Lending is no longer just about credit scores and forms, it’s about data access, speed, and trust. From personal loans to SME working capital, credit providers face two stubborn bottlenecks: confirming income accurately and judging affordability in real time.

Traditional processes don’t help. Applicants upload payslips and PDFs; teams then spend days validating them, chasing missing pages, or flagging forged documents. The friction is costly and often shuts out borrowers who don’t fit the “standard” profile.

With open banking for lending, that friction disappears. Borrowers grant consent, and lenders pull live, bank-verified data deposits, balances, and spending patterns straight from the source. No uploads, no waiting. In practice, lenders that inject this live data into underwriting have cut loan-origination times by as much as 85 per cent compared with legacy document workflows. Adoption is rising fast: UK open-banking payments jumped 88 percent between June 2022 and June 2023, signalling mainstream acceptance of bank-data rails.

This guide shows how regulated bank feeds now let credit teams:

- swap paperwork for real-time income checks

- switch rigid ratios for dynamic affordability snapshots

- deliver digital credit decisioning in minutes, not weeks

What Open Banking for Lending Really Means

In lending, open banking means more than just convenience; it means replacing guesswork with real-time financial evidence. Instead of requesting payslips, PDF statements, or self-declared income, lenders can now access verified bank data directly from the applicant’s current account, with their consent.

This access is powered by FCA-regulated APIs that support two key services:

| Regulated Service | What It Enables | Lending Impact |

|---|---|---|

| Account Information Services (AIS) | View account balances, salary deposits, regular expenses | Used for real-time income verification and affordability modelling |

| Payment Initiation Services (PIS) | Move funds between accounts instantly | Used to disburse loans or set up repayment schedules securely |

With these tools, lenders can build a complete financial picture before issuing credit, all without waiting days for uploads or risking tampered documents.

This shift isn’t just about efficiency, it’s about enabling digital credit decisioning based on real-time, authenticated financial behaviour. From high-cost short-term loans to complex underwriting for business credit, the use of open banking for lending ensures data accuracy, audit readiness, and faster turnaround at every stage of the process.

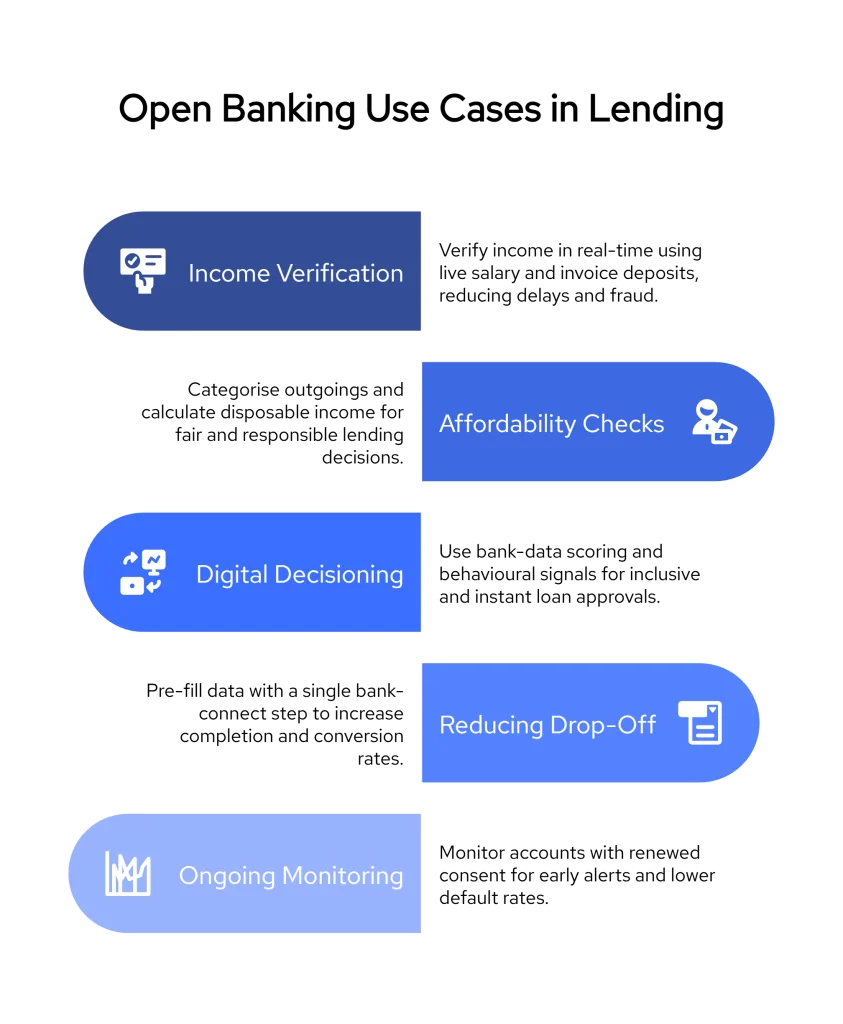

Key Use Cases of Open Banking for Lending

From Faster Income Checks to Credit Decisions Without Documents

The value of open banking for lending becomes clear when it’s mapped to real-world bottlenecks. Whether it’s speeding up onboarding or reducing dropout during applications, consented access to live bank data allows lenders to act on facts, not assumptions.

