What You will Discover:

What is Tenant Referencing?

Tenant referencing is like doing a background check before letting someone move into your property. It’s a way for landlords or letting agents to ensure that the person they’re about to rent to is reliable, can afford the rent, and is likely to take good care of the property.

Why is Tenant Referencing & Verification Important in Real Estate?

Ensures Financial Stability: Tenant referencing helps real estate landlords verify that potential tenants can afford the rent, reducing the risk of financial issues like missed payments.

Minimises Legal Risks: Right-to-rent checks are crucial in real estate to ensure tenants are legally allowed to rent, helping landlords avoid fines or legal trouble.

Protects Real Estate Investments: Accurate referencing helps ensure properties are rented to responsible tenants, safeguarding the investment and avoiding costly problems like evictions.

Builds Trust: Thorough tenant referencing in real estate builds trust between landlords and tenants, leading to smoother rental experiences.

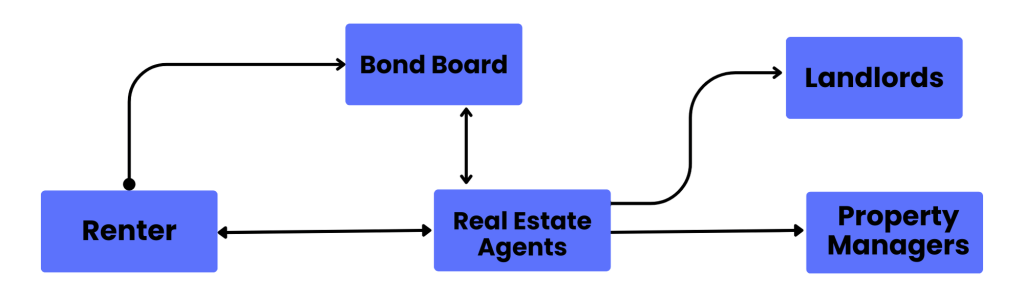

What does the tenant referencing process involve?

1. Searching for a Property

The renter begins by looking for a suitable place by browsing real estate websites or working with estate agents. They shortlist properties that match their needs and budget.

2. Application Process

Once they’ve found a property they like, the renter applies for it. This usually means providing essential documents like proof of income, identification, and possibly references from previous landlords. This step can be a bit tougher for younger renters or those with limited credit history, as they might have fewer options available.

3. Approval Notification

If everything checks out, the renter will receive a call or an email to let them know their application has been approved.

4. Negotiation and Contract Signing

Next, the renter and the landlord (or their agent) discuss the lease terms. This includes agreeing on the rent, the lease’s length, and any other special conditions. They sign the rental agreement once they’re both happy with the terms.

5. Payment of Rental Bond and Rent

The renter then pays a rental bond (a security deposit) to the Bond Board along with the first month’s rent. The Bond Board holds onto this deposit throughout the tenancy and returns it at the end, as long as there’s no damage to the property, and all the rent has been paid.

6. Living in the Property

With everything sorted, the renter moves in and enjoys living in the property for the duration of the lease. They continue to pay the rent each month, as agreed.

Can the Current Process of Renting a Property be Simplified or Enhanced?

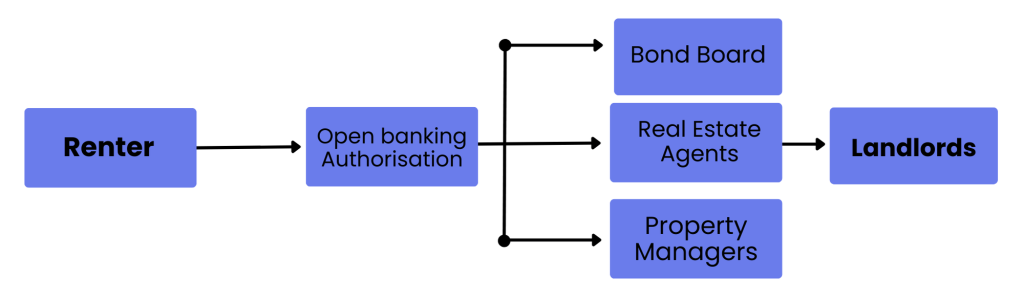

Absolutely, the process of renting a property can be significantly simplified and improved through the use of Open Banking technology.

1. Finding a Property:

You would traditionally start by searching for a property that suits your needs. However, once you find a place you like, the process becomes much smoother with Open Banking.

2. Connecting Your Bank Account:

Instead of manually gathering all your documents and financial information, you simply connect your bank account through Open Banking. This step:

✓ Verifies Your Identity: No need for extra paperwork or identity checks; the system does it automatically.

✓ Confirms Your Income: Your details are instantly shared, ensuring the landlord knows you can afford the rent.

✓ Checks Affordability: Open Banking assesses whether the property is within your budget based on your financial history.

✓ Provides Necessary Information: All essential data, such as credit history and previous rent payments, is securely shared with the real estate agency without you needing to compile and submit it manually.

3. Signing the Contract:

Once everything checks out, you sign the rental agreement. This step remains the same but is quicker because all the preceding steps have been streamlined.

4. Enjoying Your New Home:

Move in and enjoy your new home without the hassle of the rental process.

📚 Read more about How Finexer Simplifies Real estate Operations!

How does Open Banking benefit me in the rental process?

1. Efficiency

Quicker Approvals:

Open Banking speeds up the rental application process by providing instant access to your verified financial information. This means landlords and estate agents can make informed decisions quicker, allowing you to secure your desired property faster.

Streamlined Processes:

Through Open Banking, traditional steps like income verification and affordability checks are automated. This reduces the need for back-and-forth communication and eliminates unnecessary delays, making the entire experience more straightforward and efficient.

Reduced Administrative Burden:

With less manual paperwork, renters and property managers save time and effort. This allows everyone involved to focus on other essential aspects of the moving process.

2. Security

Secure Data Handling:

Open Banking uses advanced security measures to protect your personal and financial information. All data is encrypted and shared only with your explicit consent, ensuring your sensitive details remain confidential and safe from potential fraudsters.

Accurate and Reliable Information:

Since the financial data comes directly from your bank, it is accurate and up-to-date. This reduces the risk of errors with manual document submissions and provides landlords with trustworthy information on which to base their decisions.

Compliance with Regulations:

Open Banking operates under strict regulatory standards set by UK financial authorities, offering you peace of mind that all processes meet the highest security and privacy requirements.

3. Convenience

Less Paperwork:

Say goodbye to collecting and photocopying numerous documents. Open Banking allows you to share necessary financial information digitally with just a few clicks, making the application process much simpler and less time-consuming.

Automated Rent Payments:

Setting up rent payments becomes effortless, with the option to authorise automatic transfers directly from your bank account. This ensures your rent is always paid on time without you having to remember due dates or manually process payments each month.

Improved Transparency:

All parties involved have clear and immediate access to relevant information, which fosters better communication and reduces misunderstandings throughout the tenancy period.

Open Banking with Finexer

Finexer is an innovative Open Banking platform that simplifies and enhances the tenant referencing process in the real estate industry. By allowing tenants to connect their bank accounts securely, Finexer enables instant verification of identity, income, and affordability. This speeds up the application process and ensures that the information provided is accurate and reliable. For landlords and property managers, Finexer offers a streamlined, secure, and compliant way to assess potential tenants, making the entire rental process more efficient and user-friendly.

Make the Tenant Referencing process effortless and reliable with Finexer’s Open banking platform!