Is your business still struggling with slow payment processing, manual reconciliation, and high transaction fees? In today’s digital-first economy, outdated B2B payment methods can disrupt cash flow, increase costs, and create security risks, making it harder to scale efficiently.

The good news? There’s a faster, more secure, and cost-effective solution: Open Banking APIs. By integrating B2B money transfer APIs and faster payments APIs, businesses can accelerate transactions, reduce fees, and enhance security—all while maintaining compliance with the latest financial regulations.

The Shift to Real-Time Payments

This year, 96% of manufacturers anticipate replacing traditional checks with real-time payments for outgoing transactions, and 87% expect the same shift for incoming payments. This transition reflects the growing demand for faster and more efficient B2B payment solutions.

In this blog, we’ll explore:

What’s Holding Your B2B Payments Back in 2026?

Despite the rapid evolution of digital payments, B2B transactions continue to face major hurdles that slow down operations and increase costs. If your business still relies on traditional payment methods, you may be experiencing these challenges:

1. Slow Processing Times & Cash Flow Delays

Traditional B2B payment methods such as wire transfers, ACH, and paper checks often lead to delayed settlements, causing cash flow constraints. Prolonged processing times can:

- Disrupt supplier relationships due to late payments.

- Delay critical business reinvestments.

- Create operational inefficiencies, making it harder to scale.

2. High Transaction Costs & Hidden Fees

Intermediary banks, payment processors, and legacy networks add layers of fees to B2B transactions. Businesses relying on SWIFT, credit cards, or third-party platforms often face:

- High per-transaction fees, cutting into profit margins.

- Cross-border payment surcharges, making international trade more expensive.

- Variable exchange rate markups, leading to unpredictable costs.

3. Disconnected & Fragmented Financial Systems

Many companies struggle with fragmented payment infrastructures, where invoicing, reconciliation, and reporting occur across multiple disconnected platforms. This results in:

- Manual reconciliation efforts, increasing the risk of human error.

- Delayed payment matching, slowing down financial reporting.

- Compliance risks, especially with evolving Open Banking regulations.

4. Security Risks & Lack of Real-Time Transparency

Are you exposing your business to fraud due to outdated security measures?

Traditional payment methods lack real-time visibility and strong authentication, making businesses vulnerable to:

- Payment fraud & unauthorised transactions.

- Data breaches & identity theft from weak encryption standards.

- Compliance failures with regulatory requirements like PSD3 & ISO 20022.

How Open Banking APIs Solve These Challenges in 2026

Despite the complexity of modern financial systems, Open Banking APIs are transforming B2B payments, offering businesses faster transactions, lower costs, seamless integration, and enhanced security. By leveraging B2B payment APIs and account-to-account (A2A) payments, businesses can eliminate inefficiencies and future-proof their financial operations.

1. Real-Time Payments Without Delays

Imagine paying suppliers instantly, without bank clearance delays. B2B money transfer APIs enable real-time payments, allowing businesses to:

✅ Transfer funds directly between bank accounts.

✅ Improve cash flow, ensuring faster reinvestment and supplier payments.

✅ Eliminate settlement delays, increasing financial agility.

With the rise of real-time payment networks, including FedNow in the U.S. and SEPA Instant in Europe, businesses can now settle payments in seconds instead of days.

2. Lower Transaction Costs with A2A Payments

Traditional payment networks often impose high fees on wire transfers and credit card payments. Open Banking APIs reduce B2B transaction costs by:

✅ Enabling direct Account-to-Account (A2A) payments, bypassing costly intermediaries.

✅ Lowering cross-border payment fees, making international B2B transactions more cost-effective.

✅ Reducing interchange fees and processing costs, benefiting businesses with high payment volumes.

A 2025 study by Juniper Research predicts that A2A transactions will surpass $850 billion globally, reflecting a major industry shift.

3. Automated Financial Workflows & ERP Integration

Many businesses struggle with manual reconciliation, invoice mismatches, and disjointed financial systems. Open Banking APIs simplify B2B payment workflows by:

✅ Automating invoicing and reconciliation, reducing human errors.

✅ Integrating seamlessly with Enterprise Resource Planning (ERP) and accounting software.

✅ Offering real-time payment tracking, improving financial transparency.

As 85% of businesses now use Open Banking for payments, API-driven automation is becoming the standard for finance teams.

4. Enhanced Security & Fraud Prevention

B2B payments are a prime target for fraud, with business email compromise (BEC) scams costing over $50 billion globally. Open Banking APIs provide:

✅ Strong Customer Authentication (SCA), reducing unauthorised transactions.

✅ Tokenised payments & encrypted data-sharing, preventing fraud.

✅ Direct bank connections, eliminating screen scraping and insecure payment methods.

With the EU’s PSD3 regulations strengthening Open Banking security, businesses must adopt modern API-based payment solutions to stay compliant.

How Easy Is It to Integrate Open Banking APIs into Your Business?

For many businesses, adopting new financial technologies can seem complex. However, Open Banking APIs are designed for seamless integration, ensuring minimal disruption while enhancing payment speed, security, and automation. Here’s how businesses can leverage Open Banking APIs effortlessly in 2026:

1. Collaboration with Trusted Third-Party Providers (TPPs)

Many businesses partner with regulated Third-Party Providers (TPPs) to simplify API integration. These providers:

✅ Handle the technical implementation, reducing the burden on internal teams.