Below are five core use cases where bank-integrated credit workflows are already improving outcomes:

1. Real-Time Income Verification

Problem

Most lenders still ask for payslips or PDF statements. These documents are often delayed, incomplete, or even edited. Waiting for them slows down the approval process and adds extra work for both the borrower and the credit team.

Client Story

A freelance designer applies for a short-term loan. They upload one outdated payslip and a screenshot of a deposit. The lender isn’t sure if the income is current or recurring. After follow-up emails and missing files, the application is delayed for several days, increasing the chance of drop-off.

How It Works

With open banking for lending, borrowers simply connect their bank accounts during the application process. The lender can then view verified income entries directly from the account. This includes:

- Salary or invoice payments

- Frequency of deposits

- Employer or payer details

- Total income over time

The result is a complete income profile in minutes, with no need for uploads or manual checks.

Benefits

- Faster approvals using bank-verified income

- Less manual document review

- Support for gig workers and self-employed borrowers

- Stronger fraud protection with time-stamped data

Why This Matters

Verifying income is one of the biggest blockers in loan applications. With real-time income verification, lenders save time, avoid risk, and improve access for more types of borrowers.

📚 Guide to Income Verification with Open Banking

2. Affordability Checks for Lenders

Problem

Lenders often rely on fixed rules like “30% of income” to decide what a borrower can afford. But these rules ignore real expenses. Rent, bills, debt payments, and everyday spending aren’t always visible, especially when relying only on payslips or credit scores.

Client Story

A borrower applies for a £5,000 personal loan. Their income looks fine on paper, but their outgoings, including two payday loans and rising rent, aren’t considered. A standard affordability model gives the green light, but the borrower struggles to repay just weeks later.

How It Works

Using open banking for lending, lenders can view live transaction data from the applicant’s bank account. This includes:

- Regular expenses like rent, utilities, subscriptions, and debt

- One-off or seasonal spending

- Income minus outgoings to calculate real disposable income

This approach provides a full picture of what the borrower can actually afford, not just what a formula suggests.

Benefits

- Clear view of financial pressure or overspending

- More responsible lending decisions

- Reduced risk of missed payments or defaults

- Better support for borrowers during cost-of-living pressures

Why This Matters

Affordability isn’t just a box to tick; it’s a core part of lending fairly and safely. Affordability checks for lenders using live bank data make the process smarter, faster, and more accurate for everyone involved.

3. Digital Credit Decisioning

Problem

Traditional credit decisions rely heavily on credit scores and outdated data. This approach can exclude first-time borrowers, self-employed applicants, or anyone with a limited credit history, even if they’re financially responsible. Manual reviews slow things down, and inconsistent decisions increase risk.

Client Story

A lender receives two applications: one from a salaried employee with an average credit score, and one from a freelancer with no credit history but consistent income. The first is approved automatically. The second is flagged for manual review, delaying approval by three days and losing the applicant in the process.

How It Works

With open banking for lending, credit decisions can be based on actual financial behaviour. Borrowers grant consent to share their bank data, which shows:

- Income patterns and stability

- Spending behaviour

- Missed payments or overdraft use

- Account balances and financial habits

This allows lenders to score applicants in real time, even if they’re new to credit or fall outside typical models.

Benefits

- Faster approvals using verified, live financial data

- Fairer access for thin-file or credit-invisible borrowers

- Lower operational costs through automation

- Better risk control using real transaction insights

Why This Matters

Credit scoring shouldn’t punish people for not having debt. Digital credit decisioning powered by bank data makes lending faster, smarter, and more inclusive without adding manual review steps or paperwork.

📚 6 Instant Credit Scoring Methods

4. Reducing Onboarding Drop-Off

Problem

Many borrowers abandon their loan applications halfway through. Why? Long forms, repeated document uploads, and confusing steps create friction. Every extra task increases the chance that an otherwise eligible borrower gives up before submitting.

