When dealing with large corporate buyers, delayed payments often become part of the reality. While the invoice may state Net-30 or Net-60, the actual payment can take much longer, sometimes 90 or even 120 days. For finance teams managing cash flow, this creates a serious challenge: how do you keep your operations running smoothly while waiting on funds that are tied up in unpaid invoices?

Extended payment timelines are increasingly common among enterprise clients. Whether it’s due to their internal approval processes, procurement policies, or sheer bargaining power, these delays often leave smaller suppliers at a disadvantage. This blog will explore why enterprise payment terms are often extended beyond agreed timelines and how finance professionals can manage this without damaging client relationships or risking liquidity.

Keep reading or Jump to the section you’re looking for:

Why Enterprise Clients Extend Payment Terms

Extended payment timelines aren’t always the result of poor client behaviour. In many cases, enterprise payment terms are influenced by internal factors such as:

- Multi-level approvals: Invoices may pass through several departments before payment is authorised.

- Batch processing cycles: Payments may only be issued on a fixed monthly schedule.

- Contractual leverage: Larger businesses often use their position to enforce Net-60 or Net-90 terms by default.

But while these justifications may work for the buyer, they can have a serious knock-on effect on suppliers, especially those relying on consistent cash inflows. Enterprise payment terms can distort financial planning, delay payroll, and even cause businesses to seek financing to bridge the gap.

The Cash Flow Impact on Suppliers

For suppliers and service providers, extended enterprise payment terms can be more than just an inconvenience; they can disrupt the entire accounts receivable cycle. When payments are delayed beyond agreed terms, finance teams are left juggling short-term liabilities with uncertain cash inflows.

Late enterprise payments are a leading cause of working capital strain. According to a recent UK Finance report, over 50% of SMEs experience late payments from enterprise buyers, with average settlement timelines exceeding 80 days. This unpredictability makes it harder to forecast cash flow, manage payroll, pay suppliers, and invest in growth.

The longer the delay, the more likely businesses are to rely on expensive credit lines or temporary financing just to keep operations running. And when large clients represent a significant portion of revenue, a single late payment can have disproportionate effects on liquidity.

In short, enterprise payment terms don’t just affect finance operations—they shape business resilience. That’s why proactive accounts receivable management is essential, especially when working with enterprise clients on extended terms.

