UK utilities are caught between rising payment failures and higher customer expectations. Recent data underline the pressure:

- 2.7 % of Direct-Debit payments for gas and electricity failed in April 2025 triple the pre-crisis rate.

- 1 in 10 adults has missed at least one utility bill in the past six months.

- 31 million Open Banking payments were completed in March 2025, equal to 1 in every 13 Faster Payments and up 70 % year on year.

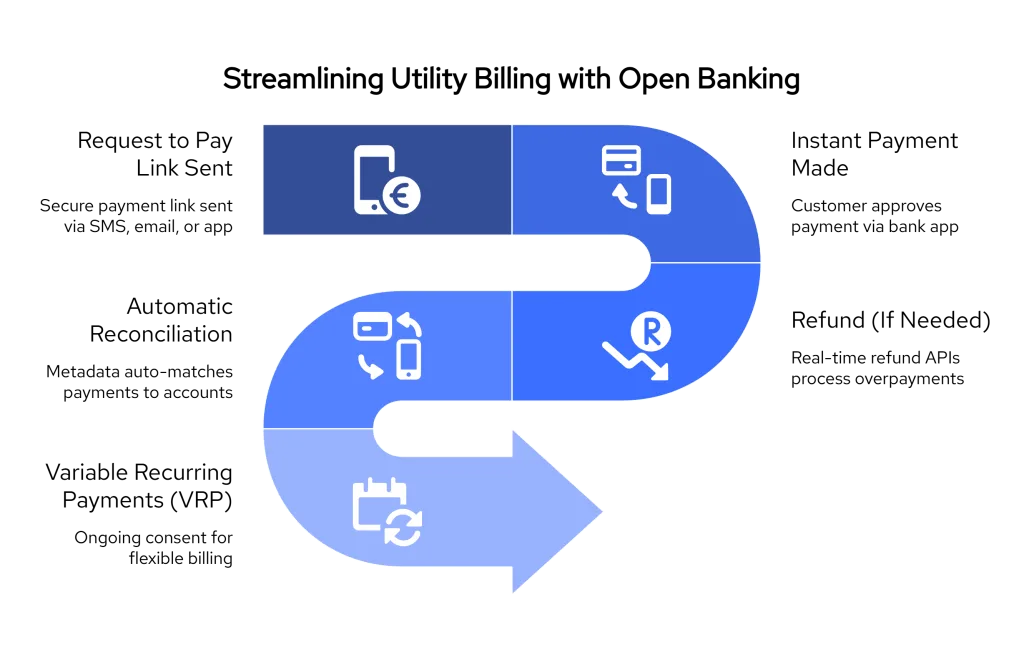

These numbers show why open banking for utilities is moving from pilot projects to mainstream adoption. Account-to-account transfers settle in seconds, refund APIs clear overpayments almost instantly, and enriched transaction data powers automated reconciliation. The result is faster cash-flow, lower costs, and a smoother experience for customers and finance teams alike.

1. Instant Utility Bill Payments with Open Banking for Utilities

Collecting utility bill payments through cards or Direct Debit often leads to settlement delays, failed collections, and higher operational costs. Open banking for utilities offers a faster, more secure way to collect payments through real-time, account-to-account transfers that settle within seconds and confirm instantly on both sides.

This reduces reliance on outdated collection cycles and helps billing teams improve cash flow without adding manual steps.

How the Pay-by-Bank Flow Works

- The utility provider sends a bill by email, SMS, app, or post, along with a secure payment link or QR code.

- The customer taps the link or scans the code, and their bank app opens with the payment details already filled in.

- After confirming the payment using Strong Customer Authentication (SCA), the funds are transferred instantly via Faster Payments.

- The utility provider receives cleared funds and immediate confirmation, including all necessary transaction references.

There’s no need for card entry, no risk of expiry dates, and no middlemen slowing things down.

Request to Pay for Variable Usage

Some utility customers, especially those using smart meters or pay-as-you-go models, receive different bill amounts each month. Request to Pay enables providers to send a precise payment request that the customer can review and approve in real time.

No fixed mandate is needed. The customer stays in control, while the provider benefits from reliable, on-time settlement, ideal for flexible or usage-based billing cycles.

