Note: Prices are subject to changeThe information about QuickBooks Pricing in this blog was sourced from publicly available materials on 2026. Please note that details may be subject to change.

For many UK businesses, keeping track of finances isn’t just a chore—it’s a constant source of stress.

- Are you paying too much for accounting software that doesn’t fully meet your needs?

- Are hidden fees making budgeting harder than it should be?

- Do you need a plan that fits your business size, but struggle to compare options?

If you’ve asked yourself any of these questions, you’re not alone. Accounting software is supposed to make your life easier, not more complicated—but choosing the right plan can feel overwhelming, especially when providers offer multiple pricing tiers with different features.

We will guide you through:

What is QuickBooks and Who is It For?

It is a cloud-based accounting software designed to help businesses manage their financial operations efficiently. It provides a range of tools that automate key accounting tasks, ensuring accuracy and saving time. The software is widely used across the UK by businesses of all sizes, from sole traders to large enterprises.

Key Features and Functions

It offers a variety of features that cater to different financial management needs:

- Income and Expense Tracking – Automatically records transactions, categorises expenses, and generates financial reports.

- Tax Calculations and VAT Submissions – Calculates tax obligations, prepares VAT returns, and submits them directly to HMRC.

- Payroll Management – Processes employee salaries, automates pension contributions, and ensures tax compliance.

- Invoicing and Cash Flow Monitoring – Creates and sends invoices, tracks outstanding payments, and provides cash flow insights.

- Bank Integrations – Connects directly with business bank accounts to reconcile transactions and provide real-time financial data.

Who Should Use QuickBooks?

It is designed for businesses at different stages of growth, offering tailored solutions based on specific accounting needs:

- Freelancers and Sole Traders – Individuals who need a straightforward way to track income, manage expenses, and prepare for self-assessment tax returns.

- Small Businesses – Companies requiring VAT management, invoicing, and financial reporting to stay compliant and organised.

- Medium-Sized Enterprises (SMEs) – Businesses handling payroll, supplier payments, and multi-currency transactions.

- Larger Businesses – Organisations that require more advanced features such as detailed financial reporting, automation, and multi-user access with role-based permissions.

Unlike general accounting software that applies a one-size-fits-all approach, It offers multiple pricing plans to cater to different business requirements.

📚 Guide to Open banking for Accountants

QuickBooks UK Pricing Overview for 2026

| Plan | Monthly Price | Annual Price | Best For |

|---|---|---|---|

| Self-Employed | £10 | £108 | Freelancers and sole traders managing self-assessment tax returns. |

| Simple Start | £16 | £192 | Small businesses that need VAT submissions and invoicing features. |

| Essentials | £33 | £396 | SMEs that work with suppliers and require payroll management. |

| Plus | £47 | £564 | Medium-sized businesses managing stock, projects, and multi-currency transactions. |

| Advanced | £115 | £1,380 | Large businesses needing advanced automation, reporting, and user permissions. |

Breakdown of QuickBooks Plans and Features

Choosing the right plan is essential to ensure your business gets the necessary tools without overpaying for features you don’t need. Below is a detailed breakdown of each QuickBooks UK 2026 plan, outlining pricing, included features, and ideal business types.

1. QuickBooks Self-Employed

Best for: Freelancers and sole traders who need basic accounting tools to track income, expenses, and prepare for self-assessment tax returns.

Price:

- £10 per month (full price)

- £108 per year (full price)

Key Features:

- Automatically tracks income and expenses

- Calculates self-assessment tax estimates

- Receipt capture and expense categorisation

- Mileage tracking for business trips

- Invoicing with payment tracking

- Bank account connectivity for easy reconciliation

Limitations:

- Does not include VAT management, payroll, or multi-user access

- Not suitable for businesses that need supplier management or advanced financial reporting

2. QuickBooks Simple Start

Best for: Small businesses that need basic accounting, invoicing, and VAT submission but do not require payroll or supplier management.

Price:

- £16 per month

- £192 per year

Key Features:

- Everything in Self-Employed, plus:

- VAT calculation and submission to HMRC

- Error checking and VAT reminders

- Construction Industry Scheme (CIS) support

- Pay-enabled invoices for direct payment processing

- Cash flow insights and forecasting

Limitations:

- No bill management or payroll integration

- Limited features for businesses working with multiple suppliers

3. QuickBooks Essentials

Best for: Small to medium businesses that need bill management, payroll, and multi-currency support.