Client Story

An SME owner applies for a working capital loan. After filling in a form, they’re asked to upload bank statements and proof of income. They don’t have the documents on hand, plan to come back later, and never do. The application sits incomplete for days and is eventually discarded.

How It Helps

With open banking for lending, lenders can skip document requests altogether. When borrowers connect their bank account securely, the lender receives:

- Verified income and transaction data

- Account holder identity

- Categorised expenses

- Current account balance

Forms can be pre-filled, and data can be reviewed instantly, no waiting, no chasing.

Benefits

- Fewer abandoned applications

- Faster onboarding with no uploads

- Improved experience for digital-first borrowers

- Higher conversion from quote to approval

Why This Matters

A smooth onboarding experience increases loan approval rates and keeps marketing spend efficient. By reducing steps and removing friction, open banking for lending helps lenders convert more qualified applicants without adding risk or complexity.

5. Ongoing Risk Monitoring

Problem

Most lenders only assess a borrower’s financial health once, at the time of application. But a lot can change after a loan is approved. Without live updates, lenders miss early signs of financial stress, like increased borrowing, missed payments, or a drop in income.

Client Story

A customer is approved for a 12-month instalment loan. Three months in, their income drops and they begin missing bill payments. The lender only finds out after a default, by which point recovery is harder and the relationship is already strained.

How It Helps

With open banking for lending, lenders can request renewed access to a borrower’s bank account (with consent) and view ongoing activity such as:

- New recurring payments or debts

- Changes in income or job loss

- Signs of overdraft use or missed payments

- Spending spikes or irregular patterns

This allows lenders to flag early risks and offer support or restructuring before the borrower falls behind.

Benefits

- Early warning signals before defaults occur

- Proactive customer engagement and support

- Stronger portfolio performance and lower write-offs

- Built-in audit trail for compliance teams

Why This Matters

Ongoing risk management reduces long-term losses and builds better customer outcomes. With continuous insight into real financial behaviour, bank data for credit assessment doesn’t stop at approval; it supports the full loan lifecycle.

Benefits of Using Open Banking for Lenders

| Benefit | What It Solves | Why It Matters |

|---|---|---|

| Faster Approvals & Higher Conversions | Manual uploads, form fatigue, slow processing | Real-time data speeds up applications and reduces dropout |

| Smarter Credit Decisions | Overreliance on credit scores and limited history | Transaction-level data helps approve more borrowers fairly |

| Lower Fraud Risk | Forged documents, unverifiable claims | Bank-verified, timestamped data is harder to fake |

| Operational Cost Savings | Manual reviews, repeated follow-ups | Automation cuts admin time and scales efficiently |

| Stronger Regulatory Compliance | Incomplete records, audit risk | Consent flows and logged access support FCA and Consumer Duty rules |

Who’s Already Using It?

Open banking for lending isn’t just for digital-first startups. It’s being used across multiple segments of the lending industry, from BNPL providers to mortgage brokers, to improve onboarding, reduce risk, and speed up approvals.

| Lender Type | How They Use It | Primary Benefit |

|---|---|---|

| Challenger Banks | Verify income and affordability for new accounts or overdrafts | Faster approvals, lower operational costs |

| Credit Unions | Serve members with thin or no credit files using bank behaviour | More inclusive lending |

| BNPL & Point-of-Sale Lenders | Run instant checks during checkout | Split-second affordability checks |

| SME & Alt-Lenders | Assess cash flow and account health for working capital loans | Better lending decisions for business clients |

| Mortgage Brokers | Confirm deposit origin and ongoing affordability | Reduced documentation, faster exchange |

