Introduction

In today’s fast-paced digital economy, where every second counts, instant payments are no longer a luxury but a necessity, especially in sectors like insurtech. Harnessing the power of instant payments transforms traditional insurance operations into dynamic, customer-focused ecosystems. This evolution is critical in an industry marred by complex processes and prolonged waiting times. Instant payments, encompassing immediate payments, faster payments, and instant bank transfers, offer an innovative solution to streamline transactions, enhance efficiency, and significantly improve customer satisfaction. They provide a robust foundation for financial transactions in the digital age, enabling instant settlements and fostering a more agile insurance market.

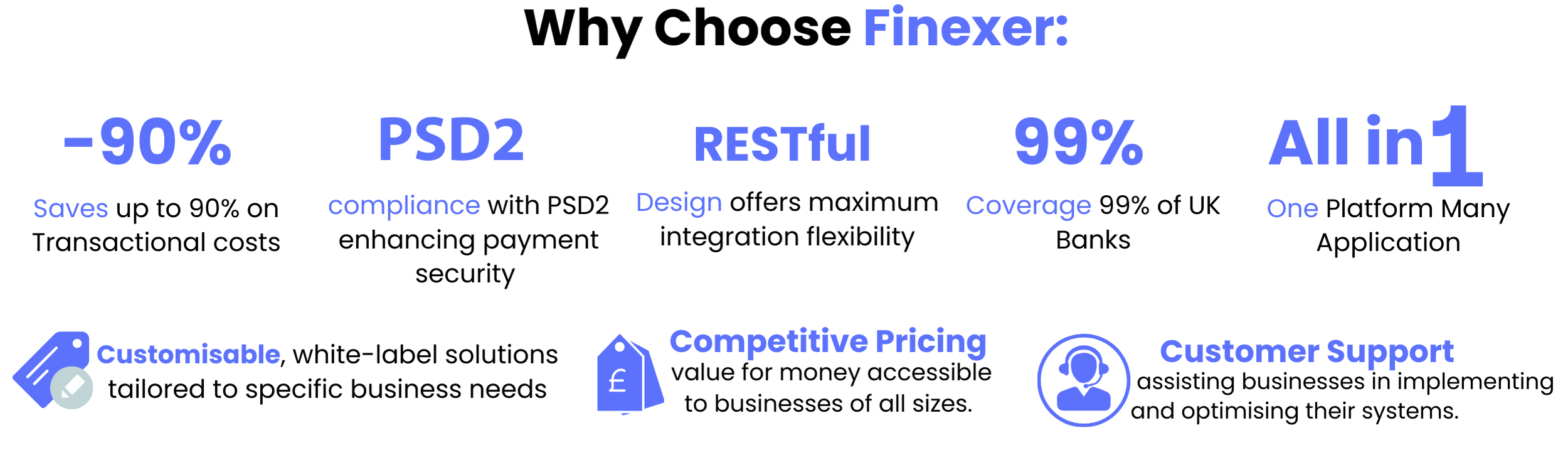

This article delves into the pivotal role of instant payments within the insurtech sector, supported by Finexer’s advanced open banking solutions. We explore how integrating such payment technologies revolutionises the insurance landscape by offering faster payouts, reducing operational costs, and elevating the user experience. Our discussion covers the technical backbone required to support real-time payments, the financial and operational challenges in implementation, and the immense benefits for both insurtech companies and their clientele. Through Finexer’s innovative approach, we highlight the transformative impact of instant payments on insurance services, ensuring businesses stay ahead in a competitive market while maximising customer satisfaction and loyalty.

Why Instant and Real-Time Payments Are Essential for Insurtech

1.Meeting Customer Expectations

Instant and real-time payments are transforming the insurtech industry by aligning with the increasing expectations of policyholders for swift and efficient service. Nowadays, 53% of consumers are willing to switch their insurance provider to benefit from the convenience of receiving claim payments instantly. This shift is largely driven by the digital-first approaches of new market entrants, reshaping customer expectations across the board.

2.Challenges of Current Payment Methods

Traditional payment methods in insurtech often involve manual processes and are prone to errors, leading to delayed payments and increased dissatisfaction. Instant payments address these issues by automating transactions and ensuring funds are transferred swiftly and accurately.

3.Efficiency in Claim Settlements

The integration of instant payments within insurtech operations significantly reduces the time taken to settle claims. This efficiency not only enhances the liquidity and operational capabilities of insurance companies but also ensures that customers receive their payouts without unnecessary delays. Such prompt service is crucial, particularly in emergency situations, bolstering the reliability and reputation of the insurance provider.

