UK payment habits are shifting faster than many retailers realise. In the debate of pay by bank vs card Payments, Open Banking “Pay by Bank” transfers hit 223.9 million in 2024, a 72 percent jump in just one year. Cards still dominate, 2.22 billion UK card transactions were logged in March 2025 alone but those card rails carry rising interchange, scheme, and gateway surcharges that chip away at every margin.

For merchants, the choice boils down to two very different rails:

- Card payments are familiar yet burdened by layered card processing fees UK retailers can’t ignore, multi-day settlement, and chargeback exposure.

- Pay by Bank checkout UK is an Open Banking flow that moves money account-to-account in seconds, with flat pennies-per-transaction pricing and no chargebacks.

This article delivers an evidence-first EPOS payment comparison so you can see exactly where bank-to-bank transfers save money, unlock instant settlement payments UK businesses crave, and improve customer experience.

Card Processing Fees UK

Card payments feel seamless at the checkout: tap, beep, done. But behind the scenes, UK retailers are absorbing significant costs.

UK merchants paid over £1.7 billion in card processing fees in 2024, according to the British Retail Consortium. For many, this is one of the biggest hidden expenses of doing business.

Below is what most merchants face with traditional card schemes:

| Factor | Card Payments (Visa, Mastercard, Amex) |

|---|---|

| Per-Transaction Fees | 1.2% to 3.5% depending on scheme, acquirer, and card type |

| Settlement Time | 1 to 5 business days (varies by provider and batching window) |

| Chargeback Risk | High (especially for online or card-not-present transactions) |

| Fraud Liability | Often passed to the merchant in disputes |

| Hardware & Maintenance | Terminal rental, PCI compliance, device upgrades |

| Refund Delays | 3 to 7 days back to card – creates support friction |

| Data Access | Minimal – usually just token and transaction ID |

| Customer Friction | Card entry, PINs, and wallet setups slow down checkout |

The Impact on Margins

A 2% card processing fee on £1 million in sales means £20,000 lost to intermediaries, just to move your customers’ money.

And that’s before factoring in dispute resolutions, chargeback admin, or lost goodwill from refund delays. In any EPOS payment comparison, card schemes carry the heaviest cost and complexity for retailers.

Open Banking checkout UK

Pay by Bank doesn’t just reduce fees, it restructures the entire payment flow. Instead of routing through acquirers and card networks, it sends money directly from the customer’s bank to the merchant’s account using Open Banking.

95% of UK Faster Payments settle in under 15 seconds, enabling retailers to manage cash flow in near real-time.

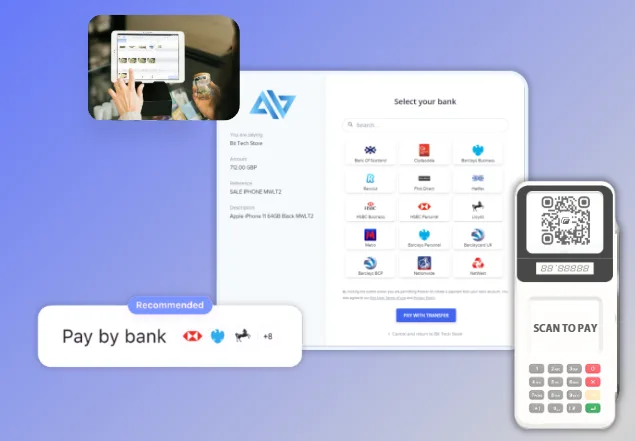

Checkout Flow: Online or In-Store

Whether you’re running a cloud EPOS or an e-commerce site, the process stays simple:

- The customer selects Pay by Bank at checkout.

- A QR code is triggered (in-store) or a bank selection screen appears (online).

- They’re redirected to their mobile banking app or web banking.

- User authenticates using Face ID, fingerprint, or passcode.

- Payment is confirmed and settled instantly into your account.

- Retailer receives full reference data and payment confirmation.

📚 Guide to Checkout Process Optimisation

What Makes Direct Bank Payment Work (Compared to Cards)

| Element | Pay by Bank (via Open Banking) |

|---|---|

| Payment Rail | Direct bank-to-bank transfer via Faster Payments |

| User Authentication | Biometric / banking app login – no card details needed |

| Settlement Time | Instant (usually < 10 seconds) |

| Transaction Cost | Flat-rate or API call pricing – no percentage fees |

| Integration Options | QR codes, API, plugins, or hosted checkout pages |

| Compliance | PSD2-compliant under FCA oversight |

This is not a workaround; it’s a secure, regulated, and scalable solution that’s purpose-built for EPOS and retail payments.

