For accounting firms, verifying the source of funds in client transactions is no longer a back-office formality. Regulators such as the FCA and HMRC place strict obligations on accountants to prove that client money has been earned legitimately, with penalties for firms that fail to meet these standards.

The challenge is that most accountants still depend on manual processes: requesting PDFs, chasing bank statements, and cross-checking transactions line by line. This not only drains billable hours but also slows down client onboarding, especially during peak tax and audit periods.

This is where Open Banking for a source of funds checks in accounting comes into play. By connecting directly to client bank accounts with consent, accounting firms can instantly access verified transactions, categorise income, and generate audit-ready records. Instead of spending days validating bank data, firms can complete checks in minutes, freeing staff to focus on advisory work and client relationships.

But not all solutions are equal. Some Open Banking providers are built with consumer payments in mind, while others prioritise fintech use cases. Accountants require something different: FCA-authorised Open Banking providers that deliver compliant, accurate, and accounting-ready data.

In this guide, we’ll explore what accountants should look for in an Open Banking API for source of funds, compare leading providers, and explain why more firms are choosing Finexer to reduce compliance risk and reclaim time.

Why Accountants Need Open Banking for Source of Funds Verification

For many accountants, source of funds verification is one of the most time-consuming compliance tasks. A single client review can take hours collecting statements, matching deposits against payslips, and confirming whether funds came from legitimate sources such as salaries, rental income, or business proceeds.

The problem isn’t just inefficiency. Manual checks increase the risk of oversight. A missing page in a bank statement or an unverified transfer can expose firms to fines and reputational damage if regulators flag a weak process. In today’s environment, AML compliance for accounting firms is not optional; it’s a legal requirement with serious consequences.

Open Banking changes this dynamic. Instead of relying on clients to send incomplete or outdated statements, accountants can connect directly to client bank accounts with consent. Within minutes, they receive:

- Real-time transaction data going back months or years.

- Categorised income and outgoings to distinguish legitimate earnings.

- Audit-ready records that can be securely stored for compliance reviews.

This reduces the workload for accountants, shortens client onboarding from days to hours, and ensures that every accounting compliance check is backed by verified data directly from the bank.

