensuring robust security and constant review. Account holders must still protect their data and guard against unauthorized access. At Blink, we do not transfer or store any accessed account data, using it only for fixed-criteria analysis to validate claims with account holder approval.

Transform your insurtech operations with Finexer’s open banking solutions. Explore now to streamline claims, boost security, and enhance customer satisfaction. Contact us to learn more!

Transform your insurance operations with Finexer’s open banking solutions. Explore now to streamline claims, boost security, and enhance customer satisfaction