Compatible With:

- Cloud EPOS platforms (e.g. Shopify POS, Square, Lightspeed)

- Kiosk and self-service checkout with QR payment

- Mobile and app-based store checkouts

- E-commerce sites using redirect or embedded flows

Pay by Bank vs Card Payments

How does Bank-to-bank transfer actually compare to traditional card payments in real-world retail scenarios?

Here’s a detailed breakdown covering cost, speed, fraud risk, and user experience.

Real-World Use Cases: Where Pay by Bank Outperforms Cards in UK Retail

Retailers that process large ticket sizes, high volumes, or frequent refunds see the clearest benefit when they switch to Account-to-account payment (A2A). Below are four data-backed scenarios showing how the rail performs in practice.

| Use-Case Category | Why Cards Struggle | How Pay by Bank Solves It |

|---|---|---|

| High-Volume Grocery & Convenience | Margins often below 3%. A 1.8% blended card processing fee UK retailers pay erodes profit on every basket. | Flat-fee A2A Payments brings per-transaction cost to pennies. Instant settlement keeps daily cash flow positive for overnight stock orders. |

| Fashion & Footwear (High Returns) | Refunds can tie up revenue for up to 7 days; chargebacks often exceed 0.7% of sales. | Open Banking refund APIs push money back in seconds, cutting support calls and improving Trustpilot scores. |

| Self-Service Kiosks & Q-Commerce | Contactless limits (£100) and card-present fraud increase operational risk. | QR-based Open Banking checkout UK adds no cap, no plastic, and fully authenticated payments—ideal for unattended units. |

| Online Luxury & Electronics | Average order value > £400 attracts fraud; chargeback dispute fees average £25. | Bank-initiated payments carry strong customer authentication and no card data, slashing fraud exposure. |

A 2025 Barclaycard survey showed 78 % of UK shoppers are more likely to rebuy if a refund lands within 24 hours. Cards rarely meet that benchmark; Instant bank payment always does.

Cash-Flow Impact Example

£50 000 daily takings • 2-day card settlement • 30 days

Unavailable working capital: £3 million locked each month.

With instant settlement payments, UK merchants gain rapid reinvestment for inventory, payroll, and marketing.

Implementation Snapshot

- Choose a regulated provider (Finexer is FCA-authorised).

- Add the API or hosted link to your EPOS

- Display a dynamic QR at checkout or embed Pay by Bank online.

- Activate refund endpoints to provide real-time reversals.

Each step removes layers of card infrastructure, giving retailers a faster, cheaper, and more secure payment flow, proving the value of this EPOS payment comparison in real numbers.

Finexer: Affordable Pay by Bank API Built for Retailers

If you’re ready to stop surrendering margin to card networks, Finexer turns any EPOS or e-commerce checkout into an instant, account-to-account payment flow live in days, not months.

- Save up to 90 % on transactional costs vs. blended card fees

- Instant settlement via UK Faster Payments, boosting daily cash flow

- 3–5 weeks of hands-on onboarding assistance from Finexer’s UK support team

- Completely white-labelled checkout and refund pages, your brand, not ours

- Flat, usage-based pricing with no interchange or scheme mark-ups

- Built-in refund API for real-time reversals that improve CSAT

- QR code and API support for in-store, kiosk, mobile, and online checkouts

- FCA-authorised infrastructure that meets PSD2 requirements out of the box

Perfect Fit For

- Retailers losing margin to high card fees

- EPOS vendors embedding Pay by Bank rails

- Businesses with frequent refunds needing money back in seconds

- Online sellers seeking faster checkout and lower fraud exposure

Finexer makes Pay by Bank easy, affordable, and fully branded, so you keep more of every sale and give customers the speed they expect.

“Our business isn’t about the volume of consents—it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

Penny Phillips, Chief Commercial Officer at Sysynkt.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowPay by Bank vs card?

Bank-to-bank transfer moves money directly from a shopper’s bank to yours; card payments route through issuers, schemes, and acquirers.

Are Pay by Bank fees lower than card processing fees?

Yes. Flat pennies per sale replace 1.5 %–3.5 % card charges, cutting costs for UK retailers.

How fast is Bank-to-bank transfer settlement in the UK?

Funds clear in seconds via Faster Payments; cards take 1–5 working days to reach a merchant’s account.

Is Pay by Bank secure for customers?

Strong Customer Authentication in each banking app makes Direct bank payment safer than card data entry.

Can my EPOS add Account-to-account payment (A2A) easily?

Yes. Most UK EPOS platforms support Open Banking plugins, QR flows, or hosted links with minimal setup.

Finexer helps you save up to 90% on transactional costs with QR, mobile, and instant bank transfers! Try Now 🙂