Benefits for Utility Providers

| Legacy Collection Issue | Solved by Open Banking for Utilities |

|---|---|

| Card failures and Direct Debit bounce rates | Real-time payments reduce failed collections |

| Multi-day settlement delays | Cash received within seconds of approval |

| High transaction fees | No interchange or chargeback costs |

| Manual payment matching | Enriched bank data simplifies reconciliation |

| Late-payment queries from customers | Instant confirmation visible in the customer’s banking app |

By shifting to Open Banking, utility providers can improve on-time payment rates, lower processing costs, and reduce the administrative burden of chasing payments.

2. Real-Time Refunds with Open Banking for Utilities

Refunds are a common but often frustrating part of utility billing. Whether it’s adjusting for an overestimated bill, returning a security deposit, or correcting a duplicate payment, traditional methods take time, increase support workload, and leave customers waiting.

Open banking for utilities simplifies this entire process. With real-time refund APIs, providers can return funds directly to the customer’s verified bank account within minutes, no cards, no batch files, and no uncertainty.

Common Utility Refund Scenarios

| Scenario | With Traditional Methods | With Open Banking |

|---|---|---|

| Overcharged based on meter reading | Manual refund, processed in 3–5 days | Instant refund via secure API |

| Security deposit return | BACS transfer or cheque posted | Same-day return to bank account |

| Duplicate payment | Manual form, customer submits bank info | Refund sent to original account-to-account payment source |

Because refunds are issued using the original payer’s bank account, verified at the time of the initial transaction, there’s no need to request sensitive details again. This reduces both friction and fraud risk.

Key Benefits of Instant Refunds

- Faster resolution — most refunds settle within minutes, not days

- Fewer support tickets — customers no longer call to “check refund status”

- Improved customer trust — faster refunds reduce disputes and build confidence

- Lower admin costs — refund processes can be fully automated in your billing system

- Accurate tracking — every refund is tied to a known, verified transaction ID

By building refunds directly into your utility billing automation flow, you improve service while cutting operational overhead. For finance and customer service teams alike, this removes a major source of friction.

📚 Utility Refund Delays Fixed with Finexer

3. Payment Reconciliation Made Easy with Open Banking for Utilities

Reconciling incoming payments is one of the most time-consuming tasks for utility finance teams. Late settlements, missing references, and unallocated funds often force teams to match transactions manually, especially when card payments or BACS transfers are involved.

Open banking for utilities changes this. Every account-to-account payment carries rich transaction metadata, including reference IDs, payer details, and timestamps. This means payments can be matched automatically to invoices, customer accounts, or usage statements without human intervention.

Why Traditional Reconciliation Slows You Down

| Reconciliation Problem | Operational Impact |

|---|---|

| Payments missing invoice references | Requires manual lookup and slows down allocation |

| Delayed settlement (2–3 days) | Cash flow visibility is delayed, affecting forecasting accuracy |

| Duplicates or partial payments | Increases reconciliation errors and complicates audits |

| Refunds and adjustments processed separately | Adds extra admin steps and risks incorrect reporting |

How Open Banking Streamlines Utility Reconciliation

- Payments settle in real time, so reconciliation can happen immediately

- Enriched data enables systems to match payments automatically to the correct customer account

- All transactions carry verified account details, no guesswork, no re-keying

- Refunds and inbound payments use the same system, so everything is tracked in one place

- Compatible with billing, ERP, or CRM platforms using simple API integrations

By integrating utility payment reconciliation into your billing process, you reduce errors, close books faster, and free up finance teams to focus on higher-value tasks.

4. Recurring Billing Made Flexible with Open Banking for Utilities

For many utility customers, recurring payments provide convenience and predictability, whether it’s a fixed monthly plan or regular pay-as-you-go top-ups. Traditionally, these recurring transactions rely on Direct Debits, which can take days to settle, fail without notice, or require complex mandate setup.

Open banking for utilities introduces a more flexible alternative using Variable Recurring Payments (VRPs). This model allows utility providers to collect payments on a recurring basis, without needing to store card data or manage mandates.

Why Direct Debits Fall Short

| Issue | Impact on Utility Providers |

|---|---|

| Fixed mandate limits flexibility | Difficult to adapt to real usage or top-ups |

| Failed collections increase workload | Missed payments create follow-ups and risk service disruption |

| Delays in settlement | Slower cash flow, especially across billing cycles |

| Complex cancellation and re-authorisation | Frustrates customers and increases churn risk |

How Variable Recurring Payments Improve the Model

With VRPs, customers approve a single, secure consent that allows the utility provider to request payments up to a pre-agreed limit. These are real-time account-to-account payments, meaning each transaction still uses strong authentication and full traceability.