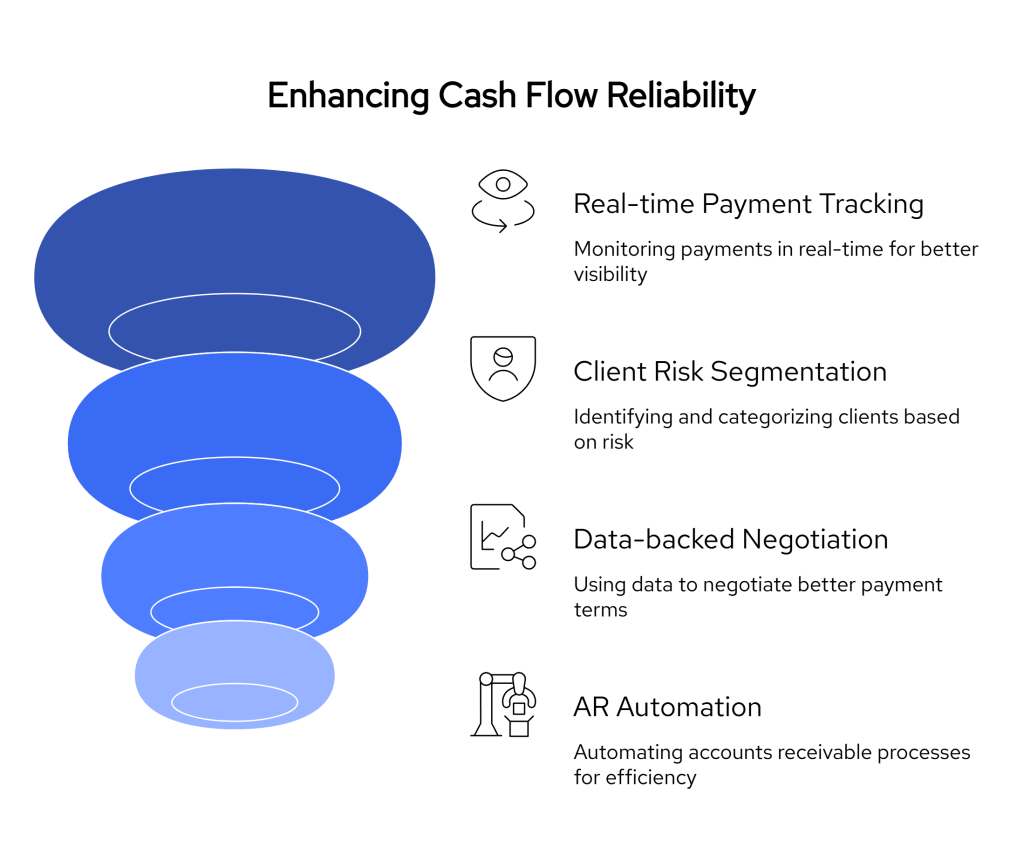

Strategy 1: Gain Real-Time Visibility Into Payment Activity

One of the most effective ways to manage extended enterprise payment terms is by gaining real-time visibility into your clients’ payment activities. Traditional accounts receivable systems often provide limited insights, leaving finance teams in the dark about when payments will actually arrive.

By implementing a robust payment tracking system, businesses can monitor the status of outstanding invoices and anticipate cash inflows more accurately. This proactive approach allows for better cash flow forecasting and reduces the uncertainty associated with delayed payments.

For instance, integrating Open Banking solutions can provide real-time updates on payment statuses, enabling finance teams to act promptly on any discrepancies or delays. This level of transparency is crucial when dealing with enterprise clients who may have complex payment processes and longer payment cycles.

Moreover, real-time visibility into payment activities empowers businesses to identify patterns in payment behaviours, allowing them to address issues proactively and maintain healthy cash flow despite extended enterprise payment terms.

Strategy 2: Segment Enterprise Clients by Risk and Behaviour

Not all clients who pay late pose the same level of risk. That’s why segmenting enterprise accounts based on payment behaviour is a crucial part of managing extended enterprise payment terms.

Start by reviewing your historical payment data. Which enterprise clients consistently pay late? Who requires multiple follow-ups? Who pays early and might qualify for incentives? Use this information to assign risk scores or tags that help you prioritise AR management efforts more efficiently.

Key segmentation criteria to consider:

- Average days beyond terms (DBT)

- Frequency of late payments

- Response time to follow-ups

- Contract size vs. cash flow disruption

With this segmentation in place, you can take targeted actions, such as enforcing stricter terms, offering early payment discounts to reliable payers, or flagging high-risk accounts for more frequent follow-ups.

This behavioural segmentation gives you greater control over how you manage enterprise payment terms, allowing you to adapt strategies based on risk rather than applying a one-size-fits-all approach.

Strategy 3: Negotiate Payment Terms Backed by Data

Extended enterprise payment terms don’t always have to be accepted as-is. With the right data, finance teams can enter negotiations on a stronger footing, especially when late payments go beyond even the agreed terms.

Start by gathering evidence from past invoice activity. If a client consistently settles invoices 90+ days after issuance despite a Net-60 agreement, you have a valid reason to reopen the discussion. Use data from your payment tracking system to show trends and highlight how delays are impacting your operations.

Consider negotiation strategies such as:

- Tiered payment structures (e.g., 50% on delivery, 50% on Net-30)

- Early settlement discounts to incentivise faster payments

- Penalties for excessive delays, written into future contracts

Framing the conversation around data rather than emotion helps preserve the relationship while asserting your business needs. Most enterprise clients understand that late payments create downstream effects, and they may be more open to adjusting enterprise payment terms if presented with a well-reasoned case.

Strategy 4: Automate the Follow-Up Process

One of the most overlooked ways to manage extended enterprise payment terms is to automate your follow-up and collection workflow. When large clients miss due dates, manually chasing every invoice wastes valuable time and creates friction between finance teams and client contacts.

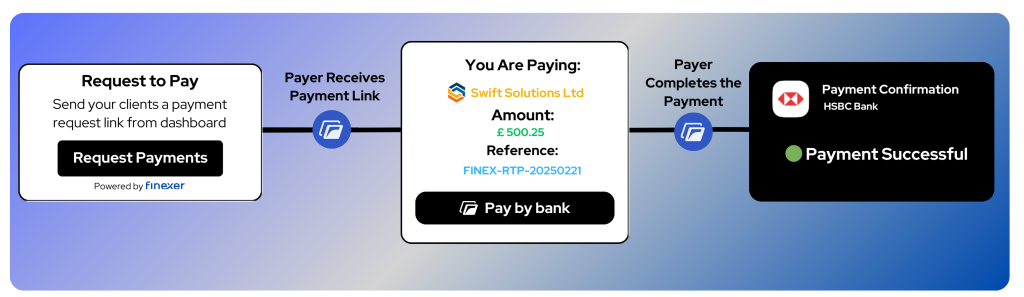

By automating payment reminders, status updates, and follow-up sequences, you reduce the pressure on your AR team and create a consistent, professional communication flow. Tools like Finexer’s Request to Pay feature, which integrates directly with UK bank feeds, allow finance teams to send secure, bank-authenticated payment requests to enterprise clients, cutting through inbox clutter and reducing delays.