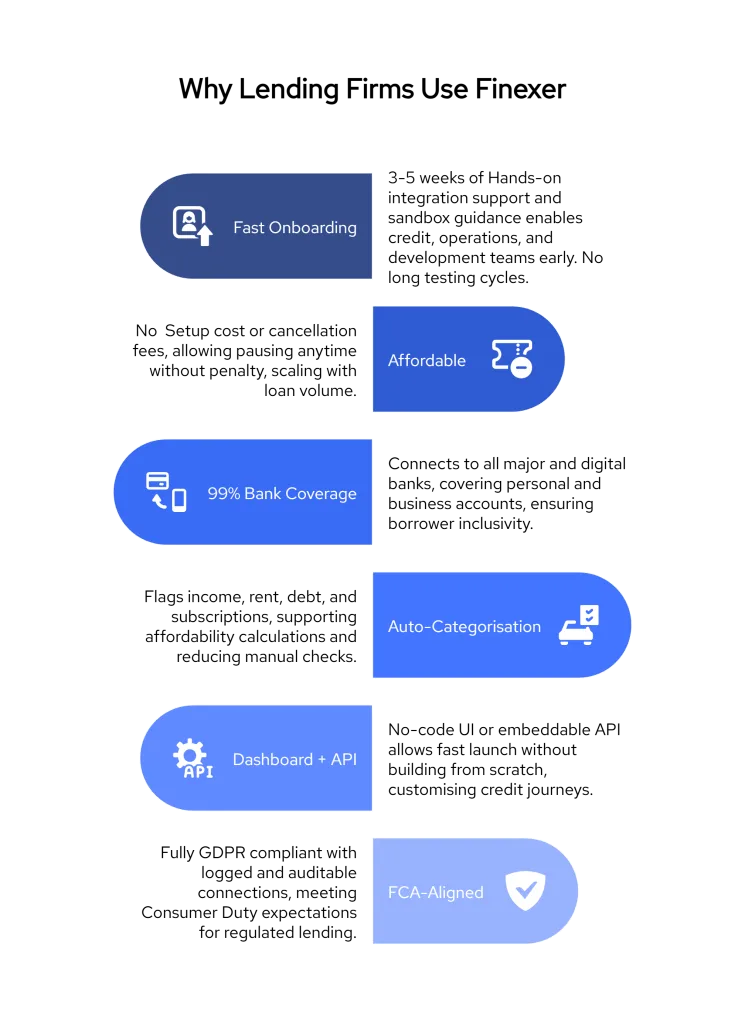

How Finexer Supports Faster, Smarter Lending

Finexer helps lenders access real-time, bank-verified financial data without the cost, complexity, or setup delays of traditional providers. Whether you’re running affordability checks, verifying income, or building automated credit flows, Finexer delivers what you need through a flexible API or ready-to-use dashboard.

What Finexer Offers

| Feature | What It Helps With |

|---|---|

| Real-Time AIS Feeds | See income, expenses, and account health instantly |

| Auto-Categorised Transactions | Understand affordability without manual review |

| White-Label or API Access | Use via dashboard or build directly into your app |

| Consent-Based Bank Connections | Fully FCA-compliant with audit-ready logs |

| Usage-Based Pricing | Only pay for completed checks — no setup fees or commitments |

What Makes Finexer Stand Out for Lenders

- 3–5 Weeks of Guided Onboarding

You get hands-on support from sandbox to production, helping your credit, dev, and ops teams move fast, without getting stuck in testing or integration cycles. - No Setup or Cancellation Fees

You can start using Finexer with zero upfront costs, and pause or scale down at any time, perfect for lenders with changing loan volumes or seasonal spikes. - 99% UK Bank Coverage

Connect to nearly every UK consumer and business bank, including high-street brands and digital challengers like Monzo, Starling, and Revolut. - Auto-Categorised Transactions

Skip the manual analysis. Finexer highlights income sources, debt repayments, and key expense categories, ideal for quick affordability checks. - Dashboard + API Options

Whether you’re building a new lending journey or just want to plug into a tool today, Finexer gives you both no-code and developer-ready access. - Consent-Based, FCA-Aligned Flows

Every connection is fully consent-driven and logged for audit purposes. Built to support Consumer Duty, GDPR, and lending compliance out of the box.

Get Started

Join the Lenders Using Finexer for Fast, Trusted, and Tailored Bank Data Access.

Try NowWrapping Up

For lenders in 2025, speed, accuracy, and compliance aren’t trade-offs; they’re expectations. And that’s exactly where Open Banking for lending fits in.

From verifying income to running affordability checks and monitoring post-loan risk, real-time bank data removes the guesswork from credit decisions. The result? More approvals, fewer defaults, and a faster path from application to disbursement.

Platforms like Finexer make it even easier to get started. With support for 99% of UK banks, no setup fees, and live deployment in 3–5 weeks, lenders can finally move fast without cutting corners.

What is open banking for lending?

Open banking helps lenders pull live bank data, income, expenses, and balances with consent, replacing slow PDFs and boosting approval speed.

How does real-time income verification work?

Borrowers connect their bank, salary and invoice deposits are auto-detected, giving lenders instant, fraud-proof income proof.

Why are affordability checks more accurate with bank data?

Live transactions reveal rent, debt and bills, so lenders see true disposable income instead of rough income-ratio guesses.

Does open banking reduce loan application drop-off?

Yes, one bank-connect step replaces uploads and long forms, cutting friction and raising completed applications.

Is open banking secure and FCA-compliant?

All data access is consent-based, encrypted and logged, meeting FCA, GDPR and Consumer Duty rules for UK lenders.

Approvals delayed by paperwork? Use Finexer to pull live bank data instantly!