Benefits include:

- Real-time pull-based payments aligned with meter data or usage patterns

- No need to set up or manage separate mandates

- Better transparency and control for the customer

- More predictable revenue for providers

- Fewer failure points, as payments are always tied to live account balances

This flexible recurring model works especially well for energy providers with usage-based pricing, water companies offering monthly pay plans, or any utility looking to move beyond static billing systems.

Why Utility Companies Choose Finexer

While many Open Banking providers focus only on basic payments, Finexer supports the full billing lifecycle: collecting utility bill payments, issuing instant refunds, automating reconciliation, and enabling recurring account-to-account payments with full consent and visibility.

With Finexer, you don’t just get an API, you get a purpose-built toolkit backed by compliance-ready infrastructure and hands-on support tailored to the utility sector. It’s designed to integrate cleanly into your existing billing systems, without disrupting what already works.

Here’s what makes it a fit for providers rolling out open banking for utilities:

| Feature | What It Means for You |

|---|---|

| Unified Open Banking API | Collect payments, send refunds, and automate reconciliation — all through a single integration |

| Pay-by-Bank and QR Code Support | Let customers pay instantly without entering card details or creating accounts |

| Real-Time Refunds | Return overpayments and account credits directly to verified bank accounts in minutes |

| Automated Reconciliation with Enriched Data | Match payments to the right accounts automatically and reduce admin time |

| VRP-Ready Recurring Payments | Replace static Direct Debits with flexible, usage-based billing that customers can control |

| 99% UK Bank Coverage | Serve nearly every bill-payer, regardless of where they bank |

| FCA-Authorised Infrastructure | You stay out of the compliance burden — Finexer handles the regulatory layer |

| 3–5 Weeks of Post-Onboarding Assistance | Technical guidance and real-time support during rollout and beyond to ensure everything works smoothly |

| Usage-Based Pricing | Pay only for what you use — perfect for variable billing cycles or seasonal volume |

Finexer gives utility providers the tools to modernise payment operations without rebuilding internal systems. Whether you’re dealing with daily top-ups, monthly smart-meter bills, or refund requests, it’s a practical, future-ready solution that fits into existing finance and billing workflows, with real results from day one.

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package. Finexer has proven to be more than a provider, they’re a trusted partner who understands our vision and helps us achieve it,”

David Kern, CEO of VirtualSignature-ID.

Get Started

Helping UK utility companies get paid faster, more reliably, and at a lower cost.

Try NowWrapping Up

Payment delays, refund bottlenecks, and reconciliation overhead have long been accepted as part of utility billing. But with rising customer expectations and increasing cost pressure, that approach no longer works.

Open banking for utilities offers a clear upgrade:

- Instant, account-to-account payments

- Real-time refunds tied to verified customer accounts

- Automated reconciliation using enriched bank data

- Recurring billing that adapts to usage, not static mandates

Whether you manage electricity, gas, water, or multi-utility services, Open Banking gives you the infrastructure to simplify collections, reduce admin, and improve customer experience without starting from scratch.

Finexer brings this infrastructure to life with a single API, FCA-authorised backend, and hands-on support to make implementation practical and low-risk.

What is open banking for utilities?

Open banking for utilities connects billing systems directly to customer bank accounts. Payments, refunds, and reconciliation move through secure account-to-account payments.

How do customers pay utility bills with Open Banking?

Customers tap a Pay-by-Bank link or scan a QR code. Their banking app opens, they approve, and the utility bill payment clears instantly, no card details, no Direct-Debit delays.

Can recurring utility charges use Open Banking?

Yes. Variable Recurring Payments (VRPs) let providers pull funds automatically within agreed limits. This replaces rigid Direct Debits and supports usage-based plans while keeping customers in control.

Are refunds faster with Open Banking for utilities?

Refund APIs return over-payments or security deposits to the original bank account within minutes, cutting typical 3-to-5-day wait times and lowering support calls.

Does Open Banking improve utility payment reconciliation?

Each utility payment reconciliation record includes enriched data, payer name, reference ID, and timestamp, allowing finance systems to auto-match transactions and close books faster with fewer errors.

Instant payments, real-time refunds, and automatic reconciliation, all in one API. Get started with Finexer today 🙂