Imagine trying to send money on a Sunday night, only to be told it will take “1 to 3 business days” to arrive. For mobile-first consumers, small business owners, and eCommerce merchants, that delay isn’t just inconvenient – it disrupts operations, slows down cash flow, and creates unnecessary friction in customer experiences.

Traditional transfers and card payments were built for banking hours, not the always-on economy. But expectations have shifted. Whether it’s splitting a restaurant bill, issuing instant refunds, or settling supplier invoices at midnight, users now expect payments to move in seconds, not days. That’s where the instant payment app comes in.

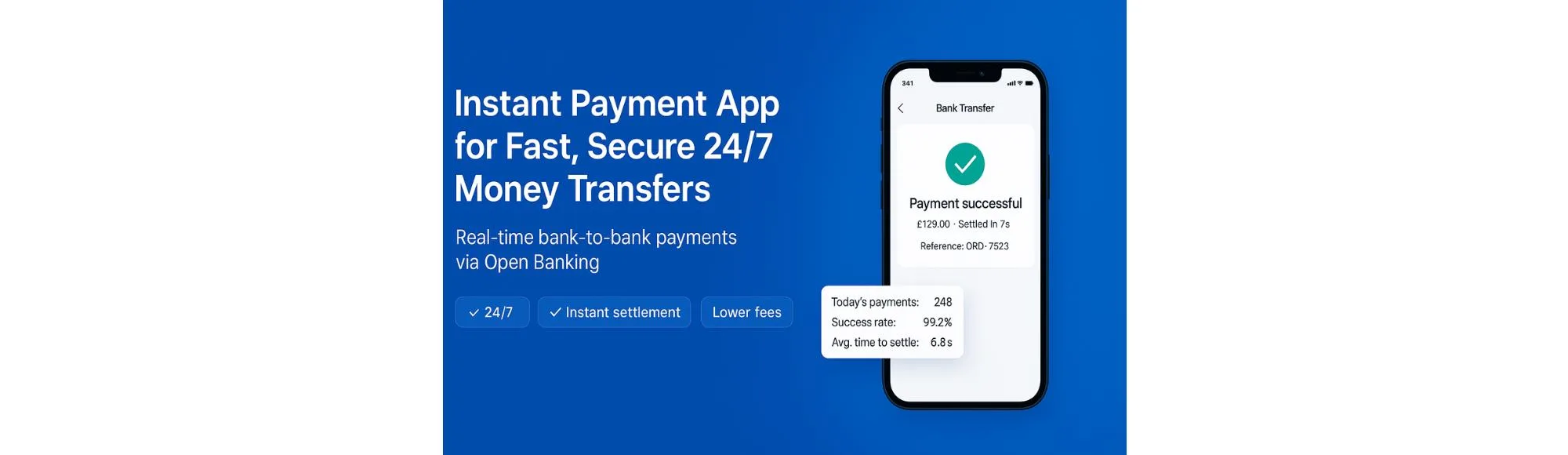

Instant payment apps are designed for speed, security, and availability. They enable 24/7 fund transfers, bypass card network delays, and deliver immediate confirmation, creating a smoother experience for both payers and recipients. In this guide, we’ll break down what makes these apps work, the features to look for, and how businesses can integrate instant payments into their existing systems.

Market Overview and Adoption Statistics

The demand for instant payments has grown rapidly over the past five years, driven by mobile adoption, regulatory push, and changing consumer expectations. What was once a niche offering is now becoming the standard way money moves.

UK Snapshot

- 5.09 billion Faster Payments transactions worth £4.2 trillion were processed in 2024, reflecting how deeply real-time payments have penetrated the banking ecosystem.

- More than 50% of UK adults regularly use mobile wallets, according to UK Finance, making mobile-first instant transfers a daily habit rather than an exception.

- With nearly every major UK bank now supporting 24/7 instant payments, the competitive battleground has shifted from infrastructure to user experience and cost structure.

Europe

- The EU Instant Payments Regulation (IPR) mandates that payment service providers must make euro instant credit transfers available within 10 seconds, 24/7.

- The SCT Inst scheme underpins this push, driving a unified real-time standard across the SEPA area. As a result, instant payments are moving from premium services to baseline expectations for European users and merchants.

Global Trends

- Worldwide, 266 billion real-time transactions were recorded in 2023, a 42% year-on-year increase, according to ACI Worldwide.

- India’s Unified Payments Interface (UPI) is a benchmark example: it processed over 19.6 billion transactions in September 2025 alone, proving that instant, mobile-first payments can operate at massive scale with low latency.

- Markets in Latin America, the Middle East, and Africa are also experiencing rapid growth as regulators and banks replicate successful models.

Key Features of a Leading Instant Payment App

Not all payment tools are created equal. The best instant payment apps combine speed, security, and user-centric design with the ability to operate reliably at scale. When evaluating your options, these are the core features that set the leading solutions apart.

1. Real-Time Transaction Processing

The foundation of any instant payment app is its ability to process and settle transactions within seconds. Unlike BACS transfers or card settlement cycles that may take days, real-time rails enable funds to move and reflect instantly in the recipient’s account.

For merchants, this means improved cash flow and faster payout cycles. For consumers, it means sending or receiving money without waiting periods.

2. 24/7 Availability

Top-tier instant payment apps operate around the clock including weekends and holidays without relying on banking hours. This always-on infrastructure allows users to transfer money with immediate payment at any time, whether they’re paying suppliers at midnight or splitting a bill on a Sunday.

3. Security and Regulatory Safeguards

Speed is meaningless without trust. Modern instant payment apps use regulated bank APIs, encryption protocols, and strong customer authentication to protect both sides of the transaction. Many also include transaction monitoring and fraud controls to reduce risks associated with real-time settlement.