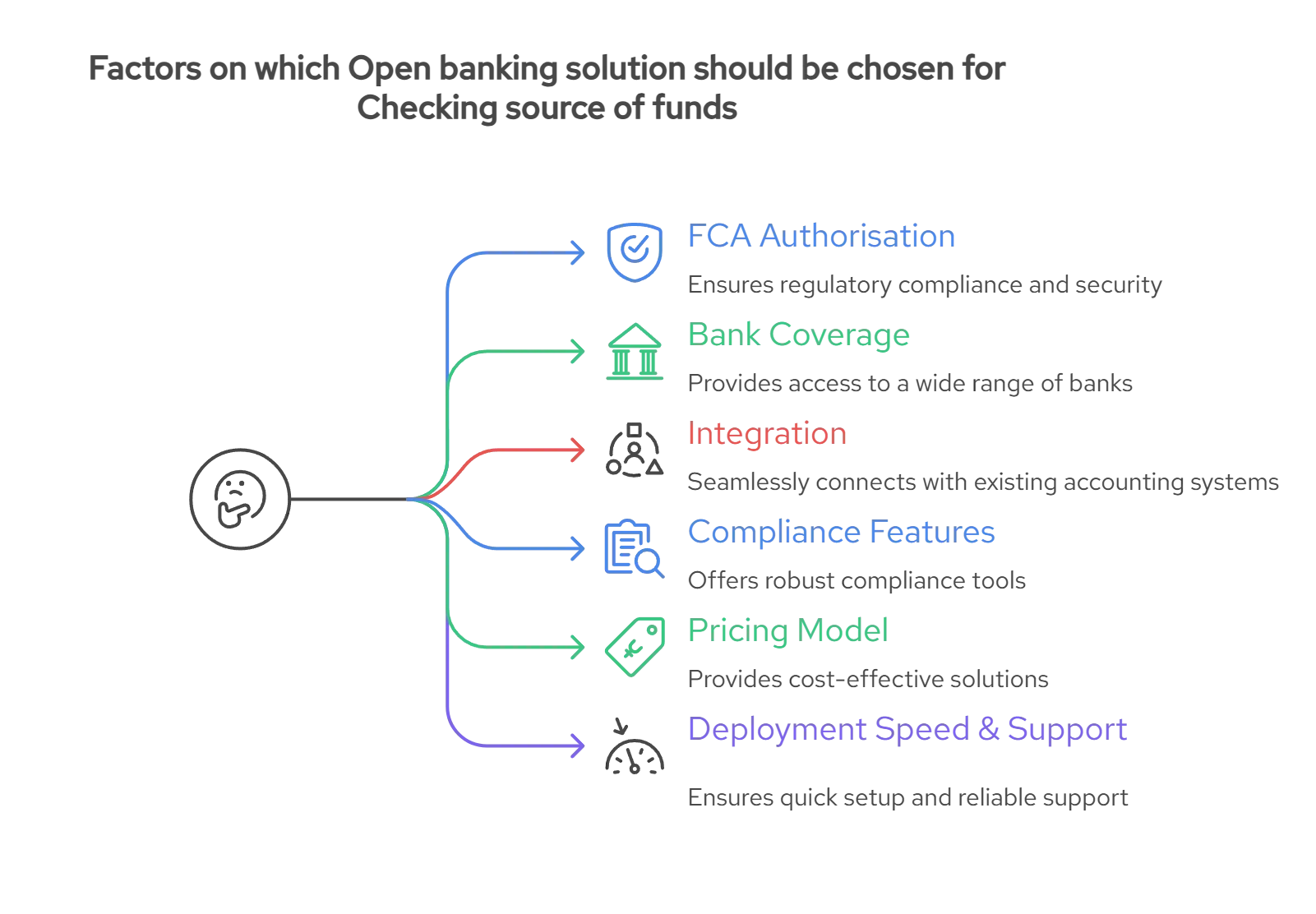

Key Criteria for Choosing Open Banking for Checking the Source of Funds checks in Accounting

Not every API on the market is suitable for accountants. While many Open Banking providers focus on payments or consumer finance, accounting firms need solutions built for compliance, record-keeping, and audit support. When evaluating vendors, firms should use a structured framework that covers both regulatory and workflow needs.

1. FCA Authorisation

Accountants must ensure they only work with FCA-authorised Open Banking providers. This gives firms confidence that both Account Information Services (AIS) and Payment Initiation Services (PIS) are regulated under UK standards, and that client data is being handled securely.

2. Bank Coverage

For thorough source of funds verification for accountants, the provider should connect to 99% of UK banks, including high street and digital-first banks. Limited coverage often means gaps in data that could compromise an audit.

3. Integration with Accounting Systems

A provider should support smooth integration with tools accountants already use, whether that’s Xero, QuickBooks, or bespoke firm software. Standardised data formats and automated syncing reduce the workload for staff and improve accuracy in accounting compliance checks.

4. Compliance Features

Look for built-in support for AML compliance for accounting firms:

- Categorisation of income (salary, rental income, dividends).

- Flags for unusual transactions.

- Audit-ready logs and exportable reports.

5. Pricing Model

Unlike enterprise fintechs, most accounting firms need flexible pricing. Usage-based models allow firms to scale without being locked into heavy monthly contracts.

6. Deployment Speed & Support

Finally, evaluate how quickly a provider can be deployed. A solution that goes live 2–3x faster than the market average can save firms weeks of delays, especially during tax or audit season.

Comparing Open Banking Providers for Source of Funds checks in Accounting

When it comes to automating source of funds verification for accountants, the choice of provider makes all the difference. Many solutions on the market are built with fintech apps or consumer payments in mind, but accounting firms need something more specialised: secure, compliant, and aligned with daily workflows.

Here’s how the leading FCA authorised Open Banking providers stack up against each other:

| Criteria | Finexer | TrueLayer | Plaid | Token.io |

|---|---|---|---|---|

| UK Bank Coverage | Yes — 99% including high street and digital banks | Limited — focused on major UK banks; EU-first strength | Limited — global-first, partial UK support | Limited — EU-first, constrained UK coverage |

| FCA Authorisation | Yes — AIS and PIS fully authorised | Yes — AIS authorised; PIS limited in the UK | Limited — strong AIS; PIS limited in the UK | Yes — AIS and PIS authorised |

| Accounting Workflow Fit | Yes — built for accounting compliance checks and MTD-ready | Limited — fintech/payments focus, not accounting-led | Limited — broad API, no accounting-specific features | Limited — more suited to EU compliance than UK accounting |

| Deployment Speed | Fast — 2–3× quicker than market average | Moderate — developer-led onboarding | Slower — enterprise onboarding cycles | Moderate — EU-oriented rollout |

| Pricing Model | Flexible — usage-based, no fixed overheads | Subscription-heavy | High minimum commitments | Enterprise-oriented |

| White-Label Options | Yes — ideal for client portals | Limited | Limited | Limited |