4.Competitive Advantage

Adopting instant and real-time payment systems offers insurance companies a substantial competitive edge. It allows them to differentiate themselves in a crowded market and innovate with unique service offerings. Insurers that implement these systems can see their Net Promoter Scores (NPS) soar well above the industry average, reflecting higher customer satisfaction and loyalty, which are key to retaining and expanding their customer base in the competitive insurtech landscape.

Key Technologies Enabling Instant Payments

SEPA Instant Credit Transfer

The SEPA Instant Credit Transfer scheme, introduced in 2017 by the European Payment Scheme, has become a cornerstone in the landscape of instant payments across Europe. Despite initial hurdles, it has set the standard for real-time financial transactions, ensuring funds are transferred within seconds, enhancing liquidity and operational efficiency for businesses and consumers alike.

Faster Payments Rails

Faster Payments Rails are pivotal in the execution of instant transactions, providing the infrastructure necessary for the immediate settlement of payments. This technology underpins systems like Finexer, allowing for rapid payouts that are crucial in sectors such as insurance, where timely payments can significantly impact customer satisfaction.

API-Driven Platforms

Modern API-driven platforms facilitate the seamless integration of banking services into various business processes, enabling instant payments at scale. These platforms support the automation of payment instructions directly from claim management systems to banks, reducing manual intervention and the risk of errors. This integration is crucial for insurance companies to offer instant claim payments efficiently and securely.

Technology Upgrades Needed for Real-Time Payments

To accommodate the demands of instant claim payments, significant technological upgrades are essential. These upgrades not only streamline the process but also ensure compliance and security, crucial for maintaining trust and efficiency.

1.API-First Solutions

Modern API-first payment solutions are pivotal in enabling instant claim payments. By integrating directly with insurance claim management systems, these solutions facilitate the automation of payment processes. This integration helps in reducing the delays between claim filing and payment disbursement, thereby enhancing operational efficiency.

2.Integration with Existing Systems

Effective integration with existing systems is vital for the seamless operation of instant payments. Insurance companies can leverage API-driven platforms to ensure that payments are processed instantly without manual intervention. This integration supports real-time updates and error handling, which are critical for maintaining the integrity of the payment process.

3.Automation of Payment Processes

Automating payment processes is a key component of upgrading technology for real-time payments. Automation not only speeds up the transaction process but also minimizes the chances of errors. This is particularly important in a high-volume transaction environment like insurance, where delays or mistakes can affect customer satisfaction and trust.

How Finexer is Solving Major Insurtech Challenges

Finexer enhances the insurtech landscape with its robust instant payment solutions, designed to streamline financial transactions efficiently. These solutions are crucial for insurance companies looking to improve operational efficiency and customer satisfaction.

Instant Payins ✅

Finexer’s technology allows for instant account-to-account payments, ensuring secure transactions by directly authenticating users with their banks. This minimises fraud risks and eliminates issues like chargebacks from cards and direct debits. The integration options provided, such as in-app payments and QR codes, allow seamless embedding into existing systems, thus enhancing the flexibility for insurance companies.

Instant Withdrawals ✅

The platform supports immediate access to funds, significantly reducing the waiting time for claim settlements from days to mere seconds. This rapid processing capability is vital during emergencies, increasing the reliability of the insurance provider in the eyes of the customer. Finexer’s efficient handling of these transactions ensures that customers receive their payouts without unnecessary delays, fostering trust and satisfaction.

Bulk Payouts ✅

Finexer simplifies the management of multiple payments, enabling insurance companies to execute bulk payouts to various stakeholders such as suppliers and claimants efficiently. This feature not only reduces administrative overhead but also minimises the potential for manual errors, thus enhancing the overall claims processing efficiency. The integration capabilities of Finexer’s platform allow for a smooth operation within the existing infrastructures of insurance companies.

Implementing Finexer’s Real-Time Payment Technologies

API Integration ✅

Finexer’s implementation of real-time payment technologies hinges significantly on API-first solutions. These solutions are seamlessly integrated within the claims management systems, enabling the automation of the instant payment process. This integration reduces the delay between claim filing and payment disbursement, enhancing the efficiency of the entire process.

Modern Payment Systems ✅

Modern payment systems like Numeral play a crucial role in supporting Finexer’s real-time payment capabilities. By providing forms to directly onboard counterparts within their platform and verifying bank account information, these systems mitigate the risk of errors and ensure funds are sent to the correct beneficiary. This is crucial in maintaining the integrity and trust of the payment process.