✅ Ensure compliance with Open Banking regulations, including PSD3 in Europe

✅ Enhance security protocols, preventing unauthorised access and fraud risks.

With the global Open Banking market projected to reach $158 billion by 2027, businesses that partner with certified TPPs can accelerate adoption without major IT overhauls.

2. Flexible & Customisable API Solutions

One of the biggest advantages of Open Banking APIs is their customisability, allowing businesses to:

✅ Enable real-time B2B payments, improving cash flow and supplier relationships.

✅ Automate financial workflows, integrating with ERP, accounting software, and AI-driven reconciliation systems.

✅ Customise payment processing, offering tailored solutions for cross-border transactions, bulk payments, and A2A transfers.

As A2A payments gain traction, businesses can use Open Banking APIs to cut transaction fees while ensuring seamless integration with existing platforms.

3. Continuous Support & Regulatory Compliance

Open Banking regulations are evolving, requiring businesses to stay compliant with:

- PSD3 (Europe) – Strengthens consumer protection and fraud prevention.

- ISO 20022 adoption – Enhances global payment standardisation.

- CFPB Open Banking rules (U.S.) – Expands data-sharing frameworks.

API providers offer ongoing compliance updates, ensuring businesses:

✅ Receive security patches & fraud prevention enhancements.

✅ Stay aligned with new regulatory requirements, avoiding penalties.

✅ Access new Open Banking features, optimising B2B transactions.

With global Open Banking API calls expected to reach 722 billion by 2029, businesses must integrate future-ready API solutions to stay competitive.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

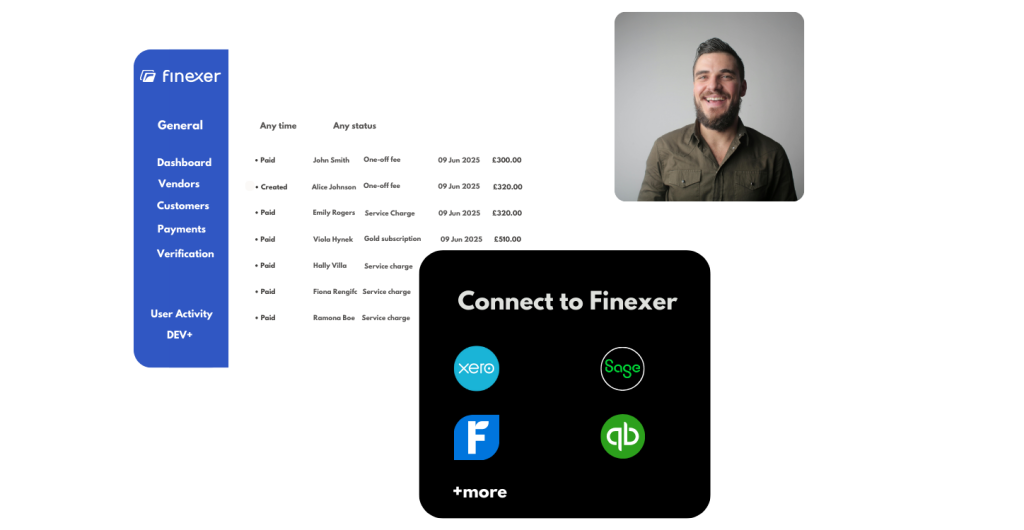

Why Choose Finexer for B2B Payments?

Seamless Integration & Scalability

- Start small, scale effortlessly—from 100 to 100,000 transactions with 98% uptime.

- Instant market access—connect to 99% of UK banks through a single integration.

- White-label platform—customise every aspect under your brand identity.

Built for SMBs & Fintech Startups

- Single-app simplicity—manage all financial operations in one intuitive platform.

- Startup-friendly pricing—transparent, consumption-based with no enterprise lock-ins.

- Enterprise-grade features—tailored solutions previously available only to large corporations.

Compliance, Speed & Strategic Support

- FCA-authorised infrastructure—automated regulatory compliance.

- 3X faster deployment—connect directly with UK banks, ensuring a smooth launch.

- Dedicated growth partners—fintech experts offering strategic guidance and insights.

With Finexer, businesses get faster payments, seamless banking connectivity, and enterprise-level tools—all without complexity.

What Are Open Banking APIs and How Do They Improve B2B Payments?

Open Banking APIs allow businesses to securely access financial data and process transactions in real-time. By integrating these APIs, companies can eliminate delays, reduce fees, and enhance security in B2B payments.

How Can Open Banking APIs Reduce B2B Payment Processing Costs?

Open Banking APIs enable direct Account-to-Account (A2A) payments, bypassing credit card networks and expensive intermediaries. This significantly lowers transaction fees and makes cross-border payments more cost-effective.

Are Open Banking Payments Secure for B2B Transactions?

Yes. Open Banking APIs utilise Strong Customer Authentication (SCA), tokenisation, and encrypted data-sharing, making them more secure than traditional payment methods. They also comply with PSD2 (Europe), ISO 20022, and CFPB Open Banking ordinances(U.S.).

How Quickly Can a Business Implement Open Banking for Faster Payments?

Businesses can integrate Open Banking APIs within weeks by partnering with Third-Party Providers (TPPs). Platforms like Finexer offer 3X faster deployment, instant UK bank connectivity, and seamless ERP integration.

Ready to modernise your B2B payments? Don’t let outdated systems slow you down. Book a Demo ! We’re just a click away 🙂