4. User Experience and Accessibility

A frictionless experience is often the deciding factor when users choose which money app is instant. Leading apps prioritise intuitive interfaces, minimal input fields, and real-time status notifications. On the business side, clear reconciliation dashboards and integration options make day-to-day operations more efficient.

5. API and Integration Flexibility

For businesses, the ability to plug the instant payment app into existing platforms is critical. Developer-friendly APIs, webhooks, and pre-built SDKs enable seamless integration into checkout flows, mobile apps, accounting software, or payout systems. This ensures instant payments can be embedded without heavy infrastructure work.

Use Cases & Applications

The rise of the instant payment app isn’t limited to consumers sending money to friends. Businesses across industries are using these tools to reduce settlement delays, lower costs, and improve customer experiences. Here are the most common applications driving adoption.

1. Person-to-Person Transfers

One of the most popular use cases is peer-to-peer (P2P) payments. Individuals use instant payment apps to pay someone instantly for everyday scenarios like splitting dinner bills, rent, or shared expenses. Because the transfer happens in real time, recipients can access the funds within seconds, even outside banking hours.

2. Merchant Payments

Small businesses and eCommerce merchants use instant payment apps to accept real-time payments at checkout, both in-store and online. This not only improves conversion rates by offering customers a faster payment method, but also helps merchants access funds immediately without waiting for card settlement cycles.

3. Bill Payments and Recurring Charges

Consumers are increasingly using instant payment apps to pay recurring bills like utilities, rent, or subscriptions. Businesses benefit from faster reconciliation, reduced late payments, and improved cash flow visibility.

4. Marketplace and Platform Payouts

Marketplaces and gig platforms often face delays when sending payouts to sellers, drivers, or service providers. With instant payment apps, payouts can be made on-demand, helping platforms increase trust, loyalty, and satisfaction among their user base.

Benefits Over Traditional Payment Methods

Switching to an instant payment app isn’t just about keeping up with technology trends — it delivers tangible operational, financial, and user experience benefits that traditional payment methods can’t match. Here’s how they stack up:

1. Speed and Settlement Time

Traditional payment methods like BACS transfers or card networks can take one to three business days to settle. In contrast, instant payment apps deliver real-time settlement, with funds typically reaching the recipient in under 10 seconds, regardless of weekends or banking hours.

| Method | Typical Settlement Time | Availability | Notes |

|---|---|---|---|

| BACS Transfers | 2–3 business days | Banking hours only | Slowest; not suitable for urgent transfers |

| Card Payments | 1–3 days (merchant settlement) | 24/7 for consumers, but delayed for merchants | Subject to card network fees |

| Instant Payment App | Seconds (usually <10s) | 24/7 including weekends | Real-time settlement with immediate confirmation |

2. Accessibility and Convenience

Instant payment apps work 24/7, giving users full control over when and how they send money. There’s no dependency on banking hours, batch processing, or card network cut-off times. For merchants, this means instant access to working capital; for consumers, it’s frictionless transfers anytime, anywhere.

3. Cost Efficiency

Traditional methods often carry hidden costs from interchange fees on card payments to float costs from settlement delays. With instant payment apps, there are typically no card network fees, and funds move directly between bank accounts. This reduces transaction costs, improves cash flow, and simplifies reconciliation.

4. Operational Transparency

Real-time confirmations and automated data feeds make it easier to track every transaction. This helps businesses identify errors faster, reduce support queries, and integrate payments seamlessly with their existing accounting or ERP systems.

Finexer for Business: Instant Settlement, Clear Reconciliation

If you are choosing an instant payment app for UK use, here is how Finexer delivers in day to day operations.

What your customers experience

- Money moves in seconds, any time of day. They scan a QR or click a payment link, confirm in their banking app, and see a clear receipt.

- No card forms or long checkouts. The journey is short and familiar, which helps conversion and reduces drop-offs.

What finance and operations get

- Clean reconciliation. Order or invoice references travel end to end and appear in the dashboard, exports, and webhook payloads.

- Real time visibility. You can see initiated, authorised, settled, refunded, and failed events as they happen.

- Flexible flows. Use payment links at checkout, QR codes in store, Request to Pay for instant collection, and batch payouts when you need to pay many recipients.

Why UK Businesses choose Finexer

- Lower total cost: Bank to bank movement helps you avoid card networks and card fees. No setup fees. Usage based pricing that is simple to forecast.

- Fast path to go live: Teams typically deploy 2 to 3x faster than the market, supported by 3 to 5 weeks of hands on onboarding assistance, so your build does not stall.

- Built for UK businesses: Broad UK bank coverage for consumer and business accounts with 24/7 availability. Focused on domestic payments so you are not paying for features you do not use.

- Developer friendly: Clean REST APIs, webhooks, unlimited sandbox for testing!

- Trust and controls: FCA-authorised AIS and PIS, strong customer authentication, encrypted APIs, granular consent, and full audit trails. Prevention first with risk rules and monitoring.

- No card chargebacks: Disputes are handled through refunds and support flows, which cuts overhead and removes surprise fees.

What is an instant payment app?

An instant payment app lets you send and receive money in seconds, 24/7, using secure bank connections and real-time payment rails.

How do instant payments work?

You authorise a payment in your banking app. Funds move account to account in near real time and both sides get immediate confirmation.

Are instant payments safe?

Yes. Security relies on bank-grade encryption, strong customer authentication, and consented access. Look for regulated providers with audit trails.

Build instant bank transfers with Finexer’s Open Banking Payment Initiation API. Book a free demo!