Price:

- £33 per month

- £396 per year

Key Features:

- Everything in Simple Start, plus:

- Bill management for tracking due and paid expenses

- Multi-currency support (over 145 currencies)

- Time tracking for employees and projects

- Payroll add-on compatibility (additional fees apply)

Limitations:

- No stock management or advanced project tracking

- Not suitable for businesses managing large teams or multiple departments

4. QuickBooks Plus

Best for: Medium-sized businesses managing inventory, budgeting, and project profitability tracking.

Price:

- £47 per month

- £564 per year

Key Features:

- Everything in Essentials, plus:

- Stock management (track purchases, stock levels, and costs)

- Project profitability tracking (monitor income vs. expenses per project)

- Budgeting and forecasting tools

- More advanced reporting and financial analysis

Limitations:

- Lacks advanced automation and multi-user access controls

- Not designed for enterprise-level operations

5. QuickBooks Advanced

Best for: Large businesses requiring custom workflows, automation, and detailed financial reporting.

Price:

- £115 per month

- £1,380 per year

Key Features:

- Everything in Plus, plus:

- Automated workflows for routine accounting tasks

- Detailed business insights and reporting

- Role-based access permissions for employees

- Batch invoicing and bulk transaction processing

- Automated data backup and restoration

Limitations:

- Most expensive plan, designed for businesses with complex accounting needs

Which QuickBooks Plan is Right for You?

| Business Type | Plan |

|---|---|

| Freelancers & sole traders | Self-Employed |

| Small businesses handling VAT & invoices | Simple Start |

| Growing businesses managing payroll & suppliers | Essentials |

| Medium businesses managing stock & projects | Plus |

| Large businesses needing automation & advanced reporting | Advanced |

QuickBooks Add-Ons and Additional Costs

While It’s core plans cover most accounting needs, some businesses require additional features such as payroll management, advanced reporting, or enhanced automation. It offers optional add-ons that can be integrated with any plan for an additional fee. Below is a breakdown of these add-ons, their pricing, and who they are best suited for.

1. QuickBooks Payroll Add-On

Best for: Businesses that need to manage employee salaries, pensions, and tax compliance.

a) QuickBooks Standard Payroll

Price:

- Base cost: £4 per month

- Per employee: £1.30 per employee per month

Key Features:

- Fully cloud-based payroll system

- Real-time HMRC submissions for PAYE and NI contributions

- Automated payslips for employees

- Pension auto-enrolment compliance

- Statutory payments management (sick leave, maternity pay, etc.)

Limitations:

- Limited customisation for payroll schedules

- Does not include advanced HR and compliance features

b) QuickBooks Advanced Payroll

Price:

- Base cost: £8 per month

- Per employee: £1.30 per employee per month

Key Features:

- Everything in Standard Payroll, plus:

- Automated pay runs with custom schedules

- Detailed HR tools, including timesheets and shift scheduling

- Automated pension submissions to multiple pension providers

- Custom reporting and payroll integrations

Who Should Choose Advanced Payroll?

- Businesses with complex payroll needs, including multiple pay schedules

- Companies that need advanced HR management tools

- Employers who want automated compliance with pension regulations

2. QuickBooks Payments (Invoicing & Online Payments)

Best for: Businesses that need to accept online payments directly from invoices.

Pricing:

- No monthly fee; pay-as-you-go transaction fees

- Card payments: 1.4% + 25p per transaction (UK cards)

- International card payments: 2.9% + 25p per transaction

Key Features:

- Accepts credit & debit card payments directly from invoices

- Seamless integration with QuickBooks invoicing

- Automatic reconciliation of payments into accounts

Limitations:

- Transaction fees apply, making it costly for high-volume businesses

- Limited to invoice payments, does not support point-of-sale (POS) transactions

3. Advanced Business Insights & Reporting

Best for: Businesses that need custom financial reports and analytics beyond standard QuickBooks reports.

Pricing:

- Included in QuickBooks Advanced Plan

- Available as a separate add-on for lower-tier plans (pricing varies)

Key Features:

- Custom financial reports tailored to business needs

- Forecasting & budgeting tools

- Excel export & advanced data visualisation

- Automated KPI tracking

Limitations:

- Not necessary for small businesses with basic accounting needs

- Only available for higher-tier plans or as an extra-cost add-on

Are Add-Ons Necessary?

While some businesses need payroll, payments, or advanced reporting, others may not require add-ons at all. Here’s a quick guide:

- Payroll Add-On Needed? If you pay employees or contractors, yes. Otherwise, no.

- Payments Add-On Needed? If you send invoices and need faster payments, yes. Otherwise, no.