Automation of Payment Processes ✅

The automation of payment processes is a key feature of Finexer’s real-time payment implementation. It not only streamlines operations but also provides real-time notifications of the payment lifecycle, allowing insurance companies to manage payment errors effectively and keep their customers informed about the status of their transactions. This level of automation and customer communication is essential for maintaining high standards of customer service and operational efficiency.

Financial Implications and Treasury Needs

Cost of Implementing Instant Payments ✅

The transition to instant payments involves significant financial implications for insurance companies. Initial setup costs and integration with existing systems can be substantial. However, these are offset by the long-term savings from reduced transaction fees, as Finexer’s open banking solutions can cut costs by up to 90% compared to traditional methods.

Managing Liquidity ✅

Instant payments require insurers to have immediate access to funds to cover claims, which impacts liquidity management. The necessity to maintain larger reserves restricts the use of these funds for other investments, increasing the demand for efficient working capital management.

Operational Efficiency✅

The adoption of instant payment systems like Finexer enhances operational efficiency. Automation reduces manual processing and the associated errors, ensuring funds are transferred and received within seconds. This not only speeds up the claims process but also strengthens the financial operations within the insurance sector.

Competitive Edge

In the competitive landscape of insurtech, instant payment solutions offer a distinct advantage. Finexer’s innovative approach, including features like direct account-to-account transactions and embedded payment options, positions insurance companies to stand out. This capability to offer faster and more reliable payouts enhances customer loyalty and helps insurance providers maintain a competitive edge in the market.

How Finexer Enhance Customer Experience

Immediate Access to Funds ✅

Finexer’s instant payment solutions provide immediate access to funds, which is crucial during emergencies or urgent situations. This rapid availability of funds reduces the wait time for claim settlements from days to mere seconds, significantly enhancing customer satisfaction and making the insurance provider more reliable.

Reduction of Claim Settlement Time ✅

By leveraging faster payment technologies, Finexer helps reduce the overall time taken to settle claims. This efficiency not only improves liquidity and operational efficiency for insurance companies but also ensures that customers receive their payouts without unnecessary delays, further enhancing the trust in their insurance provider.

Building Customer Trust and Loyalty ✅

The ability to offer instant payouts and handle transactions securely and efficiently helps in building customer trust and loyalty. Finexer’s robust platform, with its seamless integration options and secure transaction processes, ensures a smooth and reliable payment experience for customers, distinguishing the insurance provider in a competitive market.

Conclusion

In exploring the transformative role of Finexer’s instant payment solutions within the insurtech sector, we’ve unveiled the profound impacts and benefits these technologies offer. From enhancing customer satisfaction with immediate claims settlements to streamlining operational efficiencies and significantly reducing transactional costs, Finexer’s innovative approach propels the insurance industry towards a more agile and customer-centric future. The integration of open banking solutions not only ensures seamless transactional processes but also promises heightened security and compliance, addressing some of the most pressing challenges faced by insurers today.

As the insurtech landscape continues to evolve, the adoption of instant payment systems stands as a critical pivot towards achieving unprecedented levels of efficiency and customer satisfaction. Finexer’s open banking platform is at the forefront of this revolution, offering a scalable and flexible solution that accommodates the dynamic needs of the insurance sector. The transformative potential of instant payments is undeniable, making it imperative for insurance companies to leverage these advancements. Insurtech companies are encouraged to integrate with Finexer’s instant payment solutions, to not only stay competitive but also to elevate the overall customer experience. Through Finexer’s technology, the promise of real-time financial interactions is not just a possibility but a reality, fostering a new era of innovation and growth within the insurtech domain.

FAQs

1. Why are instant payments considered essential?

Instant payments are crucial because they are settled instantly between financial institutions, eliminating the risk of payments being dishonored due to insufficient funds. Additionally, they provide immediate confirmation to the recipient that their payment has been processed successfully.

2. What constitutes an instant payment solution?

An instant payment solution refers to an electronic payment system that processes transactions in real time, operating 24/7 throughout the year. This system ensures that funds are immediately available for the recipient to use.

3. What does the instant payments regulation 2024 entail?

The Instant Payments Regulation (IPR) will be officially enforced starting from 8 April 2024, following its publication in the EU official journal on 19 March 2024. It will be implemented in two phases, targeting both sending and receiving parties in instant payment transactions.

4. How do instant payments operate?

Instant payments are digital transactions processed in real-time, every day of the year. This method allows funds to be available to recipients immediately, marking a significant improvement over traditional bank-to-bank transfers, which typically take one to three business days.

Reduce costs and improve service with Finexer’s innovative payment systems- Book a demo Now 🙂