A mortgage is a type of loan that’s secured against your property. A loan is a financial agreement between two parties. A lender or creditor loans money to the borrower and the borrower agrees to repay this amount, plus interest, in a series of monthly instalments over a set term.

What You Will Discover:

Are you feeling overwhelmed by the lengthy and complex home-buying process?

Buying a home should be an exciting journey, but the current mortgage lending process and outdated systems often make buyers hesitate. The industry is under pressure from tough competition, changing customer expectations, high costs, and strict regulations, making it harder for things to run smoothly. This has led to the need for digital solutions, especially in the mortgage application process.

Buying a home is a dream for many, but the journey from dreaming to finally moving in can often feel like navigating through a maze. The traditional home-buying process has many steps that can make it overwhelming, lengthy, and sometimes frustrating

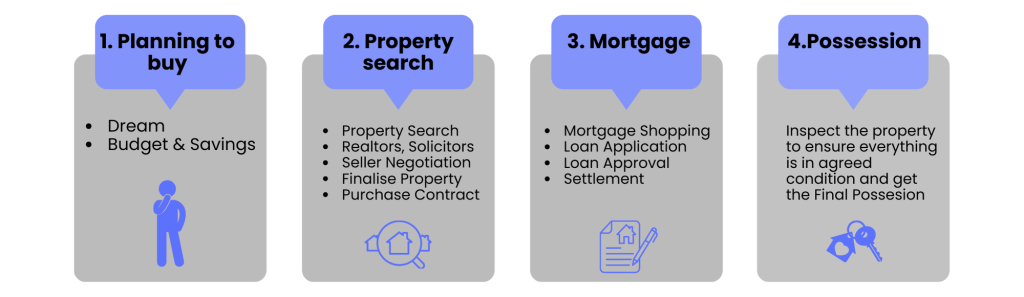

The Cumbersome Home Buying Process

1. Planning to Buy

Dream: The excitement of envisioning your ideal home.

Budget & Savings: Determining how much you can afford and setting financial goals to prepare for mortgage lending.

2. Property Search

Property Search: Browsing listings and visiting homes.

Realtors & Solicitors: Working with professionals to guide you through the property search and mortgage lending process.

Seller Negotiation: Discussing offers and terms with the seller.

Finalise Property: Deciding on the property and committing, setting the stage for mortgage lending.

Purchase Contract: Signing legal documents to secure the property and move forward with mortgage lending.

3. Mortgage Lending

Mortgage Shopping: Comparing lenders and mortgage lending offers.

Loan Application: Submitting documents and applications to get approved for mortgage lending.

Loan Approval: Waiting for the lender’s decision is often time-consuming in the mortgage lending process.

Settlement: Complete the final steps with the lender and prepare for possession.

4. Possession

Inspect Property: Check that everything is as agreed upon and finalise the mortgage lending process.

Final Possession: Receiving the keys and officially owning your new home.

What if applying for a mortgage didn’t involve so much paperwork?

Applying for a mortgage traditionally involves gathering a mountain of paperwork—bank statements, pay slips, tax returns, and more. This process can be tedious, time-consuming, and prone to errors, often overwhelming buyers. But what if there was a way to streamline this process and significantly reduce the paperwork?

This is where open banking comes into play. Open banking allows lenders to access your financial information securely and instantly, with your permission, directly from your bank. Instead of manually collecting and submitting documents, open banking provides a secure, digital connection between your bank and the lender. This means:

✓ Faster Approvals: Lenders can access your financial data in real-time, speeding up the decision-making process.

✓ Less Paperwork: No more digging through files or scanning endless documents; the necessary information is accessed digitally.

✓ Increased Accuracy: By connecting directly to your bank, open banking reduces the chances of errors or missing information.

✓ Enhanced Security: Your data is shared securely, and only the information needed is accessed, protecting your privacy.

With open banking, the mortgage lending process becomes more efficient, reducing the hassle and making it easier for you to get approved quickly. It’s a more innovative, faster way to handle your mortgage, allowing you to focus on finding your dream home without the stress of endless paperwork.