Why Finexer is the Accountant’s Choice for Source of Funds checks

While other APIs serve general fintech or global payment needs, Finexer is built for accountants in the UK. Every feature has been designed with compliance, efficiency, and client service in mind, making it the natural choice for firms that want to reduce risk and reclaim billable hours.

UK-First Coverage

Finexer connects with 99% of UK banks, from high street names like Barclays, Lloyds, and HSBC to digital-first challengers such as Monzo and Starling. This ensures accountants can perform source of funds verification for accountants across every type of client, without gaps or exceptions.

FCA Authorised for Peace of Mind

Finexer is fully FCA-authorised for both AIS and PIS. That means every client data exchange meets strict UK regulatory standards. For firms where AML compliance for accounting firms is critical, Finexer eliminates uncertainty by providing data that is both real-time and regulator-ready.

Built Around Accounting Compliance Checks

Unlike generic Open Banking platforms, Finexer’s API is designed to deliver data that accountants can use directly for accounting compliance checks. Categorised transactions, audit-ready logs, and MTD-compliant feeds reduce the manual work of sorting, tagging, and reconciling financial data.

Faster Deployment, Flexible Pricing

Accounting firms cannot afford six-month onboarding cycles or expensive enterprise subscriptions. Finexer deploys 2–3x faster than the market average, with usage-based pricing that scales with firm size. Whether you’re a small practice or a mid-sized firm, you only pay for what you use.

White-Label Ready

For firms that provide client portals, Finexer offers white-label solutions, allowing practices to deliver a modern client experience without compromising compliance or brand consistency.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowROI for Accounting Firms Using Finexer

For most accounting firms, the question isn’t whether source of funds verification for accountants is necessary; it’s how to make it efficient, compliant, and cost-effective. Manual processes eat into staff hours, reduce client satisfaction, and create compliance risks. Finexer changes that equation by delivering measurable ROI across three core areas:

1. Time Savings

- Manual process: 45–60 minutes per client check (collecting, verifying, categorising).

- With Finexer: 3–5 minutes per client check via direct bank data.

- Result: Up to 90% reduction in verification time, freeing staff to focus on higher-value advisory work.

2. Compliance Assurance

- Without automation: Higher error rates, missing records, and greater exposure to fines.

- With Finexer: Audit-ready records stored automatically, supporting AML compliance for accounting firms.

- Result: Reduced risk of non-compliance and peace of mind during regulator reviews.

3. Faster Client Onboarding

- Traditional method: 2–3 days to gather and validate statements.

- With Finexer: Same-day onboarding using real-time verified data.

- Result: Clients start services faster, improving satisfaction and accelerating revenue recognition.

4. Cost Efficiency

- Usage-based pricing means firms only pay for what they use.

- Savings from reduced staff hours and avoided compliance penalties deliver ROI within months.

In short, Finexer doesn’t just make compliance easier; it transforms it into a business advantage, helping firms grow faster while reducing operational risk.

What is Open Banking for Source of Funds checks in Accounting?

Open Banking for a source of funds checks in accounting refers to using APIs to access client bank data directly, with consent, for compliance checks. Instead of chasing PDFs or manual statements, accountants get verified, categorised transactions instantly.

How does source of funds verification for accountants improve compliance?

Source of funds verification ensures every transaction is backed by data pulled directly from banks. This reduces the chance of missing records and supports AML compliance for accounting firms, lowering regulatory risk.

Why should accountants choose FCA authorised Open Banking providers?

Only FCA authorised Open Banking providers meet UK regulatory standards for Account Information Services (AIS) and Payment Initiation Services (PIS). This ensures that sensitive client data is handled securely and in line with compliance laws.

Don’t let manual source of funds checks slow your firm down. Book a free demo with Finexer today