The Know Your Customer (KYC) process is performed to verify the identity of new customers, and to prevent illegal activities, such as money laundering or fraud. KYC is undertaken as part of Anti-Money Laundering (AML) requirements.

Overview

In today’s rapidly evolving financial landscape, ensuring robust compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is critical. Finexer’s Verification solution is designed to streamline and automate the verification process, providing businesses with a reliable and efficient method to meet regulatory requirements.

Key Features

Automated Verification Processes

Automated Data Collection: The system automatically collects user data from various sources such as government databases, credit bureaus, and financial institutions. This significantly reduces the manual effort required to gather information, ensuring a faster verification process.

Real-Time Data Analysis: Instantly analyzes data for inconsistencies and flags potential fraudulent activities. The system cross-references multiple data points to ensure accuracy, providing real-time feedback and alerts.

Compliance with Regulatory Standards: Ensures all verification processes meet the latest regulatory requirements, including GDPR, AMLD5, and other global standards. This helps businesses stay compliant with local and international laws.

Enhanced Security Measures

Biometric Authentication: Incorporates biometric authentication methods such as facial recognition, fingerprint scanning, and voice recognition to verify user identity. These methods add an additional layer of security, making it harder for fraudsters to bypass the system.

Encryption and Data Protection: Uses end-to-end encryption to protect user data during the verification process. This ensures that sensitive information is secure and accessible only to authorized personnel.

Multi-Factor Authentication (MFA): Supports MFA to add another layer of security. Users are required to provide additional verification through SMS codes, email confirmations, or authenticator apps.

Comprehensive Reporting and Analytics

Detailed Verification Reports: Generates comprehensive reports on each verification process, including data sources, verification results, and any discrepancies found. These reports can be used for auditing and compliance purposes

Dashboard and Analytics Tools: Provides a user-friendly dashboard that offers real-time insights into verification processes. Users can track the status of verifications, view trends, and identify potential issues.

Customizable Alerts and Notifications: Allows businesses to set up customizable alerts for specific events, such as failed verifications or suspicious activities. Notifications can be sent via email, SMS, or through the dashboard.

Seamless Integration Capabilities

API Integration: Offers robust API integration capabilities, allowing businesses to seamlessly integrate the verification system with their existing platforms and workflows. This ensures a smooth user experience and reduces operational disruptions.

Third-Party Integrations: Supports integrations with popular third-party services such as CRM systems, payment gateways, and financial software. This enables businesses to streamline their operations and improve efficiency.

Scalability: Designed to scale with business growth, the system can handle increasing verification volumes without compromising performance or accuracy.

These features ensure that Finexer’s Verification (KYC/AML) system is comprehensive, secure, and efficient, providing businesses with the tools they need to verify user identities and stay compliant with regulatory standards.

Benefits

Enhanced Compliance 🗹

Stay ahead of regulatory requirements with our up-to-date and comprehensive verification processes.

Ensure adherence to global standards such as GDPR and AMLD5, minimizing the risk of regulatory penalties.

Reduced Risk 🗹

Mitigate the risk of fraud and financial crime by leveraging our advanced verification technologies.

Identify and flag potential fraudulent activities in real-time, enabling prompt action to prevent financial losses.

Improved Customer Experience 🗹

Provide a seamless and efficient onboarding experience for your customers with quick and accurate verification.

Reduce wait times and enhance customer satisfaction by automating the verification process.

Operational Efficiency 🗹

Save time and resources by automating the verification process, allowing your team to focus on core business activities.

Streamline operations with a user-friendly interface and customizable workflows, improving overall productivity.

Scalability 🗹

Our solution is designed to scale with your business, handling increased verification demands as you grow.

Easily adapt to changing business needs with flexible integration options and robust API capabilities.

Use Cases

E-commerce

Use Case: KYC can be used to verify the identities of customers making high-value purchases or frequent transactions. KYB helps verify the legitimacy of sellers on the platform.

Implementation:Verification tools can cross-check the customer’s identity documents against their selfie images, ensuring they are who they claim to be. Businesses can be verified using company registration documents and bank account details.

Insurance Pricing

Use Case: Insurance companies use KYC to verify the identities of policyholders and claimants. KYB helps in verifying corporate clients.

Implementation: Identity documents and selfies of policyholders are cross-verified using facial recognition tools. Business verification involves checking company registration documents and financial records.

Real Estate

Use Case: Real estate companies use KYC to verify the identities of buyers and renters. KYB helps in verifying property management companies and landlords.

Implementation: Verification tools extract data from identity documents and use facial recognition to match the document images with selfies. Business verification involves checking company registration and bank details.

Gaming and Gambling

Use Case: Online gaming and gambling platforms use KYC to verify the age and identity of players. KYB is used to verify third-party vendors and partners.

Implementation: Players provide identity documents and selfies, which are verified through facial recognition. Business partners are verified using company registration and financial documents.

Accounting & ERP

Automated Data Entry: Integrate real-time transaction data into accounting systems, reducing manual data entry errors.

Financial Reporting: Enhance financial reporting accuracy and detail with enriched transaction data.

Reconciliation: Streamline the reconciliation process by matching transactions with accounting records in real-time.

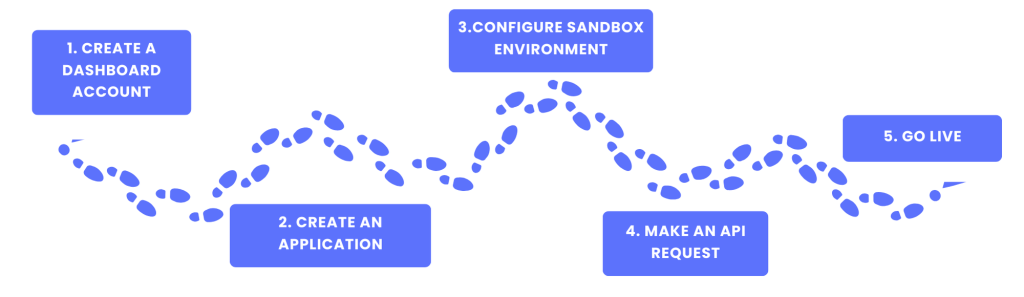

Getting Started

1.Create a Dashboard Account: Set up an account on the Finexer dashboard to manage and monitor payments.

2.Create an Application

3.Configure Sandbox Environment: Test integrations in a separate sandbox environment without affecting live data.

4.API Integration: Utilise Finexer’s APIs for seamless integration into existing systems.

5.Go Live: Launch the instant payment solution and start benefiting from real-time, secure transactions.

GET IN TOUCH

Secure your business and enhance trust with Finexer’s advanced KYC/KYB today!—read on to learn more!