- Advanced Reporting Needed? If your business needs detailed financial analysis, yes. Otherwise, no.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

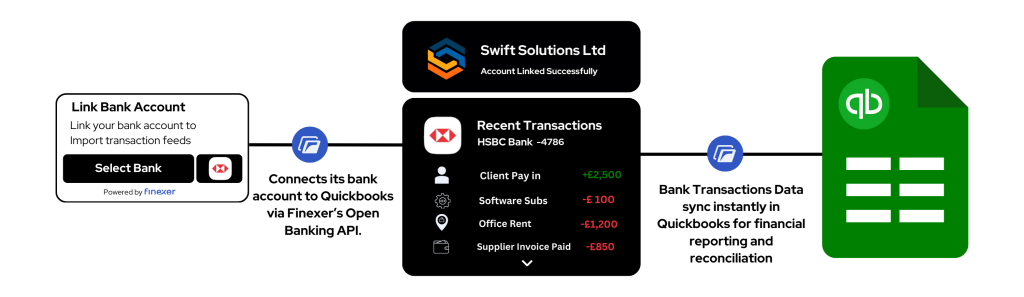

QuickBooks + Finexer: A Unified Financial Solution for Modern Businesses

QuickBooks is a powerful accounting solution known for effective expense tracking, tax management, and invoicing. However, businesses increasingly need enhanced financial visibility, secure payments, and robust verification features. By integrating QuickBooks with Finexer’s Open Banking APIs, your business gains advanced financial capabilities without leaving the QuickBooks environment.

1. Real-Time Financial Insights (AIS)

- QuickBooks syncs transactions efficiently, but Finexer extends this capability with detailed real-time transaction categorisation and affordability assessments.

- Obtain deeper insights into customer financial health, cash flow, and expenditure patterns to make informed business decisions faster.

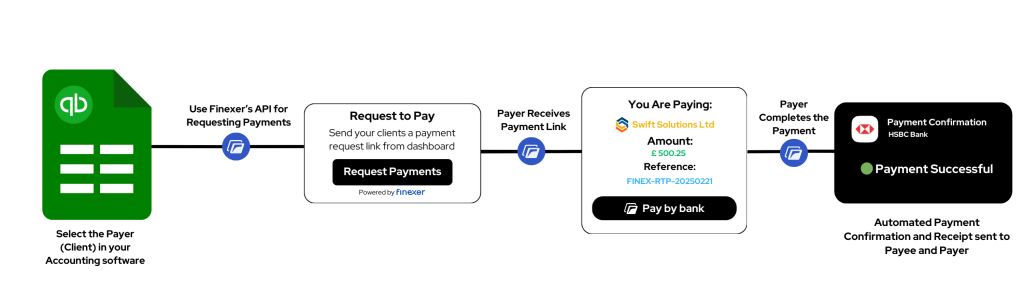

2. Seamless Payment Initiation (PISP)

- It handles invoicing and payment tracking but lacks direct payment initiation via Open Banking.

- Finexer integration lets you initiate secure, bank-to-bank payments directly within QuickBooks, eliminating reliance on manual bank transfers and streamlining your financial workflows.

3. Enhanced Bank Account Verification

- QuickBooks supports financial management effectively, but validating supplier or customer bank details manually can introduce risks.

- Integrating Finexer’s bank verification API instantly verifies bank accounts before payments, significantly reducing errors and fraud risk, enhancing transaction security and operational efficiency.

Start your 14-day free trial today to experience a more secure, insightful, and efficient financial management solution by combining QuickBooks with Finexer’s advanced Open Banking capabilities.

Can QuickBooks handle VAT submissions directly to HMRC?

Yes, QuickBooks supports VAT submissions directly to HMRC starting from the Simple Start plan (£16/month). It includes VAT calculations, error checks, reminders, and direct digital submissions.

Can QuickBooks integrate with Open Banking solutions like Finexer?

Yes, QuickBooks integrates seamlessly with Finexer, enhancing financial insights, enabling direct payment initiation, and providing secure bank verification through Open Banking APIs.

Is QuickBooks suitable for large enterprises in the UK?

The QuickBooks Advanced plan (£115/month) is specifically designed for large UK enterprises, offering advanced automation, custom financial reporting, batch processing, and role-based access control.

How secure is financial data within QuickBooks?

QuickBooks uses bank-level encryption and complies with strict UK data privacy standards, ensuring the security and confidentiality of your business financial data.

Connect Finexer with Quickbooks for Simplified Financial Management,Book a Demo now and get started with Finexer 🙂