Automation also helps you:

- Avoid missed follow-ups due to human error

- Maintain client relationships by removing emotion from reminders

- Scale your AR process without increasing headcount

For businesses dealing with extended enterprise payment terms, automation ensures you stay on top of what’s owed, without exhausting your team or damaging client goodwill.

Tools That Can Help You Manage Extended Payment Practices

To effectively navigate extended payment practices from enterprise clients, finance teams need more than just spreadsheets and reminders. They need visibility, automation, and insights. Here are tools that can make a real difference, especially when enterprise payment terms stretch beyond your cash flow comfort zone.

Chaser – Humanised AR Automation

Chaser lets you automate follow-ups and reminders without sounding robotic. You can schedule emails that adjust in tone and content based on invoice age, client history, or communication preferences.

This is especially useful when managing multiple enterprise clients with varying invoice cycles. Instead of sending the same “gentle reminder” to everyone, Chaser helps keep the relationship intact while reinforcing payment discipline.

Best for: Teams managing a high volume of outstanding invoices from large clients.

Finexer: Real-Time Visibility and Secure Payment Prompts

Finexer connects directly with 99% of UK banks through Open Banking APIs, giving you real-time visibility into whether an enterprise client has actually initiated a payment. Instead of waiting in the dark or relying on vague email confirmations, your finance team can see when a payment has been triggered—or if it’s being held up.

More importantly, Finexer’s Request to Pay feature lets you send secure, bank-integrated payment requests. These notifications appear in the client’s banking interface or preferred channel, increasing the chance of immediate action. It’s like giving your invoice a direct line into the enterprise’s financial system.

What makes it helpful for extended payment practices?

- You get live payment signals, not outdated bank feeds or guesswork

- Reduce invoice ageing by sending prompts directly through banking apps

- Settle large, high-value invoices faster without awkward follow-ups

For finance teams dealing with Net-60 or Net-90 terms, Finexer helps shift from reactive to predictive AR management.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Xero & QuickBooks – Smart Invoice Tracking and Reporting

Both Xero and QuickBooks offer native AR modules that can help you:

- Track overdue invoices

- Segment by ageing buckets

- Send recurring reminders

- Sync with your cash flow forecasts

When integrated with Finexer or similar real-time feed providers, these tools become much more powerful. Instead of just knowing that an invoice is overdue, you can see if the payment is actually on its way—or not.

Cash Flow Tools – Satago, Fluidly, Capchase

These platforms are great for forecasting and short-term liquidity planning when extended payment practices put pressure on working capital. Some, like Satago, also offer invoice financing based on your AR ledger, helping you unlock cash before the client pays.

Why they matter:

When enterprise clients delay payments for 90+ days, these tools help bridge the gap without resorting to expensive loans.

By combining live payment tracking (Finexer), intelligent AR workflows (Chaser), and forecasting tools (Satago or Xero), your team can respond faster, plan better, and take back control from inconsistent enterprise payment terms.

What are enterprise payment terms?

Enterprise payment terms refer to the agreed time frame large businesses have to settle invoices with suppliers. These terms are often Net-30, Net-60, or even Net-90, but delays beyond these periods are common due to internal approval processes or payment cycles.

How can finance teams manage extended payment practices from enterprise clients?

Finance teams can manage extended payment practices by using real-time bank feed tools like Finexer, automating invoice follow-ups, segmenting clients by risk, and negotiating terms backed by data. These strategies improve visibility and reduce cash flow uncertainty.

What tools help track and manage enterprise payment delays?

Tools like Finexer, Chaser, and Xero can help track delayed payments and automate accounts receivable processes. Finexer, in particular, provides live payment updates from UK banks and allows you to send secure payment requests directly to enterprise clients.

Can payment terms with enterprise clients be negotiated?

Yes, enterprise payment terms can be renegotiated, especially when data shows repeated delays. Suppliers can propose alternatives like tiered payments, early payment discounts, or updated terms during contract renewals or performance reviews.

Extended payment terms hurting your cash flow? Gain real-time visibility and take control with Finexer’s live bank feed integration.