How does Open Banking Simplify Mortgage Lending?

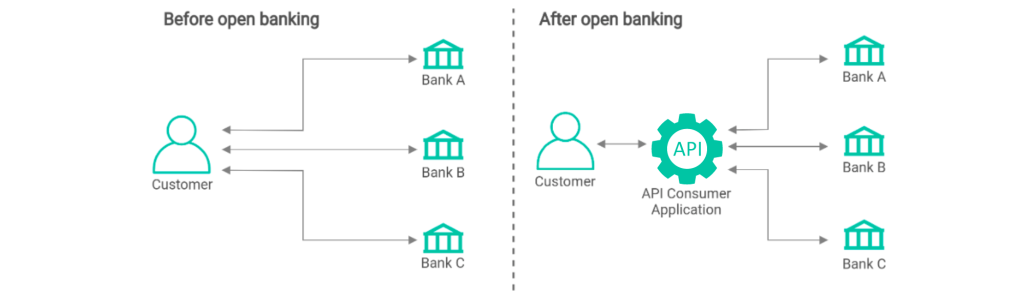

Before Open Banking

In the traditional system, when you applied for a mortgage, you had to deal with multiple banks individually. Each bank requires you to submit the same documents and information repeatedly. It was your responsibility to make sure everything was complete and accurate. If you missed something or there was an error, it could delay the entire process, making it longer and more frustrating than needed.

After Open Banking

Open banking changes the game by introducing a more streamlined and efficient way to handle your financial data. Instead of manually submitting documents to each bank, open banking allows you to share your financial information directly through a secure digital platform known as an API (Application Programming Interface).

Here’s how it works:

✓ Centralised Data Access:

With open banking, all your financial information is stored securely in one place. When you apply for a mortgage, you can access your bank data via API. This data includes your income, transaction history, account balances, etc.

✓ Real-Time Data Sharing:

Once you consent, the API connects to your bank accounts and pulls the necessary information in real time. This means the lender receives up-to-date and accurate data, reducing the chances of errors.

✓ Faster, More Accurate Decisions:

Lenders can make quicker and better-informed decisions because all your financial data is available instantly and accurately. This speeds up the approval process and increases your chances of getting a mortgage that suits your financial situation.

✓ Enhanced Security and Control:

Open banking ensures that your data is shared securely, and you have full control over what information is shared and with whom. This adds an extra layer of transparency and trust to the mortgage process.

The Benefits for Lenders

One of the biggest challenges in mortgage lending is the complex and time-consuming underwriting process. So, how can lenders make this process more efficient and less burdensome?

The answer lies in leveraging the power of open banking.

Lenders can access real-time, accurate financial data directly from customers’ bank accounts by connecting to an open banking service provider. This eliminates the need for manual document collection and reduces the potential for errors, significantly speeding up the underwriting process. With instant access to detailed financial information such as income, spending habits, and account balances, lenders can make more informed and quicker decisions, enhancing the overall customer experience.

This is where Finexer comes in. Finexer’s open banking platform offers seamless integration with various banks, providing lenders secure, consent-based access to the financial data they need. By partnering with Finexer, lenders can streamline their underwriting process, reduce operational costs, and deliver faster mortgage approvals while maintaining high levels of data security and compliance.

📚 Discover How Finexer makes credit & Lending Easier

Get Started with Finexer!

Finexer’s Open Banking data products are tailored to revolutionise the lending process, offering secure and real-time insights into borrowers’ financial profiles

Account Information Services (AIS): Gain direct access to verified bank data, allowing lenders to assess creditworthiness accurately. This streamlines the application process and reduces the reliance on outdated credit checks.

Income Verification: Easily verify income sources and stability with real-time data, providing a clearer picture of a borrower’s financial health.

Transactions: Understand spending patterns and financial behaviour through transactional data, aiding in more informed lending decisions.

Affordability Assessment: Assess borrowers’ ability to repay by analysing income, expenses, and overall financial commitments.

Are you struggling with the Underwriting process? We are here to help, just a click away 🙂